U.S. and world emergency crude oil reserves could replace a complete shut-off of Iranian oil exports for 18 months, avoiding an estimated 1 billion in damage to the American economy, the Government Accountability Office said on Tuesday. Â

U.S. and world emergency crude oil reserves could replace a complete shut-off of Iranian oil exports for 18 months, avoiding an estimated 1 billion in damage to the American economy, the Government Accountability Office said on Tuesday. Â

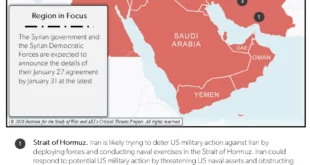

There has been concern among energy traders that tough action by the United States and other western countries against Iran’s nuclear program could cause Tehran to retaliate by cutting off the country’s oil exports. Iran is the world’s fourth biggest oil exporter, selling about 2.7 million barrels a day.Â

Such a disruption would remove close to 1.5 billion barrels of crude from the market over an 18-month period, according to the GAO, which is the investigative arm of the U.S. Congress.Â

To avoid a huge price spike and ensure adequate supplies, the United States could coordinate with its fellow member countries in the International Energy Agency to jointly release their emergency oil reserves to offset a disruption in Iranian crude shipments for 18 months, the GAO said.Â

U.S. Secretary of State Condoleezza Rice, speaking in Saudi Arabia, said on Tuesday that the “only choice” for the international community is to impose sanctions on Iran if Tehran does not suspend uranium enrichment in the country’s nuclear program.Â

The United States does not directly import oil from Iran, but a shut-off of Iranian oil exports would force countries that do buy Iranian oil to compete with the United States for crude supplies from other producing nations.Â

“Removing this (Iranian) oil from the market would raise prices everywhere, thus impacting the U.S. economy,” the GAO said in its new report on how the U.S. emergency oil stockpile should be operated.Â

“At their current capacities, the SPR (Strategic Petroleum Reserve) and international reserves can replace the oil lost … doing so protects the economy from significant damage,” the agency said.Â

The United States holds about 688 million barrels of oil in the SPR. In addition, other IEA countries have about 2.7 billion barrels of public and industry reserves, with about 700 million barrels under government control for emergency purposes.Â

The GAO said using excess world oil production capacity, particularly in Saudi Arabia, along with industrial customers switching from oil to natural gas for fuel, would also be needed to help offset a disruption in Iranian oil exports.Â

Not replacing a cutoff of Iran oil shipments would cost the U.S. economy about 1 billion, the GAO said. Tapping just the SPR oil would avoid 2 billion in damage to the American economy, but also using international oil reserves would cause no substantial economic damage, according to the GAO.Â

The Energy Information Administration, which is the Energy Department’s analytical arm, estimates the harm to the U.S. economy would be much lower at between billion and billion if the lost Iranian oil were not replaced.Â

The GAO said the lower number reflects the EIA model’s assumption that oil price increases would cause as much harm to the U.S. economy.Â

The GAO report comes as the Energy Department says it will delay purchasing until after the winter some 11 million barrels of oil that would replace SPR crude it sold to energy companies last year after Hurricane Katrina in order to keep more supplies on market during the upcoming heating fuel season.Â

Â

Â

Eurasia Press & News

Eurasia Press & News