“Whom exactly does this budget favour?” asked a leading anchor on national TV, who was disappointed that there was nothing specific for the poor or the middle class in the annual budget announcement earlier in the day. The short answer—the future generation! This year’s budget has a singular focus on kickstarting economic growth in the country.

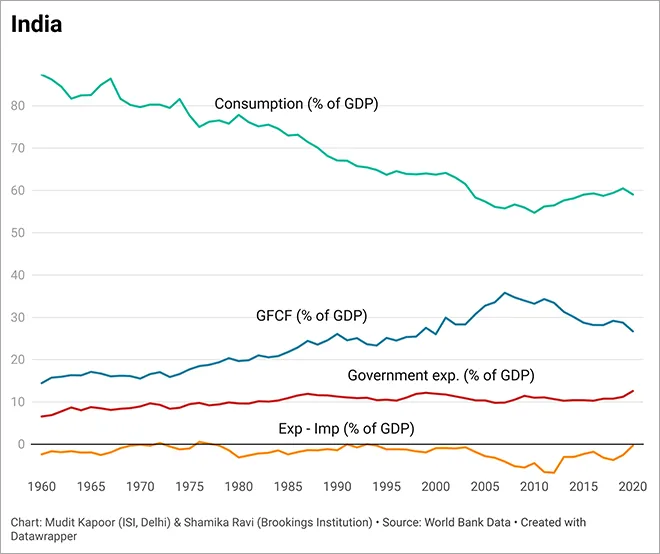

It adopts a strategy to address the most worrying trend in India’s growth story—that of declining private investment for the last 10 years. In simpler words, this year’s budget is a reinforcement of last year’s strategy of economic recovery from the pandemic but meant to be a booster shot for long-term economic growth. The core strategy is to significantly intensify government spending with focus on asset creation and job creation.

Government spending has two core categories—revenue expenditure and capital expenditure. The former includes all those expenditures of the government that does not create any assets or reduce liabilities. These include salaries, interest payments, pensions, administrative expenses, etc. Very importantly, these also include large welfare schemes such as food security act, MNREGA and several direct cash transfer schemes. In the aftermath of the devastating COVID-19 pandemic, several of these schemes were instrumental in avoiding a humanitarian crisis and hunger deaths in India. Unlike the last two years, in this year’s budget allocations, most of these schemes have received marginal raise while the focus for the bulk of increase in government spending has instead been on the second component—capital expenditure. These include spending for asset creation, which leads to raising productivity, job creation, and long-run growth. Capital expenditure growth for the next fiscal year is budgeted at 24.5 percent over last year’s revised estimates. The chosen avenue for this is PM-GatiShakti Scheme, which is meant to accelerate major infrastructure development across the economy and improving connectivity through roads, railways, waterways, airways, etc. This is likely to get overwhelming support from market watchers and economists who study economic growth and development. There is compelling evidence from various developing countries that roads reduce poverty.

In a departure from past approach, this government is redefining and expanding the concept of social protection in the country. While existing forms of social protection have focused on immediate relief and short run approaches through cash transfers, food grains and employment guarantee, this year’s budget expands social protection to include affordable housing and access to piped water and sanitation facilities. These schemes have received a major allocation boost in the budget. So even from the point of view of social protection, asset creation has received a significant thrust.

While the government has placed its faith in a strategy for long-term economic growth, the trade-off is clearly in terms of immediate consumption and demand support. This has raised hackles for several understandable reasons. The pandemic has dealt a severe blow to livelihoods and earnings across the population. Fiscal support in response to this has fundamentally focused on the bottom 40 percent of the population. Our analysis, however, shows that consumption has fallen significantly for the bottom 80 percent of rural India. This analysis is for rural households (based on available data) but can quite easily be extrapolated to urban households given that the pandemic was reportedly worse in urban areas across India. So, the middle class has suffered a decline in consumption levels equivalent to the poorest quintiles in the population.

The economic logic for putting greater faith in expanding capital expenditure over revenue expenditure is sound. Evidence from global and Indian data shows that multiplier effect of capital expenditure on economic activity is significantly larger than the multiplier effect of revenue expenditure on economic activity. In fact, the estimators for capital expenditure and revenue expenditure have been precisely calculated for India to be 2.45 and 0.99 respectively. So it makes economic sense to put the marginal government spending into infrastructure and long-term asset creation.

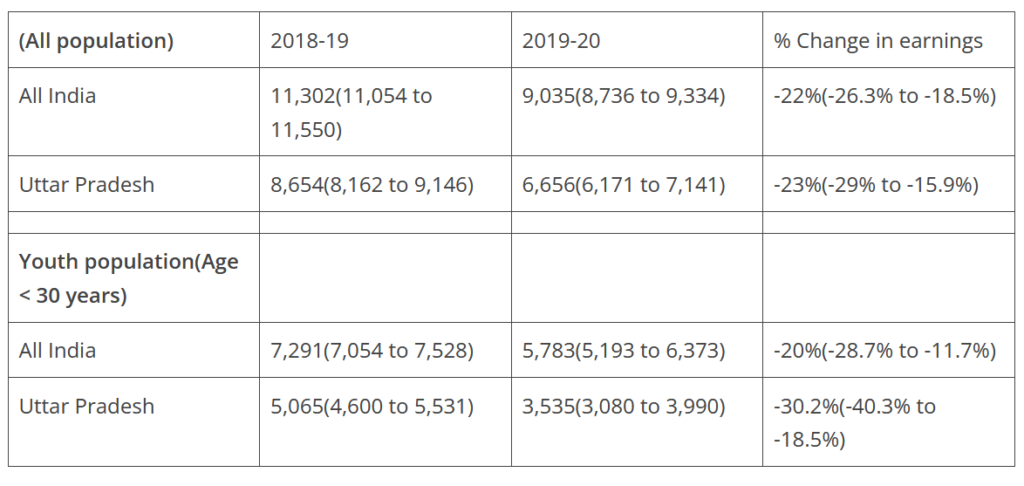

The political logic of betting on long-term infrastructure development and job creation over enhancing immediate consumption support, however, is not as obvious. In fact, beyond unemployment numbers, it is evident from the Periodic Labour Force Survey (PLFS) data that there has been severe decline in earnings. What is, perhaps, more striking is that this decline in earnings is much more severe in states like Uttar Pradesh compared to the rest of India. As the Table 1 below shows, UP suffered a decline of 23 percent in earnings post the pandemic as compared to 22 percent decline for all India. But more strikingly, the data shows that the youth of UP have suffered some of the biggest decline in earnings in the country. While all India decline for youth earnings is approximately -20 percent, this number is much greater for UP youth at more than -30 percent. Given that UP is headed to the polls within a few days, it is evident that the government has steered clear of populist electoral measures in this year’s budget announcements. Commitment to long-term growth makes good economic sense, but politically, it appears to be a calculated risk that the BJP government is willing to take. The logic appears to be that schemes such as PM-Awas Yojana and ‘Har-Ghar-Nal’ will drive voters in 2022 state elections much like the massive rural electrification project did in the last state elections of 2017.

Table 1: Monthly earnings decline after pandemic

Beyond the headline allocations that drive most public discourse around the Union Budget, several progressive and strategic ideas require highlighting. Here are a few:

(1) Extending tax relief to parents and guardians of disabled persons is an important measure. Currently, disability in India is a highly privatised matter, where the families bear the brunt with minimal public support. This policy blind spot needs to be immediately rectified as more than 5 percent of India’s population is disabled,[i] amounting to nearly 50 million people. This number is likely to be much higher in the next census due to growing awareness and improved reporting by families and healthcare providers.

(2) The recognition and emphasis on mental health as a public policy concern is welcome. This year’s budget allocates funds to create a network of 23 digital centres to extend telehealth services for mental health. This is to be coordinated from NIMHANS with support from IIT Bengaluru. Of course, mental health, like much of general healthcare, requires localised brick and mortar support along with trained manpower. Hopefully in the future, these telehealth centres can be extended and integrated into primary healthcare centres and wellness centres across the country.

(3) In a welcome (and strategic) move, green finance found a place in the budget, in the form of green bonds. Being a major emerging market, India has the potential and ambition to steer global energy transition. While there are numerous market opportunities, India lacks the necessary financial instruments to attract global investments that can help the country achieve its goals. The green bond has the potential to fill this crucial gap for India.

(4) Focus on urban planning in the annual budget is a major recognition that cities need planning, and cannot be allowed to grow organically in the haphazard way they have so far across the country. Today, India is approximately 65 percent urban[ii], yet city planning and governance are often policy after-thoughts. The cost of poor planning and poor city governance translates into inefficient administration and low livability for citizens.

Overall, this budget is sound despite no major increase in allocations for healthcare and education. Finance, though critical, is merely a part of the larger problem in health and education in India. Public health and public education need major overhaul beyond informtion and technology solutions and quick fixes. For example, in the aftermath of the pandemic, Budget 2021 included a major plan to create infectious disease wards in every district hospital across India. We should get an update on this—if there are delays, then is it on account of poor financing or low state capacity? Unfortunately, the Finance Minister has a solution to only one of these!

Eurasia Press & News

Eurasia Press & News