Much has been said about the problematic implications of cybercurrencies like Bitcoin for contemporary security environments. After all, they provide unsupervised conduits for the cross-border circulation of money in ways that can conceal the identities of those responsible. Needless to say, such advantage can be useful for the various financial operations of malicious nonstate actors, such as transnational criminal organizations, terrorist networks, insurgent militias, hacktivists, and even separatist forces.

Unsurprisingly, evidence confirms that the cryptocurrency ecosystem has attracted the involvement of unsavory groups like ISIS, Hamas, Mexican drug cartels, cybercrime syndicates, and professional money launderers. Plus, as the case of the so-called ‘Silk Road’ illustrates, Bitcoin has become the coin of the realm in the illicit markets which flourish in the deepest corners of the digital lawless underworld known as the ‘dark web.’ Likewise, the esoteric realm of cryptocurrencies is seemingly fertile for all sorts of criminal activities, intrigues, fraudulent businesses, scandals, conspiracy theories, scams, make-believe, and wild unconfirmed rumors. Arguably, this emerging microcosm reflects some of the dark traits associated with human nature since the dawn of time, including greed, the pursuit of power, and deception. However, the instrumental implications of Bitcoin for the practice of statecraft have not been fully understood in a comprehensive manner. Thus, this analysis seeks to clarify in-depth the relevance of Bitcoin for national power and, specifically, to determine how and why it can either strengthen or weaken it in today’s increasingly complex strategic geopolitical realities and geoeconomic dynamics.

Background: What is Bitcoin?

As the first of its kind, the creation of Bitcoin (BTC) is a major evolutionary turning point in the historical development of money. This cryptocurrency was born in a period shaped by the changing Zeitgeist in the wake of the 2008 global systemic financial crisis, particularly growing public concern and discontent over the implementation of unsound monetary policies (i.e. rampant levels of quantitative easing), the oligopolistic structure of Western financial systems, the questionable legitimacy of fiat money, deepening spirals of debt, the reliability of the US dollar as a reserve currency, and the unchecked market power of big banks. Its precedents include the development of electronic payment systems, the proliferation of digital FinTech innovations, and theoretical proposals to formulate virtual equivalents of cash that could be used to carry out anonymous transactions. The invention of Bitcoin was masterminded by someone called Satoshi Nakamoto. However, the consensus indicates that said name is an alias adopted by an individual or a group that wishes to remain anonymous for unclear reasons.

The uniqueness of this cybercurrency is defined by several characteristics. Bitcoin’s governance structure is stateless, unofficial, and decentralized. In practical terms, that means that the BTC environment ‒ which encompasses an integrated financial grid ‒ is not controlled by hierarchical governmental or corporate nerve centers. Instead, the behavior of its organic ecosystem responds to the authority of algorithmic programming. Therefore, unlike fiat money (issued by governments and flowing through arteries owned by private baking entities), nobody is in charge of Bitcoin. Hence, it purports to replace the socio-economic need for mutual trust and faith in the money issued by central banks with an impersonal mathematical accuracy that resembles the automatic perpetual motion of a clockwork mechanism. The design of this singular architecture is underwritten by a couple of ideological frameworks: 1) libertarianism, a philosophical school of thought that seeks to diminish the presence of the state in the sphere of economic matters as much as possible; and 2) techno-utopianism, a movement which believes that high-tech can offer functional solutions for every conceivable societal problem.

Moreover, Bitcoin’s technical properties are also noteworthy. Access to its operational interfaces (wallets) is protected by cryptographic keys and its technological engine is the automatic bookkeeping system known as ‘blockchain,’ identified as one of the chief drivers of the so-called “Fourth Industrial Revolution.” A blockchain is a collective and self-sustaining digital systemic record that is periodically updated in a way that makes it inalterable. In addition, as a horizontal and leaderless domain, the Bitcoin community gathers its users and holders through a peer-to-peer protocol. Furthermore, although it does not provide full anonymity, BTC facilitates pseudonymous transactions. In other words, people involved in BTC can ‒to a certain extent‒ hide their identities and protect their personal privacy in a manner that would not be possible through the services offered by conventional third-party platforms.

On the other hand, the process through which new Bitcoin units are minted does not involve either printing legal tender or fractional reserve banking. Known as ‘mining,’ it entails the performance of mathematical operations to solve increasingly complex puzzles as a step that is necessary for the collective validation of transactions (‘proof of work’). Once the equation has been deciphered by one of the advanced computers connected to the Bitcoin network, the winner is rewarded with new Bitcoins. The quest to harvest this incentive is what keeps the whole thing going. In other words, BTC mining includes both collaborative and competitive ingredients. Cryptocurrency mining requires elements such as state-of-the-art hardware with powerful computational capabilities and an abundant source of electricity. Accordingly, this flourishing industry is intensive in terms of both technological resources and energy. As some observers have noted, the artificial difficulty of the process is supposed to mimic the hard effort that is needed to extract precious metals such as gold and silver, both of which have acted as universal monetary substances for centuries due to their natural scarcity, intrinsic value, aesthetic beauty, and reputational prestige. Hence, it has been argued that BTC embodies the conceptual model of ‘digital metallism.’

There are unsettled debates in the rising intellectual and academic universe of ‘cryptonomics.’ Some analysts claim that, not unlike fiat money, Bitcoin has no intrinsic worth. According to this interpretative perspective, Bitcoin acts a lot like a virtual speculative asset whose value is determined by the behavior of market forces and the accompanying expectations to make a quick profit. In contrast, others believe that Bitcoin is tacitly backed by the work that is needed to ensure its survival and its large consumption of energy, as well as by the underlying support of material components which undergird its circuitry, such as servers, internet infrastructure, specialized computers, chips, graphics cards, power grids and so on. In other words, despite being a purely virtual currency, the existence of BTC goes beyond the dimension of digital code thanks to the various pillars which anchor it to physical reality.

On the other hand, scholars like Saifadean Ammous and Niall Ferguson emphasize Bitcoin’s peculiar traits and the potential shockwaves of this disruptive FinTech invention. These thinkers argue that Bitcoin’s long-range significance goes much further, as it heralds nothing less than a revolution that represents a new ground-breaking chapter in the long-range historical trajectory of money, after decades of constant debasement. This idea of Bitcoin as a visionary innovation that will redefine the world’s monetary standards is seemingly supported by the influence of this cybercurrency in the creation of a constellation of hundreds of spin-offs and offshoots. Likewise, the introduction of BTC was a pivotal breakthrough that prompted the subsequent development of both ‘stablecoins’ launched by private companies and Central Bank Digital Currencies (CBDCs).

Finally, the Bitcoin universe is remarkably plural. It contains a heterogenous myriad of inhabitants, participants and stakeholders. Some of its early adopters were tech-savvy enthusiasts, libertarian activists, dissidents living under political repression, outlaws, start-up innovators, speculative traders, scholars, cryptographic experts, and cyber-anarchists, amongst others. However, the circulation of BTC is no longer a marginal phenomenon confined to some obscure niches reserved for an elite of intrepid merchants and enlightened initiates who share some sort of arcane knowledge. By now, its projection has become substantially wider as it has drawn the attention and active involvement of corporate heavyweights, mainstream digital platforms, investment banks, traditional financial firms, policymakers, regulatory authorities, law enforcement, ordinary investors and even curious members of the general public. In order to keep things in perspective, it is pertinent to highlight that Bitcoin’s market cap is already superior to the GDP of countries like Chile, Portugal and New Zealand.

Hypothetical Possibilities

In theory, the mere existence of a nonstate cybercurrency like Bitcoin challenges one of the most emblematic hallmarks of the modern Westphalian conception of national sovereignty: the monopoly of states as the only issuers of legal tender within their territorial perimeter. However, this is not just a symbolic attribution. Monetary policy is a tool that states use to direct the performance of their economies, influence their international economic exchanges, and manage their governmental expenses. Thus, the circulation of decentralized unofficial cryptocurrencies can hypothetically jeopardize said ability by displacing conventional currencies issued by central banks. Furthermore, unlike hard currencies, BTC is not backed by the national strength of any great power, or any other state for that matter.

Nevertheless, those realities do not mean that Bitcoin is necessarily always detrimental for national power or inconsequential for it. In fact ‒ Inspired by the analytical lens of strategic foresight ‒ several potential opportunities to harness Bitcoin as an instrumental tool of states to pursue their national interests have been identified. First, special operations units and intelligence services can rely on Bitcoin’s discreet financial channels as users in order to fund clandestine activities, reward agents and informants, make purchases of illicit items in black markets, carry out all sorts of undisclosed payments, and even bankroll agitation in foreign countries as a way to instigate instability. Likewise, Bitcoin represents a catalyst for the development of better capabilities in terms of financial intelligence (FININT). Specifically, a better understanding of the BTC operational environment would enhance the ability of intelligence agencies and law enforcement to track transactions denominated in cryptocurrencies and discover the real-life identities of the corresponding users. This upgrade would increase the coercive power of states to disrupt the alternative financial conduits employed by their enemies, including nonstate actors and hostile states regarded as strategic competitors. In fact, such course of action has even been endorsed by former high-ranking CIA officials.

On the other hand, states can also engage the world of unofficial cryptocurrencies like BTC in a beneficial way through the encouragement of mining as a productive activity on a large scale. This undertaking can bring wealth, bolster economic dynamism, and support technological development. Nevertheless, the successful implementation of this option requires a systematic industrial policy and economies of scale, as well as comparative advantages related to the availability of affordable electricity and access to sophisticated equipment. Moreover, due to the wild fluctuations of Bitcoin’s exchange rates, this pursuit would face the typical challenges associated with the extraction of commodities whose market prices are highly volatile. Yet, as long as favorable circumstances prevail, this unconventional industry can represent an option worth considering to increase prosperity when participation in more traditional options is difficult or if there are obstacles which hamper the ability to make profits through international economic exchanges.

Finally, an even more counterintuitive possibility is the accumulation of BTC holdings in order to diversify a country’s foreign exchange reserves. For example, Indian analyst Ashwath Komath argues that said recommendation makes sense for the national interests of states which seek to adopt a nonaligned foreign policy orientation, a distinctive trait of Indian statecraft for decades. Unlike assets denominated in fiat currencies, BTC cannot be frozen, sanctioned, or confiscated in case conflict breaks out. Likewise, adding this cybercurrency to a state’s coffers would also prevent overreliance on foreign financial systems and strengthen Delhi’s position towards both the West and China, the major players in the ongoing strategic competition to shape the architecture of the global monetary order in the coming decades. Furthermore, a country like India could be uniquely positioned to embrace Bitcoin as a secondary reserve currency, especially considering its growing participation in the field of high-tech innovations.

Nonetheless, there are reasons why decentralized cryptocurrencies like Bitcoin could be potentially harmful for national power. Since their value fluctuates so drastically, they are vulnerable to speculative attacks, which could be motivated by economic and political agendas. Furthermore, the incremental progress of quantum computing can compromise their protective cryptographic shields. Plus, if their internal circulation reaches substantial proportions, then they can marginalize the national currency, which would entail the partial degradation of monetary sovereignty. Furthermore, powerful rival states can seek to establish a dominant high ground in the environment of a cybercurrency with a considerable degree of international projection in a quest to harness the resulting asymmetric leverage vis-à-vis other states whose position there is comparatively weaker. Another detrimental consequence of embracing decentralized virtual currencies is the exposure to the potential backlash of the states which control the top reserve currencies. In other words, there is no guarantee that Bitcoin and its derivatives will necessarily boost national power. Thus, under certain conditions, relying on them can backfire.

Empirical Examples

Aside from exploratory forecasts, there are already several empirical examples which demonstrate how states are adjusting in the monetary realm based on their expectations about how said currencies might reinforce or damage national power.

Perhaps the most paradigmatic example is El Salvador. Back in 2021, this Central American country became the first national state to formally accept BTC as fully legal tender in an ambitious experimental attempt to merge its economy with the ecosystem of such cybercurrency. The purpose of this fateful decision responded to economic interests, such as the desire to upgrade the profile of the Salvadorean economy, boost the flow of remittances from overseas, position itself as regional hub for crypto mining as a source of wealth, and correct financial imbalances. Nevertheless, this measure was not just about the pursuit of prosperity. Considering the background of El Salvador as a peripheral theatre for proxy wars during the late Cold War, BTC can ‒ as an asset that represents a strategic vector ‒ help this small nation navigate independently under an intense strategic competition between Washington and Beijing (a rivalry whose fallout is felt in the sphere of money and finance) without having to take sides. The recent decline of Bitcoin’s value raises reasonable doubts about the wisdom of this decision, but only time will tell if the benefits outweigh the costs.

On the other hand, it is known that entities affiliated with the US state establishment ‒ including the foreign policy complex, intelligence agencies, and think tanks involved in strategic studies ‒ are actively interested in surveillance of the Bitcoin ecosystem because it can be exploited by nonstate and state actors regarded by the US as enemies. For example, the revelations shared by whistle-blower Edward Snowden indicate that the NSA has been intensively trying to find ways to uncover the identities of users who belong to the BTC community through measures like cyberespionage, technical interference, and even the design of misleading crypto platforms that have no intention to protect the privacy of their members. Years later, the current CIA Director William Burns openly admitted (in the context of a public event) that the agency under his leadership is running several projects focused on cybercurrencies, though no precise details were disclosed.

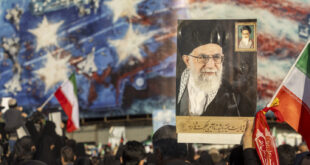

Furthermore, another case worth considering is the Russian Federation. This Eurasian state was at first reluctant to embrace cryptocurrencies like Bitcoin but then it reassessed its position after it realized that crypto represented certain opportunities. Thereafter, Moscow has nourished the development of a domestic industry involved in Bitcoin mining in the Russian Far East. It must be noted that Siberia offers the comparative advantages to do so on a large scale, including the availability of hydropower as a generous source of cheap electricity, infrastructure that supports an optimal internet connectivity, permissive regulatory frameworks, and a cold weather that mitigates the excessive heat that is generated as a by-product of this activity. Moreover, the imposition of Western sanctions after the takeover of Crimea has encouraged the Kremlin to double down in this pursuit, as it generates wealth which does not flow through financial arteries controlled by hostile states and furthers technological progress. It is important to emphasize that, for Russia, access to international finance and cutting-edge technologies is a national security priority because, without those elements, the national power of the Russian state would be substantially reduced in the near future. Perhaps not surprisingly, after the 2022 invasion of Ukraine, Moscow has reportedly been examining the pertinence of accepting payments denominated in cryptocurrency in order to counter the ongoing efforts to restrict its exports of energy, including both oil and natural gas.

In contrast, the case of the China points in a very different direction. Initially, the Middle Kingdom was one of the enthusiastic early adopters of Bitcoin and similar cryptocurrencies. At some point, China was by far the undisputed global leader of mining operations. Nevertheless, Beijing moved towards a diametrically different position as it implemented a series of increasingly draconian restrictions, including the shutdown of mainland cryptocurrency exchanges, heavy-handed measures of technical interference, the closure of BTC mining facilities and even mass arrests of Bitcoin users. It is believed that this course of action responded to the need of preventing capital flight and undermining an activity which could have posed meaningful challenges for the energy security of the Chinese state. However, another possible motivation was likely an interest in casting aside a potential source of unwanted competition for the release of the e-CNY, the official currency designed by the People’s Bank of China as a digital version of the national legal tender. It is unknown if this was the plan all along, but it is suggestive that the idea of aggrandizing the proportions of something in order to get rid of it afterwards (the so-called ‘principle of reversal’) is consistent with the prescriptions found in classical Chinese strategic thinking.

Lessons Learned

Far from being neutral, Bitcoin entails significant ramifications for national power, understood as the combined ability of states to further their interests through their resources, assets, and capabilities. Just like any other invention, said cybercurrency is an instrumental item that can be harnessed, leveraged, exploited, and/or manipulated in the practice of statecraft. As such, it can offer strategic, diplomatic, economic and technological benefits worth harvesting. Nevertheless, though there is no single recipe to engage this FinTech innovation, exploratory forecasts and the scrutiny of empirical developments indicate that it can be employed as a tool to carry out black ops, a catalyst for the optimization of financial intelligence, a facilitator of industrial development, a source of national wealth, an alternative reserve currency, and even an unconventional vector of grand strategy which can enable the performance of balancing acts. Needless to say, such attributes make it attractive under conditions of heightened geopolitical and geoeconomic tensions. However, as double-edged sword, Bitcoin can also be detrimental for national power in some circumstances. Paraphrasing a sharp observation made by Joseph de la Vega about the contradictory nature of high finance in 17th century Amsterdam in his legendary treatise “Confusion of Confusions,” the paradoxical ambivalence of BTC is that can be both a treasure of usefulness for the intrepid and ‒ at the same time‒ a treacherous road that leads to the downfall of the unwise.

Eurasia Press & News

Eurasia Press & News