Suffering from geopolitical and energy crises, the European economy in 2022 had a hard time when it faced the triple predicaments of high inflation, energy crisis, and economic slowdown. Looking forward to 2023, as the European Central Bank (ECB) continues to push for interest rate hikes, which in turn may cause the European economy to face a long period of difficulty. According to the researchers at ANBOUND, it remains challenging for Europe to resolve the inflation problem, and there is more likelihood for it to fall into stagflation.

The economic forecast report of the European Commission in November 2022 shows that the eurozone’s economy shrunk in the fourth quarter of 2022 and will continue to shrink in the first quarter of 2023. The inflation rate in the eurozone is estimated to be 8.5% in 2022 and is expected to fall to 6.1% in 2023. The European Commission predicts that the EU’s inflation rate will remain at 7% in 2023 and fall to 3% in 2024. According to the report, high energy prices will continue to hit consumer purchasing power and lead to prolonged inflation.

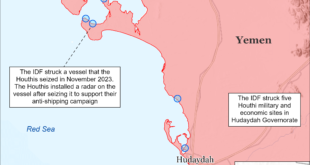

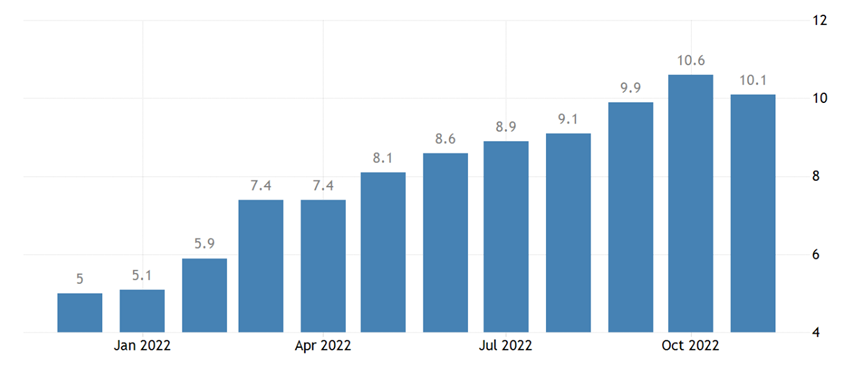

Figure 1: Monthly Inflation Level Changes in the Eurozone (%)

Although recently inflation in Europe has shown a trend of falling from a high level, there is still a significant gap compared with that of the United States. Preliminary data released by Eurostat show that the inflation rate in the eurozone in November 2022 is estimated to be at an annual rate of 10%, down from 10.7% in October, but this is still in double digits. The latest data show that the initial value of the German consumer price index (CPI) in December 2022 rose by 8.6% year-on-year, compared with a year-on-year increase of 10.0% in November and 10.4% in October. At the same time, the initial value of Germany’s reconciled CPI rose by 9.6% year-on-year in December and fell sharply by 1.2% month-on-month.

In the United States, according to data from the U.S. Department of Labor published in December 2022, the U.S. CPI in November rose by 0.1% month-on-month and 7.1% year-on-year, compared with the previous value of 7.7%. The growth rate hit the smallest increase this year. It can be seen that geopolitical risks such as the conflict between Russia and Ukraine, as well as the resulting energy crisis, have a greater impact on inflation in Europe than in the U.S. At the same time, under the circumstances of increasing geopolitical risks, the differences among European countries further present a trend of fragmentation. As far as the November data is concerned, the inflation rate of Germany, a major EU economy, was 11.3% For France, this was 7.1%, and that of Italy was 12.5%, while the inflation rates of the three Baltic countries all exceeded 20%.

Although the level of inflation in Europe is much higher than that of the United States, it is also subject to a slow economic recovery, while the implementation of the ECB’s tightening policy is far behind the Federal Reserve. In 2022, the Fed pushed for an aggressive tightening policy. While shrinking its balance sheet, it increased the benchmark interest rate from zero to the level of 4.25%-4.5% at the end of the year, with a cumulative increase of 425 basis points. In contrast, the ECB was slow, raising interest rates by 250 basis points within the year, bringing the interest rate level to 2%-2.75%, and the balance sheet reduction would not start until 2023. However, the ECB will continue to raise interest rates in 2023, making its rate hike cycle longer. The central bank believes that since the current inflation rate in the eurozone has not yet peaked and is much higher than its 2% inflation target; even if raising interest rates could lead to a slowdown in economic activity, tightening financing conditions is still mandatory. ECB President Christine Lagarde said the recession in the eurozone was insufficient to halt the further hike of interest rates.

While the ECB is determined to continue raising interest rates at the cost of economic recession, the resulting debt problem may further evolve into a fiscal crisis. The rate hikes will bring greater downward pressure on the eurozone economy, leading to a slowdown in fiscal revenue growth. At the same time, in order to cope with geopolitical risks and energy issues, European countries have to increase fiscal expenditures, further increasing fiscal deficits. The European Commission forecasts a total deficit of 3.7% of GDP in the eurozone in 2023, compared with 3.5% in 2022. However, the differences among countries in the region could mean that some countries with heavy debt burdens will face further financial pressure, and may even see the re-emergence of the sovereign debt crisis.

Although Italy has reduced the fiscal deficit-to-GDP ratio from 5.6% in 2022 to 4.5% in 2023, the country’s public debt-to-GDP ratio is around 145% and remains to be one of the highest in Europe. Under the pressure of interest rate hikes, Italian government bond yields rose sharply, and the 10-year bond yield once climbed to above 4.6%. According to a media survey, 9 out of 10 economists believe that Italy is the country most prone to the debt crisis in the eurozone. This debt risk will also limit the ECB’s policy of continuing to raise interest rates, further adding to the difficulty of achieving its monetary policy goals.

Since the ECB Bank lacks the restraining power on the governments of various countries, it is more difficult for Europe to control inflation targets than the Fed’s strong interest rate hikes. ANBOUND’s founder Chan Kung believes that the financial policies of European countries are active in releasing money to stimulate the economy, and they are extremely cautious in restraining monetary policy and curbing inflation. This is because such a move will involve politics and parties. Therefore, parties in European countries are willing to come out with active macro-stimulus policies, but not so much on implementing strict monetary policies. The result is of course obvious, that is, the serious inflation in European countries will last longer in the future. Its cycle of decline too will be slower, which will also lead to a longer cycle of economic recovery in Europe.

Against the backdrop of such system differences, Chan pointed out that the situation in the United States will see improvement, while the inflation situation in European countries is still at risk of getting out of control. He remarked that inflation in European countries in the future will lead to the devaluation of European currencies and there will be outflows of European assets. On the European side, when it is difficult to coordinate internally, they are more willing to pass the responsibility to Russia, as well as blame the U.S. for it, which will inevitably lead to further alienation between the U.S. and Europe. As a result, the evolution of Europe’s internal problems has made it more difficult to solve the uncontrollable inflation problem, making it challenging to get out of the quagmire of stagflation.

Final analysis conclusion:

Although the European Central Bank has recently repeatedly emphasized that it will further raise interest rates at the cost of economic slowdown to curb inflation, in the face of internal and external difficulties, such a move remains full of challenges. It will still be hard for Europe to get rid of the increasingly obvious prospect of stagflation.

Eurasia Press & News

Eurasia Press & News