There are no known reasons about what is causing he delay in IMF Staff Level Agreement. According to media reports the Fund seeks assurances from the friendly countries for funding gap. It seems the program is near from the Government side, but still too far from the IMF side.

In a week mired with political uncertainty, the movement at Pakistan Stock Exchange remained jittery. Furthermore, the IMF has set forth another condition regarding written assurances from friendly countries to fund balance of payment gap before the Staff Level Agreement (SLA). The ICBC has given assurance that it will provide another refinanced US$500 million loan in few days bringing total commercial loans refinanced up to US$1.7 billion.

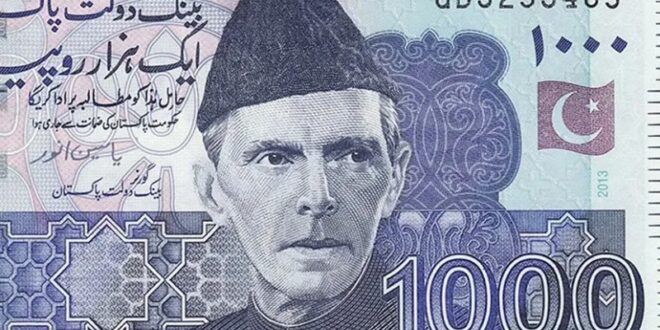

Pakistan’s foreign exchange reserves inched by US$18 million to US$4.3 billion as on March 10, 2023, culminating to an import cover of less than a month.

The benchmark index closed the week at 41,330 points, down 1.11%WoW. Participation in the market increased, with daily volumes averaging 223.02 million shares during the week, from 209.24 million shares in the prior week depicting a gain of 6.6%WoW.

Other major news flows during the week included: 1) Saudi Arabia extended US$1.2 billion deferred oil payment facility till February next year, 2) GoP raised PKR26 billion through PIBs auction, 3) July-January LSM output declined 4.40%YoY, 4) Bank deposits were up 15%YoY to Rs22.9 trillion in February, 5) workers’ remittances for February post 5%MoM growth and 6) GoP announced plan to borrow PKR7 trillion from banks in three months.

Top performing sectors were: Woolen, Glass and Ceramics, and Sugar & Allied industries, while the least favorite sectors included: Miscellaneous, Close- End Mutual Fund, and Synthetic and Rayon.

Stock-wise, top performers were: YOUW, TGL, CEPB, DGKC, and BNWM, while laggards included: PSEL, NESTLE, FHAM, BAHL, and RMPL.

Flow wise, individuals were the major buyers with net buy of US$4.23 million, followed by Banks/DFI with net buy of US$1.06 million), while Insurance companies were major sellers during the week, with a net sell of US$2.08 million.

Any further development on the IMF front is likely to set the direction of the market. The recorded high inflation of 31.5%YoY in February 2023 is expected to remain a thorn in the country’s side, driven by hikes in tariffs along with Rupee devaluation. This may lead the market to another hike in upcoming Monetary Policy accouchement scheduled for April 04, 2023.

Moreover, the local currency has continued to slide against the US dollar with no certainty regarding its limit. With this backdrop, analysts continue to advocate scrips that have dollar-denominated revenue streams to hedge against the currency risk, which include the Technology and E&P sectors.

Eurasia Press & News

Eurasia Press & News