The crashes of Silvergate, Silicon Valley Bank, Signature Bank and the related bank insolvencies are much more serious than the 2008-09 crash.

The problem at that time was crooked banks making bad mortgage loans. Debtors were unable to pay and were defaulting, and it turned out that the real estate that they had pledged as collateral was fraudulently overvalued, “mark-to-fantasy” junk mortgages made by false valuations of the property’s actual market price and the borrower’s income. Banks sold these loans to institutional buyers such as pension funds, German savings banks and other gullible buyers who had drunk Alan Greenspan’s neoliberal Kool Aid, believing that banks would not cheat them.

Silicon Valley Bank (SVB) investments had no such default risk. The Treasury always can pay, simply by printing money, and the prime long-term mortgages whose packages SVP bought also were solvent. The problem is the financial system itself, or rather, the corner into which the post-Obama Fed has painted the banking system. It cannot escape from its 13 years of Quantitative Easing without reversing the asset-price inflation and causing bonds, stocks and real estate to lower their market value.

In a nutshell, solving the illiquidity crisis of 2009 that saved the banks from losing money (at the cost of burdening the economy with enormous debts), paved away for the deeply systemic illiquidity crisis that is just now becoming clear. I cannot resist that I pointed out its basic dynamics in 2007 (Harpers) and in my 2015 book Killing the Host.

Accounting fictions vs. market reality

No risks of loan default existed for the investments in government securities or packaged long-term mortgages that SVB and other banks have bought. The problem is that the market valuation of these mortgages has fallen as a result of interest rates being jacked up. The interest yield on bonds and mortgages bought a few years ago is much lower than is available on new mortgages and new Treasury notes and bonds. When interest rates rise, these “old securities” fall in price so as to bring their yield to new buyers in line with the Fed’s rising interest rates.

A market valuation problem is not a fraud problem this time around.

The public has just discovered that the statistical picture that banks report about their assets and liabilities does not reflect market reality. Bank accountants are allowed to price their assets at “book value” based on the price that was paid to acquire them – without regard for what these investments are worth today. During the 14-year boom in prices for bonds, stocks and real estate this undervalued the actual gain that banks had made as the Fed lowered interest rates to inflate asset prices. But this Quantitative Easing (QE) ended in 2022 when the Fed began to tighten interest rates in order to slow down wage gains.

When interest rates rise and bond prices fall, stock prices tend to follow. But banks don’t have to mark down the market price of their assets to reflect this decline if they simply hold on to their bonds or packaged mortgages. They only have to reveal the loss in market value if depositors on balance withdraw their money and the bank actually has to sell these assets to raise the cash to pay their depositors.

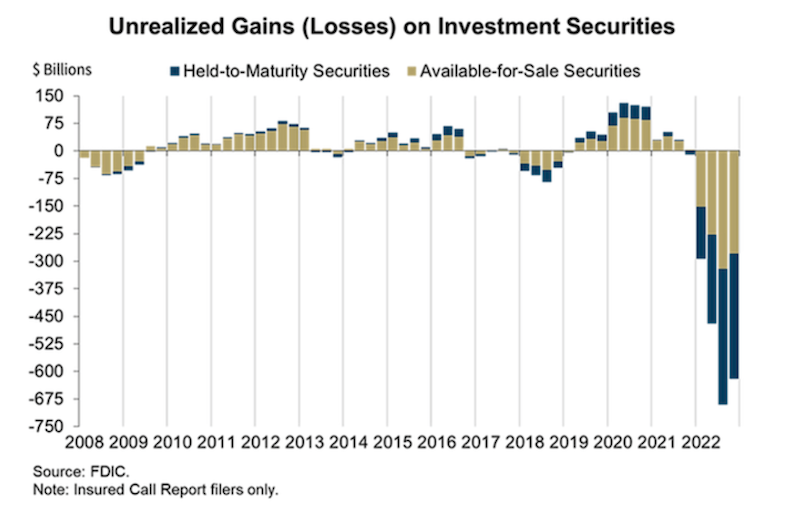

That is what happened at Silicon Valley Bank. In fact, it has been a problem for the entire U.S. banking system. The following chart comes from Naked Capitalism, which has been following the banking crisis daily:

How SVP’s short-termism failed to see where the financial sector is heading

During the years of low interest rates, the U.S. banking system found that its monopoly power was too strong. It only had to pay depositors 0.1 or 0.2 percent on deposits. That was all that the Treasury was paying on short-term risk-free Treasury bills. So depositors had little alternative, but banks were charging much higher rates for their loans, mortgages and credit cards. And when the Covid crisis hit in 2020, corporations held back on new investments and flooded the banks with money that they were not spending.

The banks were able to make an arbitrage gain – obtaining higher rates from investments than they were paying for deposits – by buying longer-term securities. SVB bought long-term Treasury bonds. The margin wasn’t large – less than 2 percentage points. But it was the only safe “free money” around.

Last year Federal Reserve Chairman Powell announced that the central bank was going to raise interest rates in order to slow the wage growth that developed as the economy began to recover. That led most investors to realize that higher interest rates would lower the price of bonds – most steeply for the longest-term bonds. Most money managers avoided such price declines by moving their money into short-term Treasury bills or money-market funds, while real estate, bond and stock prices fell.

However, it was left holding the bag when Mr. Powell announced that not enough American workers were unemployed to hold down their wage gains, so he planned to raise interest rates even more than he had expected. He said that a serious recession was needed to keep wages low enough to keep U.S. corporate profits high, and hence their stock price.

This reversed the Obama bailout’s Quantitative Easing that steadily inflated asset prices for real estate, stocks and bonds. But the Fed has painted itself into a corner: If it restores the era of “normal” interest rates, that will reversed the 15-year run-up of asset-price gains for the FIRE sector.

This sudden shift on March 11-12 left SVB “sitting on an unrealized loss of close to $163bn – more than its equity base. Deposit outflows then started to crystallize this into a realized loss.” SVB was not alone. Banks across the country were losing deposits.

This was not a “run on the banks” resulting from fears of insolvency. It was because banks were strong enough monopolies to avoid sharing their rising earnings with their depositors. They were making soaring profits on the rates they charge borrowers and the rates yielded by their investments. But they continued to pay depositors only about 0.2%.

The U.S. Treasury was paying much more, and on Thursday, March 11, the 2-year Treasury note was yielding almost 5 percent. The widening gap between what investors can earn by buying risk-free Treasury securities and the pittance that banks were paying their depositors led the more well-to-do depositors to withdraw their money to earn a fairer market return elsewhere.

It would be wrong to think of this as a “bank run” – much less as a panic. The depositors were not irrational or falling subject to “the madness of crowds” in withdrawing their money. The banks simply were too selfish. And as customers withdrew their deposits, banks had to sell off their portfolio of securities – including the long-term securities held by SVB.

All this is part of the unwinding of the Obama bank bailouts and Quantitative Easing. The result of trying to return to more normal historic interest-rate levels is that on March 14, Moody’s rating agency cut the outlook for the U.S. banking system from stable to negative, citing the “rapidly changing operating environment.” What they are referring to is the plunge in the ability of bank reserves to cover what they owed to their depositors, who were withdrawing their money and forcing the banks to sell securities at a loss.

President Biden’s deceptive cover-up

President Biden is trying to confuse voters by assuring them that the “rescue” of uninsured wealthy SVB depositors is not a bailout. But of course it is a bailout. What he meant was that bank stockholders were not bailed out. But its large uninsured depositors who were saved from losing a single penny, despite the fact that they did not qualify for safety, and in fact had jointly talked among themselves and decided to jump ship and cause the bank collapse.

What Biden really meant was that this is not a taxpayer bailout. It does not involve money creation or a budget deficit, any more than the Fed’s $9 trillion in Quantitative Easing for the banks since 2008 has been money creation or increased the budget deficit. It is a balance-sheet exercise – technically a kind of “swap” with offsets of good Federal Reserve credit for “bad” bank securities pledged as collateral – way above current market pricing, to be sure. That is precisely what “rescued” the banks after 2009. Federal credit was created without taxation.

The banking system’s inherent tunnel vision

One may echo Queen Elizabeth II and ask, “Did nobody see this coming?” Where was the Federal Home Loan Bank that was supposed to regulate SVB? Where were the Federal Reserve examiners?

To answer that, one should look at just who the bank regulators and examiners are. They are vetted by the banks themselves, chosen for their denial that there is any inherently structural problem in our financial system. They are “true believers” that financial markets are self-correcting by “automatic stabilizers” and “common sense.”

Deregulatory corruption played a role in carefully selecting such tunnel-visioned regulators and examiners. SVB was overseen by the Federal Home Loan Bank (FHLB). The FHLB is notorious for regulatory capture by the banks who choose to operate under its supervision. Yet SVB’s business is not home-mortgage lending. It is lending to high-tech private equity entities being prepared for IPOs – to be issued at high prices, talked up, and then often left to fall in a pump and dump game. Bank officials or examiners who recognize this problem are disqualified from employment by being “over-qualified.”

Another political consideration is that Silicon Valley is a Democratic Party stronghold and rich source of campaign financing. The Biden Administration was not going to kill the goose that lays the golden eggs of campaign contributions. Of course it was going to bail out the bank and its private-capital customers. The financial sector is the core of Democratic Party support, and the party leadership is loyal to its supporters. As President Obama told the bankers who worried that he might follow through on his campaign promises to write down mortgage debts to realistic market valuations in order to enable exploited junk-mortgage clients to remain in their homes, “I’m the only one between you [the bankers visiting the White House] and the mob with the pitchforks,” that is, his characterization of voters who believed his “hope and change” patter talk.

The Fed gets frightened and rolls back interest rates

On March 14 stock and bond prices soared. Margin buyers made a killing as they saw that the Administration’s plan is the usual one: to kick the bank problem down the road, flood the economy with bailouts (for the bankers, not for student debtors) until election day in November 2024.

The great question is thus whether interest rates can ever get back to a historic “normal” without turning the entire banking system into something like SVB. If the Fed really raises interest rates back to normal levels to slow wage growth, there must be a financial crash. To avoid this, the Fed must create an exponentially rising flow of Quantitative Easing.

The underlying problem is that interest-bearing debt grows exponentially, but the economy follows an S-curve and then turns down. And when the economy turns down – or is deliberately slowed down when labor’s wage rates tend to catch up with the price inflation caused by monopoly prices and U.S. anti-Russian sanctions that raise energy and food prices, the magnitude of financial claims on the economy exceeds the ability to pay.

That is the real financial crisis that the economy faces. It goes beyond banking. The entire economy is saddled with debt deflation, even in the face of Federal Reserve-backed asset-price inflation. So the great question – literally the “bottom line” – is how can the Fed maneuver its way out of the low-interest Quantitative Easing corner in which it has painted the U.S. economy? The longer it and whichever party is in power continues to save FIRE sector investors from taking a loss, the more violent the ultimate resolution must be.

Eurasia Press & News

Eurasia Press & News