Since the Ukraine crisis entered its second year, there has been wide-ranging speculation concerning the resilience of the India-Russia bilateral partnership. Western alienation has pushed Russia towards China, and Moscow is gradually becoming economically and strategically dependent on the dragon.

Chinese exports to Russia—especially electronics, motor vehicles, integrated circuits and chips, and machinery goods—have skyrocketed since the war, with an average growth of 18 percent in each sector. More than that, since Western companies have exited Russia, Chinese companies in the technology, automobiles, and energy sectors have been swift to capture market shares in the Russian economy. This has raised concerns in New Delhi, Russia’s strategic partner and China’s adversary.

Yet, at the same time, Indo-Russian ties have also gained momentum. In April 2023, amidst such speculation, Indian External Affairs Minister, Dr. S. Jaishankar, termed the bilateral among ‘the steadiest in the world’. A month before his remarks, the Kremlin’s foreign policy document of March 2023 stated that Russia will ‘continue to build up a particularly privileged strategic partnership’ with India.

The India-Russia bilateral partnership has evolved over decades into a multifaceted engagement, centring around space, defence, multilateral cooperation, and trade. In the past two decades, their dynamic energy ties have also emerged as a critical driver of their bilateral ties. Endowed with vast energy reserves, Russia is important for India’s energy security. The bilateral partners have embarked on numerous joint ventures in the Russian energy sector. Furthermore, the International North-South Transport Corridor, a multimodal network connecting India and Russia via Iran, holds immense promise for enhancing trade and connectivity, underpinning the economic dimension of their partnership.

India has stepped up its investment and trade ties with the Russian energy sector, even more so after the Ukraine war. This article analyses India’s investments in the Russian state energy complex and delineates the geoeconomic and strategic implications for the bilateral partners. It also analyses the geoeconomic implications of the Indo-Russian energy trade after the Ukraine war.

Indian investments in the Russian energy sector

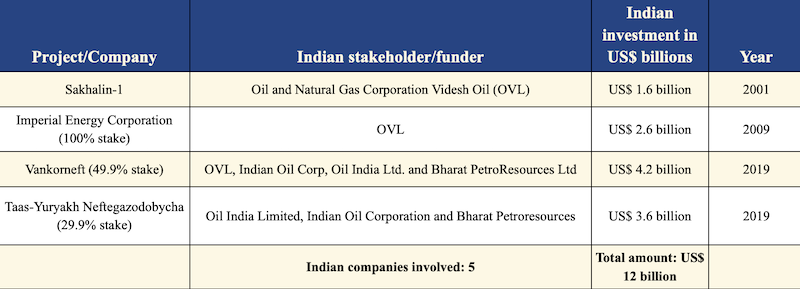

India’s investments in the Russian energy sector commenced with India’s Oil and Natural Gas Corporation Videsh Oil (OVL) investing US$1.6 billion for a 20 percent stake in the Sakhalin-1 oil field project. Until the Ukraine war, Sakhalin-1 produced220,000 barrels per day (bpd), with ONGC receiving 44,000 bpd. The Indian state company sold most of its share internationally, generating export revenues worth US$100-150 million yearly since production plateaued in 2013. OVL also has a 100 percent stake in Russia’s Imperial Energy Corporation. Its major oil fields, Maiskoye and Snezhnoye, produced 216,000 bpd in 2018, adding to India’s strategic energy reserves immensely, a huge boost from 18,000 bpd in 2009.

Table 1: Indian Investments in Russia’s oil sector

Additionally, in 2019, a consortium of Indian state companies bought 49.9 percent and 29.9 percent stakes in Rosneft’s subsidiaries, Vankorneft and Taas-Yuryakh Neftegazodobycha.

Vankor’s cluster of oil fields holds a capacity of 2.5 billion barrels of oil. Although Rosneft holds the majority 51.1 percent stake in Vankorneft, the deal is projected to add 14 million metric tonnes of oil to India’s reserves. Taas develops Rosneft’s largest assets in Eastern Siberia—the Central block and Srednebotuobinskoye field—and India’s investments there are projected to add 6.56 million metric tonnes of oil to India’s reserves.

Collectively, Vankor and Taas oil fields produced 542,000 bpd in 2021. Vankor produced about 442,000 bpd, while Taas produced 100,000 bpd. Indian and Russian stakeholders are also looking to deepen collaboration for energy production in Russia’s Far East and Arctic regions, especially in the Sakhalin-3 in the Far East, Vankor in East Siberia, and Terbs and Titov oilfields in the Timan Pechora basin, which are located on the western upper end of the country, on the shores of the Kara Sea and Barents Sea. India’s deepening interest follows major Chinese inroads in the region. Over the past several years, China has emerged as the Far East’s primary foreign investor and trading partner. In 2019, Chinese FDI accounted for over 70 percent of total FDI and 30 percent of all international trade in Russia’s Far East. Between February 2022 and May 2023, China also invested US$3.43 billion in mining and transport infrastructure in the region.

Moscow sees potential Indian investments as a counterbalance to Beijing’s growing presence there. Beijing’s historical links with the region and growing Chinese immigration worry Kremlin. New Delhi’s willingness to invest in these regions has been met with receptiveness from Moscow, which is keener for its strategic partners to invest in Russia, as multiple Western energy companies pulled out of the country after the Ukraine war commenced.

Implications of the Ukraine war on the energy bilateral

Indian investments in Russia have reaped rich dividends for the bilateral partners. Indian oil companies billed US$5 billion in the past four years on collaborative projects with Rosneft, a Russian state-owned energy company. However, the Ukraine war has dented returns on these investments. Since April 2023, Indian dividends worth US$400 million have been parked in Russian banks, which cannot be transferred because of Western sanctions. Moreover, four Russian energy projects— Sakhalin-1 and the 3 Taas oil fields—stopped production temporarily, as they were operated by Western energy companies that pulled out of Russia after the Ukraine war commenced.

Yet, India has gained geoeconomic advantages from Western sanctions and the West’s alienation of Russian oil and gas. Since Russian oil is irreplaceable, banning it outright would have resulted in massive global shocks. Hence, the European Union (EU), United States, Australia, and their Western allies imposed a price cap on Russian oil (US$60 per barrel). Western nations largely control the oil-shipping industry and, since February 2022, have refused to ship Russian oil above the imposed price cap since half of the Kremlin’s revenues are comprised of energy-export returns. This particular strategy aimed to cripple Moscow’s war funding in the long term.

India, which imports 87 percent of its oil and 65 percent of its gas, was offered oil at major discounts on pre-war prices by Moscow, going as low as US$69.7 per barrel in June 2023.

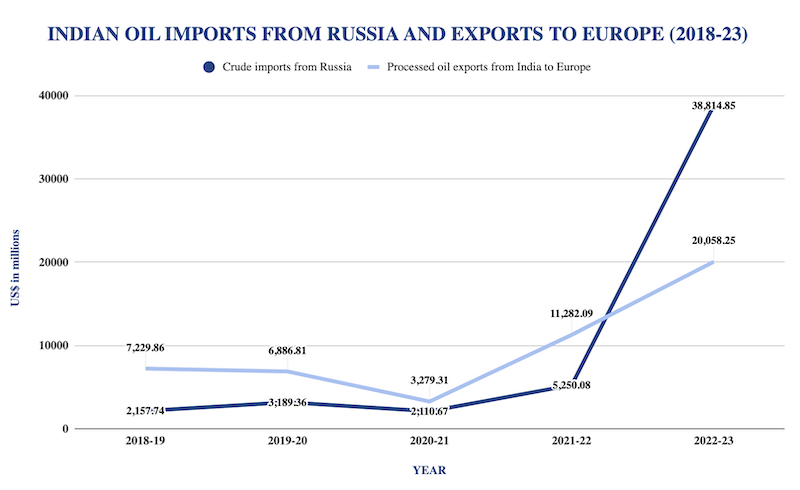

Consequently, between February 2022 and 2023, India’s oil imports from Russia swelled from 1 percent (3.6 million tonnes) to 40 percent (56 million tonnes) of India’s gross oil imports. The Indian government saved US$3.6 billion in energy imports in the last financial year by importing Russian oil worth US$38.8 billion in FY2022-23. The private refineries saved even more to the tune of US$7.6 billion. Reliance Industries and Nayara Energy (in which Rosneft has a 49.13 percent stake) emerged as the largest buyer of Russian crude at 45 percent.

Nayara’s India operations are strategically crucial to Rosneft, as investments in India allow Rosneft to export oil to India, where it is whitewashed and then exported to the West, thus generating export revenues for Rosneft, a Russian government-owned company.

Indian private and public companies also exported 3.8 million tonnes of processed Russian crude to the EU, formerly Russia’s largest oil buyer, worth US$20 billion in FY2022-23, generating precious export returns and contributing to the country’s burgeoning forex reserves. A new price cap enforced in February 2023 has provided the Indian government with even cheaper oil, although the rates have not been declassified yet.

Conclusion

The India-Russia bilateral ties are rooted in history and guided by shared policy objectives and similar strategic imperatives. Energy sector collaboration is a cornerstone of their bilateral engagements, even more so today, when energy security is a crucial strategic imperative for India. The policy-oriented approach that the partners have adhered to in furthering their cooperation in the energy sector is a testament to the strength and expansive nature of the bilateral. Yet, as New Delhi and Moscow continue to navigate their diverse challenges and changing positions in the global world order, as well as their different relations with China—a key facet of their respective foreign policy imperatives—it remains to be seen how diverging strategic interests will impact this historical bilateral partnership.

Eurasia Press & News

Eurasia Press & News