(FPRI) — In the past month, there has been a flurry of diplomatic activity between countries that, typically, don’t get along: Cyprus, Egypt, Israel, Lebanon, and Turkey. Turkish President Recep Tayyip Erdoğan met in New York with Israeli Prime Minister Benjamin Netanyahu for the first time on September 19. Additionally, Netanyahu met with the president of Cyprus and the prime minister of Greece in Nicosia on September 3. Acting Lebanese Prime Minister Najib Mikati and Speaker of the Parliament Nabih Berri flew a helicopter miles out to sea on August 22. Italy’s energy giant ENI announced plans to invest close to $8 billion in Egypt.

What has helped bring some of these countries closer together? Simply put, natural gas.

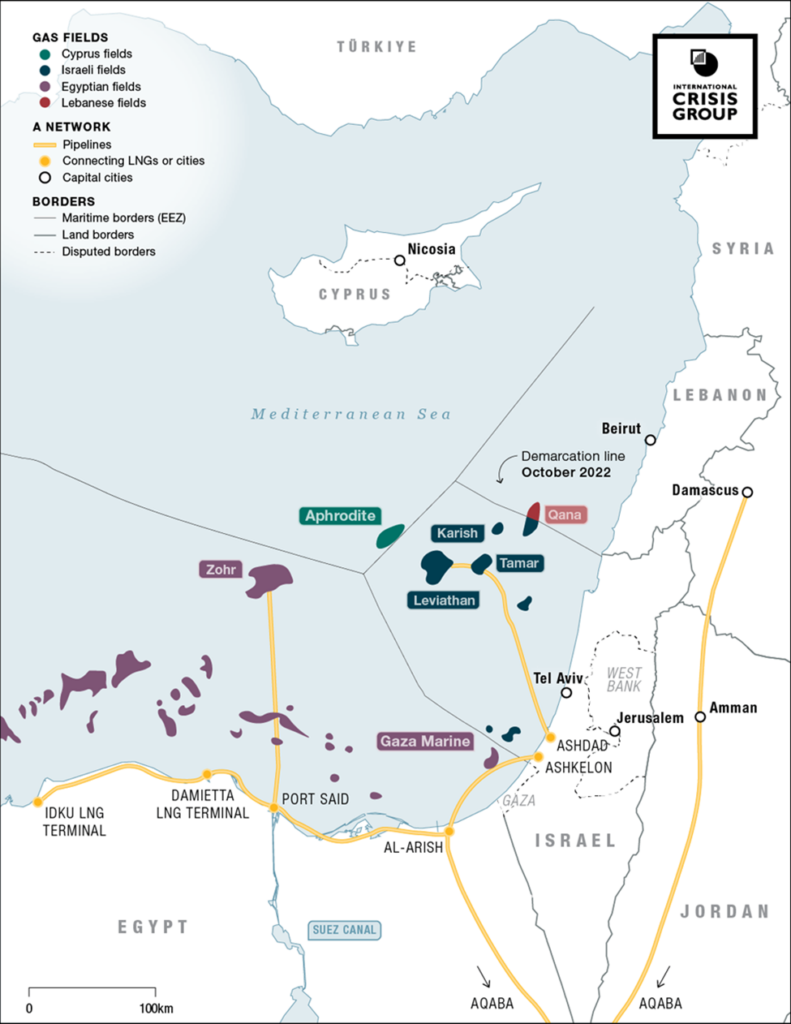

The fortuitous discovery of economically viable natural gas deposits in the exclusive economic zones (EEZ) of Israel, Egypt, and Cyprus over the past decade and a half has transformed the political economy and geopolitics of the Eastern Mediterranean. Israel was formerly an “energy island,” whose foreign policy in its first seventy years was largely dictated by the need to discreetly procure fossil fuels (oil, which it still imports, and coal), from Iran, South Africa, Iraqi Kurdistan, Russia, and Azerbaijan. It now produces 75 percent of its electricity with domestic natural gas and is a gas exporter. Egypt produces gas for most of its domestic needs and for export. Cyprus is poised to join the gas bonanza, with several promising finds. Exploitation, however, is constrained by its continued strategic conflict with Turkey, which claims part of its potential reserves for itself and its Turkish Cypriot satellite.

The earliest peace process partners, Israel, Egypt, and Jordan, have since 2020 added a crucial, long-term economic infrastructure component to their relations: Some 70 percent of Jordan’s and a significant part of Egypt’s electricity comes from Israeli gas. These supplies are anchored in multi-decade contracts based on the previous decade’s low gas prices, which in the current gas market provides windfall savings for the two Arab partners. The European Union’s efforts since the Russian invasion of Ukraine to replace Russian piped gas in their energy mix and diversify their sources of gas and oil for the coming decades provide an opportunity, and the Mediterranean is a readily accessible source of gas for Europe.

Gas has become a major force for interstate cooperation, as well as competition, in the sub-region. These dynamics are still unfolding, with numerous significant diplomatic and economic developments affecting the littoral states unfolding in the past few months and weeks. For instance, gas geoeconomics has strengthened the already emerging geopolitical alignment between Greece, Cyprus, Israel, Egypt, and the Gulf States. They have also enabled negotiations and agreements between ostensibly warring parties in Lebanon and Gaza.

Geoeconomics of Eastern Mediterranean Gas

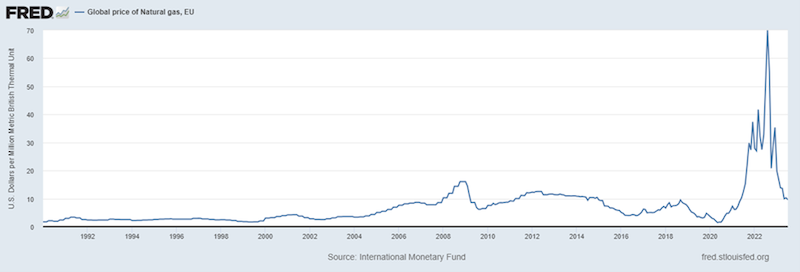

The gas export possibilities of Eastern Mediterranean producers are limited by geography. There is no existing land-based or undersea pipeline to potential customers in Europe. The much-touted EastMed pipeline, connecting Israel’s gas fields to Cyprus and then to Greece and Italy, seems to be dead in the water. Its construction would have significant security and technical challenges, as it would be the longest and deepest pipeline in the world. It may well also, at an estimated cost of over 6 billion euros, not be economically viable if gas prices return to pre-2021 levels (see Figure 2). This is especially true as Europe will continue, alongside its short-term and medium-term efforts to find alternative gas sources, to reduce dependence on fossil fuels (including gas) over the next decades. Policymakers will seek to avoid being locked into major projects like pipelines that, to be viable, need to possess long-term supply contracts.

Figure 2: Global Price of Natural Gas, European Union

Liquified natural gas (LNG) is more flexible—it can be exported anywhere by ship and is not tied to pipelines. It does, however, require liquefaction plants on the exporter side, and regasification plants on the importer side. The only liquefaction plants operating in the Eastern Mediterranean are those in Idku and Damietta, on the Egyptian coast, with a maximum production of approximately 17 bcm (billion cubic meters) a year (LNG exports from Egypt were 10 bcm in 2022).

For the foreseeable future, all gas pumped in Israeli waters and not earmarked for domestic use must be exported by pipeline either to end-users in Jordan—which is an economically and strategically important, but not a large, market—or to Egypt for local use or liquefaction. This forms a bottleneck for Israeli and future Cypriot exports, and makes Egypt the current hub of Eastern Mediterranean gas infrastructure. Any major expansion of Israeli (or, in the future, Cypriot) exports to customers outside the sub-region requires the expansion of Egyptian liquefaction capacity, the development of liquefaction plants in Israel or Cyprus, and/or the laying of a pipeline to Europe or Turkey.

Egyptian domestic demand for gas has surpassed production in 2023, leading to power cuts, as well as extended periods with no gas exports. Egypt has been saved from an even more serious gas shortage by record imports from Israel, with much of the piped Israeli gas being used domestically and relatively small amounts being liquefied and shipped on. Egypt’s petroleum minister predicted in July that this year’s income from LNG exports will be half of 2022’s record $8 billion, due both to lower volumes and lower gas prices. Part of the deficit is due to technical problems at the Zohr gas field (operated by Italy’s ENI, which holds 50 percent of the shares), the largest in the sub-region, which has led to production that is consistently below nominal capacity.

The companies working in Israeli and Cypriot waters would like to have an LNG export channel not dependent on Egypt. This is for several reasons, including redundancy; worry about Egypt diverting gas for domestic needs; and the option of exporting directly to European and other consumers without going through Egyptian state-backed monopoly entities, which pay low fixed prices. The companies also have significant problems regarding the timely payment of debts and receivables by Egypt. Chevron and its partners, the licensees and operators of Leviathan, the largest Israeli field, are examining the possibility of positioning a floating natural gas liquefaction plant (FLNG) above it. Such a plant, with a 3–6 bcm/year liquefaction and export capability, could also serve the partners’ Aphrodite field on Cyprus’ maritime border with Israel. There is also an alternative idea, of building a land-based liquefaction facility in Cyprus, or a FLNG off Cyprus, linked to the Israeli fields.

The FLNG option is technically challenging, expensive, and subject to geopolitical risk, due to terrorism threats. In any case, the potential for Israel’s gas exports to increase over current levels is some additional 10 bcm/year, absent the discovery of further resources. If dependence solely on the Egyptian route is deemed undesirable or unworkable due to long-term capacity limitations, there does not seem to be enough exportable gas for more than one solution. A Cyprus-based liquefaction plant, an Israeli FLNG, and a Turkish pipeline, all of which are currently being discussed, are largely competing, not complementary, solutions.

In the past few years, major international fossil fuel companies have entered the region. In the absence of major national oil and gas production companies, these companies comprise the operators of the fields and in many cases, the major shareholders. While national governments have interests and desires, their fulfillment is—to the displeasure of the public and some policymakers in the relevant countries—predominantly dependent on the business considerations of these foreign companies.

As another sign of the greater regional significance of Eastern Mediterranean gas, major players in the Gulf are penetrating the market. Several Gulf companies are involved in the Egyptian gas and oil market. Abu Dhabi’s national oil company, ADNOC, and BP are in negotiations since March to buy 50 percent of Israel’s NewMed gas company, which holds 45 percent of the Leviathan gas field and 30 percent of Aphrodite. Abu Dhabi’s Mubadala owns 11 percent of Israel’s Tamar. QatarEnergy holds 30 percent of the Qana concession being explored in the Lebanese EEZ.

Israeli Natural Gas Outlook

Israel has more than 940 bcm of proven gas resources: 600 bcm in Leviathan, operated by Chevron, which owns 40 percent; 300 bcm in Tamar, also operated by Chevron, which owns 25 percent; and 10 percent or so in Karish—whose output is dedicated to the domestic market—and other northern fields, held and operated by Energean (Greece). Over half of this has been earmarked, by law, for domestic use. Total Israeli production in 2022 was 22 bcm/year, of which 12.7 went to the domestic market, and 9.2 bcm to export.

Israel’s Energy Minister Yisrael Katz in July 2023 called Israel’s ability to export gas “an enormous diplomatic weapon, which strengthens Israel’s status in the region and in the whole world.” Israel is required by contract to export 3 bcm a year to Jordan through 2035, and it exports 6–7 bcm/year to Egypt, of which 1.5 bcm is liquefied and exported onward. This leaves some 400 bcm total for export until the reserve is exhausted, unless new reserves are discovered. In August 2023, Katz approved increased export levels to Egypt, which needs more, both for domestic use and for liquefication and export. The Tamar field will be allowed to export a total of 68.7 bcm, rather than 30 bcm, over the next eleven years. The Leviathan partners have requested that their export ceiling also be raised (more than doubled) to 280 bcm total. Increasing exports to and through Egypt requires the laying of additional pipelines in and from Israel, including directly from the platforms to Idku and Damietta, as the current pipelines are close to capacity.

The Israeli Finance Ministry opposed Katz’s decision. It leaked its assessments that increasing exports could reduce gas availability for the domestic market, potentially increasing prices for local users and even necessitating gas imports in future decades. This has stoked a longstanding public debate on gas issues. There has been public and media pushback against the intent to expand exports. Accusations are heard regarding oligopolistic Israeli and foreign entities enriching themselves with “sovereign national assets;” the threat of foreign (Chevron, Mubadala, ADNOC) control of “sovereign gas;” governments’ “handing over sovereign national territory” to foreign governments (Lebanon and Cyprus); and government “feebleness” facing tycoons and multinationals.

Supporters of export expansion reject these criticisms. The Israeli Energy Ministry estimates that even with rises in domestic demand and a possible doubling of allowable yearly exports to approximately 20 bcm/year, Israel’s current gas reserves will suffice until 2048. Supporters of export expansion note restricting them might deter international firms from further developing Israel’s resources, to the detriment of the local market (including loss of substantial tax revenues), and would harm relations with Egypt. They also note that the global energy transition may well leave Israel with stranded gas assets in future decades. On the background of the public and inter-ministry debates, Netanyahu chaired a meeting on gas export policy on August 27. Netanyahu ordered the formation of an interagency team to formulate a plan that would “give horizons to the companies, and assurances for the local economy.” However, he reiterated that the minister of energy is the authority that grants export permits.

The flurry of recent Israeli moves stems from two internal political drivers. First, the current Israeli government strives for high-profile foreign policy successes, in order to deflect criticism that its policies are causing international and regional isolation. Second, Katz and Foreign Minister Eli Cohen are to rotate jobs in January 2024. Each of these officials—perhaps looking to the post-Netanyahu leadership struggle in Likud—is trying to chalk up as many successes as he can before leaving, as well as close as many open issues as possible before handing over to his colleague.

Israel (and Egypt) closed bidding rounds for new offshore exploration blocs on July 16, 2023. Four consortia, which include five companies new to the market (the names of BP and of the Azeri national oil company SOCAR have been leaked), reportedly submitted six bids for licenses from Israel. The Israeli Energy Ministry has noted that it wants to bring new companies into the sector, to prevent overconcentration of market control in the hands of the existing producers (Chevron, the Israeli NewMed, and Energean).

The View from Cyprus

As Peter Stevenson of the Middle East Economic Survey notes, Cyprus’ position as the only EU state with untapped gas reserves has swung into focus in the past year. Cyprus understands the need to begin translating its gas potential to reality, and the opportunity the current situation—relatively high gas prices combined with heightened EU interest—offers. In addition, absent major new discoveries in Lebanon, Israel, or Egypt, the beginning of production by Cyprus is the most significant hope for increasing the supply of gas from the sub-region.

Talks between Israeli officials and their peers in the newly minted Christodoulides government have in recent months concentrated on a 300 km pipeline connecting Israel’s marine platforms to gas liquefaction facilities to be built in Cyprus. Cypriot Energy Minister George Papanastasiou—who bruited the idea during his June 2023 visit to Israel—noted this is a much more realist option than the 2,000 km EastMed pipeline. It would also help reduce electricity costs in Cyprus, which are much higher than the EU average. Netanyahu and the Cypriot energy minister announced in May 2023 that Israeli gas would be sent to Cyprus for liquefaction at a land-based or floating gas liquefaction plant. The international majors operating in Cyprus’ EEZ prefer piping the gas to existing infrastructure in Egypt.

Another recent development has been the Cypriot government’s rejection of Chevron’s recently submitted Aphrodite Development Plan, modified from the 2019 plan agreed between Cyprus and the previous licensee, Noble Energy (which also operated Leviathan, and was acquired by Chevron in 2020). Chevron and Shell each hold 35 percent of the license, with 30 percent held by the Israeli NewMed. Chevron’s current plan reduces the number of wells from five to three, and abandons plans for a floating production unit over the field in favor of piping the gas to existing Shell infrastructures off Egypt. The Cypriot government claims these changes favor the companies (significantly lowering costs and speeding up timetables), but reduce volumes of gas extracted long-term and thus, potential revenue for Cyprus. The Aphrodite partners are expected to return with an updated plan in the coming weeks. The US government is said to back Chevron’s plans since it will get gas to market faster and with a lower carbon footprint, as it does not involve building large infrastructure.

Cyprus has to be careful its demands do not continue to leave its gas on the bottom of the sea. Aphrodite, its most mature field, was discovered in 2011 and has not been utilized until now (partially due to claims by Israeli companies that some of it crosses the maritime border into Israel’s Yishai field). Chevron and its partners have other options in the sub-region. Given the current European thirst for gas, but the long-range dampening of opportunities for gas, it may be now or never for Cyprus. Even if the decision-making occurs soon, and is positive, first gas is not expected before 2027–2028.

Turkey Still Outside Looking In

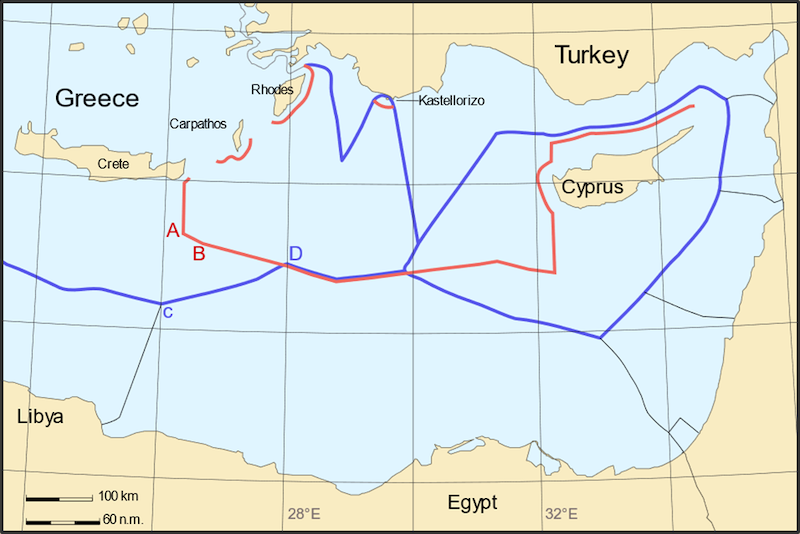

Turkey has been largely excluded from the gas “gold rush,” because of its intractable conflict with Cyprus, its tense relationship with Israel between 2010 and 2022, and the fact that despite its efforts, it has not discovered any gas deposits in its Mediterranean waters. This is not for lack of trying: Starting in 2017, Turkish seismic and drilling ships operated aggressively in Cyprus’ EEZ in search of reserves. In the early stages of Israeli gas exploration and development, Turkey was considered a leading candidate for energy cooperation, including the construction of a pipeline. Then began the decade of tension, in which Turkey pursued a vocal anti-Israel policy, and Israel began defining Turkey as a national security threat. Israel’s relationship with Greece and Cyprus, as well as with Egypt, became closer and more multi-faceted, and Israel’s gas infrastructure and industry looked south and west for development, rather than northeast. This was illustrated by the establishment in 2018 of the Eastern Mediterranean Gas Forum, of which Turkey is not a member.

Since the renewal of full Israel-Turkish diplomatic relations in 2022, Turkey—including Erdoğan—has been talking up gas cooperation with Israel. Turkey has in the past year raised, on multiple levels, the idea of a pipeline from Israel’s gas fields to Turkey. This would both enable Turkey to import Israeli gas for its needs and to promote Turkey’s desired role as the major transit hub of oil and gas from the Eastern Mediterranean, the Caucasus, and Central Asia to Europe. From Ankara’s perspective, such a project would also help “rebalance” what it perceives as Israel’s over-tilt towards the Hellenic states.

A pipeline from Israeli production facilities to Turkey would, however, be problematic. As can be seen on Map 2, a pipeline would have to transit the EEZ of Cyprus. This would be a problem because of longstanding tension with Turkey, including Turkish claims to much of the Cypriot EEZ and therefore, to a share of any gas found. In addition, the pipeline would intersect the EEZ of Lebanon and Syria, which is formally in a state of war with Israel.

Map 2: Eastern Mediterranean Exclusive Economic Zone Conflicts

There seems to be a duality in recent Israeli policy, with senior Israeli officials discussing competing concepts with Cypriot and Greek officials, on the one side, and Turkish ones, on the other. Netanyahu met with his Cypriot and Greek counterparts on September 3–4, and said a decision will be made in the next three to six months regarding the option chosen for future Israeli gas exports, referring positively to Cyprus-based alternatives. Conversely, he is reported to have in late August instructed the inter-ministerial team on gas exports to consider, inter alia, the construction of an underwater pipeline from Leviathan to Turkey. This connects to phone conversations Katz had with his Turkish and Egyptian counterparts, as well as the US envoy on regional normalization efforts, Dan Shapiro, parallel to Netanyahu’s Cyprus summit, regarding gas exports in the Eastern Mediterranean. In the wake of these discussions, the Turkish minister said he would visit Israel to continue discussions of the issue. These statements seem to be aimed at improving the bilateral atmosphere in preparation for Netanyahu’s meeting with Erdogan in New York on September 19, and a planned visit to Turkey in the coming weeks (postponed after a health scare in July).

The Lebanon Precedent Applied to Gaza

Exploration activity began in late August 2023 in Lebanon’s Block 9 (“Qana Prospect”), which straddles the de facto maritime border between Israel and Lebanon. The exploration of the lease, held by Total, ENI, and QatarEnergy, was made possible by the maritime border deal signed by both states in November 2022, under American auspices (and attacked vigorously at the time by Netanyahu, then opposition leader). The production of gas, if discovered, would take place on the Lebanese side, but Israel would be compensated for gas extracted from its side of the line by Total, under a side deal signed by the company and Israel.

Israel announced in June 2023 that it had begun cooperation with Egypt and the Palestinian Authority to develop the Gaza Marine field, discovered 30 km off Gaza in 2000. The field will be developed by state-owned Egyptian Natural Gas Holding Company which will hold a 45 percent stake in it; some 2 bcm/year will be piped into the Egyptian gas network for domestic consumption and export, including to Palestine. The Palestinian Authority will share in the profits; it is not clear how these will be shared with Hamas, which has controlled the Gaza Strip since 2007, and whose agreement will be required to implement the project. Israel (and likely Egypt, too) would oppose Hamas directly securing a slice of any gas revenues.

As Elai Rettig notes, this deal could not have happened without the precedent of the Lebanon maritime delimitation agreement. Both deals involve indirect, third-party negotiations between Israel and a hostile non-state militant organization that is acting behind the scenes and approving the deal (Hezbollah in Lebanon and Hamas in Gaza). This allows both sides to achieve not necessarily identical, but complementary interests, in a way that may stabilize their relations, without diplomatic relations or even direct contact.

The Eastern Mediterranean came late to the fossil fuel rentier economy. Public and elite opinion regarding the need for decarbonization, as well as high fossil fuel prices and the supply shocks associated with the Russo-Ukrainian War and OPEC+ production cuts, are pushing most advanced economies to invest more in renewable sources of energy and to talk of phasing out fossil fuels by mid-century. This has impacted the willingness of international investors to enter new major projects in fossil fuels, such as pipelines, as does the fact that pipelines lock countries into long-term dependence on specific suppliers. The new producers thus run the risk of having stranded assets—gas still in the ground when there is no longer demand. The Eastern Mediterranean countries are therefore very interested in getting their gas to market as quickly as possible: This trend is only strengthened by the jump in gas prices over the past two years.

Eurasia Press & News

Eurasia Press & News