Banks have been tightening their lending standards, and they plan to keep doing it throughout the rest of the year. Last week, the Board of Governors of the Federal Reserve released a new report on how much banks plan to expand or tighten lending in coming months. The report, known as the Senior Loan Officer Opinion Survey on Lending Practices, found that bankers expect a deteriorating economic picture in 2023, both for themselves and for their customers.

If accurate, this report is yet one more indication that the US economy is headed toward recession. In fact, it’s one of the more compelling indicators that a bust is unavoidable. This is because, as Austrian Business Cycle Theory shows us, a slowdown in bank lending goes hand-in-hand with a slowdown in monetary growth, which correlates with economic busts.

What Does the Fed Survey Say?

According to the Fed survey,

banks, on balance, reported tightening lending policies for all categories of [commercial real estate] loans over the past year, with the most frequently reported changes pertaining to wider spreads of loan rates over banks’ cost of funds and lower loan-to-value ratios. …

[B]anks cited a less favorable or more uncertain economic outlook, reduced tolerance for risk, deterioration in collateral values, and concerns about banks’ funding costs and liquidity positions. [B]anks reported expecting to tighten standards across all loan categories. Banks most frequently cited an expected deterioration in the credit quality of their loan portfolios and in customers’ collateral values, a reduction in risk tolerance, and concerns about bank funding costs, bank liquidity position, and deposit outflows as reasons for expecting to tighten lending standards over the rest of 2023.The report goes on to note that the bank’s plan to rein in lending extends to residential real estate, home equity lines of credit, auto loans, and credit cards.

These expected drops in lending are due to both anticipated drops in demand for loans as well as banker concerns over their own liquidity and financial obligations. Importantly, bankers reported that fears about future economic conditions focus on “deterioration in credit quality, deterioration in collateral values, and reduction in risk tolerance.”

This is coupled with banks rising concerns about cash flow at banks who face rising interests, and thus higher borrowing costs for the banks themselves. Meanwhile, banks are losing access to liquidity as depositors withdraw their deposits at historically high rates to put their in other investments that pay higher interest than the near-zero interest being paid out by commercial banks. As the report puts it: “the largest banks and additionally cited concerns about their banks’ funding costs, banks’ liquidity position, and deposit outflows.”

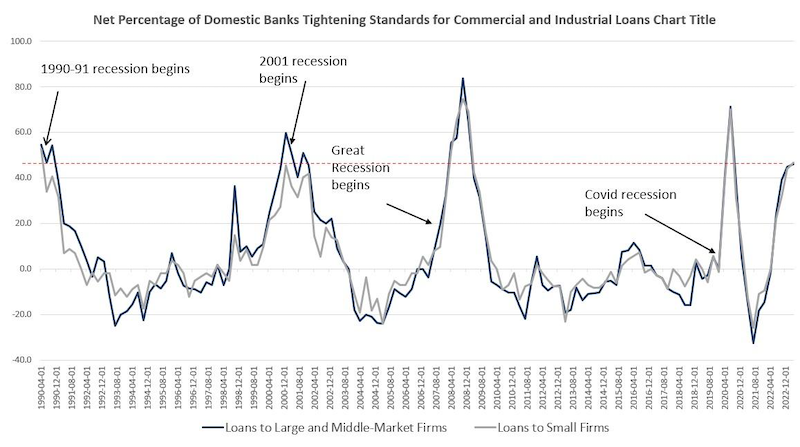

Historically, this tightening in lending is at recessionary levels already. With the exception of a false alarm in 1998, a rapid rise in tightening standards for firms (both large and small) has coincided with recession in every bust cycle for at least the past 35 years:

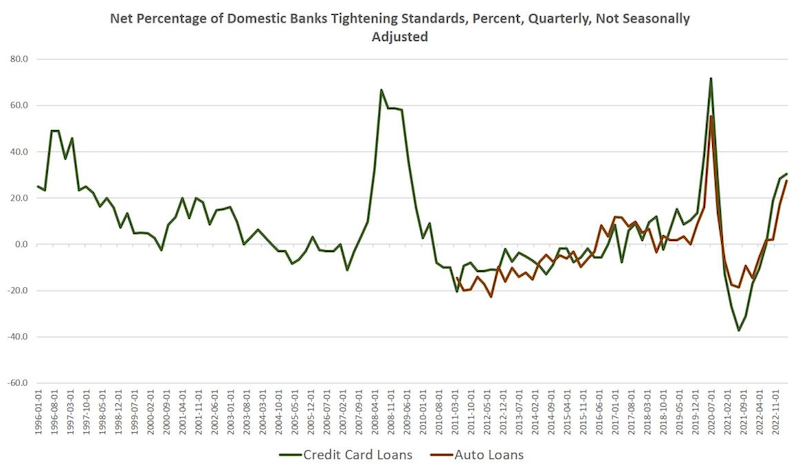

We can see a similar trend in lending to households in terms of credit cards loans and auto loans as well:

Why Bank Lending Matters to the Boom-Bust Cycle

So why the connections between lending and recession?

Decades ago, Ludwig von Mises described how an inflationary boom—which describes our current economy—can only be sustained by additional infusions of unbacked money or “fiduciary media.” In its initial stages, entrepreneurs increase production based on false signals about demand and saving that come from artificially low interest rates. In our current economy, these interest rates are pushed down by central banks in part through monetary inflation. Entrepreneurs then increase production and hiring, but this also leads to rising prices. In order to deal with these rising prices, entrepreneurs will then need more easy money to cope. Bank lending is a key component of this process. Central banks are indeed central to the inflationary process in that they incentivize banks to lend recklessly, and central banks are also instrumental in forcing down interest rates, faster more bank lending and lower lending standards. If banks become skittish due to worsening collateral values or rising interest rates, banks will not cooperate with this inflationary process and the cycle goes into reverse. Mises puts it this way:

[I]n order to continue production on the enlarged scale brought about by the expansion of credit, all entrepreneurs, those who did expand their activities no less than those who produce only within the limits in which they produced previously, need additional funds as the costs of production are now higher. If the credit expansion consists merely in a single, not repeated injection of a definite amount of fiduciary media into the loan market and then ceases altogether, the boom must very soon stop. The entrepreneurs cannot procure the funds they need for the further conduct of their ventures.…The entrepreneurs draw from the fact that demand and prices are rising the inference that it will pay to invest and to produce more. They go on and their intensified activities bring about a further rise in the prices of producers’ goods, in wage rates, and thereby again in the prices of consumers’ goods. Business booms as long as the banks are expanding credit more and more.

…The boom can last only as long as the credit expansion progresses at an ever-accelerated pace. The boom comes to an end as soon as additional quantities of fiduciary media are no longer thrown upon the loan market.

Could this problem just be solved by central bank action to force down interest rates and encourage more bank lending forever? Unfortunately, political realities get in the way. So long as these inflationary policies continue, price inflation becomes a mounting problem, as we have seen since 2022 when price inflation reached 40-year highs. Rising price inflation is both politically unpopular and an economic danger in that rising prices—especially at higher levels—render entrepreneurs increasingly unable to plan output and investment. This leads to what Mises calls the “crack-up boom” which is when economic collapse and high price inflation coincide. So, inflationary booms must end one way or another:

[The boom] could not last forever even if inflation and credit expansion were to go on endlessly. It would then encounter the barriers which prevent the boundless expansion of circulation credit. It would lead to the crack-up boom and the breakdown of the whole monetary system.As Frank Shostak notes, the bust that results from a slowdown in money creation is not caused by the changes in the money supply per se. The bust results from a hollowing out of saving and investment caused by inflationary bubbles—which are themselves caused by monetary inflation. The exact connection between slowdowns in new money and recessions does not change the fact that declines in bank lending are closely connected to recessions. It’s just one more indication that an economy like ours simply cannot survive in its current form without relentless new injections of easy money.

Eurasia Press & News

Eurasia Press & News