With Europe facing another winter of war in Ukraine and the broader stand-off with Russia showing no signs of easing, the continent’s gas supply remains precarious and reliant on offshore infrastructure. What are the principal dangers, and how can they be mitigated?

The recent disruption of the Baltic Connector pipeline linking Finland and Estonia serves as a timely warning of the vulnerabilities that Europe faces in the maritime domain, particularly at a time when gas markets remain tight and European supply is still vulnerable. A considerable part of the infrastructure upon which Europe relies for economic activity and the sustenance of its civilian population is vulnerable to adversary sabotage. While the precise circumstances of the events which led to the disruption of the Baltic Connector are still subject to enquiry, the incident should nonetheless lend further momentum to nascent discussions regarding the types of vulnerability that adversaries might seek to exploit.

Gas prices in Europe are still more than double what they were in the first half of 2021, and the European Network of Transmission System Operators for Gas (ENTSOG) has warned that a cold winter alone without significant demand reduction could leave Europe with only 12% gas storage by spring 2024, compared with a target of 30%. If chance chips away at gas supply, through accident or strong demand from Asia, there may be opportunities for adversaries to cause severe damage to the European economy once again.

The Russian Challenge

While there is no explicit Russian doctrine for targeting undersea infrastructure, broader Russian discussions regarding strategic attacks on critically important targets can be instructive, even if they do not refer to activity in the maritime domain specifically. In Russian thinking, such attacks are a tool to be used across the spectrum of competition. In what the Russians define as a local war with a neighbouring country (not unlike Ukraine), the function of such attacks is to limit or preclude intervention by a regional coalition by inflicting damage sufficient to demonstrate the costs of intervention without being of a scale that precipitates a non-desirable response. In a regional war involving Russia and a stronger coalition, the destruction of critical targets on a much larger scale is viewed as a means of compelling the cessation of hostilities on Russian terms.

Current conditions, which conform to the definition of a ‘local war’, would appear to incentivise calibrated actions with limited consequences. However, leaders are not bound by military doctrine – Russia’s invasion of Ukraine violated several tenets of its own doctrine, for example. Russia might seek to inflict more than demonstrative damage for several reasons. The first would be that a tight gas market made worse by an unexpected occurrence such as an escalation in the Strait of Hormuz could make it possible for Russia to achieve cascading effects with relatively few acts of sabotage. Since each act raises the risk of detection and attribution, there would seem to be a natural trade-off between achieving effects at scale and avoiding escalation. An already tight gas market would eliminate this trade-off, however, since even a limited reduction in capacity could result in an increase in storage withdrawals and an attendant requirement to attract LNG cargoes to regional regasification terminals. One would expect, based on the impact of previous disruptions such as strikes at Australian LNG export facilities, that this would drive a significant spike in traded spot market prices.

Even if it did not attempt sabotage at scale, however, Russia has incentives to signal its ability to do so. Russian leaders might view this as a means of deterring methods of economic warfare such as secondary sanctions or the interdiction of grey shipping which could prove especially damaging to the Russian economy. Threatening physical disruption to the flows of critical resources is one of the few levers that Russia, with its relatively marginal role in the global economy, has as a riposte to sanctions short of war.

Responsibility for such operations would likely fall to the main directorate for deep sea research (GUGI) and the GRU – Russia’s foreign military intelligence agency – which controls regional naval Spetsnaz units and naval intelligence-gathering vessels. The capabilities of the naval Spetsnaz would be of particular significance in shallow water, since the organisation operates mini submarines such as the Triton-2 which can operate at depths of around 40 m. They can also operate using SOM-1 diver propulsion vehicles and Sirena UM swimmer delivery vehicles (SDVs) launched from the torpedo tubes of submarines. The major limitation of many Spetsnaz capabilities is the depth at which they can operate, with 40–60 m representing the upper limit of their operating depths. These capabilities are also limited in range and would be of less use in areas such as the North Sea.

The GUGI’s personnel and platforms would be more likely candidates for activity in the North Sea, which averages depths of 200 m in the areas where major pipelines converge. The organisation’s deep-diving submarines, such as the Paltus and X-Ray, are optimised to operate at much more extreme depths than this, and in the case of the latter carry diver lockouts. The GUGI, along with those elements of the Russian Navy which are responsible for deep-sea salvage, is also the likely home of Russian personnel capable of saturation diving at extreme depths. In principle, deep-submergence rescue vehicles (DSRVs) such as the AS-26 could also represent a nondescript tool with which to emplace explosives at depth. Each method has challenges, however. Special-purpose submarines rely on large and likely heavily monitored motherships to operate, while saturation diving requires the use of dedicated vessels with decompression chambers. DSRVs have to be loaded and unloaded from host ships with winches, which is a visible process.

There are alternative methods of sabotage at depth, however, which might not require the GUGI’s specialised and thus distinctive capabilities. Modified versions of remotely operated vehicles (ROVs) like the MSS-3000 or the Harpshichord unmanned underwater vehicle (UUV), which have respectively been operated from nondescript salvage vessels and civilian icebreakers, could also be used to place explosives. It should be noted, however, that while vessels deploying UUVs may be nondescript, their patterns of activity would not be. Vessels need to maintain proximity to allow for communications with a UUV, and many ROVs are tethered to their host vessel by a cable. Nonetheless, such vessels would be harder to identify than more bespoke capabilities. More crude forms of sabotage, such as dragging a vessel’s anchor across a pipeline, can also be attempted at comparatively shallow depths.

If circumstances arise that constrain gas supply – a cold winter, restricted LNG supplies, an outage at key infrastructure – then Russia will have more potential to cause damage to the European energy systemWhile there are a number of avenues through which the destruction of pipelines might be pursued – many involving repurposed civilian assets – mapping them requires vessels with specialised sensors, including powerful magnetometers. There are relatively few vessels equipped with these sensors, and many which are, such as the Yantar and Akademik Vladimirskiy, are known military assets. That being said, assuming that a body of data has been built over the years, a less bespoke asset could presumably target a pipeline based on information provided to its crew before departure. It is unlikely that Russia has just started the process of mapping pipelines, and thus the appearance of vessels such as the Akademik Vladimirsky near Allied coastlines might perhaps be viewed as a means of signalling rather than information gathering.

Dependence on Russia Continues, Sometimes

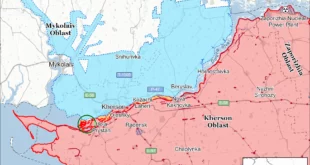

The European gas market remains tight, and potential disruptions will not have a uniform impact across the continent. ENTSOG modelling shows, for example, that a cold winter could disproportionately impact the Baltic states because of infrastructure bottlenecks between Poland and Lithuania, making these countries more susceptible to interventions that could worsen the already difficult gas supply situation.

Recent events show that misfortunes can quickly stack. In 2021, the year began with cold weather in Asia pulling LNG supply away from Europe in January, while February saw snowstorms curtail US LNG exports from the Gulf of Mexico, and March saw the Ever Given block the Suez Canal and disrupt LNG flows from the Middle East to Europe. Across the year as a whole, economies re-opening from Covid lockdowns meant that global LNG demand rebounded at a time when global LNG supply did not grow as quickly as previously forecast (for example, Norway’s only large-scale LNG export terminal, at Hammerfest, was closed between September 2020 and June 2022 due to a fire). In summer 2021, Gazprom added to the European gas market jitters by not replenishing its European seasonal storage stocks and by reducing its sales to the European spot market, thus adding to the price rally.

In 2022, Russian pipeline supply to Europe was curtailed further by Gazprom abandoning its European trading subsidiaries and suspending supplies to European buyers that refused to pay in roubles in the spring, followed by the reduction in supplies via the Nord Stream pipeline throughout the summer. The final closure of Nord Stream at the end of August 2022 was the catalyst for record European wholesale gas prices, reaching almost 10 times the pre-2021 record. With LNG from the US playing a major role in replacing Russian pipeline gas, the closure of the Freeport LNG export terminal – which accounted for almost 20% of US LNG exports in 2021 – further exacerbated the supply squeeze, remaining offline from June 2022 to February 2023.

This summer, the tightness of the European gas market was illustrated by the fact that the possibility of a strike at Australian LNG facilities caused a 40% spike in the main European gas price benchmark in early August. Consequently, while ENTSOG and others suggest that Europe is likely to hit its target of 30% storage levels by 1 April 2024, this should not be taken for granted, nor should the potential for damaging price spikes be dismissed. An escalation of violence in the Middle East – such as the recent attack on a ship off the coast of Yemen by Houthi fighters – is another potential source of disruption to European supply, especially if LNG or oil tankers passing through the Bab al-Mandab Strait and Red Sea were to be targeted.

If circumstances arise that constrain gas supply – a cold winter, restricted LNG supplies, an outage at key infrastructure (strikes in Australia alone would have taken 7% of global LNG supply out of action) – then Russia will have more potential to cause damage to the European energy system. The simplest way it could do this would be by ceasing its ongoing supply. A pretext has already been created. The Russian government has asserted that an arbitration launched by Ukraine’s Naftogaz constitutes an aggressive act that could allow sanctions to be imposed, should the government so choose. Even in a normal winter without disruption elsewhere, this would result in storage levels dropping to 12% by April and the potential for severe price increases.

Russia’s Escalation Ladder

As discussed, Russia has a number of avenues with which to pressure Europe. The most likely and doctrinally consistent of these is a limited attack with plausible deniability that would test NATO responses and appetite for escalation. However, we cannot preclude a more dramatic attack that could cause severe damage to the European economy as a whole.

Tight gas markets combined with a perceived strategic advantage for Russia might motivate an attack on a single pipeline with a view to achieving disproportionate effects. The Baltic Pipe would be one possible target, as it is located in the shallower waters of the Baltic Sea and is small enough to make a European response less likely. At the same time, an attack on the pipe, which transports gas from Norway to Poland via Denmark, would disproportionately impact Poland – which has taken a strong line on Ukraine and recently elected a more anti-Russian, pro-EU government – and the Baltic states, whose resilience has already been impacted by damage to the Baltic Connector. Achieving dissimilar levels of impact could serve as part of a strategy to drive a political wedge between Eastern and Western Europe. Russia could impose costs primarily on those states which are especially opposed to it, while also sending a signal to the rest of Europe. The attendant need to reallocate energy supplies within Europe could also potentially serve as a political wedge if it impacted consumer costs in countries where publics are already wavering with respect to support for Ukraine.

Such an attack could be carried out by the Baltic Fleet’s Spetsnaz units, which are entirely capable of operating at the depths which the Baltic Pipe traverses. The detection of small submersibles and SDVs has historically been difficult, as evidenced by Sweden’s difficulties with proving an incursion by a Russian Triton SDV near Stockholm in 2014.

Western navies need a campaigning framework which allows them to shape the legal and operational dynamics in ways that proactively constrain the threat, rather than reactively responding to itA more dramatic escalation that would likely have deeper and more widespread consequences would be an attack on one of the major pipelines carrying gas from Norway to mainland Europe or the UK. Such an attack would be significantly more challenging than an attack on the Baltic Pipe because of the potential requirement for the use of bespoke capabilities owned and operated by the GUGI, which Western navies likely pay a considerable degree of attention to. However, remotely operated and autonomous underwater vehicles may represent a tool allowing such targets to be damaged without the need for bespoke human assets or platforms. The prize in terms of economic damage would be much more significant than an attack on the Baltic Pipe. The two largest pipelines by capacity are the 658 km EuroPipe II pipeline to Germany (73.5 mmcm/d) and the 523 km Langeled pipeline to the UK (73.8 mmcm/d). The Norwegian supply to Germany and the Netherlands is supplemented by the EuroPipe I (45.7 mmcm/d) and NorPipe (44.4 mmcm/d). An attack on EuroPipe II would likely be the more problematic because of the UK’s strong LNG import and interconnector capacity, as well as domestic production using different pipelines, although the complete curtailment of Norwegian pipeline exports to Germany would require attacks on three pipelines simultaneously, which may be unlikely. However, an attack on the Langeled pipeline during a period when supply was also tight in Europe, or when a problem emerged with a UK LNG terminal, could test the UK’s solidarity with its neighbours while also having the potential to cause a short-term technical challenge because of the lack of domestic storage in the UK. In 2022, supply from the UK to Europe was essential for energy security in mainland Europe, while supply from Europe to the UK has also bolstered UK energy security at times, such as during the ‘Beast from the East’ spell of bad weather in 2018.

How to Respond? Learning to Campaign at Sea

In certain respects, the challenge is a geographically bounded one. The areas spanning the North Sea and the Baltic, while by no means small, represent a comparatively small portion of the maritime space for which the navies that make up NATO are collectively responsible. A more pressing challenge, then, is that persistent presence in this area will strain the capacity of the navies of regional states which will also have other responsibilities. There is also the consideration of how the defence of this area is achieved given both the volumes of data which must be processed and the limitations navies face in prosecuting targets of interest in peacetime.

To effectively surmount the threat, Western navies need a campaigning framework which allows them to shape the legal and operational dynamics in ways that proactively constrain the threat, rather than reactively responding to it. This requires the creative use of lawfare, the engagement of actors beyond government and the creation of retaliatory options short of war.

The immediate challenge of capacity for maritime presence could be mitigated by the use of fleet auxiliaries for presence. Though not optimal vessels, assuming that the primary task of presence is verification rather than interdiction, this may matter less – the primary deterrent being the presence of a state asset which can verify certain forms of activity such as a DSRV being winched into the water. Leveraging sensors deployed by actors in the commercial sector such as oil and gas companies might be another way for individual countries to both expand situational awareness and source data that can be used for attribution. For example, several private organisations provide data which cross-references AIS and emissions from a ship’s navigation radar, allowing vessels which go AIS-dark to be identified automatically.

Deterrence by denial is also possible if the legal basis for it is established and if appropriate retaliatory options are identified. One legal mechanism by which external vessels could be excluded from parts of the Baltic and North Sea is the creation of maritime safety zones near areas where multiple pipelines converge over the course of the winter. While the complete exclusion of vessels from an area is of questionable legality, maritime safety zones which civilian shipping are advised to avoid and where they may be inspected should they choose to transit are not. Of course, past instances of the use of such zones, such as the US Navy’s creation of one in the eastern Mediterranean in 2003, corresponded with hostilities. However, this is not a legal prerequisite – the basis for such a zone is merely that naval vessels are conducting operational activity which poses a hazard to navigation.

In principle, then, a steady drumbeat of activities such as exercises conducted bilaterally or through frameworks such as the Joint Expeditionary Force might meet this definition, as might posturing vessels near critical infrastructure to secure it. Operating concepts such as the UK’s Integrated Operating Concept separate operating from warfighting, and treat securing national assets and constraining threats as operational activities. There is a doctrinally sound basis for treating activity near critical infrastructure as an operation that warrants a maritime safety zone, even if it does not constitute combat. Such zones cannot preclude damage to pipelines but can limit vulnerabilities by channelling shipping away from the most vulnerable points in a network. They would, by necessity, need to be combined with transit passages for shipping which, ideally, do not cross over points of fragility such as areas where several pipelines converge. While one might argue that this mimics Russia’s own exclusion zones in the Sea of Azov which have long been regarded as illegitimate, it might be noted that there is a difference between an absolute exclusion zone and a safety zone, with the latter being time-bounded and linked to a specific operational activity and moreover conferring no right to hinder vessels beyond stop and search, except when a vessel represents a clear danger. Moreover, precedent has hardly precluded both Russia and China from using exclusion zones as coercive tools and as such dealing with their strategic costs.

Another palliative might be using states’ recognised right to preclude economic activity within their exclusive economic zones. Since a vessel deploying a deep-diving submersible could plausibly be conducting economic research, such activity could be precluded. This would also allow law enforcement assets to contribute to maritime presence and interdiction.

Finally, countries have engaged in non-kinetic coercion in areas of interest at sea, including the use of electronic warfare, jamming directed energy, and the use of sonar against divers. While it might be objected that these acts are often deemed illegitimate, legitimacy is a matter of ends as much as it is one of means.

In effect, then, the maritime challenge represents both an important issue in itself and a test of Western capacity for operating across the spectrum of competition. Many of the key characteristics of the challenge – including the trade-off between maintaining presence and readiness, the difficulties of timely attribution, and ambiguity regarding rules of engagement – are common to other grey-zone challenges. As illustrated by cases such as the Cod Wars and the actions of China’s maritime militias in the South China Sea, navies often struggle under such circumstances when operating alone. To be more proactive, their activities should be coordinated with those of the rest of the state to establish the legal and political grounds for campaigning, and they should be enabled to draw on the capacity of actors beyond the government. Moreover, navies will need to develop methods of denying space to an opponent short of war. This is not new, and Cold War-era campaigning in areas such as the competition between submarines and anti-submarine warfare forces captured some (though not all) of the dynamics discussed. It is, however, a skill which will need to be relearned.

Eurasia Press & News

Eurasia Press & News