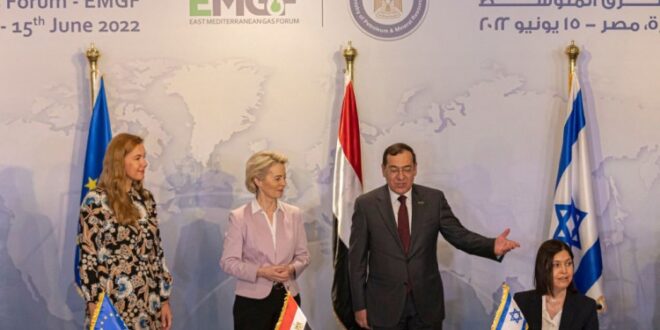

On June 17, the European Union (EU) signed a memorandum of understanding with both Egypt and Israel that creates a framework for Israel to expand its natural gas exports to Europe via Egypt. The EU also agreed with Egypt to increase collaboration on renewable energy, hydrogen, energy efficiency, and the development of trans-Mediterranean electricity interconnectors. European Commission President Ursula von der Leyen described the agreement as a big step forward “for Egypt to become a regional energy hub.”

The emergence of Egypt as an Eastern Mediterranean energy hub did not start with these accords, however. Instead, the trilateral agreement was a culmination of years of deliberate efforts by the African country to reach this position.

The rise of a natural gas hub

The change in Egypt’s energy fortunes started in 2015, when Italian oil company Eni discovered Zohr, an offshore natural gas field in the Egyptian Exclusive Economic Zone (EEZ). Considered the largest field in the Eastern Mediterranean region, Zohr was estimated to hold 850 billion cubic meters (bcm) of gas — a volume approximately equal to 15 years of Egypt’s domestic consumption at the 2020 rate. By 2018, the country became a net gas exporter.

This development was also a game changer for other regional countries that discovered gas in their EEZs. With no gas export infrastructure of their own, states such as Israel and the Republic of Cyprus began contemplating the use of Egypt’s coastal liquefaction facilities and its pipeline infrastructure to ship their volumes abroad as liquefied natural gas (LNG). Egypt had built LNG liquefaction infrastructure almost two decades ago in anticipation of its own long-term exports; but when volumes dropped, these facilities remained largely unused for years.

Cairo saw this as an opportunity to become a gas hub for the Eastern Mediterranean, and it signed a bilateral agreement in 2019 to import 85 bcm of Israeli gas over a period of 15 years through a pipeline, built in 2008, that was originally intended for Egypt to export gas to Israel. Egypt could use the gas domestically or re-export it for profit. Israeli volumes began flowing in 2020, and by the following year, Egyptian LNG exports reached a 10-year high.

Cairo also outmaneuvered other contenders for the regional hub role by leveraging geopolitical fault lines. It capitalized on the tensions between Turkey on the one hand, and Israel, the Republic of Cyprus, and Greece on the other, joining the latter group of countries to co-found the East Mediterranean Gas Forum (EMGF). The Forum’s goals were aimed at creating a regional market for gas, rationalizing the cost of infrastructure, and offering competitive prices. Although it also included Jordan, Palestine, France, and Italy, the grouping’s exclusion of Turkey weakened the latter’s chances of becoming a transit route for regional gas to European energy markets.

The EMGF’s own flagship project was initially the construction of the underwater Eastern Mediterranean pipeline (EastMed), connecting Israeli and Cypriot gas fields to Cyprus, Greece, and onward to the rest of Europe. The apparent demise of the pipeline project in 2021 — due to concerns over its technical and commercial viability and the withdrawal of U.S. support — was most beneficial to Egypt, as it weakened another alternative route to European markets. The fact that last month’s trilateral EU-Israeli-Egyptian agreement was signed during the seventh EMGF ministerial meeting indicated a wider recognition of this shift.

The energy landscape that emerged since the beginning of the 2022 Russo-Ukrainian war further confirmed Egypt’s role. With the EU trying to reduce its dependence on Russian gas, the Eastern Mediterranean region emerged as an alternative supplier, and the Egyptian hub was best positioned to provide the short-term exports that Europe sought. Egypt’s ability to increase LNG export capacities at the Idku and Damietta liquefaction plants as well as to expand imports from Israel offered the fastest option available to deliver regional gas to Europe — particularly since most of the required infrastructure already existed.

The recent trilateral memorandum of understanding, along with the latest EU energy plan, formalized the mechanisms established by previous agreements to increase Egyptian LNG exports to the EU to 5 bcm this year. Simultaneously, Egypt also agreed with Lebanon to supply the latter with gas via the pipeline connecting the northeast African country with Jordan and Syria.

Egypt appears to have won the race to become the Eastern Mediterranean’s gas hub in the short term. Yet Israel — the primary producer supplying gas via that hub — also emerged as a winner. At the same time, however, with natural gas reserves equal to 82 years of its annual consumption, Israel is also exploring other export opportunities, such as a floating LNG platform at the Karish gas field.

Obstacles ahead

The Zohr field has been producing less than initially expected, and fresh offshore exploration is slowing down; unless newly planned drilling proves more successful, Egypt’s own offshore gas is likely to continue being consumed at home. Therefore, looking beyond the short term, Egypt appears set to rely on re-exporting gas imported from its regional neighbors, leaving it with the possibility to profit only from transit and liquefaction fees. Moreover, Egypt retained the right to use Israeli gas imports domestically if its own demand increases.

To expand its hub status and maximize profits, Cairo reached an agreement with Nicosia to build a new pipeline from Cypriot gas fields to Egypt. It also proposed new pipelines linking Israel’s Leviathan gas field directly to Egypt as well as connecting Egypt with the Greek island of Crete through their recently agreed EEZ boundary.

Yet Egypt’s medium- and long-term prospects are also challenged by the fact that parts of the world are transitioning away from fossil fuels. The term set for last month’s trilateral agreement was limited to a maximum of five years, in line with the EU’s plans to use 30% less gas by 2030 and 80% less by 2050. The EU even warned Egypt against the risks of being locked into gas for an extended period of time.

Foundations for future energies

Thanks to its location and infrastructure, Egypt has a number of energy export options, and its hub plans are not limited to gas. Over the last few years, the country increased its electricity generation capacity to 59 gigawatts (GW), despite peak domestic demand topping out at only 32 GW. This huge spare capacity — which occurred thanks to a drop in demand caused by energy subsidy reform and supply-side energy efficiency programs — allows Egypt to quickly expand its gas-fueled electricity generation for export.

Potential electricity importers include Libya, Sudan, and Jordan via existing interconnections; Greece via a planned cable; and Cyprus via the Euro-Africa interconnector, currently under construction. An exchange interconnection is also being built between Egypt and Saudi Arabia.

Egypt also has great potential to expand its renewable power beyond today’s modest 6 GW of generating capacity — which includes solar farms at Benban, wind farms near Hurghada, and hydropower from the Aswan High Dam. Such expansion could allow it to export green electricity to European markets via planned cables. It would additionally enable it to produce green hydrogen for export by sourcing electricity for electrolysis from renewable energy sources.

Cairo has already signed a number of agreements with foreign investors to develop green hydrogen and green ammonia production facilities near the Suez Canal. Some of these are expected to become operational before the end of the year by diverting green electricity from existing renewable energy sources to power them via the national grid. Imported natural gas can be used to make up for the shortfall; however, this means that renewables will represent an even smaller share of the Egyptian electricity grid.

In fact Egypt’s green hydrogen project plans currently amount to almost 12 GW, equivalent to more than 1.57 million tons of green hydrogen. Not only do these projects rank Egypt among the top three green hydrogen pipelines globally, but if implemented fully, they position it well to provide one-sixth of the 10 million tons of green hydrogen the EU plans to import by 2030. With the exception of the waste-to-hydrogen plant planned for the Suez Canal Zone, these projects will require new renewable energy installations. Those facilities will not contribute to increasing the share of renewables in the national grid since their production will be diverted to export-bound hydrogen.

In addition to green hydrogen, Cairo is also exploring the potential of blue hydrogen, wherein natural gas is converted to hydrogen and the emitted carbon is captured and stored. It is currently considering ways in which it can implement carbon capture and storage strategies to make this happen.

Egypt’s geography was a major contributing factor to its emergence as an energy hub. Its proximity to Europe is comparable to the role played by Algeria and Morocco in supplying the west of the continent with gas and electricity. The fact that 12% of all of the world’s seaborne freight passes through the Suez Canal also positions Egypt as an important hub in the growing hydrogen and ammonia markets — especially within the EU’s Mediterranean Green Hydrogen Partnership, as a node between emerging hydrogen producers in the Gulf and Europe.

The role of climate policy

In a few years, the Egyptian hub will be ready to supply whatever the energy market needs. Egypt could re-export Israeli natural gas or keep it and develop the capacity to convert it into blue hydrogen. It could use the gas to generate electricity for export or to compensate for renewable power currently being diverted for the production of green hydrogen. It could also increase its renewable energy capacity from wind and solar to support the export of green electricity and green hydrogen, or to increase the amounts of its natural gas available for export.

Egypt’s energy options provide it with great flexibility in pursuing projects that are most commercially viable or that advance its geopolitical goals. This flexibility stems from its geography, the physical infrastructure it developed, and the regional alliances it has built up.

However, another underlying reason behind this flexibility is that Cairo is not tied down by climate commitments. The Egyptian Nationally Determined Contribution (NDC) — its 2030 pledge under the December 2015 Paris Agreement on climate change — did not include any quantifiable emission reduction targets, perhaps because Egypt does not see itself as responsible for mitigating climate change. It is also one of a handful of countries that failed to submit an updated NDC in 2021. When Cairo finally presented an update this month, the document did not pledge an economy-wide reduction in greenhouse gases; rather it predicted an increase in emissions from the transport and electricity-generation sectors by 2030.

This lack of commitment means that Egypt has few self-imposed environmental barriers to pursuing options most advantageous to its economic and political interests. And the absence of a long-term climate strategy or decarbonization plan also means that the country has no end-state to work toward. Egypt could theoretically export green hydrogen and green electricity one year, and natural gas the following year.

Such a tactical approach was evident over the last two years, when the glut in gas-fueled generation capacity contributed to a slowdown in renewable energy projects. As a result, Egypt is expected to miss its renewable energy target for 2022, set at 20% of generation capacity. The same approach is also evident this summer, with domestic demand for electricity having increased so much that all LNG exports from the Idku liquefaction plant had to be halted for two months.

Opportunities for engagement at COP27

This year, Egypt holds the presidency of the United Nations Framework Convention on Climate Change’s 27th Conference of Parties (UNFCCC COP27). As such, Cairo is under pressure to demonstrate that it will commit to more ambitious climate action. It has also signaled that its long-held climate policies — which a focus on receiving technical and financial support for climate adaptation and on promoting natural gas as a “transition fuel” — are subject to change with the right incentives. According to one senior Egyptian official, Cairo could deliver on mitigation if it receives predictable, adequate, and sustainable finance. So while Egypt’s rise as a regional energy hub makes it a reluctant partner on decarbonization, the government also recognizes that change is afoot and is hedging its bets.

At COP27, set to be held in Sharm el-Sheikh in November, Egypt is expected to highlight its solar and wind farms, energy efficiency initiatives, and green hydrogen projects — not just to showcase its green credentials but also to attract foreign direct investment into these sectors. This opening presents an opportunity to nudge Egypt toward low-carbon energy sources. If Egypt is to be won over to the climate cause, its unique circumstances must be recognized; and if it is to be meaningfully engaged on energy transition, 2022 is the year to start doing so.

Eurasia Press & News

Eurasia Press & News