Oil and other petroleum futures surged amid supply concerns sparked by a decline in crude inventories at a key Oklahoma terminal. “This is basically fear of a fundamental supply disruption,” said Fadel Gheit, an analyst at Oppenheimer & Co.

Oil and other petroleum futures surged amid supply concerns sparked by a decline in crude inventories at a key Oklahoma terminal. “This is basically fear of a fundamental supply disruption,” said Fadel Gheit, an analyst at Oppenheimer & Co.

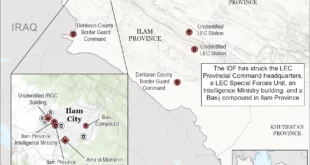

The US is trying to raise support for new UN sanctions against Iran over its nuclear programs. Iranian President Mahmoud Ahmadinejad says the nuclear issue is “closed”.

Many traders worry that economic sanctions or a military strike on Iran will result in the disruption of oil supplies from the Middle East, Gheit said.

“I think we probably built in a dollar or two of (Iran-related) premium here in the last 48 hours,” said James Cordier, president of Liberty Trading Group in Tampa, Fla.

Also stoking concerns about crude supplies was a slight decline in oil inventories at the New York Mercantile Exchange crude delivery point of Cushing, Okla., last week. That decline was about the only element of Wednesday’s inventory report by the Energy Department’s Energy Information Administration that was supportive of prices, analysts said. But it was enough to spark a late rally on Wednesday and to boost oil prices again on Thursday.

Analysts said a number of tropical weather systems were not affecting prices, as none are forecast to disrupt critical gas and oil infrastructure in the Gulf of Mexico.

November light, sweet crude jumped $2.58 to settle at $82.88 a barrel Thursday on the Nymex, while October gasoline rose 6.65 cents to settle at $2.0939 a gallon. Prices got an additional boost in afternoon trading from a Dow Jones Newswires report that 700,000 barrels of crude oil originally scheduled to be shipped to the Strategic Petroleum Reserve in September have been rescheduled for October delivery, which will increase demand for crude next month.

Crude prices peaked near $84 a barrel last week before falling for several sessions. Prices settled below $80 Tuesday and dipped below $79 on Wednesday before rallying late in the day. Analysts are divided on oil’s future direction. Gheit, for instance, argues that there are no fundamental reasons for $80 oil. He sees oil’s true value as being closer to $60 a barrel.

Cordier, on the other hand, thinks bullish sentiment will boost crude prices to near $85 a barrel.

Most analysts agree that oil prices will begin a seasonal decline within the next month.

In other Nymex trading, heating oil futures rose 6.95 cents to settle at $2.2521 a gallon, while November natural gas fell 12.7 cents to settle at $6.919 per 1,000 cubic feet. The government on Thursday reported that natural gas inventories rose by 74 billion cubic feet last week, slightly more than expected. Natural gas inventories are higher than they were one year ago.

In London, November Brent crude rose $2.60 to settle at $80.03 a barrel on the ICE Futures exchange.

At the pump, meanwhile, the average national price of a gallon of gas fell 0.2 cent overnight to $2.811, according to AAA and the Oil Price Information Service. Some analysts expect gas prices to rise further to catch up with oil’s recent gains. Others argue that gas prices won’t rise nearly as much as oil prices have, because gasoline futures have lagged oil’s advance.

In addition to the supply concerns, energy traders continue to be encouraged by positive economic reports, analysts say. Energy investors are closely monitoring whether the problems affecting the subprime lending industry will spread, causing a wider economic slowdown and affecting demand for oil and gasoline.

The Commerce Department on Thursday said the economy grew at a 3.8 percent annual rate in the second quarter, less than expected but much faster than the first quarter’s 0.6 percent growth rate. New home sales fell in August to the lowest level in seven years, but the housing sector’s problems have yet to show up in overall economic figures.

“As long as we don’t have horrid numbers coming out, people think we’re going to weather this,” Cordier said.

Also supporting high oil prices are the weak dollar and unrest in Nigeria. Because of the dollar’s decline, foreign investors are actually paying less for oil futures now than in recent years, despite record crude prices, Cordier said.

In Nigeria, Africa’s biggest oil producer and one of the top overseas suppliers to the United States, a foreign oil worker was killed and another kidnapped.

Eurasia Press & News

Eurasia Press & News