TEHRAN (FNA) – While Washington, facing European Union discomfort and frank opposition from Russia and China, remains obsessed with another round of United Nations sanctions against Iran, the facts on the ground spell an overwhelming “expansion of mutual cooperation” in the energy sector between Iran and Russia.

TEHRAN (FNA) – While Washington, facing European Union discomfort and frank opposition from Russia and China, remains obsessed with another round of United Nations sanctions against Iran, the facts on the ground spell an overwhelming “expansion of mutual cooperation” in the energy sector between Iran and Russia.

Iran holds the world’s second-largest proven natural gas reserves, behind only Russia. Alexei Miller, chief executive of Russia’s state-run gas exporter Gazprom, recently visited Tehran and met with Iran’s Oil Minister Gholam Hossein Nozari. The result is that Gazprom will develop “two or three” blocks of the monstrous South Pars gas field in Iran; and its daughter company, Gazpromneft, will also be part of a huge oil project in Iran. Gazprom has been in South Pars since 1997, alongside TotalFinaElf of France and Malaysia’s Petronas.

For Iran, this is really big news, an Asia Times commentary said. Reza Kasaeizadeh, the managing director of Iran’s National Gas Company, now insists that Iran will supply no less than 10% of the world gas market in the next 20 years; currently it’s only 1%. Iran at the moment exports gas only to Armenia and Turkey. When South Pars phases 17, 18 and 19 are developed by 2013 that will be a whole different ball game. South Pars – which Iran shares with Qatar – is the largest gas field in the world. Annual output of its eight blocks on the Iranian side stands at 73 billion cubic meters; in the next few years it will easily reach 200 billion cubic meters.

Sanctions? What Sanctions?

Hardcore Washington political pressure on European giants such as TotalFinaElf and Royal Dutch Shell as well as on European banks is leading Gazprom to make a killing in Iran. Russia is left virtually alone to develop the second-largest (after Russia) gas reserves in the world. Iran is in a hurry. And so is Gazprom, while it is able to extract fabulous deals thanks to lack of competition.

As any European Union negotiator in Brussels is forced to admit, the EU is a virtual hostage of Gazprom. Adding to European angst, both Russia and Iran want the formation of a gas equivalent of the Organization of Petroleum Exporting Countries (OPEC) sooner rather than later – a likely scenario at least from the point of view of Russian-Iranian coordination in investment policy and pricing.

Teymur Huseynov, head of the Eurasia department at the Exclusive Analysis risk consultancy, confirms “Gazprom’s vulnerability to US sanctions is minimal”. Gazprom supplies over 25% of Western Europe’s gas. Much of Iran’s future production will also go to Western Europe anyway. Russia and Iran are competitors in the world gas market – but up to a point: Europe needs both.

Gazprom has already invested at least US$4 billion in Iran since 2000. The Russian company will also help Iran to develop its pipeline system – which will finally link the north (where Tehran is located) to the oil and gas fields in the south and southwest. This means Iran won’t need to import gas from unreliable neighbor Turkmenistan, prone to cut off supplies over endless arguments about unpaid bills or increased prices.

Iran is also basking in good news in the oil front. The first phase of early production from the giant Azadegan oilfield, west of Ahvaz in Iranian Khuzestan, is already on. According to Iranian estimates, Azadegan holds no less than 33 billion barrels of crude oil. For the moment it’s pumping only 25,000 barrels a day – but the point is that the whole technology was Iranian.

According to the deputy manager of technical affairs at the National Iranian Oil Company (NIOC), Hamid Deris, the Iranians had to take over when experts of Japan’s largest oil and gas explorer, INPEX, under no-holds-barred US pressure, balked at investing in the enormous project. The Japanese share was initially 90%; in the end it fell to 10%.

On the Caspian front, the Alborz semi-floating drilling rig – able to drill at 6,000 meters under the seabed – will soon be operational. That means exploration of oil and gas in the deep waters of the southern part of the Caspian – which holds at least 32 billion barrels of oil – is a go. Brazilian oil giant Petrobras is very much interested, and not in the least mindful of UN or US sanctions.

Iran and Russia have also signed a letter of understanding to speed up construction of power grids. Iran was represented by Energy Minister Parviz Fattah, Russia by the chairman of the board of RAO UES, the export arm of OAO Unified Energy System, Anatoly Chubais.

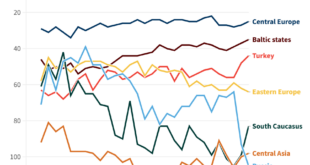

This means that Iran – already exchanging energy with Azerbaijan, Armenia and Turkmenistan – will also connect to Russia’s national power grid. Fattah said Iran and Russia would cooperate in the construction of two power plants in Tajikistan. The results are obvious: the merging of Russian and Iranian electricity networks will cover virtually all the demand in Central Asia and the Caucasus. Most of the new investment will be Russian.

As Iran strengthens its position in the region’s oil and gas networks, the outlook for its newly opened oil exchange, intended among other things to reduce the influence of Western interests in the oil trading business, may be less substantial.

The Iranian International Petroleum Exchange – the first oil, gas and petrochemical exchange in the Islamic Republic, and the first within OPEC and launched earlier this month – is intended eventually to compete directly against London’s International Petroleum Exchange (IPE) and the New York Mercantile Exchange (NYMEX).

Chris Cook, a former director of the London International Petroleum Exchange (IPE) and now a strategic market consultant after being involved from the beginning with the Iranian oil bourse, told Asia Times Online “the trading ‘system’ is the rudimentary one [not much more than a spreadsheet] used by the Tehran Metal Exchange. As far as we know it is not even web-enabled”. Iranian ministers say the bourse will soon be online.

Rajab Safarov, the director of the Iran Contemporary Studies Center in Moscow, has told the Vermianovesti daily that oil deals in the recently opened bourse will be on in only a few months’ time. According to Safarov, European middlemen are about to form companies with Iranian firms and will then start operating in the bourse.

Eurasia Press & News

Eurasia Press & News