Many people are concerned today with the low price of oil. Others are concerned about slowing or stopping COVID-19. Is there any way forward?

I gave a few hints regarding what is ahead in my last post, Economies won’t be able to recover after shutdowns. We live in a world with a self-organizing economy, made up of components such as businesses, customers, governments and interest rates. Our basic problem is a finite world problem. World population has outgrown its resource base.

Some sort of economy might work with the current resource base, but not the present economy. The COVID-19 crisis and the lockdowns used to try to contain the crisis push the economy farther along the route toward collapse. In this post, I suggest the possibility that some core parts of the world economy might temporarily be saved if they can be made to operate fairly independently of each other.

Let’s look at some parts of the problem:

[1] The world economy works like a pump.To use a hand water pump, a person forces a lever down, and the desired output (water) appears. Human energy is required to power this pump. Other versions of water pumps use electricity, or burn gasoline or diesel. However the pump operates, there needs to be some form of energy input, for the desired output, water, to be produced.

An economy follows a similar pattern, except that the list of inputs and outputs is longer. With an economy, we need the following inputs, including energy inputs:

Human energy

Supplemental energy, such as burned biomass, animal power, electricity, and fossil fuel.

Other resources, including fertile land, fresh water and raw materials of various kinds.

Capital goods, built in previous cycles of the “pump.” These might include factories and machines to put into the factories.

Structure and support provided by governments, including laws, roads and schools.

Structure and support provided by business hierarchies and their innovations.

A financial sector to provide a time-shifting function, so that goods and services with future value can be paid for (in actual physical output) over their expected lifetimes.The output of the economy is goods and services, such as the following:

Food and the ability to store and cook this food

Other goods, such as homes, cars, trucks, televisions and diesel fuel

Services such as education, healthcare and vacation travelThe more human energy is applied to a manual water pump, the faster it can pump. The economy seems to work somewhat similarly.

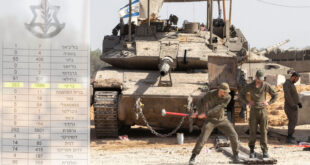

If we look back historically, the world economy grew well when energy supplies were growing rapidly.

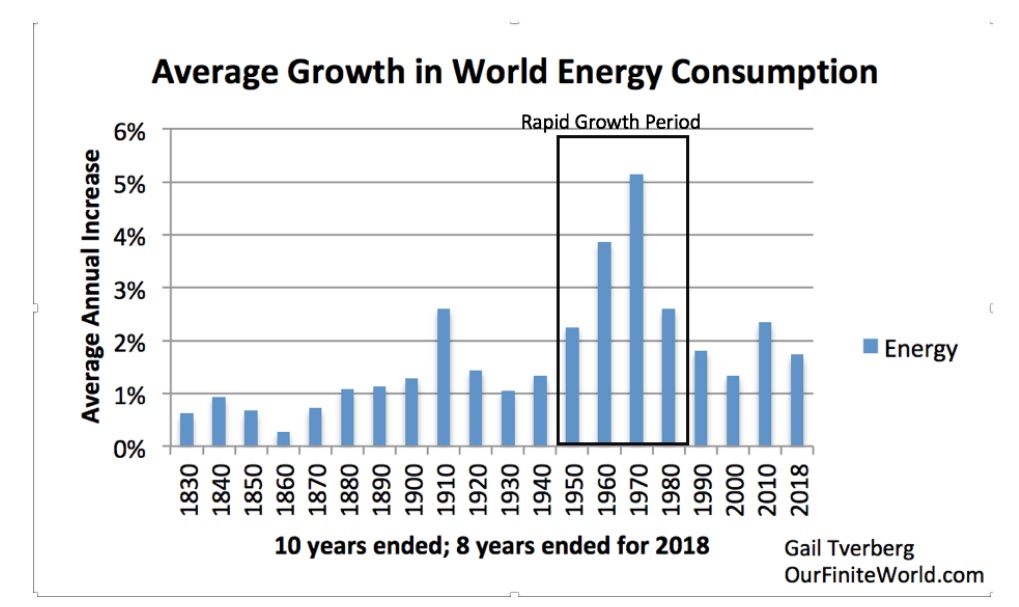

Economic growth encompasses both population growth and rising standards of living. Figure 3 below takes the same information used in Figure 2 and divides it into (a) the portion underlying population growth, and (b) the portion of the energy supply growth available for improved standards of living.

Looking at Figure 3, we see that, historically, more than half of energy consumption growth has been associated with population growth. There is a reason for this connection: Food is an energy product for humans. Growing food requires a lot of energy, both energy from the sun and other energy. Today, a large share of this other energy is provided by diesel fuel, which is used to operate farm equipment and trucks.

Another thing we can see from Figure 3 is that peaks in living standards tend to go with good times for the economy; valleys tend to go with bad times. For example, the 1860 valley came just before the US Civil War. The 1930 valley came between World War I and World War II, at the time of the Great Depression. The 1991-2000 valley corresponds to the reduced energy consumption of many countries affiliated with the Soviet Union after its central government collapsed in 1991. All of these times of low energy growth were associated with low oil (and food) prices.

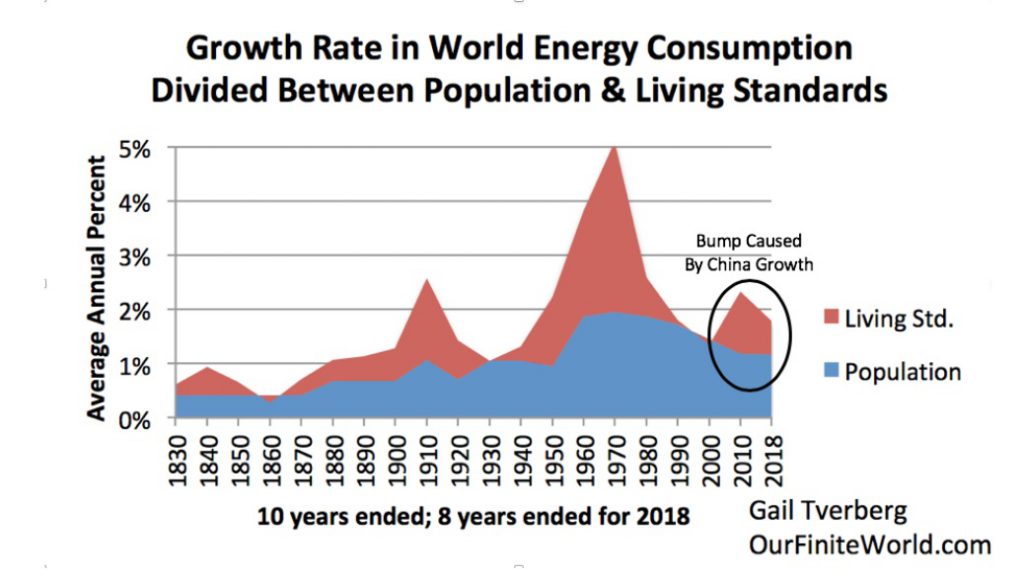

[3] Even before COVID-19 came along, the world’s economic pump was reaching limits. This can be seen in several different ways.(a) China’s problems. China’s growth in coal production started lagging about 2012 (Figure 4). As long as its coal supply was growing rapidly (2002 to 2012), this rapidly growing source of inexpensive energy helped pull the world economy along.

Once China needed to depend on importing more energy to keep its energy consumption growth, it began running into difficulties. China’s cement production started to fall in 2017. Effective January 1, 2018, China found it needed to shut down most of its recycling. Auto sales suddenly starting falling in 2018 as well, suggesting that the economy was not doing well.

(b) Too much world debt growth. It is possible to artificially raise economic growth by offering purchasers of goods and services debt that they cannot really afford to pay back, to use for the purchase of goods and services. Clearly, this was happening before the 2008-2009 recession, leading to debt defaults at that time. The rise in debt to GDP ratios since that time suggest that it is continuing to happen today. If the world economy stumbles, much debt is likely to become impossible to repay.

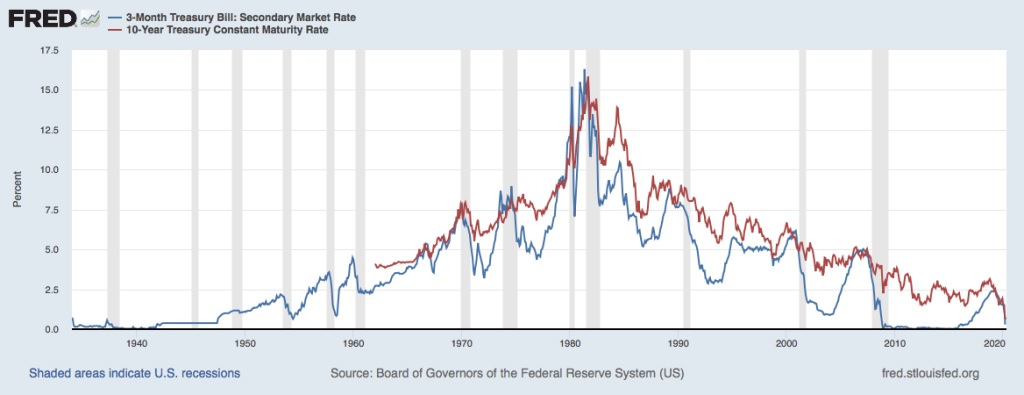

(c) The need to lower interest rates to keep the world economy growing. If the world economy is growing rapidly, as it was in the 1950s, 1960s and 1970s, the economy is able to grow in spite of increasing interest rates (Figure 5). After energy supply growth slowed about 1980 (Figure 2), interest rates have needed to fall (Figure 5) to hide the slowing energy consumption growth. In fact, interest rates are near zero now, similar to the way they were in the 1930s. Interest rates are now about as low as they can go, suggesting that the economy is reaching a limit.

(d) Growing wage disparity. Increased technology is viewed positively, but if it leads to too much wage disparity, it can create huge problems by bringing the wages of non-elite workers below the level they need to support a reasonable lifestyle. Globalization adds to this problem. Income disparity is now at a peak, around the level of the late 1920s.

(e) Excessively low commodity prices, even before COVID-19 problems. With the world’s wage disparity problem, many workers find themselves unable to afford homes, cars, and restaurant food. Their lack of purchasing power to buy these end products tends to keep commodity prices too low for producers to make an adequate profit. Oil prices were already too low for producers in 2019, before lockdowns associated with COVID-19 were added. Producers of oil will go out of business at this price. In fact, other commodity prices, including those of liquified natural gas, copper, and lithium are all too low for producers.

[4] The COVID-19 problem, and in fact epidemic problems in general, are not going away.The publicity recently has been with respect to the COVID-19 virus and the need to “flatten the curve” of infected individuals, so that the health care system is not overwhelmed. The solutions offered revolve around social distancing. This includes reduced air travel and fewer large gatherings.

The problem with these solutions is that they make the world’s problems related to slow economic growth and too much debt a great deal worse. Growing businesses are built on economies of scale. Social distancing requirements lead to less efficient use of buildings and furnishings. For example, if a restaurant can only serve 25% as many customers as previously, its overhead quickly becomes too high, relative to the customers it can serve. It needs to lay off workers. Laid off workers add to the problem of low demand for goods like new homes, vehicles and gasoline. Indirectly, they push commodity prices of all kinds down, including oil prices.

If this were a two-week temporary problem, the situation might be tolerable, but the virus causing COVID-19 is not easily subdued. Many cases of COVID-19 seem to be infectious during their latency period. They may also be infectious after the illness seems to be over. Without an absurd amount of testing (plus much more accurate testing than seems to be really available), it is impossible to know whether a particular airline pilot for a plane bringing cargo is infectious. No one can tell whether a factory worker going back to work is really infectious, either. Citizens don’t understand the futility of trying to contain the virus; they expect that an ever-large share of our limited resources will be spent on beating back the virus.

To make matters worse, from what we know today, a person cannot count on life-long immunity after having the disease. A person who seems to be immune today, may not be immune next week or next year. Putting a badge on a person, showing that that person seems to be immune today, doesn’t tell you much about whether that person will be immune next week or next year. With all of these issues, it is pretty much impossible to get rid of COVID-19. We will likely need to learn to live with it, coming back year after year, perhaps in mutated form.

Even if we could somehow work around COVID-19’s problems, we can still expect to have other pandemic problems. The problem with epidemics has existed as long as humans have inhabited the earth. Antibiotics and other products of the fossil fuel age have allowed a temporary reprieve from some types of epidemics, but the overall problem has not disappeared. Our attention is toward COVID-19, but there are many other kinds of plant and animal epidemics we are facing. For example:

Bananas are being attacked by a fungus in many parts of the world.

African swine fever has killed tens of millions of pigs in China and elsewhere.

Locusts are attacking crops in Africa.

Human pathogens are constantly evolving, so that today’s antibiotics work much less well.Even if COVID-19 does not do significant harm to the world economy, with all of the resource limits and economic problems we are encountering, certainly some future worldwide pandemic will.

[5] Historically, the way the world economy has been organized is as a large number of almost separate economies, each acting like a separate economic pump. Such an arrangement is much more stable than a single tightly networked world economy.If a world economy is organized as a group of individual economies, with loose links to other economies, there are several advantages:

(a) Epidemics become less of a problem.

(b) Each economy has more control over its own future. It can create its own financial system if it desires. It can decide who owns what. It can decree that wages will be very equal, or not so equal.

(c) If population rises relative to resources in one economy, or if weather/climate takes a turn for the worse, that particular economy can collapse without the rest of the world’s economy collapsing. After a rest period, forests can regrow and soil fertility can improve, allowing a new start later.

(d) The world economy is in a sense much more stable, because it is not dependent upon “everything going correctly, everywhere.”

[6] The COVID-19 actions taken to date, together with the poor condition the economy was in previously, lead me to believe that the world economy is headed for a major reset.Recently, we have experienced world leaders everywhere falling in line with the idea of shutting down major parts of their economies, to slow the spread of COVID-19. Citizens are worried about the illness and want to “do something.” In a way, however, the shutdowns make no sense at all:

(a) Potential for starvation. Any world leader should know that a large share of its population is living “on the edge.” People without savings cannot get along without income for for a long period, maybe not even a couple of weeks. Poor people are likely to be pushed toward starvation, unless somehow income to buy food is made available to these people. This is especially a problem for India and the poor countries of Africa. The loss of population in poor countries due to starvation is likely to be far higher than the 2% death rate expected from COVID-19.

(b) Potential for oil prices and other commodity prices to fall far too low for producers. With a large share of the world economy shut down, prices for many goods fall too low. As I am writing this, the WTI oil price is shown as $1.26 per barrel. Such a low price is simply absurd. It will cut off all production. If food cannot be sold in restaurants, its price may fall too low as well, causing producers to plow it under, rather than send it to market.

(c) Potential for huge debt defaults and huge loss of asset value. The financial system is built on promises. These promises can only be met if oil can continue to be pumped and goods made with fossil fuels can continue to be sold. Today’s economic system is threatening to fall apart. Even at this point in the epidemic, we are seeing a huge problem with oil prices. Other problems, such as problems with derivatives, are likely not far away.

The economy is a self-organizing system. If there really is the potential for some parts of the world economic system to be saved, while others are lost, I expect that the self-organizing nature of the system will work in this direction.

[7] A reset world economy will likely end up with “pieces” of today’s economy surviving, but within a very different framework.There are clearly parts of the world economy that are not working:

The financial system is way too large. There is too much debt, and asset prices are inflated based on very low interest rates.

World population is way too high, relative to resources.

Wage and wealth disparity is too great.

Too much of income is going to the financial system, healthcare, education, entertainment, and travel.

All of the connectivity of today’s world is leading to epidemics of many kinds traveling around the world.Even with these problems, there may still be some core parts of the world economy that perhaps can be made to work. Each would have a smaller population than today. They would function much more independently than today, like mostly separate economic pumps. The nature of these economies will be different in different parts of the world.

In a less connected world, what we think of today as assets will likely have much less value. High rise buildings will be worth next to nothing, for example, because of their ability to transfer pathogens around. Public transportation will lose value for the same reason. Manufacturing that depends upon supply lines around the world will no longer work either. This means that manufacturing of computers, phones and today’s cars will likely no longer be possible. Products built locally will need to depend almost exclusively on local resources.

Pretty much everything that is debt today can be expected to default. Shares of stock will have little value. To try to save parts of the system, governments will need to take over assets that seem to have value such as farm land, mines, oil and gas wells, and electricity transmission lines. They will also likely need to take over banks, insurance companies and pension plans.

If oil products are available, governments may also need to make certain that farms, trucking companies and other essential users are able to get the fuel they need so that people can be fed. Water and sanitation are other systems that may need assistance so that they can continue to operate.

I expect that eventually, each separate economy will have its own currency. In nearly all cases, the currency will not be the same as today’s currency. The currency will be paid only to current workers in the economy, and it will only be usable for purchasing a limited range of goods made by the local economy.

[8] These are a few of my ideas regarding what might be ahead:(a) There will be a shake-out of governmental organizations and intergovernmental organizations. Most intergovernmental organizations, such as the United Nations and European Union, will disappear. Many governments of countries may disappear, as well. Some may be overthrown. Others may collapse, in a manner similar to the collapse of the central government of the Soviet Union in 1991. Governmental organizations take energy; if energy is scarce, they are dispensable.

(b) Some countries seem to have a sufficient range of resources that at least the core portion of them may be able to go forward, for a while, in a fairly modern state:

United States

Canada

Russia

China

IranBig cities will likely become problematic in each of these locations, and populations will fall. Alaska and other very cold places may not be able to continue as part of the core, either.

(c) Countries, or even smaller units, will want to continue to limit trade and travel to other areas, for fear of contracting illnesses.

(d) Europe, especially, looks ripe for a big step back. Its fossil fuel resources tend to be depleted. There may be parts that can continue with the use of animal labor, if such animal labor can be found. Big protests and failing debt are likely by this summer in some areas, including Italy.

(e) Governments of the Middle Eastern countries and of Venezuela cannot continue long with very low oil prices. These countries are likely to see their governments overthrown, with a concurrent reduction in exports. Population will also fall, perhaps to the level before oil exploration.

(f) The making of physical goods will experience a major setback, starting immediately. Many supply chains are already broken. Medicines made in India and China are likely to start disappearing. Automobile manufacturing will depend on individual countries setting up their own manufacturing supply chains if the making of automobiles is to continue.

(g) The medical system will suffer a major setback from COVID-19 because no one will want to come to see their regular physician any more, for fear of catching the disease. Education will likely become primarily the responsibility of families, with television or the internet perhaps providing some support. Universities will wither away. Music may continue, but drama (on television or elsewhere) will tend to disappear. Restaurants will never regain their popularity.

(h) It is possible that Quantitative Easing by many countries can temporarily prop up the prices of shares of stock and homes for several months, but eventually physical shortages of many goods can be expected. Food in particular is likely to be in short supply by spring a year from now. India and Africa may start seeing starvation much sooner, perhaps within weeks.

(i) History shows that when energy resources are not growing rapidly (see discussion of Figure 3), there tend to be wars and other conflicts. We should not be surprised if this happens again.

Conclusion

We seem to be reaching the limit of making our current global economic system work any longer. The only hope of partial salvation would seem to be if core parts of the world economy can be made to work in a more separate fashion for at least a few more years. In fact, oil and other fossil fuel production may continue, but for each country’s own use, with very limited trade.

There are likely to be big differences among economies around the world. For example, hunter-gathering may work for a few people, with the right skills, in some parts of the world. At the same time, more modern economies may exist elsewhere.

The new economy will have far fewer people and far less complexity. Each country can be expected to have its own currency, but this currency will likely be used only on a limited range of locally produced goods. Speculation in asset prices will no longer be a source of wealth.

It will be a very different world!

Eurasia Press & News

Eurasia Press & News