In a recent issue, Time Magazine boldly declared, “The Free Market Is Dead,” and then added: “What Will Replace It?” Of course, one always can expect Time to be disingenuous at best and dishonest at worst, and as an academic economist, I have come to realize that after reading Time off and on for more than five decades, this is a publication that rarely gets it right when it comes to economic analysis.

Yet, we also are dealing with a publication that effectively reflects whatever the current spirit might be. In the mid-1980s, Time gave its readers the infamous cover condemning the bacon-and-eggs breakfast and gave massive publicity to the eat-more-carbs “experts.” America’s climb into obesity followed shortly afterward, and even Time had to backtrack on its original claims in 2014, admitting that the so-called food science truths it promoted turned out to be falsehoods.

One doubts, however, that Time ever will admit in any future edition that it has promoted outright economic lies while it promotes the policies of the Joe Biden administration. Instead, one figures that the publication will do what it always does when the government interventions it champions blow up: blame free market capitalism. For example, even more than a decade after the 2008 meltdown occurred, Time still claims that the free market did it:

We are witnessing the most profound realignment in American political economy in nearly forty years. President Ronald Reagan summed up the conventional wisdom that reigned from the mid-1970s onward in the United States: “Government is not the solution to our problem, government is the problem.” Economists, policymakers, and everyday Americans alike generally accepted that markets, unfettered and free, are the best way to create economic growth. (Emphasis mine)

That ideology began to crack after the Great Recession, and in the wake of the coronavirus pandemic, it has collapsed. The rise of ethno-nationalism on the right and democratic socialism on the left testify to the growing disillusionment with the conventional wisdom of how government and economics are supposed to work.There is plenty of evidence to demonstrate that government housing policies, combined with the policies of the Federal Reserve System, helped drive the infamous housing and stock booms even if the editors of Time refuse to acknowledge its existence. No free market in real estate and banking would have created the utter recklessness that characterized the booms of the early 2000s, even as we see a current repeat of the housing and stock bubbles, houses of cards that have arisen in the aftermath of government’s near nationalization of the mortgage industry. The reckless behavior we observed happened because the Federal Reserve under Alan Greenspan and Ben Bernanke made public their infamous “put,” a promise to “provide liquidity” to the markets in case of losses. With the Fed providing the financial backstop, investors were greatly incentivized (to put it mildly) to pyramid questionable securities atop each other until the whole unstable mass collapsed. Not surprisingly, the Krugmans of the economic and political world claimed the entire matter was due to rampant free enterprise.

Progressives, including journalists, politicians, academics, and corporate interests, for the past four decades have claimed that markets have caused a particular problem—a problem that usually is related to a past government market intervention—and demand governmental action to fix that same problem. The proposed intervention, after being implemented, then causes another set of issues (and it also fails to “fix” the original difficulty) that now requires even more governmental action. All the time, the media assures us, the economy has operated under total laissez-faire.

One is hard-pressed to understand how the onset of covid-19 discredited free markets, given that private enterprise was the entity that kept necessities delivered to American homes even while governments at all levels did everything they could to shut down the economy. It wasn’t the government that made massive adjustments on the fly to keep Americans fed, clothed, and relatively healthy. Instead, governments engineered the mass deaths in nursing homes (by ordering patients infected with covid to be put into the nursing home populations) and thoroughly botched the distribution of vaccines. But Time has spoken; the free market caused covid.

The magazine is not satisfied with false claims about what happens with free markets, electing to shill for the economic plans of the Biden administration, which make the irresponsible economic policies of Donald Trump look almost Misesian in comparison. Not surprisingly, Time gives its readers a rather crabbed (and false) history of what has happened in the last forty years regarding government and the economy. While I cannot repeat everything Chris Hughes has written on the recent history of “free market” economics, what I can say is that his account makes even Paul Krugman look honest. Here are a few vignettes:

A crisis in confidence in government triggered the last paradigm shift, making way for the rise of free market thinking. In the 1970s, the Vietnam War and Watergate challenged America’s faith in their leaders at the start of the decade. Meanwhile, the gains of the Civil Rights Movement and the introduction of affirmative action profoundly threatened the American racial order of the time, facilitating a narrative that government was putting its thumb on the scale for “undeserving” Black and poor folks.

Geopolitical tensions in the Middle East flared, causing oil prices to spike and creating long gas lines. Inflation was out of control, reaching as high as 20% on an annualized basis in 1978. Americans stopped spending, and inflation and unemployment kept rising. Presidents Gerald Ford and Jimmy Carter, Congress, the Federal Reserve all failed to develop any coherent program to help.

Far-right economists and policymakers were waiting in the wings with an explanation for the social and economic instability and a way out: government created our problems, and markets will solve them.It gets even better:

Inside the academy, they aimed to demolish the intellectual paradigm that predated free market orthodoxy, the Keynesian consensus. Before the 1970s, most economists and lawyers believed that we needed robust government action—countercyclical fiscal spending, management of the currency, tactical protectionism—to create long-term prosperity. The free market apostles wanted to erase the role of the state.

Their ideas rapidly caught on more broadly, in large part because of a shift in the country’s racial politics. Their supposedly “values neutral” economic framework justified an end to race conscious policymaking.

Until the 1960s, numerous government policies were explicitly racist. Black Americans were unable to take advantage of the Homestead Act or the GI Bill, and they were effectively barred from purchasing homes, limiting their ability to build household wealth. But the 1960s saw a historic shift with government moving to support racial equality, through the Civil Rights Acts, Voting Rights Act, and integrated schools.

Free market orthodoxy made an intellectual case that government should stop pursuing policies that might disproportionately help Black Americans, like investments in public housing or affordable health care. Any state program—even those focused on reducing poverty, providing healthcare access, or banning discrimination in the workplace—was an “intervention” in the natural economy, no matter how virtuous the intent. Political leaders cast the logic in unthreatening language, arguing that hard working Americans, whatever their race, should simply work their way to the top. But limiting government’s role in public investment and regulation only entrenched and deepened the racial inequities in the American economy.

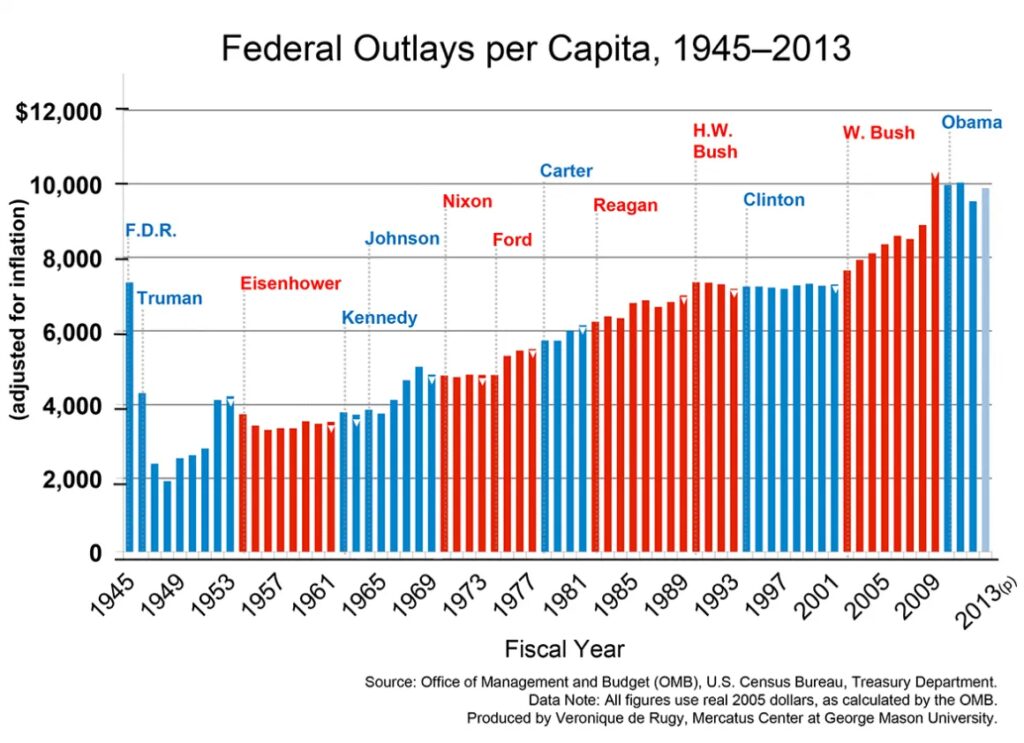

Reagan and George H.W. Bush used the same rhetoric of the free market to demolish programs that reined in private corporations and supported the middle class and poor. Their successors, Democrats and Republicans alike, continued to cut spending, pursue deregulation, and privatize swaths of the government.The scenario Hughes has presented does not exactly square with what happened since the 1970s. First, and perhaps most important, the first meaningful steps toward reversing the inflation and economic instability of that time did not come from Milton Friedman, James Buchanan, or others who might fall into the “free market” category. Instead, they came from President Jimmy Carter, Cornell University economist Alfred Kahn, and Senator Edward Kennedy, names that are not exactly synonymous with free market economics. These men were the architects of massive deregulation that effectively repealed many New Deal–era regulatory measures of railroads, trucking, passenger airlines, and finance, and they also began steps to undo the regulatory measures shackling telecommunications. Furthermore, it was Jimmy Carter who appointed Paul Volcker, who at least brought some discipline to the Federal Reserve, certainly more discipline than what we saw from Republican appointments. (Yes, these facts do disturb the modern progressive narratives that Hughes presents, which is why they didn’t make it into the Time article.)

Second, the notion that governments cut spending is simply a progressive fantasy. The graph below shows that contrary to what Hughes claims, federal spending per capita has risen sharply, especially with Republican presidents.

However, in 2008 all those so-called free market reforms fell apart and it was Government to the Rescue. That the current real estate and stock market bubbles are the direct creation of a nationalized mortgage system and aggressive Federal Reserve System efforts to suppress interest rates does not even begin to resonate with people like Hughes. They simply stick to the narratives spelled out twice weekly by Paul Krugman—government spending is good, private saving and investment are bad—and repeat them enough that they supposedly become established facts.

So, what kind of economic future do Hughes and Time envision for the rest of us? Hughes presents a scenario:

[A] managed economy on a national scale needs public investment to flourish. When government invests in public goods like roads, airports, public transit, schools, solar panels, economic growth soars—just like when you put a roof over a farmer’s market. President Biden has begun his term as President by proposing a $2 trillion infrastructure investment and calling it a prerequisite for creating growth in the future. Finally, the new managed market recognizes the need for the state to buffer shocks and surprises.The fantasy continues:

At a national level, monetary and fiscal authorities employ macroeconomic policy to mitigate the blows of unexpected crises. Just last year in response to the pandemic, the Federal Reserve took rates to zero, restarted its bond buying program, and broke new ground by moving into corporate and municipal debt markets. Meanwhile, political leaders of both parties passed three emergency aid bills to keep tens of millions of Americans out of poverty and thousands of businesses above water.

Without this support, economists believe we would be living through the darkest time in modern economics. “Without them, without those fiscal and monetary measures, the global contraction last year would have been three times worse,” said the managing director of the IMF. “This could have been another Great Depression.”

We have always used regulation, public investment, and macroeconomic management to make our economy work, but we’ve done so sporadically and often weakly because we’ve told ourselves a different story about how the economy works. It’s time for the story we tell to match the reality of economic growth—and to fully embrace the opportunity that creates.As I read this sort of economic revisionism, I am reminded of Rod Dreher’s book, Live Not by Lies, which is based on a text written by Aleksandr Solzhenitsyn. Dreher is writing specifically to American Christians who are facing increasing hostility from progressives and the institutions that they control. His point is that much of what our political, economic, media, and educational elites are telling us are outright lies and that elites are demanding that everyone conform to them. Those that don’t are mobbed, fired from their jobs, and publicly humiliated.

Likewise, we see elite academic economists and elite journalists telling outright falsehoods about our own economic history, making false claims and even trying to portray the Great Depression itself as something that was caused by failing markets and was mitigated and ultimately ended by FDR’s New Deal policies. (Krugman and other economists make the false claim that the New Deal actually created the American middle class.)

The current set of lies tell us that the way to “grow” the economy over the long term is for government to borrow trillions of dollars, spend it on programs (such as paying people not to work at a time when jobs are begging) while simultaneously blocking capital development in areas that are profitable, especially in the energy industries in which the Biden administration plans to seek capital “divestment” from profitable oil and gas ventures and divert capital into the inefficient and costly “alternative energy” sectors.

The Biden administration justifies such plans by claiming that “thousands of new jobs” will be created in the solar and windmill industries to replace those lost elsewhere, something that is economically impossible if the “new” technologies are more costly and less productive than what currently exists. (The bigger lie is that such destruction of the economy will reverse the dreaded “climate change,” making everything worth it.)

So, the lies continue to pile up. Massive borrowing and spending by the federal government will create all sorts of economic miracles such as ending poverty, pumping vast amounts of new money will neither increase inflation nor force up interest rates (from Janet Yellen), and the government can administratively replace prices and profits when it comes to capital development and there be no negative consequences or even the dreaded opportunity cost. All it takes is vision and political will, both of which Biden and his government own in spades.

We don’t need for the “build back better” economy to play out in order to know how this latest iteration of democratic socialism (or whatever one calls it) will end. Inflation already is here, even in the early stages of the so-called Biden boom. While Yellen, Biden, Krugman, and media acolytes such as Hughes are claiming that all that is needed to bring back prosperity is for government to borrow and print money, which will pay for all of the new “investments” to save us from climate change and in the process give everyone high-paying jobs, the economic adults in the room know better.

Economists Ludwig von Mises and Murray Rothbard didn’t live by lies, nor did they advocate replacing the truth with lies when presenting economic analysis. Mises a century ago proved that one cannot build an economy on socialist lies, and nothing since has proved him wrong.

Eurasia Press & News

Eurasia Press & News