China may face a significant challenge to its energy security if it tries to retaliate against Australia for plans to acquire nuclear submarine technology from the United Kingdom and the United States.

On Sept. 16, Beijing blasted the announcement one day earlier that Australia will join in a new security partnership known as AUKUS that plans to develop a nuclear powered submarine fleet “to sustain peace and stability across the entire Indo-Pacific region.”

At a press conference, China’s Foreign Ministry spokesperson, Zhao Lijian, made it clear that China did not buy the assurance of senior U.S. officials in a background briefing for reporters that the security initiative “is not aimed or about any one country.”

The submarine deal “has seriously undermined regional peace and stability, intensified the arms race and undermined international non-proliferation efforts,” Zhao said, according to a ministry transcript.

“China always believes that any regional mechanism should … contribute to enhancing mutual trust and cooperation among regional countries. It should not target any third party or undermine its interests,” Zhao said.

Western media have interpreted the AUKUS pact as a response to China’s military buildup and territorial claims in the South China Sea.

Under the plan to provide Canberra with more capable and stealthier subs, “Australia may be conducting routine patrols that could sail through areas of the South China Sea that Beijing now claims as its own exclusive zone, and range as far north as Taiwan,” Britain’s The Guardian said.

Although the conventionally armed but nuclear powered vessels are not expected to be launched until late in the next decade, the plan could open a new chapter in China’s retaliatory campaign against Australian trade and economic interests in the near term.

Despite a free trade agreement since 2015, China has been punishing Australia for policies ranging from its support for Hong Kong democracy dissidents to its calls for investigating the origins of COVID-19.

Over the past two years, Chinese authorities have imposed cutbacks and crackdowns on Australian exports of products including wine, barley, lobster, copper and coal.

The retaliatory measures have mostly focused on products that Beijing can afford to forgo, although analysts are divided on whether the ban on Australian coal has contributed to shortages and record prices for China’s main fuel this year.

Until now, the authorities have been careful to avoid restricting imports of largely irreplaceable Australian iron ore for fear of damaging China’s steel industry.

But even that safe haven for Australia may be endangered as China cuts steel output to meet emissions targets and property development fades due to rising debt risk.

Trade friction

In mid-September, iron ore futures dropped by double digits following reports of expanded production controls, PMN Business news said.

As China runs out of Australian trade categories that it can safely punish, it may be tempted to retaliate against its supplies of liquefied natural gas (LNG), the second leading commodity import from the country after iron ore.

For now, Australia remains China’s leading supplier of the super-chilled fuel, accounting for 45 percent of its LNG imports until the share recently slipped to 43 percent, according to UK-based energy consultants Wood Mackenzie.

“I don’t think China can afford to cut Australian LNG imports anytime soon,” said Mikkal Herberg, energy security research director for the Seattle-based National Bureau of Asian Research.

“This winter would be disastrous to do so. LNG is sold out globally, essentially,” Herberg said by email.

In May, Bloomberg News reported that two of China’s smaller traders were told to avoid buying new LNG cargoes from Australia, although no similar signal was sent to the country’s major importers, the national oil companies (NOCs).

In June, Wood Mackenzie said in a posting that the report of LNG restrictions was “unconfirmed,” but it may have been an indicator of pressure for broader curbs to come.

The potential for targeting Australia’s LNG trade has been closely watched this year because of a collision of factors.

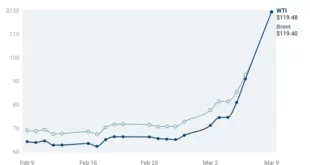

After a slump that extended through February, Asian LNG prices on the spot market have soared to record highs as China displaces Japan to become the world’s biggest buyer.

The price spike has reportedly made some Chinese importers reluctant to buy more LNG, but pre-winter stock building has combined with pressure to cut carbon emissions from coal, driving spot prices even higher.

Record gas prices, low storage levels and shortages in Europe have caused further tightening.

Some buyers are hoping that prohibitive LNG prices will eventually force fuel switching and temper demand, S&P Global Platts said.

Energy and climate

But China’s demand for both pipeline gas and LNG has been high despite rising costs as the country faces pressure to constrain coal and meet climate goals.

In the first eight months of the year, combined gas imports jumped 22.2 percent from a year earlier, accounting for over 44 percent of China’s supplies of the fuel, according to National Bureau of Statistics (NBS) data.

Despite bilateral tensions, Australia’s LNG shipments to China climbed in August with nine additional cargoes compared with July, the Australian Financial Review reported, citing an analysis by consultancy EnergyQuest.

China’s LNG imports climbed 23.3 percent through August, based on customs figures, lngprime.com reported.

In the longer term, Australia’s submarine deal may pose a strategic predicament for China, with energy security at its core.

Beijing’s claims to the South China Sea have been driven in part by its needs for offshore resources and demands to control its vital trade routes for energy imports.

But with a fleet of silent nuclear submarines patrolling the contested waters, the claims of control and issues of free passage may remain unresolved.

In the near term, China’s attempts to punish Australia for the AUKUS initiative may only succeed in trading one vulnerability for another by highlighting its reliance on energy imports through the very same waters.

While deployment of Australian nuclear submarines may be far in the future, China’s energy import dependence is also likely to continue for years.

“Their targets for domestic gas production are already very ambitious and still imply growing dependence on imported gas,” Herberg said.

“It’s hard to see when the LNG market will be supplied enough to make a shift feasible,” said Herberg. “Only in the case that the global LNG market went into huge surplus could they entertain the notion of eliminating Australian LNG.”

“I would put LNG in the same basket as Australian iron ore. It’s very difficult for China to diversify away from Australian iron ore, so they just ignore the contradiction,” he said.

Eurasia Press & News

Eurasia Press & News