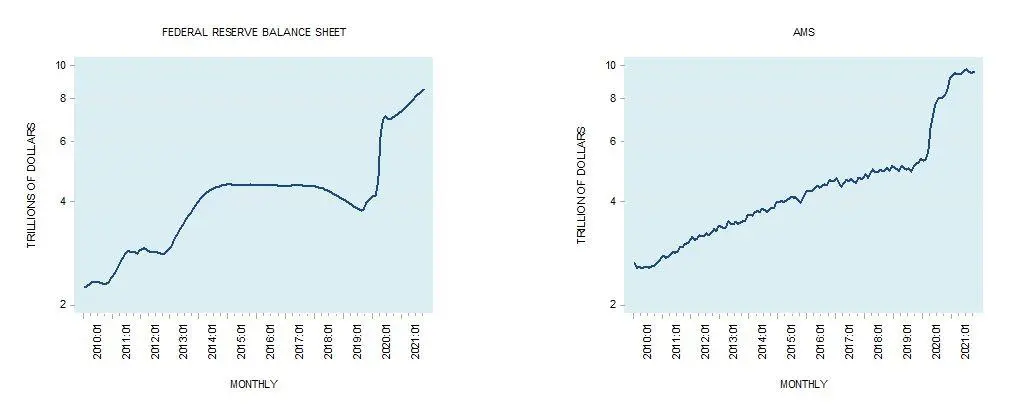

According to the popular narrative, the role of the central bank is to navigate the economy along the so-called path of economic stability. By this way of thinking if various shocks cause the economy to deviate from this path, then it is the role of central bank policy makers to offset these shocks. This is done by means of suitable monetary policies. In line with this way of thinking to counter the shocks from covid-19, the US central bank, the Federal Reserve System, pumped a massive amount of money into the economy. This is depicted by the increase in the Fed’s balance sheet from $4.2 trillion in January 2020 to $8.5 trillion by October of this year—an increase of 102.7 percent. Because of this massive increase, the Austrian money supply (AMS) measure climbed from $5.28 trillion in January 2020 to $9.59 trillion by October 2021, an increase of 81.6 percent.

Conventional thinking would suggest that with more money in their pockets, individuals are likely to increase their spending and through the magic of the Keynesian multiplier, the rest will follow suit. By this way of thinking, increases in money supply enable individuals to accommodate increases in their demand for goods and services. It is also held that in response to the increase in demand, producers are likely to oblige by raising supply through the increase of goods and services production. What we have here is that demand creates supply.

Note that in a free, unhampered market economy, individuals pay with goods in their possession for the goods they require to maintain their lives and well-being. For an individual to be able to secure something, he has to have something else. Individuals are trading goods and services for other goods and services. (Note that the trading is also of present goods and services for future goods and services).

The role of money in all this is—among other things—to facilitate trade. Money emerged as a result of the fact that barter could not support the market economy. A distinguishing characteristic of money is that it is the general medium of exchange. Money enables one producer to exchange his produce for the produce of another producer. The means of payment are always goods and services, which pay for other goods and services.

Thus, a baker exchanges his bread for money and then uses the money to buy fruits. The baker pays for the fruits not with money but with the bread produced. Money just allows the baker to make this payment. Also, note that the baker’s production of bread gives rise to his demand for money. By demand for money, what we really mean is demand for money’s purchasing power. After all, individuals do not want a greater amount of money in their pockets but a greater purchasing power in their possession.

On this Ludwig von Mises wrote, “The services money renders are conditioned by the height of its purchasing power. Nobody wants to have in his cash holding a definite number of pieces of money or a definite weight of money; he wants to keep a cash holding of a definite amount of purchasing power.”

In a free market, in similarity to other goods, the price of money is determined by supply and demand. Consequently, if there is less money, its exchange value will increase. Conversely, the exchange value will fall when there is more money. Within the framework of a free market, there cannot be such thing as “too little” or “too much” money. As long as the market is allowed to clear, no shortage of money can emerge.

Consequently, once the market has chosen a particular commodity as money, the given stock of this commodity is going to be sufficient to secure the services that money provides. Hence, in a free market, the whole idea of the optimum growth rate of money is absurd. According to Mises:

As the operation of the market tends to determine the final state of money’s purchasing power at a height at which the supply of and the demand for money coincide, there can never be an excess or deficiency of money. Each individual and all individuals together always enjoy fully the advantages which they can derive from indirect exchange and the use of money, no matter whether the total quantity of money is great, or small…. the services which money renders can be neither improved nor repaired by changing the supply of money…. The quantity of money available in the whole economy is always sufficient to secure for everybody all that money does and can do.Consumption without Production Undermines Individuals’ Well-Being

People produce and exchange with each other goods and services in order to promote their lives and well-being—their ultimate purpose. Hence, in a free market economy, consumption and production are in harmony. In a free market economy, consumption is fully backed by production.

Observe that the production of bread permits the baker to consume bread and fruits. A portion of his produced bread is used for his personal consumption while the other portion is used to pay for fruits. Note that the baker’s consumption is fully backed, i.e., paid for, by his production. Any attempt, then, to increase consumption without a corresponding increase in production results in unbacked consumption, which must come at somebody else’s expense. This is precisely what monetary pumping does. It generates demand which is not supported by any production. Once exercised, this type of demand undermines the flow of savings and weakens the pool of savings. A weakening of the pool of savings undermines the formation of capital, thereby stifling the economic growth.

Savings—Not Money—Are Key for Economic Growth

It is savings and not money that fund and make possible the production of better tools and machinery. With better tools and machinery it is possible to increase the production of final goods and services—this is what economic growth is all about. Hence, contrary to the popular way of thinking, setting in motion an unbacked-by-production consumption by means of monetary pumping will stifle, not promote, economic growth.

If it were otherwise, then poverty in the world would have been eliminated a long time ago. After all, everybody knows how to demand and to consume. The only reason why loose monetary policies may appear to grow the economy is because the pace of savings generation is still strong enough to absorb increases in unbacked consumption.

Once, however, the pace of unbacked consumption reaches a stage where the flow of savings weakens, the economy falls into a severe recession. Any attempt by the central bank to pull the economy out of the slump by means of more money pumping makes things much worse, for it only further strengthens unbacked consumption, thereby undermining further the pool of savings.

A weakening in the pool of savings—the heart of economic growth—exposes commercial banks’ fractional reserve lending and raises the risk of a run. Consequently, to protect themselves, banks curtail the generation of credit out of “thin air.” In these conditions, further monetary pumping cannot cause banks to increase lending. On the contrary, more pumping weakens savings and undermines business activity, which in turn makes banks reluctant to expand lending.

Note that after closing at 43.1 percent in December 2020, the yearly growth rate of banks’ inflationary credit (credit not backed by savings) fell to 15.7 percent by October of this year (see chart below). The decline in the momentum of inflationary credit is already exerting downward pressure on the yearly growth rate of money. This growth rate fell from 79 percent in February 2021 to 17.1 percent in October.

Furthermore, because of loose monetary policy, the low-interest environment against the background of growing risk raises the likelihood that banks are likely to reduce the expansion of inflationary lending further. All this puts downward pressure on the stock of money. Note that our monetary measure, which closed at $9.8 trillion in June 2021, fell to $9.6 trillion by October. Hence, the central bank may find that despite its attempt to inflate the economy, the money supply momentum could follow a declining path. A decline in the money supply momentum is going to undermine various activities that emerged on the back of the Fed’s monetary pumping, thereby posing a threat to economic activity.

The Fed is likely going to attempt to offset this decline in economic activity with aggressive direct monetary pumping. For example, the central bank could monetize the government budget deficit or it could mail checks to every citizen in the US—all this however, is going to further undermine savings and devastate the economy.

Surely, the government and the central bank should be doing something to prevent further economic deterioration. Unfortunately, neither the central bank nor the government have the resources to grow the economy. Neither the central bank nor the government are wealth generators—they are supported by diverting resources from the wealth-generating private sector.

This means that any measures the government undertakes must come at the expense of activities that generate wealth. Needless to say, this is likely to weaken the ability of the economy to generate goods and services.

Some commentators are of the view that monetary pumping, which generates a temporary illusion of an increase in wealth, will boost the demand for goods and services and that this increase in the demand is likely to trigger an increase in the production of goods and services. But without an expanding pool of savings it is not possible to increase the production of goods and services. Hence, if this pool stagnates or declines, then the economy’s growth rate is going to follow suit.

Conclusion

The massive monetary pumping by the Fed has likely undermined the pool of savings already. Consequently, the economic growth rate will likely weaken ahead. According to most commentators, the increase in money supply will raise the demand for goods and services. As a result, they hold, this will set in motion an increase in the production of these goods and services. But the reality is that if the pool of savings is in trouble, it will not be possible to increase production.

Eurasia Press & News

Eurasia Press & News