This analysis sets out ten ways Spain can contribute to European energy security.

Spain is part of the solution to the European energy crisis caused by Russia’s invasion of Ukraine, even if it is not part of the problem.

Analysis

This analysis is based on consultations and meetings with analysts and other actors from the Spanish energy sector as part of a series of working groups for the Elcano Royal Institute Energy and Climate Programme. It does not seek to reflect a consensus but to distil the main ideas, proposals and debates into a list of 10 ways Spain can contribute to European energy security as part of attempts to bring forward the energy transition and diversify away from Russia.[1]

(1) Spain has a key role to play in the European solution to the energy shock caused by Russia’s invasion of Ukraine

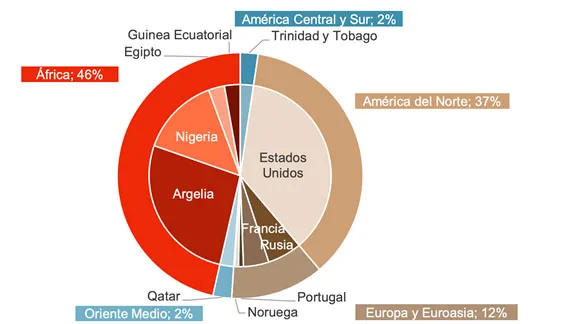

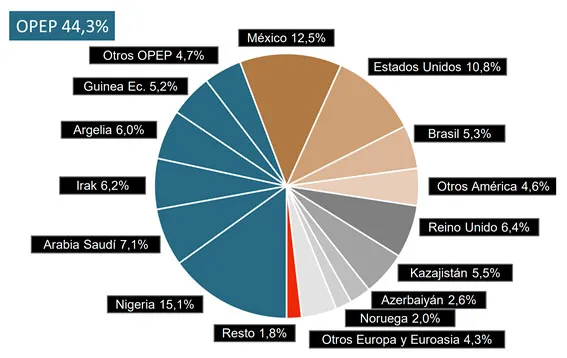

Spain’s role in addressing the energy crisis created by Russia’s invasion of Ukraine is attracting attention in Europe. Spain is largely independent of Russian hydrocarbons: according to figures from Cores (the Spanish Corporation of Strategic Reserves of Oil Products)for January 2022, they make up just 2% of its oil and 6% of its gas imports, (figures 1 and 2). Since mid-2021, Spain has halved its imports, making a significant contribution to diversification in Europe. The decommissioning of coal power plants and their replacement by gas, alongside contributions from nuclear and renewable energy are also among the country’s contributions to mitigating climate and geopolitical risk. Renewable energy in Spain is around the EU average (21.2% of energy consumption, compared with 22.1% for the EU, according to Eurostat figures for 2020). This places it ahead of the four biggest players in the EU’s energy markets: Germany (19.3%), France (19.1%), Italy (20.4%) and Poland (16.1%).

While the security of Spain’s gas supply and the resilience of its energy system as a whole has actually benefited from its status as an energy Island, the national energy strategy is focused on overcoming this barrier. Spain now has the largest capacity for LNG regasification in Europe. It also has two gas pipelines with Algeria: the first (Medgaz) is operating at full capacity; the second (Gazoduc Maghreb Europe –GME–), via Morocco, was discontinued by Algeria in October 2021. The resilience of the Spanish (and Iberian) grid can be explained by its lack of interconnections, which has favoured the development of management capacity and a highly meshed grid. Spanish energy companies are internationally established and stand out for their solidity and leadership in renewables and LNG.

(2) To its regret, Spain’s contribution to European energy security is unfortunately limited by the absence of energy interconnections and its unexploited renewable capacity

Spain has been insisting for decades on the need to urgently increase gas and electricity interconnections to make progress on European energy integration. There will be no Energy Union without integration, which in turn requires interconnections across the Pyrenees. Russia’s invasion of Ukraine has highlighted three costly strategic errors by the EU: overdependence on Russia, lack of energy integration and not moving fast enough on renewable energy. The credibility of the urgent calls made recently by France for gas (but not electricity) interconnections is undermined by the fact that the country has spent 30 years opposing them. French obstructions to the energy integration of Portugal and Spain into Europe has been a source of much frustration. However, the country is now urgently pushing to resuscitate the same projects –the Midi-Catalonia (Midcat) gas pipeline being one of the most significant examples– that it has systematically paralysed in the past. Resistance from Spain’s northern neighbour has kept Spain far below the EU target for electricity interconnection (under %, compared with the targets of 10% for 2020 and 15% for 2030). None of the interconnection summits held by successive French presidents with Spain has led to tangible results.

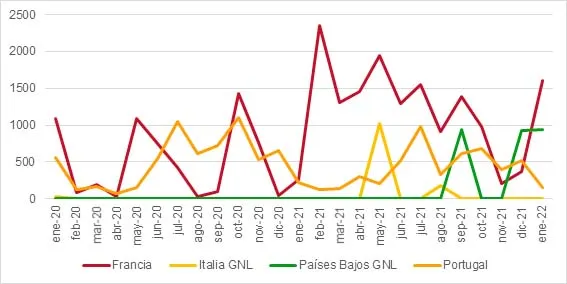

Notwithstanding these limitations, Spanish gas and electricity exports currently make a modest but significant contribution to European energy security. Spanish natural gas exports to Europe almost doubled in 2021, with respect to the previous year, and the figure jumped five-fold between January 2021 and January 2022. France is the primary destination of these exports, with its imports from Spain surging by almost 500% in January 2022 and 200% year-on-year. Figure 3 also shows a sharp rise in exports to the Netherlands, together with the compensatory effect of Portugal’s LNG terminal. All this has allowed the Iberian Peninsula as a whole to act as a moderate but robust shock absorber. Spain has also cut its gas imports from France in recent months, freeing up resources replaced by LNG. Nonetheless, figures published by the transmission company Enagás for February 2022show a rebound in Spanish imports and a fall in exports, resulting in a return to deficit. The underlying cause of this dynamic is the capacity of the two gas pipelines linking Spain and France, which is just 7 billion cubic metres. However, Europe’s imports from Russia total around 155 billion cubic metres, which means Spain’s ability to provide short-term relief is significant but limited.

The lack of electricity interconnection restricts Spain’s ability to offer short-term flexibility through spare combined cycle capacity and hinders the integration of Iberian renewables in Europe in the medium to long term. Trans-Pyrenean exchanges remain low, despite a technical and economic consensus that electricity integration would make the energy transition more efficient. Nonetheless, Spain was a net exporter to France in November and December 2021 to the tune of 1,000 MWh, although this surplus fell in January 2022 and by February, Spain had returned to being a net importer. The dynamic of Spanish exports to Portugal is structural, with exports rising to 1,500 MWh in February 2022.

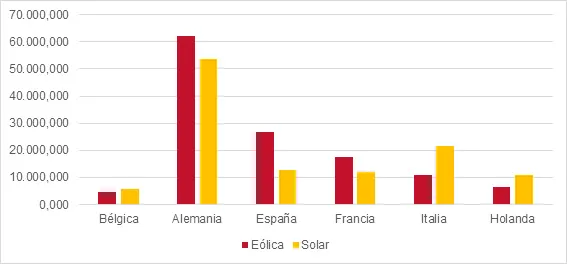

There are also limitations on the Spanish side, since the country has been slow to take full advantage of its renewable potential, especially in light of its sizeable resources and the significant fall in costs in recent years. Figure 5 shows the EU Member States with the highest installed solar and wind capacity: Spain has less installed solar capacity than Germany and Italy and only slightly more than France and the Netherlands. The higher level of solar irradiance in Spain evens out generation, given the more widespread use of roof-mounted solar systems in these countries. Nevertheless, if a similar percentage of Spanish households were to fit roof-mounted solar panels, this would increase the country’s contribution to European energy security. Climatologically, Spain is also one of the Member States whose buildings have the greatest energy efficiency potential. Both contributions depend not only on economic and regulatory aspects but on public enthusiasm, which could be incentivised in the short term.

(3) Spain has much more potential over the medium to long term, which means the EU should take advantage of the full potential of the country’s resources

While the short-term measures discussed under the previous heading provide a starting point, Spain has much more potential over the medium to long term. In the case of the Midcat pipeline, whose construction will take years, the European Commission’s recent REPowerEU communication mandates that all gas infrastructure must be hydrogen compatible. The consequences if this is not achieved, however, are not clear and no deadlines have been set. REPowerEU also echoes Spain’s urgent call for electricity interconnections, despite the poor track record on Franco–Spanish cooperation. Given that both countries agree on the need to reform the European energy market, it is essential to normalise bilateral cooperation, with mechanisms to set clear expectations and ensure France’s strategic reorientation is consistent with energy integration. This means addressing all interconnections, including electricity. It also means ensuring guarantees are in place so that France will not create similar obstacles to exporting green hydrogen across the Pyrenees such as those faced by gas and electricity to date.

Spain (with Portugal) is among the Member States with the greatest long-term potential and export capacity for green hydrogen and renewables. Estimates show the combined potential of renewable energy from the Iberian Peninsula and Nordic countries could suffice to ensure self-sufficiency for the EU in green hydrogen over the long term. The offshore wind targets contained in the Spanish road map are also ambitious and could overcome the limitations of a narrow continental shelf and growing public acceptance concerns. Spain also has experience and potential for biofuels, biogas, biomass, concentrated solar power and pumped-storage hydro, all dispatchable sources of power with storage capacity. All this gives the country significant potential, not least because the strategic advantage in a highly electrified and integrated continental energy system lies not in generating capacity but in grid management. In addition to interconnections, this also requires flexibility, storage and balancing capacity, and a meshed grid. In short, going forward, Spain has the potential to play a key role in the European energy transition acting as a transition and capacity companion.

(4) The nature and scale of Spain’s contribution will depend on European energy transition pathways and its decoupling from Russia

The REPowerEU initiative seeks to accelerate the uptake of renewables and associated technology to create the extra capacity needed to allow Europe to turn its back on Russian hydrocarbons. Spain has a clear roadmap for the transition, based on renewables and efficiency. It has opted for a green hydrogen strategy, in contrast to France’s decision to use nuclear power (a so-called ‘pink’ approach) and the Netherlands’ focus on the use of natural gas (low-carbon or otherwise, that is, both blue and grey). The greater the role played by renewables, interconnections and green hydrogen in the EU’s strategic reorientation, the greater Spain’s contribution to European energy security. In contrast, it will be smaller if the medium- to long-term response focuses on nuclear energy, coal or low-carbon (but not green) hydrogen. For example, the coexistence of green and nuclear hydrogen could lead to competition and protectionism from the latter’s advocates, further hampering efforts to integrate Iberian resources into Europe’s future hydrogen market.

The geopolitical outlook is similar: in Spain, there is a relative consensus on green (or at least low carbon) strategic autonomy. However, the EU will also need oil and gas imports over the coming decades, meaning economically and geopolitically viable alternatives must be found. If there is a sudden interruption to imports from Russia, Europe’s only options will be LNG, stocks and drastic measures to curtail demand. Under this scenario, Spain’s contribution will remain significant but limited. If, on the other hand, we see a phased reduction in Russian gas imports (still close to their peak at the time of writing), this may create more space to build up reserves and make medium-term progress on diversification through LNG and the local and industrial use of hydrogen, with complementary initiatives such as efficiency measures or speeding up the transition to electric transport. All the alternatives are partial solutions, such as increasing flows through gas pipelines with Norway, Azerbaijan and Algeria. Moreover, until a few months ago, some measures were practically unthinkable, such as bringing the Iranian nuclear agreement back to life and talks with Venezuela.

As we shall see below, the EU needs viable alternatives to Russia to support the acceleration of its geostrategic shift on energy and in its immediate neighbourhood. From a Spanish perspective, Latin America offers a number of quick wins, including, flared gas in Venezuela, linking spare capacity in Trinidad and Tobago’s liquefaction facility to Venezuelan gas fields, and new discoveries in Guyana and Suriname. The region’s reserves of transition minerals mean it also has an important role to play in diversifying European value chains from Russian resources. In the longer term, it also has significant potential for renewables (eg, green hydrogen exports from Chile). Lastly, there is an Atlantic dimension to the solution, including African LNG exports, where Europe can also count on Spain’s contribution.

(5) Spain’s geopolitical contribution depends on the role accorded to North Africa in the EU’s diversification away from Russia: proximity matters

In addition to the flexibility of its LNG terminals, Spain’s biggest geopolitical contribution to European energy flexibility lies in its potential to support the orderly integration of North African energy resources, including both hydrocarbons and renewables. For a number of years, Spain has been arguing for Algeria to be treated preferentially, in a similar way to the dynamic between Russia and Germany. A publication by the Elcano Royal Institute in 2019 on Spanish preferences in European energy policy noted:

“While projects like Nord Stream 2 and reducing the dependency on Russia have been at the forefront of European debates due to their impact on multiple Member States and their implications for neighbourhood policies with Ukraine and for the diversification of supply sources, there appears to be room for the EU’s relationship with North African countries to play a greater role. […] There is widespread consensus that Spain should continue to intensify its efforts […] to make Algeria Europe’s preferred partner.”

It warned that geopolitical tensions with Russia (but also over gas in the Eastern Mediterranean) favoured diversification of the gas supply, and giving a clear incentive to Algeria to reform its energy sector and to unlock investment in the exploration and production of its sizeable gas reserves. Since then, momentum has stalled, the GME pipeline has been discontinued and Medgaz is operating at full capacity. In the short term, Europe’s best option would be to import additional Algerian gas via TransMed to Italy if it wants to scale back Russian imports. In the medium term, Spain’s contribution to the investment needed to develop and export Algerian (and Libyan) hydrocarbons is significant, and there is a consensus that these resources will be needed. Among stakeholders, there are concerns about the impact on bilateral relations of Spain’s backing for the autonomy of Western Sahara, which resulted in Algeria recalling its Ambassador from Madrid.

Spain also has a key role to play in Europe’s long-term integration of renewable resources in North Africa. The Moroccan, Algerian and Tunisian grids are all synchronised with the European system and linked by the two interconnections between Spain and Morocco across the Strait of Gibraltar, Europe’s only interconnections with North Africa. Exchanges with Morocco are now small compared with France and Portugal, with the balance ranging around 50 MWh in either direction. Morocco has requested a third interconnexion but the high coal content of its current energy mix is an obstacle to its construction. According to figures for 2020 published by the International Energy Agency, 68.6% of Morocco’s electricity was generated using coal. There is widespread support in Spain for integrating the renewable resources of North Africa into the European market, albeit subject to clear sustainability criteria. The region must make progress with its own transition in order to free up renewable/low-carbon resources for export, whether in the form of renewable energy or green (or at least low-carbon) hydrogen, in the case of Algeria (the Netherlands also plans to import low-carbon hydrogen from Saudi Arabia).

(6) Spain contributes to European leadership on the energy transition and efforts to prevent the human, ecological and energy insecurity caused by climate change

Spain has made a consistent contribution to Europe’s climate leadership. Its commitment to the transition is clear and its comprehensive regulatory framework provides a credible roadmap. The effects of climate change are an asymmetric shock for Spain, whose solutions align Spanish and European values and interests. As noted, there is a relative consensus in Spain that the EU’s strategic autonomy should be green or low-carbon. There is also a relative consensus on the need for a Fit for 55 package that sets ambitious targets to maintain the EU’s leadership on climate and its competitiveness on renewable energy. The impetus behind the European Green Deal, which has fundamentally shaped the Next Generation EU mechanism, must continue to define the response to Russia’s invasion of Ukraine. The convergence of human-security, environmental and energy objectives means the transition and the fight against climate change must remain at the top of the European agenda.

However, the current energy crisis may hinder progress on multiple fronts (eg, environmental tax). Similarly, the extraordinary measures required for electricity and gas markets may affect the outlook for the sector. Among those consulted, there is a relative consensus on maintaining Spanish support for European leadership in decarbonisation and the fight against climate change, as well as on ruling out changes in the direction and pace of the transition (with many voices in favour of acceleration). However, there are also criticisms of the impact of the Emissions Trading System on the current crisis in prices, highlighting the need for reform. Moreover, the approach outlined in REPowerEU also favours nuclear energy, alongside investment to diversify away from Russian gas, and their inclusion in the EU Taxonomy for Sustainable Activities (although some members of the European Parliament are calling for the withdrawal of the complementary delegated act). The Spanish Government has made clear its opposition to the inclusion of gas and nuclear energy in the taxonomy and this has also given rise to clashes in the Spanish energy sector. Some analysts suggest a distinction should be made between the climate crisis and the energy crisis precipitated by Russia’s invasion of Ukraine but stress they should be addressed consistently and with the same energy.

(7) Spain is not part of the problem: it has a diversified energy mix and import pattern, almost full autonomy from Russia and Europe’s largest LNG capacity

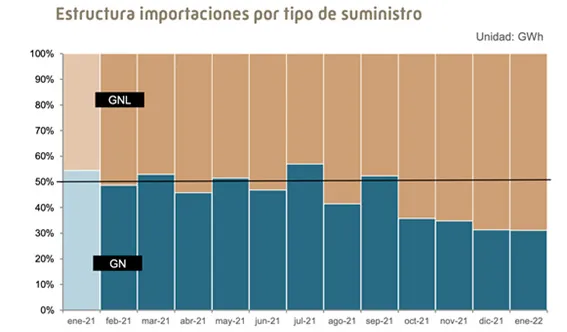

Politically, Spain has overwhelmingly condemned the invasion of Ukraine and has backed sanctions on Russian energy. As shown in point 1 (Figures 1 and 2), Spain is much less dependent on Russian energy than other European countries and it has slashed its imports of Russian gas and oil in recent months. Similarly, Spanish energy companies had already begun to divest from Russia prior to the invasion. Another key aspect of Spain’s resilience is its diversified energy mix, encompassing almost all sources and technologies: combined cycle gas, nuclear, hydroelectric and almost the full spectrum of renewables (wind, photovoltaic and solar thermal, biofuels, biogas, etc). The flexibility provided by Spanish LNG terminals is shown in Figure 6. In September 2021 (the last month in which the GME pipeline was operational), Spain imported over 50% of its gas by pipeline. However, by January 2022, LNG had compensated for the loss of GME, totalling almost 70% of Spanish gas imports and making the US the country’s number one supplier of gas (almost 35% of the total). According to data from Enagás, discharges from ships and the number of ships unloaded increased by almost 70% between February 2021 and 2022. Nonetheless, Spain still has spare capacity at its regasification terminals and combined cycle plants.

(8) Spain is suffering both the energy and economic consequences of Russia’s invasion of Ukraine and backs urgent measures to deal with them

Despite not being part of the problem when it comes to Europe’s overdependence on Russian hydrocarbons, Spain is nonetheless still suffering from the tensions created by high oil and gas prices. Rising prices are having a major economic impact, particularly on consumers and energy-intensive sectors. At the macroeconomic level, the sharp rise in inflation has already caused the first shifts in monetary policy and the downgrading of growth forecasts. With the deteriorating macroeconomic outlook accepted, the questions are now about the scale and duration. There is also concern about the loss of competitiveness abroad and factory shutdowns, as well as the effects on transport, tourism, agroindustry, and agriculture and fishing. The slowdown in growth could damage investment in renewables and electrification, slowing the energy transition instead of bringing it forward.

The combination of rising energy prices and the slowdown in growth is taking its toll on a country that was only just recovering from the crisis caused by the pandemic. Electricity prices have been in the headlines since August (the current record of €544/MWh was set on 8 March 2022), evidence of the growing risk of their impact. In Spain, the social dimension has played a bigger role than elsewhere in Europe for a number of years now, adding to existing discontent and political clashes. There is growing concern about the emergence of populist discourses and increasing polarisation on the solutions to the energy crisis. Finally, there is widespread feeling that the public is not receiving the explanations it deserves regarding the economic implications of the crisis and the need to take urgent extraordinary measures befitting a situation of war.

(9) Spain contributes solutions to the debate on the EU’s energy policy and security and it calls for European measures

In September 2021, the Deputy Prime Ministers of Spain, Nadia Calviño and Teresa Ribera, addressed a letter to the European Commission requesting coordinated measures to address rising electricity prices. They asked for a flexible set of guidelines providing Member States with options to mitigate soaring prices, highlighting: (1) the urgency of taking measures to address rising prices and protect consumers and the economic recovery; (2) the need to reform the market’s marginal pricing system to decouple prices from gas prices and avoid carbon prices affecting non-emitting technology; and (3) the importance of setting guidelines for jointly addressing gas supply issues, making coordinated use of strategic reserves via a centralised platform if necessary. The letter contains a number of prescient messages, including the warning that the energy transition ‘will see new setbacks as a result of unexpected events’, which the EU should ‘seek to anticipate’.

The European Commission unveiled a toolbox to tackle the crisis in energy prices in a communication in October 2021. Of the three Spanish proposals, the Commission included temporary measures, including tax cuts, sectoral support, protection for vulnerable consumers and the reallocation of income for CO2 emissions. Opposition from countries including Germany and the Netherlands (which persists at the time of writing) prevented any reform of the electricity market, despite support from France and other Member States. Finally, Portugal and Spain requested an exception to temporarily intervene de electricity market, on the grounds of being an energy island. There was also opposition to creating a centralised gas platform from German industry and government. However, the potential of voluntary cooperation for the storage and management of reserves was highlighted. The parties involved have cited concerns about the lack of progress and the operational difficulties of these schemes.

Lastly, the communication on REPowerEU in March 2022 included variations on many of the measures proposed by the Spanish Government in September. The document has been criticised for its lack of detail and its application will depend on negotiations currently taking place. Six months after its letter, Spain made another attempt to convince the EU of the need for extraordinary measures not just to safeguard the economic recovery but also to prevent spiralling inflation, stagnation, economic crisis, social unrest and political tensions. The figures and analysts who have been consulted tend to agree on the need for urgent extraordinary measures. However, there is a broad range of alternatives: price caps on gas and other price regulations; storage requirements and incentives; a return to long-term gas contracts; facilitating permits for renewable energy and infrastructure; a return to energy planning; a windfall profits tax; contracts for difference; redesigning renewable energy auctions; and flexible measures for the electricity system (eg, pumps, independent aggregators and the development of local markets, distributed generation and energy communities).

All the experts consulted stress that these must be carefully designed and time limited. Market signals must be preserved to avoid distorting the investment landscape at a time when finance is needed most. There is consensus on the complexity of regulating competition and inframarginal performance and on the need for clear guidelines as soon as possible. There is also agreement on the need to protect consumers and vulnerable sectors, changing contract types and approving sectoral measures. In terms of sources, and given the serious long-term risk to energy security, some voices have not ruled out extending the life of nuclear plants, a temporary return to coal and even lifting the prohibition on the exploration and extraction of hydrocarbon reserves in Spain (a measure that goes against article 9 on the Law on Climate Change and the Energy Transition). There are also proposals for the creation of a European energy agency to make information and analysis more transparent (eg, it is not currently clear exactly how much gas Germany imports from Russia and at what price). Other voices advocate a comprehensive package of energy efficiency measures (including fiscal and regulatory) but also campaigns to raise public awareness.

(10) Spain can channel public awareness and enthusiasm on climate and energy security but this means alleviating the social impact of measures

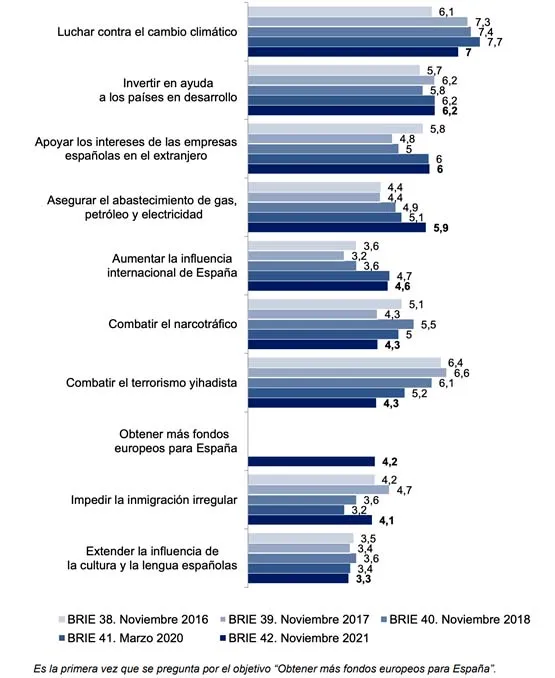

Finally, one of Spain’s biggest contributions to European energy and climate security lies in the potential of its citizens. Throughout the COVID-19 pandemic, the Spanish public has stood out for its solidarity, respect for the rules and openness to scientific arguments. In Spain, attitudes towards climate change are indicative of the public’s green outlook, similar to other developed Western countries. Spain averages 3.69 on the New Ecologic Paradigm scale, which ranks the level of ecological engagement from 1 (low) to 5 (high). Similarly, the Barometer of the Elcano Royal Institute has consistently recorded climate change as the top foreign policy priority among the Spanish public, far ahead of development aid, support for Spanish businesses and the energy supply. When interviewed, participants spontaneously mentioned promoting renewable energy as the main primary measure to address climate change, far ahead of other policies like promoting sustainable transport or energy efficiency. These preferences are echoed in the distribution of European investment funds to tackle the crisis caused by the pandemic.

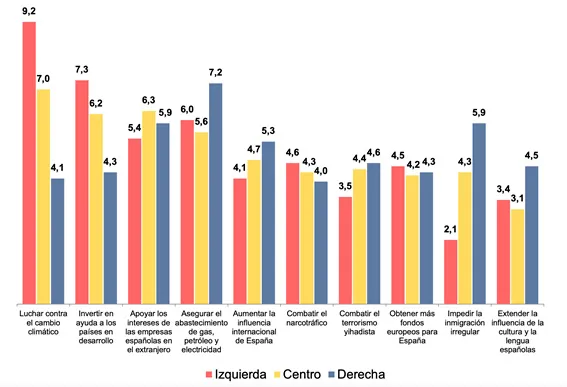

However, the results for November 2021 show that while climate change continues to top the list of foreign policy priorities, it has fallen sharply for the first time (Figure 7). In contrast, rising electricity prices have been fuelling concerns about the security of energy supplies since 2018. Ideologically, energy security was already a natural priority for the political right, taking second place on the left (Figure 8). If this trend continues, it could see climate change and energy security become equal priorities for the Spanish public. The barometer also recorded a sharp rise in the number of people who perceive Russia as a threat, reflecting the military build-up prior to its invasion of Ukraine. In the second wave of the fieldwork, Russia was cited as a threat by 34% of respondents, compared with just 5% in the first. This makes it the biggest concern among the Spanish public, ahead of Morocco and jihadist terrorism. By autumn 2021, the public was already acutely aware of the threat posed by Russia’s attitude and the potential fallout from the invasion of Ukraine.

Providing the public with adequate information and explanations given the seriousness of the situation and the issues at stake is the best way to galvanise support for the extraordinary measures that need to be adopted. This is particularly true since the figures suggest that the Spanish public is open to the idea that energy security and the energy transition are parallel priorities. Public information campaigns could benefit from studies on ways to promote green behaviour among people with different preferences (eg, climate security versus energy security), explaining how the two can complement each other. Research also shows that perceptions of self-efficacy and peer influence increase acceptance of policies and behaviour change. It also highlights how the inevitable ‘hard’ measures (eg, regulations, taxes and subsidies) are more effective when accompanied by information measures, since the two reinforce each other. However, they warn that certain measures can be counter-productive, with the potential for a backlash against interference or attempts at persuasion, especially if they do not stick to objective facts.

The bottom line is that, without social justice, attempts to promote the environment, the transition and strategic autonomy will be doomed to fail. Two of the main consensuses among those consulted are the need to change the current approach to protecting vulnerable families and supporting the most exposed sectors. There is also agreement on the urgency of providing explanations and on the need to go further: compensatory measures to protect the most vulnerable groups are key, but they must also preserve and boost public enthusiasm and result in more effective policies.

Conclusions

Spain has a key role to play in the European solution to the energy shock caused by Russia’s invasion of Ukraine.

To its regret, Spain’s contribution to European energy security is unfortunately limited by the absence of energy interconnections and its unexploited renewable capacity.

Spain has much more potential over the medium to long term, which means the EU should take advantage of the full potential of the country’s resources.

The nature and scale of Spain’s contribution will depend on European energy transition pathways and its decoupling from Russia.

Spain’s geopolitical contribution depends on the role accorded to North Africa in the EU’s diversification away from Russia: proximity matters.

Spain contributes to European leadership on the energy transition and efforts to prevent the human, ecological and energy insecurity caused by climate change.

Spain is not part of the problem: it has a diversified energy mix and import pattern, almost full autonomy from Russia and Europe’s largest LNG capacity.

Spain is suffering both the energy and economic consequences of Russia’s invasion of Ukraine and backs urgent measures to deal with them.

Spain contributes solutions to the debate on the EU’s energy policy and security and it calls for European measures. Eurasia Press & News

Eurasia Press & News