The United Kingdom is the ninth-largest economy in the world by GDP and the third-largest energy consumer in Europe, according to Eurostat.

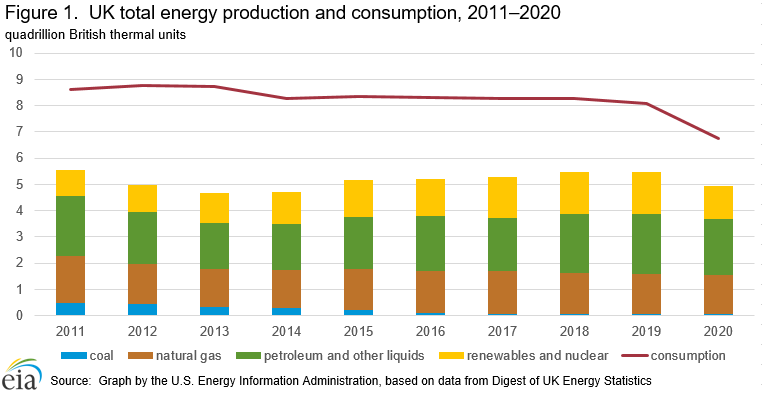

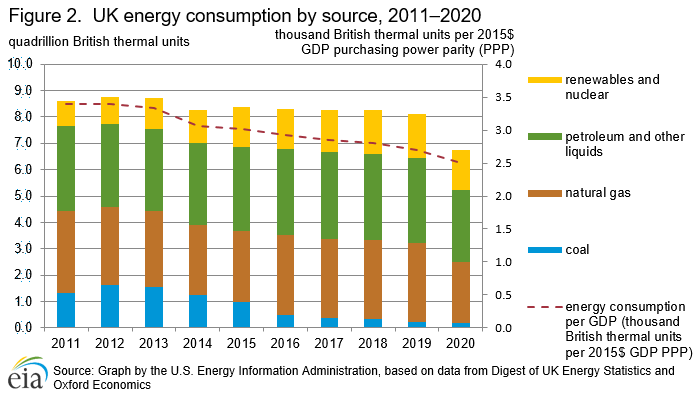

In 2020, the United Kingdom produced 4.9 quadrillion British thermal units (quads) and consumed 6.8 quads of energy. Fossil fuels accounted for 75% of total energy supply and 77% of total energy demand (Figure 1 and Figure 2).

The United Kingdom has been a net energy importer since 2004. However, lower energy demand, a result of the COVID-19 pandemic, contributed to a decline of 30% in net energy imports in 2020. The United Kingdom imported less coal, petroleum and other liquids, natural gas, and electricity that year.

In 2021, the United Kingdom was the second-largest producer of petroleum and other liquids and natural gas in OECD Europe, after Norway.

Nearly all UK petroleum and natural gas production comes from offshore fields. In 2021, the United Kingdom produced 934,000 barrels per day (b/d) in total liquid fuels and 1.1 trillion cubic feet (Tcf) of natural gas.

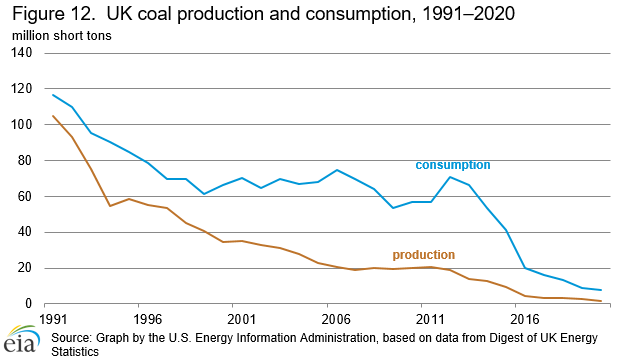

Coal production decreased nearly 91% between 2010 and 2020, falling from 20.2 million short tons (MMst) in 2010 to 1.8 MMst in 2020. This significant decline is the result of environmental regulations and falling consumption.

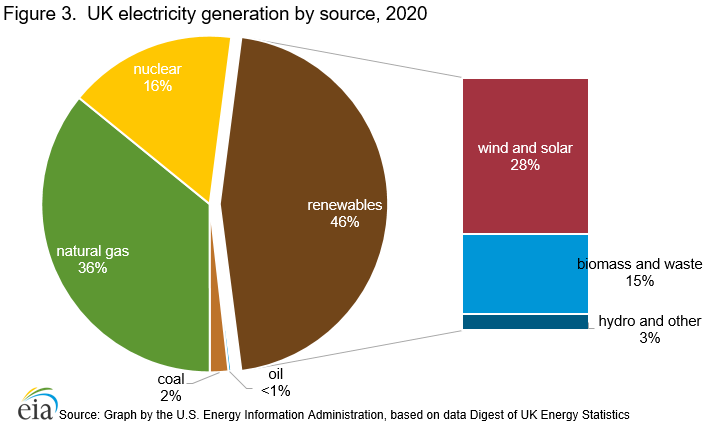

The proportion of renewable electric power generation (46%) exceeded generation from fossil fuels (38%) for the first time in 2020. In addition, renewable and nuclear energy cumulatively accounted for almost two-thirds of UK electricity generation that year. Electricity generation from natural gas represented 36% (Figure 3).1

Petroleum and other liquids

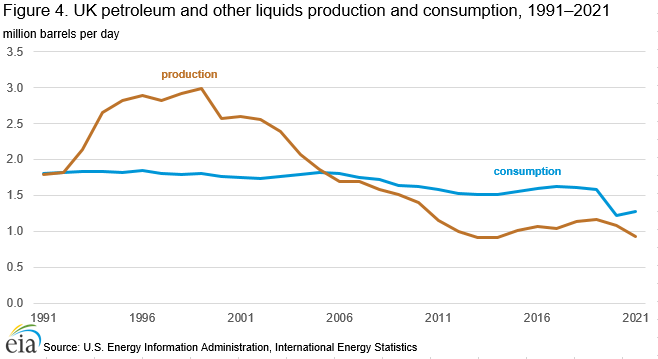

Petroleum and other liquids production peaked at 3.0 million barrels per day (b/d) in 1999 before declining to 0.9 million b/d in 2014 (Figure 4). Between 2014 and 2019, production increased by over 28%. Fields that were brought online in the second half of 2014 contributed to this increase. Production declined after 2019, returning to 934,000 b/d in 2021.

Despite making steady production gains in recent years, the United Kingdom became a net importer of crude oil in 2005 and continued to be through 2021. The country briefly became a net exporter in 2020 in part because of lower domestic demand for petroleum products.

The economic slowdown in 2020 during the COVID-19 pandemic significantly affected the transportation sector, which typically accounts for about 80% of total domestic petroleum product supplied in the United Kingdom. Petroleum product supplied is a proxy measure for consumption. Petroleum products supplied to the transportation sector decreased 29% year-over-year, leading to a 25% drop in total petroleum product supplied in 2020.2

In 2021, UK crude oil imports grew by 2% after declining by 21% in 2020. Similarly, imports of petroleum products increased by 5% in 2021 after falling by 25% in 2020. However, the United Kingdom exported 17% less crude oil and 2% less petroleum products than in 2020.

Sector organization

The UK government does not hold a working interest in oil production, but the sector remains important to the government because of its contributions to the overall economy. In fiscal year (FY) 2020–21, government revenues from crude oil and natural gas production were £248 million. Revenues in FY 2020–21 decreased 71% from FY 2019–20 mainly as a result of lower oil prices, driven by reduced demand for petroleum and other liquids during the COVID-19 pandemic.3

The UK government regulates the oil, natural gas, and carbon storage industries through the Oil and Gas Authority (OGA). OGA issues crude oil and natural gas licenses, collects data from license holders, and promotes investment, collaboration, and efficiency in the industry. Since 2021, OGA has encouraged a North Sea energy transition, finding that closer coordination of offshore fossil fuel and renewable energy sectors (for example, wind, wave, and tidal) could help the United Kingdom meet its 2050 net zero emissions target.4

Exploration and production

According to the Oil & Gas Journal (OGJ), the United Kingdom had 2 billion barrels of proved crude oil reserves as of the end of 2021, 20% lower than at the end of 2020.5 Crude oil represents approximately 70% of the petroleum reserves, and most resources are located on the United Kingdom Continental Shelf (UKCS).6

The United Kingdom produces three grades of light, sweet crude oil: Flotta, Forties, and Brent blends.

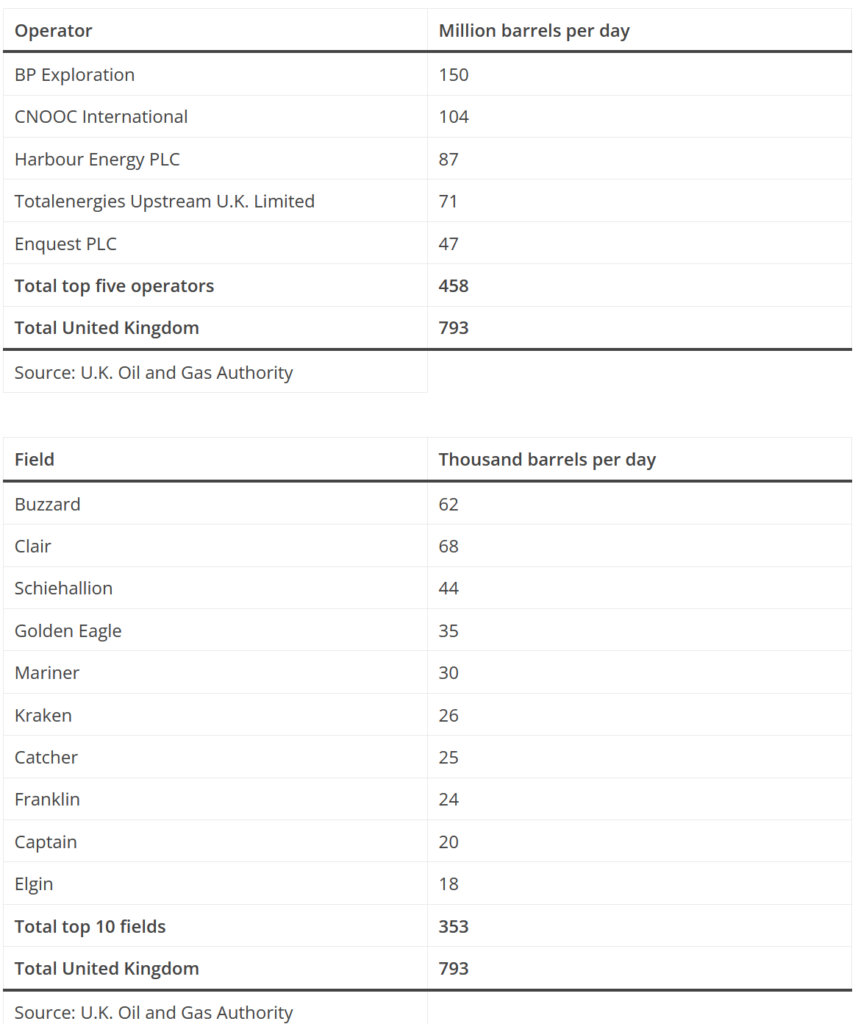

In 2021, UK crude oil production decreased by 15% to 793,000 b/d, according to OGA. Five operators accounted for 58% of total crude oil output (Table 1). BP-operated fields produced the largest volume of crude oil, and the China National Offshore Oil Corporation (CNOOC), which produced crude oil from the Buzzard and Golden Eagle oil fields, ranked second (Table 2).

Transport and refining

The United Kingdom’s extensive network of pipelines carries oil extracted from North Sea fields to coastal terminals in Scotland and northern England. The network includes six major pipelines (Table 3).7 Many smaller pipelines transport petroleum liquids from individual fields to the major pipelines for transport to the coast. Pipelines in the United Kingdom are privately owned and operated; however, any qualified shipper may access the pipelines.

The United Kingdom had 1.2 million b/d of refining capacity at the end of 2020, according to the OGJ. Fuels used for transportation, specifically motor gasoline (27%), diesel (26%), and gas oil (12%), accounted for nearly two-thirds of total refined petroleum products produced that year.8

Trade and consumption

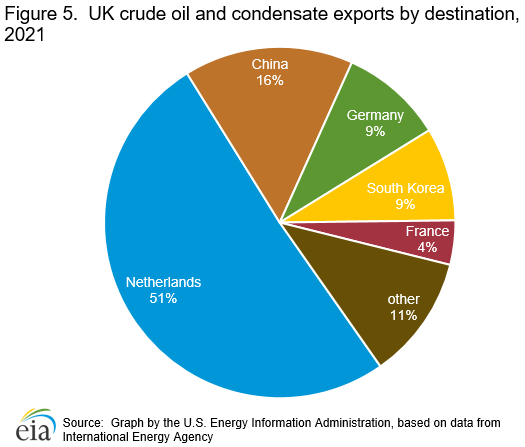

Exporting over 600,000 b/d in 2021, the United Kingdom is the second-largest exporter of crude oil in Europe. Most UK crude oil exports (73%) go to the Netherlands and other EU countries. The bulk of UK exports to Germany are used for refining and consumption, while exports to the Netherlands include crude oil ultimately destined for other countries. Most of the United Kingdom’s non-EU export trade was with China and South Korea (Figure 5).9

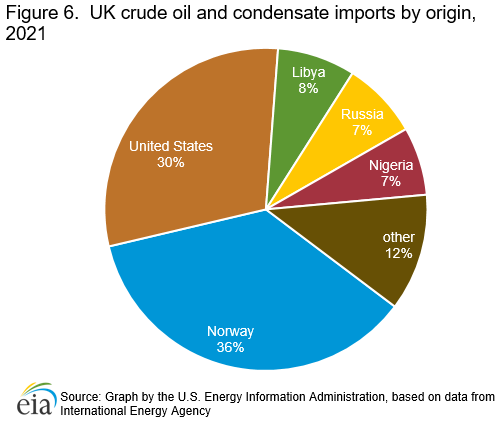

UK refiners imported 723,000 b/d of crude oil in 2021. Together, crude oil (including condensate) from Norway, the United States, and Libya accounted for 74% of UK crude oil imports. Russia and Nigeria were also among the top five suppliers of UK crude oil imports (Figure 6).

UK refineries produce more motor gasoline and fuel oil than is used domestically, and the country remains a net exporter of these products. Significant volumes of diesel and jet fuels are imported into the United Kingdom to meet local demand. Based on the most recent data available, net imports of diesel accounted for 43% of total diesel demand, and net imports of jet fuel accounted for 85% of total jet fuel demand in 2020.10

In 2021, diesel imports from Russia represented 34% of total imports, and diesel from the Netherlands accounted for 20%. Jet fuel imports from Kuwait (18%), the United Arab Emirates (17%), and Saudi Arabia (17%) made up over half of total jet fuel imports.11

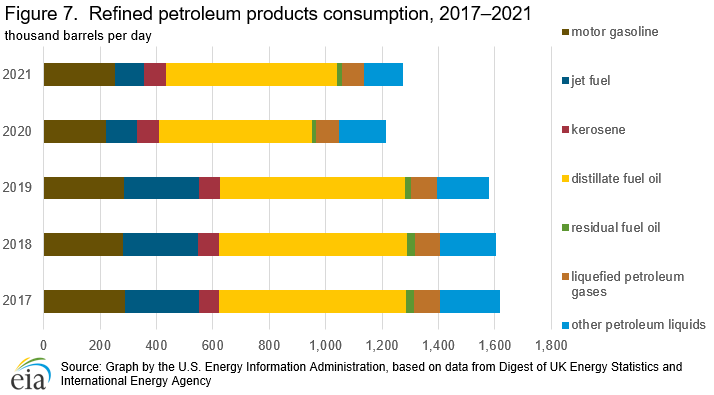

Following a 23% decline in 2020, UK consumption of refined petroleum products increased by 5% to 1.3 million b/d in 2021 (Figure 7). In 2021, demand for jet fuel, which dropped by 60% to 107,000 b/d in 2020 because of tight air travel restrictions during the pandemic, remained well below pre-COVID levels at 101,000 b/d. Kerosene (heating oil) demand, which increased by 9% to 80,000 b/d in 2020 as more people remained indoors, decreased to 77,000 b/d as lockdowns ended in 2021.

Natural gas

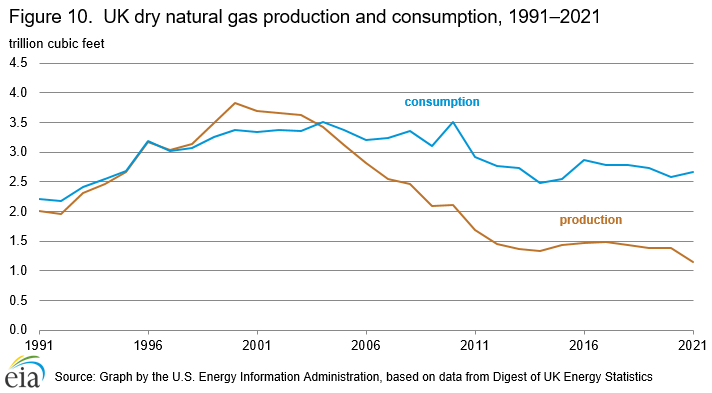

UK natural gas production peaked in 2000 at 3.8 trillion cubic feet (Tcf). From 2000 to 2014, production declined at an average rate of 7% per year. Increased investment in North Sea assets, driven by high crude oil and natural gas prices before and during 2014, led to production growth between 2014 and 2017 at an average rate of 4% per year.

The United Kingdom has been a net importer of natural gas since 2004 and has three large-scale operational liquefied natural gas (LNG) terminals (South Hook, Dragon, and Isle of Grain) with total import capacity of 1.8 Tcf per year. A planned expansion of the Isle of Grain terminal will add another 183 billion cubic feet (Bcf) to UK total LNG import capacity by mid-2025. A fourth terminal in Teesside is idled and pending redevelopment.12

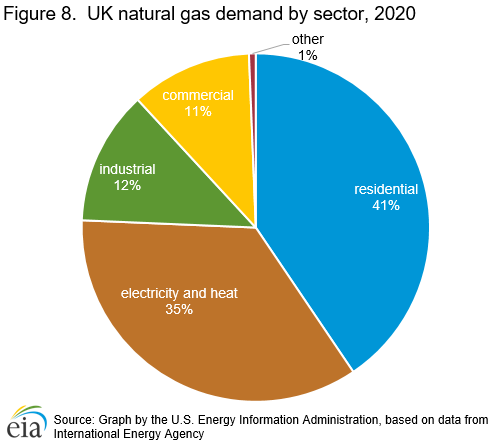

In 2020, demand for natural gas in the residential sector, which accounted for 41% of UK consumption of natural gas, increased by 2% as a result of stay-at-home measures. Conversely, demand for natural gas in the industrial sector in 2020, which accounted for 12% of total consumption, decreased by 8% (Figure 8).13

Sector organization

In the United Kingdom, natural gas production, transmission, and distribution is fully privatized. With a market share of 27%, British Gas, a subsidiary of Centrica, is the largest natural gas distributor in the United Kingdom, according to the UK Office of Gas and Electricity Markets (Ofgem). E.ON and OVO Energy each hold about 10% of the distribution.14

The UK natural gas distribution sector underwent a major change in 2005, when National Grid Gas sold four of the eight natural gas distribution networks to Scotia Gas Networks, Wales and West Utilities, and Northern Gas Networks. Before this sale, National Grid controlled the domestic natural gas distribution system.

Exploration and production

According to OGJ, the United Kingdom held an estimated 4.6 Tcf of proved natural gas reserves as of January 2022, a 27% decrease from January 2021.15

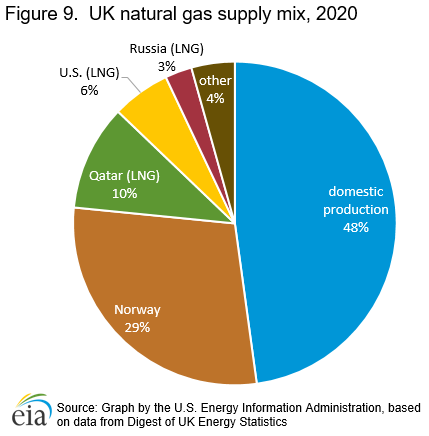

Domestic natural gas production accounted for 48% of total natural gas supply in 2020 (Figure 9). More than 70%, or 987 Bcf, of the total gross natural gas produced in the United Kingdom came from offshore associated gas fields. Annual production from dry natural gas fields decreased for a third year to 394 Bcf, and onshore fields continued to account for less than 1% of total gross natural gas production.16

According to the British Geological Survey, the United Kingdom has identified four potentially viable areas for the commercial extraction of shale gas. These four areas are the Carboniferous Bowland-Hodder area in northwest England, Carboniferous Midland Valley in Scotland, Jurassic Weald Basin in south England, and Wessex area in south England.17

Trade and consumption

The United Kingdom continues to import more natural gas than it exports. In 2021, the United Kingdom imported 1.8 Tcf of natural gas, about 73% of which arrived via pipeline and the remainder arrived as liquefied natural gas (LNG), according to the Global Trade Tracker. Natural gas from Norway and Qatar combined accounted for nearly 80% of total imports.

In 2021, the United Kingdom imported 485 Bcf of LNG. Qatar, which was the largest source of LNG imported into the United Kingdom, accounted for 41% of total LNG imports last year. Imports of LNG from the United States and Russia accounted for 26% and 23%, respectively, of total LNG imports.19

In 2021, the United Kingdom also exported 0.2 Tcf of natural gas to the Republic of Ireland and the European continent via pipelines.20

In 2021, UK natural gas consumption increased by 3% to 2.7 Tcf after declining by 5% to 2.6 Tcf in 2020 (Figure 10). Increased activity in the industrial and commercial sectors contributed to higher natural gas consumption in 2021.

Hydrocarbon gas liquids

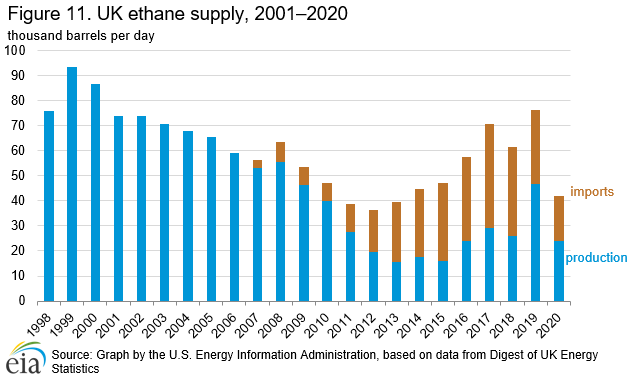

UK production of hydrocarbon gas liquids (HGLs) has been generally declining, reflecting the downward trend in UK natural gas production and refinery output. HGLs are produced alongside raw natural gas and crude oil. They are separated from dry natural gas at natural gas processing plants and are produced from crude oil at refineries.

As a result of decreasing natural gas production in the North Sea, UK ethane production declined from a peak of 93,000 b/d in 1999 to a multiyear low of 16,000 b/d in 2015 (Figure 11).21 In need of additional feedstock, UK petrochemical producers began importing ethane from Norway in 2007 and the United States in 2016. Although ethane production has increased since 2015, the United Kingdom continues to import ethane to meet domestic demand.

Coal

The United Kingdom had an estimated 26 million short tons (MMst) of recoverable coal reserves at the end of 2020, according to BP’s Statistical Review of World Energy 2021.22 The United Kingdom closed its final underground coal mine, North Yorkshire’s Kellingley Colliery, in December 2015. Several surface mines, located in central and northern England, south Wales, and central and southern Scotland, remain in operation.

Use of coal in the United Kingdom has declined because of environmental regulations and competing fuels, mainly natural gas (Figure 12). Although coal consumption experienced a brief increase in 2012, growing 14 MMst from 2011 levels, domestic coal production continued to decline. Coal imports increased to meet the increase in demand. Coal consumption resumed its decline in 2013, decreasing at an average rate of 23% per year from 2013 until 2020, in part because of the United Kingdom’s Carbon Price Floor policy, which increased the cost of carbon emissions.

Electricity

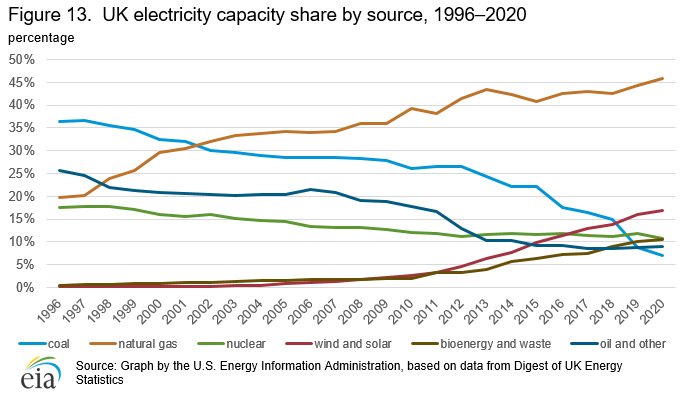

The United Kingdom had 76 gigawatts (GW) of installed electricity generation capacity at the end of 2020. Non-renewable single-fueled capacity, as a share of total capacity, has decreased year-over-year since 2012 because of multiple fossil fuel-fired plant and nuclear reactor closures (Figure 13). Conversely, the share of renewable capacity has more than tripled since 2012 in part because of wind and solar expansions.

In 2020, the United Kingdom generated 300 billion kilowatthours (kWh) and consumed 280 billion kWh of electricity. Generation declined by 3%, and consumption declined by 5% compared with 2019 levels, according to the Digest of UK Energy Statistics.

Natural gas-fired generation (111 billion kWh) continued to account for the greatest share of UK total generation, representing 36% of total generation in 2020. Together, generation from renewable sources (wind, solar, bioenergy, and hydro) grew to 46% of total generation.23

In 2020, nuclear power accounted for 11% of total generation, but nearly half of the United Kingdom’s current capacity is expected to retire by the end of the decade, according to the World Nuclear Association.24 The United Kingdom plans to expand its nuclear fleet with four new nuclear plants likely to be built in Sizewell, Bradwell, Oldbury, and Wylfa Newydd.

The United Kingdom has six transnational electricity interconnectors with a total capacity of 6 gigawatts (GW):25

Interconnexion France-Angleterre (IFA) and Interconnexion France-Angleterre 2 (IFA2) with a total capacity of 3 GW to France

BritNed with a capacity of 1 GW to the Netherlands

Nemo Link with a capacity of 1 GW to Belgium

Moyle with a capacity of 0.5 GW to Northern Ireland

East West with a capacity of 0.5 GW to Ireland

Eurasia Press & News

Eurasia Press & News