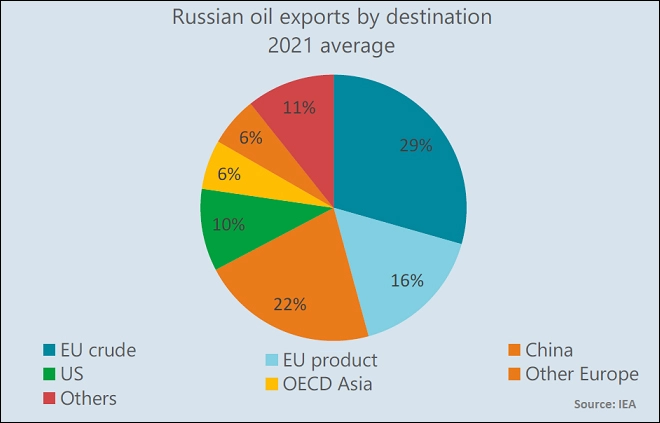

Russia’s unprovoked invasion of Ukraine is profoundly altering the global energy landscape. As the world’s third-largest oil producer (US $11.3 billion barrels per day) and second-largest exporter and producer of liquified natural gas (LNG), Russia supplies nearly a sixth of the global oil and gas supply. Moscow’s dominance is particularly evident in Europe which is heavily dependent on Russia for its oil and gas supplies. According to the International Energy Agency (IEA), the European Union (EU) in 2021 bought 155 billion cubic meters (bcm) of Russian gas, accounting for 45 percent of the EU’s gas imports and around 40 percent of its total gas consumption. Germany alone imports nearly 555,000 barrels of Russian oil per day. The IEA estimates that Kremlin is earning around US $20 billion each month in 2022 from the combined sales of crude and products despite facing sanctions and boycotts from the West.

An opportunity for Africa

The rapid rise in oil and gas prices is changing the landscape for Africa’s leading energy powerhouses. However, it is on a political level—as in Europe’s desire to end its dependence on Russian hydrocarbon—where Africa’s economic opportunity truly lies.

Countries in Africa, particularly in the western part of the continent, such as Nigeria, Angola, and Senegal, offer largely untapped potential for LNG. This raises the question if African countries have the requisite capacity to meet European energy demands.

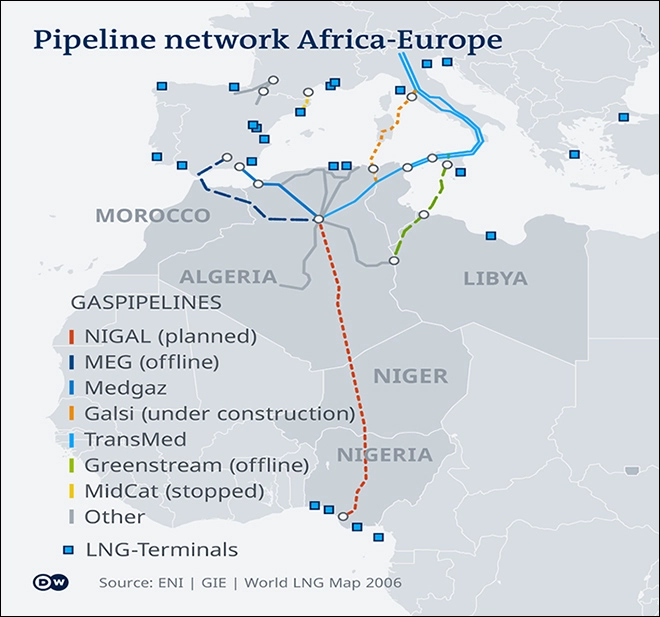

At face value, Africa’s hydrocarbon resources are a promising solution to Europe’s Russian problem. The continent’s vast fossil fuel reserves, its proximity to Europe, and its growing LNG market may tempt European leaders to look southwards. African countries that have traditionally been gas suppliers to Europe are well placed to scale up their exports. This is because certain African countries already have existing pipelines connected with the wider European gas grid across the Mediterranean. Current pipeline exports from the continent to Europe run through Algeria into Spain and from Libya into Italy. It is going to take some time before the new pipelines operationalise.

Just as recently as April 2022, Italy, the world’s eighth largest economy, was the front mover by striking new deals with Angola and the Republic of Congo for natural gas supplies that would help it compensate for its cuts on Russian imports.

This represents a great opportunity for African oil and gas producers with strong ties with European nations, particularly those where Italian supermajors, Eni, has a solid foothold, like Angola, where Eni is a dominant driver in the market. The MoU, signed in Luanda by Italian Foreign Minister Luigi Di Maio and Ecological Transition Minister Roberto Cingolani, establishes the protocols for natural gas trade between the two nations for years to come.

Major upcoming natural gas start-ups in Africa

Oil and gas pipelines in Africa

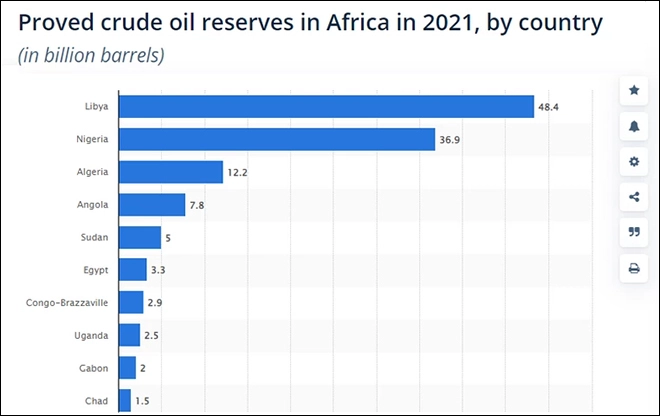

As the conflict in Ukraine rages on, European gas prices have soared. Russia has already halted and cut off gas supplies to countries like Poland, Bulgaria, and Finland over the energy payments dispute. This has led Europe to search for contingency energy supplies, and Africa, by way of proximity, has emerged as the natural choice to replace Russian oil and gas. It is no secret that Africa has some of the world’s deepest gas reserves.

Indispensable to economic and social development, Africa’s rich endowment of oil and gas reserves are projected to catalyse growth across the continent in the long term. In the medium term, African countries could become a proper stopgap solution for natural gas as Europe looks to reduce its dependence and reliance on Moscow “well before 2030”. However, their ability to step in to fill a gap – a demand of anywhere between 50-190 bcm annually that Russia has supplied, is contingent on many factors like adequate energy infrastructure and the capital necessary to build the requisite infrastructure.

As of 2021, Africa’s crude oil reserves amounted to 125.3 billion barrels, while natural gas reserves stood at 625 trillion cubic feet.

There are several ongoing and upcoming oil and gas projects in Africa. Some of the major projects are listed below;

Trans-Saharan gas pipeline (NIGAL): This is a planned natural gas pipeline expected to run along 4,401 kilometres from Nigeria to Algeria. The project was initially proposed in the 1970s but no progress was made until 2002 when an MoU was signed between Nigerian National Petroleum Corporation (NNPC) and Algerian national oil and gas company, Sonatrach. The cost of the project is estimated to be around US $13 billion and the annual capacity of the pipeline is up to 30 billion cubic meters of natural gas.

Nigeria-Morocco gas pipeline (NMGP): In 2016, Nigeria and Morocco signed an agreement to develop a 5,560 kilometres pipeline that is expected to connect many West African countries to Europe. The pipeline is intended to deliver Nigeria’s natural gas resources to 13 countries in the West and North Africa as a continuation of the existing West Africa Gas Pipeline (WAGP) between Nigeria, Benin, Ghana, and Togo. The OPEC Fund for International Development is set to contribute US $14.3 million to fund the second phase of the NMGP project’s front-end engineering study.

Medgaz pipeline project: The Medgaz pipeline is a 210-kilometre subsea pipeline between Beni Saf in Algeria and Almeria in Spain. The pipeline can carry 8 billion cubic metres per year of natural gas. Since the pipeline does not pass through any third countries, it increases the security of supply to southern Europe.

Trans-Mediterranean pipeline (TRANSMED): This is a 2,475-kilometre pipeline built to transport natural gas from Algeria to Italy via Tunisia and Sicily. The total cost of the project is around US $6.25 billion and has a capacity of 33.5 billion cubic metres annually.

Tanzania Liquified Natural Gas Project (TLNGP): This project, also known as the Likong’o-Mchinga Liquified Natural Gas Project, has been in the pipeline since Tanzania’s first natural gas discovery in 2010. Tanzania has a proven natural gas reserve of 57tcf with a further 29.5 trillion cubic feet located far offshore. The project is expected to cost around US$30 billion and will have a capacity to produce 10 million tonnes per annum of LNG. Regulatory delays halted the construction of this project which is now expected to start in 2022 and conclude in 2028.

Rovuma LNG Liquification Plant: The US $30-billion Rovuma LNG Terminal located off the Cabo Delgado coast in northern Mozambique is based on three gas reservoirs in Area 4 block of the Rovuma Basin which contains an estimated 85tcf of natural gas. ExxonMobil is leading the construction and operation of the facility and the facility has a planned capacity of 15.2 million tons of LNG per year.

Namibe Refinery Complex (NAMREF): The Namibe refinery is proposed to be built at Namibe in Angola and is expected to start operations in 2025. The cost of the project is estimated to be around US $12 billion in which a new 400,000 barrels per day refinery would be built in Namibe, Angola.Challenges

The plethora of ongoing and upcoming oil and gas projects in Africa underscores the critical opportunity for African countries to play a more central role in the global energy market as European countries look for alternative suppliers. However, if African countries are to take advantage of this opportunity, they need to overcome and address certain bottlenecks.

The foremost issue is the considerable lack of investment in gas infrastructure which has hampered the energy industry, especially in sub-Saharan Africa. This lack of transnational infrastructure makes Africa’s natural gas reserves difficult to export. For African countries to adequately meet Europe’s gas needs by having enough pipelines and adequate storage and processing facilities, they need a significant uptake in investments in African gas and infrastructure by financial institutions, energy companies, and European countries.

Ensuring the security of energy supplies is another challenge. Most of the energy exported from sub-Saharan Africa would need to pass through the Sahelian region. The region faces multiple political, social, economic, and security challenges, which are exacerbated by terrorism, violent extremism, and communal violence. The situation on Africa’s eastern coast is also no different, where Islamist insurgency in Mozambique’s Cabo Delgado forced TotalEnergies to halt work and withdraw its personnel due to growing insecurity.

For the EU, reducing reliance on Russian gas is not going to be an easy task. However, if the capital necessary to build Africa’s gas infrastructure is accrued and the security of energy supplies from the continent is ensured, Africa has the potential to reduce Europe’s energy dependence on Russia.

Eurasia Press & News

Eurasia Press & News