Americans are experiencing the worst inflation they have in over four decades. The Federal Reserve is gearing up for a series of big interest rate hikes to try to slow it.

Those rate hikes mean big trouble lies ahead for the fiscal health of the U.S. government. Through June 9, 2022, Uncle Sam has racked up nearly $30.4 trillion worth of debt. That’s over $230,278 of national debt for each of the U.S. estimated 132 million households.

The U.S. government borrowed most of that money by issuing short term Treasury bills and bonds. It could afford to do that with the Fed holding interest rates near zero percent. It could also afford to roll over any debt it didn’t pay off at that very low interest rate. For both politicians and bureaucrats, it was like getting a free lunch.

But that’s about to change because the free lunch is over. Every time the government rolls over debt now, it will have to pay out more interest to its creditors. Rising interest rates make the national debt cost more. And because inflation has gotten out of control, interest rates will have to rise faster than anyone wants.

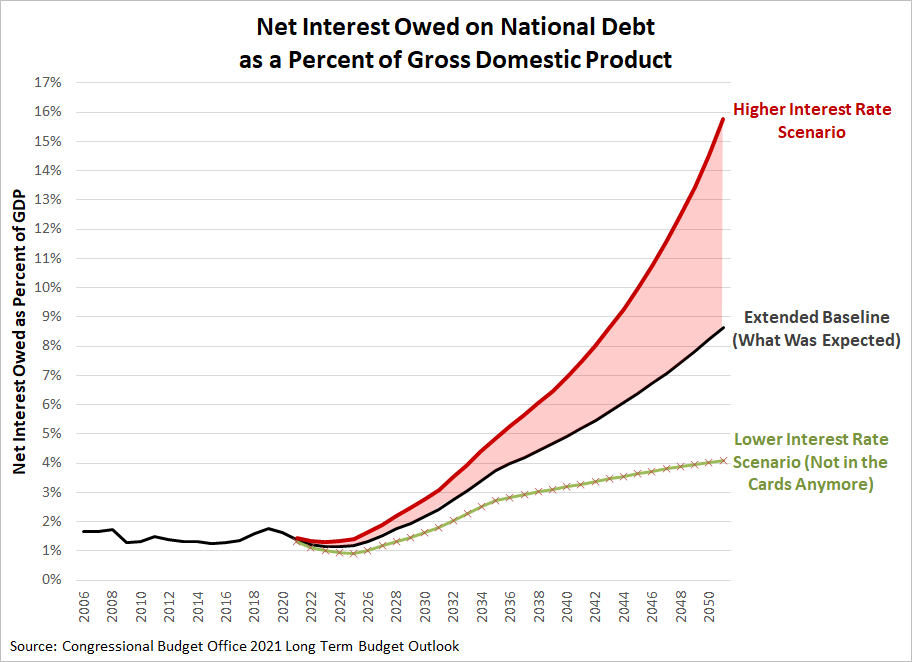

The Congressional Budget Office considered what that means in its 2021 Long Term Budget Outlook report. The graph below displays how much that cost grows as a percent of GDP if interest rates rise higher and faster than they thought would happen.

Net interest expense must be paid, or else the U.S. government risks defaulting on the national debt. With higher interest rates, the government must pay more interest on the national debt. That shrinks the money available for politicians to spend on other things they want more.

A Bigger Problem

That’s not the only problem. In August 2021, Nouriel Roubini described how the Biden-Harris administration’s red ink would lead to high inflation and a stagflationary debt crisis.

In April, I warned that today’s extremely loose monetary and fiscal policies, when combined with a number of negative supply shocks, could result in 1970s-style stagflation (high inflation alongside a recession). In fact, the risk today is even bigger than it was then….

Making matters worse, central banks have effectively lost their independence, because they have been given little choice but to monetize massive fiscal deficits to forestall a debt crisis. With both public and private debts having soared, they are in a debt trap. As inflation rises over the next few years, central banks will face a dilemma. If they start phasing out unconventional policies and raising policy rates to fight inflation, they will risk triggering a massive debt crisis and severe recession; but if they maintain a loose monetary policy, they will risk double-digit inflation – and deep stagflation when the next negative supply shocks emerge.Roubini ended his essay by saying “the question is not if but when” for the stagflationary debt crisis he predicted. The “slow-motion train wreck” he described seems to be picking up speed.

Eurasia Press & News

Eurasia Press & News