For the outside world, the resignation of British Prime Minister Boris Johnson on July 7 is tantamount to detonating a bomb in British politics. Yet, for the United Kingdom which pays attention to the rules of the political game and is good at it, this is not exactly something that is momentous.

In historical precedence, Margaret Thatcher, with her achievements such as monetarist reform, privatization reform, and the victory of the Falklands War, had assumed premiership three times. Yet, in the end, she still resigned on November 28, 1990, for the sake of “the unity of the Party and the prospects of victory in a General Election”.

Similar to the background of Johnson’s resignation, the UK back in 1990 also faced the threat of inflation. Although Thatcher’s economic policy focused on curbing inflation, at one point it reduced Britain’s inflation rate from 21.9% to 2.4%, but since then nation’s high inflation had rebounded to 8.3%, and the Thatcher government also raised interest rates 13 times in 15 months. The UK had the highest inflation rate among Western countries at the time, which made the British lose confidence in the economic policies. Hence, an important reason for the resignation of the Iron Lady is undoubtedly high inflation.

The UK now is also under the shadow of high inflation. In April 2022, its consumer price index (CPI) surged 9% year-on-year, the fastest pace since 1982. This means that the UK is currently suffering from the highest inflation rate in four decades. High inflation hits British consumers directly, with Bank of England (BoE) Governor Andrew Bailey calling the prospect “apocalyptic” for consumers. There is still the possibility of continued inflation in the UK. Catherine Mann, a member of the BoE Monetary Policy Committee, said that the basis of British inflation is expanding, and inflation expectations for the next year will be rather high.

Looking back at the past and present inflation in the UK, it is clear that high inflation is nothing short of a disaster for the economy and society. It not only greatly damages the living standards of ordinary consumers, but also leads to changes in government. Apart from political reasons, because of economic reasons, Thatcher resigned in the context of inflation, and Johnson likewise follows in her footsteps.

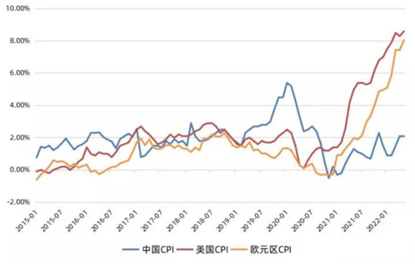

High inflation has become a worldwide economic phenomenon. It is faced by most of the eurozone countries right now. In the first quarter of 2022, the eurozone’s inflation rate reached 7.5%. In March, inflation was 7.6% in Germany, 5.1% in France, 7.0% in Italy, 9.8% in Spain, 19% in Estonia, and 11.2% in the Netherlands. In the United States, the inflation rate in March this year rose to 8.5%, the most serious one in the past four decades. Its inflation rate in April increased by 8.3% compared with the same period of the previous year, slightly lower than that in March. In May, it was 8.6% year-on-year, once again hitting the 40-year record. High inflation pushes prices further up, aggravating the difficulties of ordinary people’s livelihood, and may escalate into social and then political problems.

The reasons for the formation of high global inflation are not complicated. They basically fall into several categories: First, countries have implemented easing policies for a long period of time, while the global central banks have imposed massive quantitative easing. Extremely low-interest rates and sufficient liquidity have become the best breeding ground for inflation. Since the 2008 global financial crisis, the ultra-loose monetary policy has lasted for 14 years. Based on the “Crisis Triangle model” (Chan Kung, 2015), it is the continuous urbanization that leads to excess capital, which in turn, causes economic crisis. The cycle of urbanization begins once again after the economic crisis is over. The current global phenomenon of high inflation is a precursor to the economic crisis caused by excess capital.

Figure: Changes in CPI Prices of Major Global Economies in Recent Years

The second reason is that geopolitical crises have stimulated the hike in energy and food prices. After the outbreak of the war in Ukraine, global energy prices continued to rise. Brent crude oil once rose to as high as USD 139/barrel, and is still around USD 105/barrel. Under the backdrop of the war, energy and food have become “weapons” to varying degrees. The war factor has intensified risks, whereas high uncertainties in energy supply have contributed to the rise in energy prices, leading to high inflation.

The third is the outbreak of the COVID-19 pandemic, which has obstructed the supply chain and increased logistics costs, aggravating the cost of existing production and supply links. This ultimately leads to a higher price at the consumer’s end.

As countries continue to release monetary issuance in recent years, the discussions on Modern Monetary Theory (MMT) heee become much-talked-about. MMT believes that money originates from the relationship between creditors’ rights and debts, that the government uses the means of creating money for spending, and fiscal expenditure precedes income. With the pandemic impacting the global economy, for many countries that urgently need to expand their finances to stimulate the economy, MMT undoubtedly provides a relief to open the gate of government debt.

If a country is not concerned about local currency debt causing the government to go bankrupt, expanding debt becomes a very tempting policy option for the government. However, researchers at ANBOUND believe that fiscal deficit monetization is not a policy that every country can adopt, and the basis of debt issuance still depends on several fundamental factors: First, it depends on the country that issued the bond. The second is to look at the economic situation of the bond-issuing country, such as economic growth capacity and economic scale. Even for a country as large as China, overextending government debt would carry significant risks. In our opinion, unlimited debt expansion is definitely not a panacea for China, but a time bomb instead.

As inflation has become a reality today, it is clear that the MMT does not solve the problem at all. The world is facing a complex future. Will inflation evolve into a lasting wound that cannot be healed? To answer this, meticulous observation and research are required. Indeed, there is the possibility that some countries implement temporary price controls similar to those during wartime, and use tougher administrative measures to control price increase. In addition, it also includes military control of some major logistics nodes. Will these measures take place? Few people in the past would believe that such a scenario could become a reality, but in the context of the war in Ukraine, the market and all sectors of society should seriously reflect on the possibility that various extreme measures may very well be implemented to control inflation.

There is another way to curb inflation mentioned by ANBOUND in the study on Crisis Triangle. This method, a rather extreme one, is to use war as means to eliminate a large amount of capital accumulation and social wealth. While this is a quick way to curb inflation, it is also the most catastrophic one. Will the war in Ukraine evolve into a war of this nature? It’s too early to draw conclusions, but what is certain is that inflation is now evolving into a major public disaster ravaging the world. Therefore, on the issue of inflation, all countries in the world should abandon ideological disputes and deal with inflation rationally. After all, the harm caused by global inflation may pose huge challenges and threats to humanity.

Final analysis conclusion:

Under the influence of long-term ultra-loose policies, the COVID-19 pandemic, wars, and other factors, inflation is spreading in countries and economies around the world. This is becoming a public disaster that all countries need to face. To this end, all countries should put aside their previous differences and work toward a solution together.

Eurasia Press & News

Eurasia Press & News