It is hard to feel good about this report, but with wage growth slowing sharply in the last six months to around 4.0 percent (compared to 3.4 percent in 2019), it’s hard to see how an inflation rate north of 9.0 percent can be sustained. The overall CPI was up 1.3 percent in June, core rose 0.7 percent; 9.1 percent and 5.9 percent year-over-year, respectively.

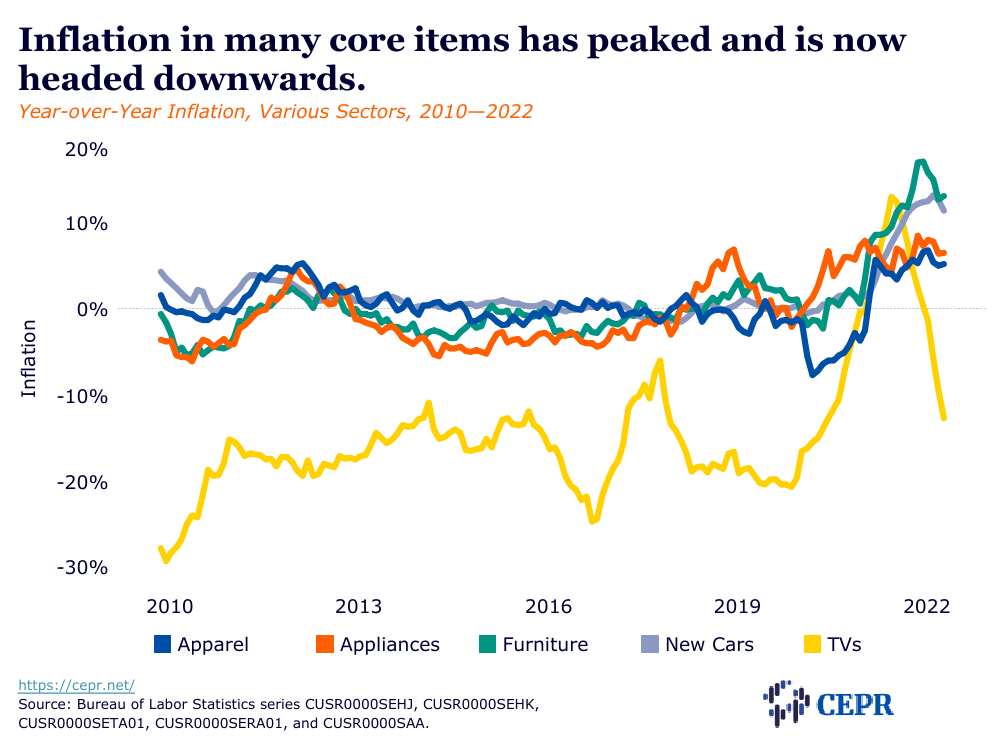

Even though non-car retail inventories are very high, we are still seeing sharp price increases for items like apparel and household furniture. This is hard to understand.

Gas prices rose 11.2 percent in June, 59.9 percent year-over-year, adding 2.1 percent to inflation rate. On the plus side, gas prices have been falling sharply since early June. Lower gas prices should pull July inflation lower.

There were a few areas of price declines, like air travels, hotels, and car rentals, but not many others. One piece of positive news is that television prices continue to fall sharply (they rose sharply last spring-summer), down 2.3 percent in June, 12.7 percent year-over-year.

Rent proper rose 0.8 percent in June, up 5.8 percent year-over-year. Owners equivalent rent (OER) rose 0.7 percent, up 5.5 percent year-over-year. The difference is likely explained by higher utility costs (count in rent proper, but not OER).

The bad news on rent is it is even hitting cities with lower rates of rental inflation. Rent was up 0.5 percent in New York City in June, 2.3 percent year-over-year; in Washington DC, rents were up 0.4 percent in June, 2.2 percent year-over-year; in San Francisco rents were up 0.2 percent in June, 1.3 percent year-over-year.

Rents also accelerated in cities already seeing sharp rent increases. In Detroit, rent rose 0.7 percent in June, 7.3 percent year-over-year, and in Atlanta, rent rose 1.5 percent in June, 12.2 percent year-over-year. The continued rise in the rental indexes is surprising given that indexes of market rents had actually shown some decline.

New and used vehicles showed sharp price rises, 0.7 percent and 1.6 percent, respectively. Year-over-year their prices have risen 11.4 and 7.1 percent, respectively, adding just under 0.7 percentage points to the inflation rate. Cars are still in short supply, but we have been seeing price declines in used vehicle indexes, according to the Manheim index. It is hard to understand the June rise in the CPI.

Car insurance, which has a 2.4 percent weight in the CPI, and almost 3.0 percent in the core, rose 1.9 percent in June, 6.0 percent year-over-year.

Health insurance (profits and administrative costs, not premiums) rose 2.1 percent in June, the fourth consecutive month above 2.0 percent; up 17.3 percent year-over-year.

Medical care services rose 0.7 percent in June and are now up 4.8 percent year-over-year. Much of this increase is health insurance. Professional medical service prices are up just 2.6 percent year-over-year.

Eurasia Press & News

Eurasia Press & News