What makes Bitcoin a gold-like commodity is its perfect decentralisation and high cost of production, both traits lacking by every other cryptocurrency. Like gold can be found in physical nature, Bitcoin can be found in digital nature, by anyone with electricity, internet, and some hardware.

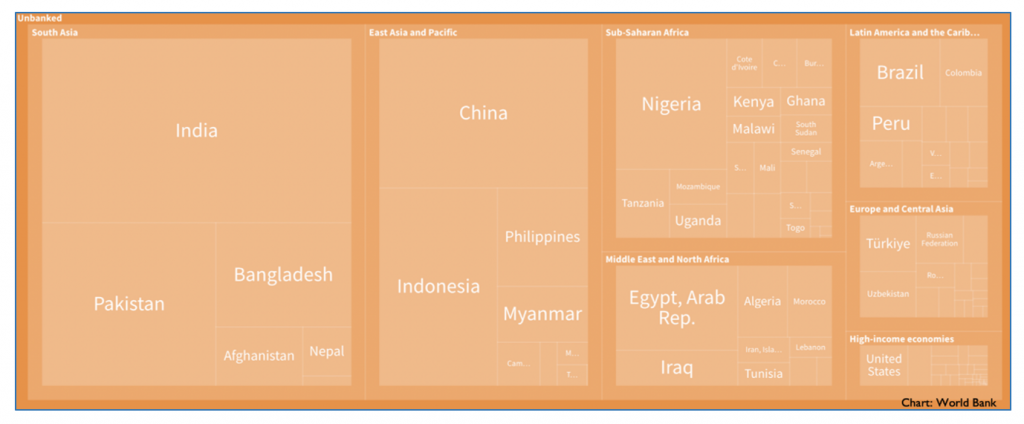

Those who lack access to basic financial services like banking, credit, and insurance are considered financially excluded. The World Bank estimates that about 24 percent of the world’s adult population did not have access to regulated banking services in 2021, with about half of them living in just seven economies including India (Figure 1).

There is also a sizable population that may have access to basic banking but suffer from low financial resilience—they are deep in debt and have low savings or erratic income. They are especially vulnerable to financial shocks due to the lack of quality assets, whose earnings can cushion the shock. They are not necessarily poor—many are from the middle and lower-middle classes—but being priced out of asset ownership by events such as COVID-19 and the subsequent inflation spiral pushes them close to poverty. In the United Kingdom (UK), over 25 percent of the adult population was left with low financial resilience in the wake of the pandemic; globally, between 75 million to 95 million people could fall into extreme poverty.

In Assets for the Poor: The Benefits of Spreading Asset Ownership, sociologist Thomas M Shapiro points out that wealth has been a “neglected dimension” of social science’s concern with the financially weak. “We have been much more comfortable describing and analysing occupational, educational, and income distributions,” he writes, “than examining the economic bedrock of a capitalist society, private property.”

In the current era of high inflation and rapid currency debasement, the asset-poor—those saving only in cash or in a simple savings account—are exposed to a crushing devaluation of their wealth. To decode this systemic impairment of the asset-poor (and Bitcoin’s structural intervention), we need to dive into an economic phenomenon called the Cantillon Effect.

The Cantillon Effect

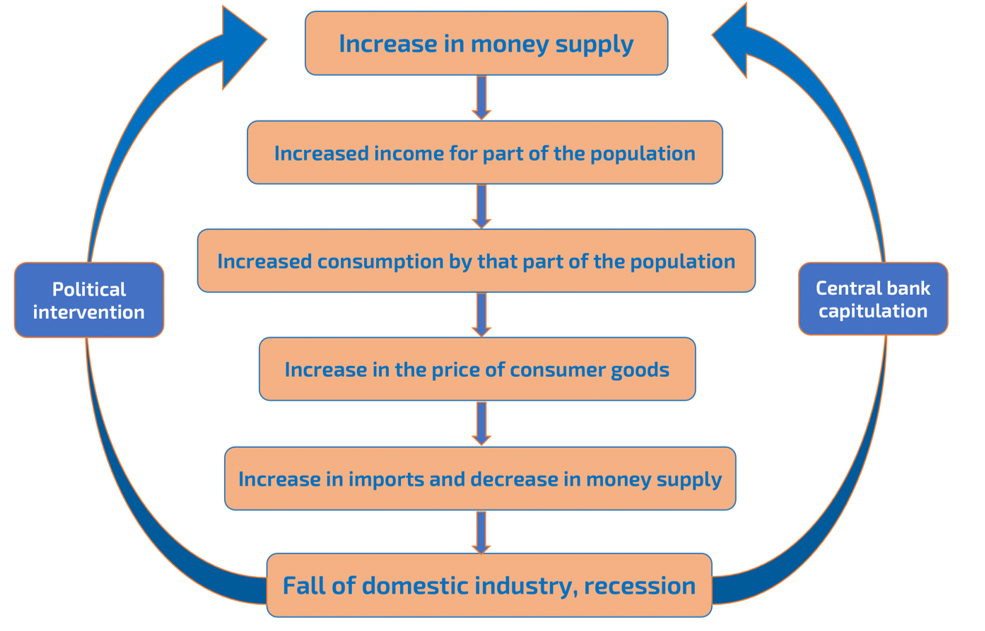

Richard Cantillon, an 18th-century banker, economist and author, observed that when new money is injected into the economy, those closest to the source of money benefit first (and most), while it trickles down much later (and less) to those further downstream. In other words, the distribution of new money is not neutral: It favours the credit-worthy over the credit-poor who do not have collateral, though it’s the latter who need the stimulus in a crisis. And the inequity gets worse over time because the entire population has to pay higher prices caused by the increase in the money supply.

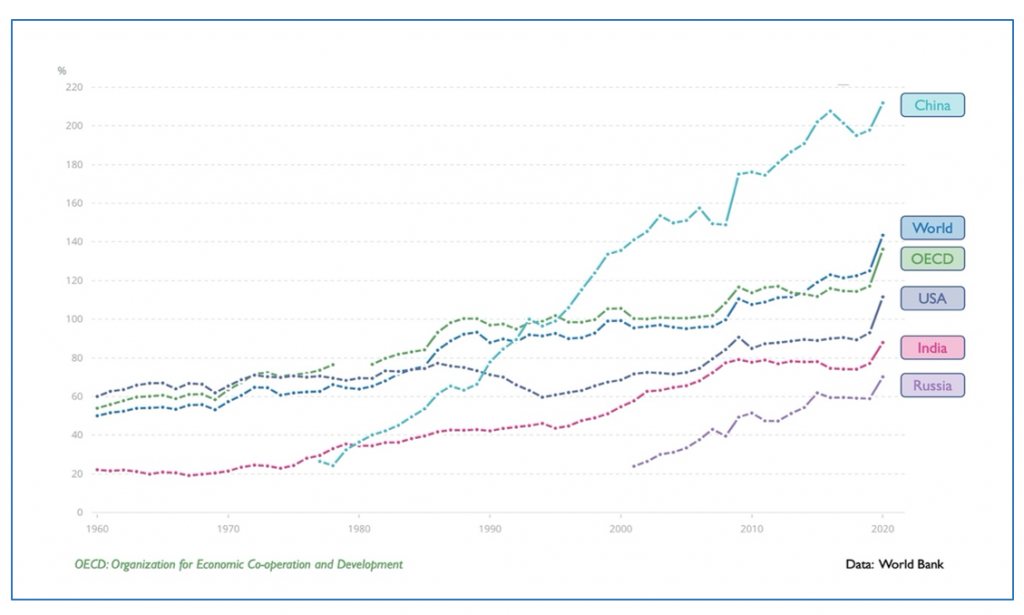

While Adam Smith is widely regarded as the intellectual father of modern capitalism, Cantillon had some prominent backers for that title—Joseph Schumpeter, Friedrich Hayek, and Murray Rothbard amongst them. Hayek called Cantillon’s work “the first attempt…to trace the actual chain of cause and effect between the amount of money and prices”. Now though, as unprecedented money printing by central banks (Figure 3), coupled with supply shocks, wreak havoc with consumer prices globally, Cantillon’s work on the uneven (and sometimes unpredictable) effects of monetary stimulus is emerging from Adam Smith’s long shadow.

In trying to engineer a quick economic turnaround from COVID-19, the United States (US) Federal Reserve’s policies increased the dollar’s supply by an astounding 40 percent since 2020, while keeping interest rates near zero. Other central banks followed with their own big liquidity pumps, at a time when the global economy had come to a standstill with low productivity. As the excess liquidity pushed up demand, broken supply chains were not able to keep up; and with the Russia–Ukraine war putting further pressure on food and energy prices, we were thrown into the worst inflation spiral the world has seen in the last 40 years. Now, as central banks hurriedly raise interest rates to reduce liquidity and get a grip on inflation, we could be standing at the cusp of a recession, which we set out to avoid in the first place.

So who are the winners and losers of this Cantillon cycle? The winners are the asset-rich: Those who owned real estate, high-growth stocks, or Bitcoin before early 2020 got asymmetric returns on their wealth, aided by the monetary stimulus. The losers are the asset-poor, whose small savings got brutally devalued through a combination of high inflation and low-interest rates. Worse still, quality assets are now further out of their reach, and they could face unemployment in a recession.

In sum, the post-pandemic monetary stimulus, while politically packaged to help the vulnerable and restart the economy, ended up in the hands of higher income groups who have a propensity to invest in financial assets overspending in the real economy overspending kick starts a productive cycle, this created a frothy asset bubble, risk of stagflation and heightened wealth inequality.

Bitcoin disrupts the domestic Cantillon cycle by hard-capping and decentralising the supply of new money; it also gives nations an escape hatch from the global boom-and-bust cycles (the international Cantillon Effect) triggered by the US Federal Reserve, which supplies the premier currency of international trade. Since the Cantillon business cycle disproportionately hurts poor people (with weak assets) and poor countries (with weak currencies), Bitcoin’s disruption of this cycle is a salient breakthrough in financial inclusion and equitable global development.

Bitcoin restores money as a quality asset

On 15 August 1971, with the US economy under serious stress, President Richard Nixon removed the dollar’s last tether to gold, ushering in the age of fiat currencies—money backed by nothing more than confidence in the US Treasury. Other national currencies, which were all pegged to gold via the dollar, also came off the gold standard by default. Since then the “exorbitant privilege” of the dollar has kept growing in the absence of a clear competitor; till now, that is. “Nixon’s closing of the gold window marked the end of a commodity-based monetary order, and the beginning of a new world of fiat currencies,” wrote Princeton historian Harold James, and now “we are moving toward another new monetary order, based on information.”

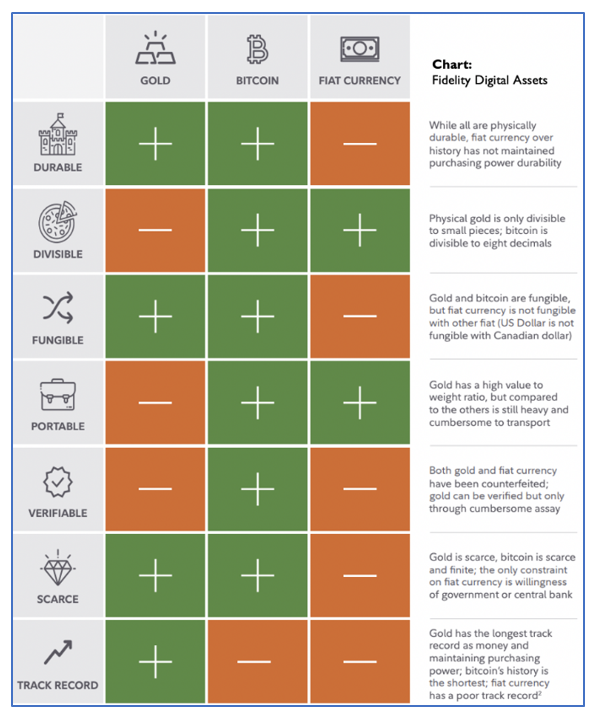

But Bitcoin is as much a hark back to the past (commodity money) as it is a stab at the future (information money). It is a digital commodity, an energy derivative, accounted for on an immutable information ledger, secured by military-grade cryptography. As a monetary good, it combines and improves upon the properties of both gold and fiat currencies (Figure 4).

What makes Bitcoin a gold-like commodity is its perfect decentralisation and high cost of production, both traits lacking by every other cryptocurrency. Like gold can be found in physical nature, Bitcoin can be found in digital nature, by anyone with electricity, internet, and some hardware. And just like gold, Bitcoin has a high cost of extraction (mining) that ensures it is not oversupplied. Bitcoin goes a step further and mathematically hard caps its supply; in effect, it mimics the absolute scarcity of our time on earth, which makes it a superior store of our time and value.

As we saw earlier, the core problem of the asset-poor is that our money has stopped working as a store of value, due to continuous debasement through inflation. This has led to speculative investments in other assets with a limited supply – particularly real estate – which has driven up prices beyond the reach of ordinary people. When money itself stops working as a store of value, the price of virtually every other asset is distorted, as they take on a monetary premium beyond their utility value. With its conservative design, Bitcoin corrects this major structural flaw of the fiat economy; it restores money as a high-quality asset with a finite supply, which leads to honest price discovery in other assets based on their real utility.

Bitcoin for the poor: Risks and benefits

At a theoretical level, Bitcoin has profound benefits for the financially weak, but they will be realised only in the medium-term, as the market matures with less speculation and volatility, with more adoption and utility. There are already some encouraging signs of bottom-up adoption from different parts of the world: The El Zonte beachcommunity in El Salvador is the most famous example, which eventually led to Bitcoin becoming a legal tender in the country; there are also inspiring stories coming out of Afghanistan, South Africa, Costa Rica, and racial minorities in the US.

Here are some risks and benefits of early Bitcoin adoption by the financially weak:

Risks:

Crypto scams: The plethora of scams in the wider cryptocurrency market, with heavily marketed get-rich-quick schemes, can lure newcomers away from Bitcoin with the promise of higher and faster gains. Once burnt by a scam, many investors are likely to shun the market altogether.

Regulatory uncertainty: Most small savers tend to be risk-averse with their money. The regulatory uncertainty around Bitcoin is likely to keep the masses away from investing in the top-performing financial asset of our times.

Volatility: Small savers need to dip into their savings in times of crisis, so they are more sensitive to the short-term volatility of Bitcoin. A prudent investment in Bitcoin should involve a cost-average strategy with a minimum four-year time frame.

Knowhow: The Bitcoin user experience (UX) is still evolving and some aspects like self-custody can feel intimidating, not intuitive. On a comparative timeline, we are still in the era of dial-up internet connections. Further innovations and education are needed before the entire range of UX becomes intuitive and ready for mass adoption.Benefits

Accessibility: In many countries, smartphone penetration is now greater than the banking system’s reach, making Bitcoin a potentially powerful tool for financial inclusion. Access to the Bitcoin network is permissionless and equal; it is free of human bias against the financially weak, which is inherent in the traditional banking system.

Remittances: Many financially vulnerable citizens are dependent on foreign remittances from their relatives. Current intermediaries charge high fees, while settlements are not instant. Bitcoin’s Lightning Network enables instant remittances at near-zero fees.

Easy liquidity: Small savers prefer instant liquidity with their assets to protect themselves in a crisis. Bitcoin is redeemable on the network at all times, without holidays.

Long-term, inflation-proof savings: With its supply being halved every four years, Bitcoin’s design is the antithesis of fiat currency inflation. Small savers with a long-term view now have instant access to an asset that protects their purchasing power.

Financial resilience: All the above benefits make small savings in Bitcoin a pivotal advance in financial resilience; it gives the asset-poor a chance to withstand with minimum damage, the boom-and-bust cycles of the fiat economy.In conclusion, no nation-state—particularly one of India’s size and stature—can afford to ignore the transformative potential of Bitcoin. A hostile or ignorant stance, against an unstoppable idea whose time has come, is unlikely to fetch any good results. The focus of regulation should, therefore, be on utilising Bitcoin’s benefits, while prudently managing the risks.

Eurasia Press & News

Eurasia Press & News