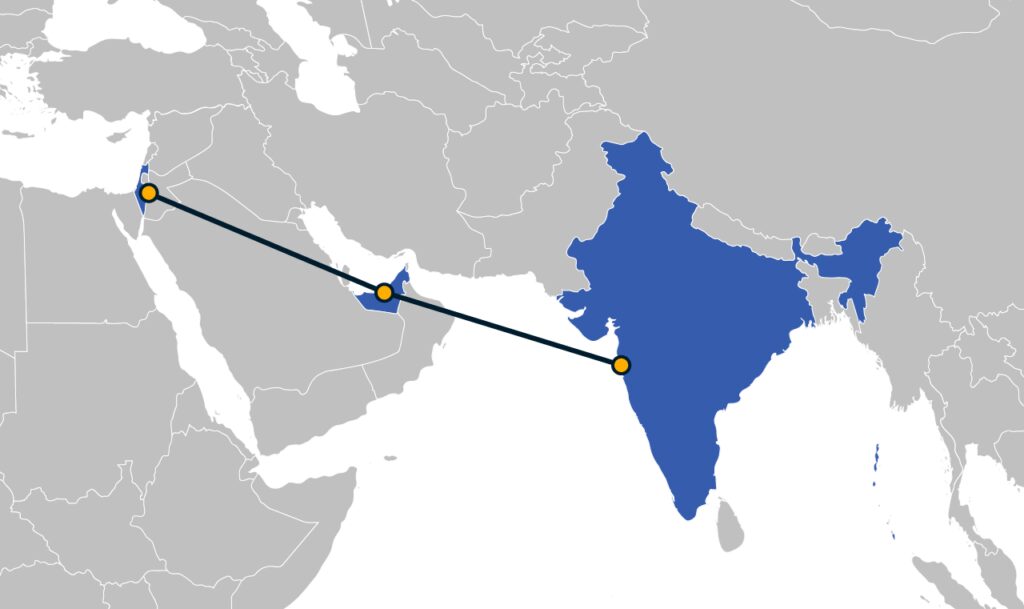

As countries around the world cope with supply shortages of staple foods, the United Arab Emirates (UAE), Israel, and India are creating an India-Middle East Food Corridor — a new West Asia value chain that harnesses the three states’ commercial and technological synergies to form what promises to be a new food exporting powerhouse. A resilient 21st century food supply chain forged from innovative and climate-smart technologies, the India-Middle East Food Corridor is also reconfiguring commercial relations across the southern rim of Eurasia.

For Washington, the development of an arc of commercial connectivity from India’s Arabian Sea coast to Israel’s Mediterranean coast with the UAE as its hub provides a geopolitical counterweight to China’s expanding commercial presence across the Indo-Pacific into the Middle East. At the July 14, 2022, “I2U2” summit, the first convening of the heads of government of India, Israel, the UAE, and the United States, the food corridor featured prominently, leading to the erroneous impression that the corridor is a geo-economic contrivance of a U.S.-sponsored “Middle East Quad.” The India-Middle East Food Corridor is neither anti-China nor a new initiative. In fact, the corridor had been evolving without any U.S. involvement at all.

The geopolitical and economic significance of the food corridor project rests on the vital yet separate roles the UAE and Israel have already been playing in the advancement of India’s food production and distribution systems. These roles are now becoming intermeshed. The normalization of Emirati-Israeli relations following the September 2020 signing of the “Abraham Accords” is now enabling deliberate trilateral cooperation among the UAE, Israel, and India. Although the U.S. is becoming a participant through the I2U2 format, the strategic power of the India-Middle East Food Corridor derives from the fact that it developed organically among the three Asian countries themselves, through private sector, joint venture investments carefully cultivated via bilateral public-private partnerships. Although not requiring Washington as a benefactor, the United States’ participation in the corridor could prove beneficial as the U.S. seeks to bolster its presence in the strategic architecture of the Indo-Pacific.

An organic development: The India-Middle East Food Corridor’s origins

The first I2U2 leaders’ meeting was conducted by video conference during U.S. President Joe Biden’s visit to Israel, as part of his four-day Middle East tour. Bringing together India’s Prime Minister Narendra Modi, the UAE’s President Mohammed bin Zayed al-Nahyan, Israeli Prime Minister Yair Lapid, and President Biden, the I2U2 summit sought to promote joint investment in the food, water, energy, transportation, health, and space sectors. Joint investments in the first four of these sectors have been occurring between the UAE and India as well as between Israel and India over the past 5-10 years and already underpin the food corridor project. The signature initiative of the I2U2 summit is the UAE’s $2 billion investment in the construction of food parks in India that will utilize Israeli and U.S. climate-smart agritech, clean tech, and renewable energy technologies to, in the words of the summit’s joint statement, “help maximize crop yields and, in turn, help tackle food insecurity in South Asia and the Middle East.” The food parks were already an integral part of the UAE’s logistical plan for the food corridor since 2019. Israeli agritech, clean tech, and renewable energy solutions have formed a critical component of India’s food production sector for an even longer time.

The India-Middle East Food Corridor originated in the symbiosis between the Arab Gulf states’ strategic need to ensure their food security and India’s strategic imperative to increase the value of its food production. India is the world’s second-largest food producer when measured by calorie content but ranks fourth when measured by the total value of agricultural production, reflecting the fact that India processes less than 10% of its agricultural output. More than one out of every 10 members of India’s workforce is employed in the food-processing sector. Therefore, two of New Delhi’s highest strategic priorities include developing higher value-added secondary food processing as well as logistics that prevent distribution loss through efficient integration from farm to retail outlets.

In 2017, India signed 14 Comprehensive Strategic Partnership (CSP) agreements with the UAE, India’s third-largest trading partner and Arabian Sea neighbor. Among the CSP agreements were three that addressed India’s strategic food priorities through creating Emirati-Indian cooperation frameworks in food processing, maritime transport, and freight logistics and warehousing. These agreements serve as the springboard for the UAE’s development of the logistics and distribution infrastructure of the corridor.

UAE: The India-Middle East Food Corridor’s logistics and distribution engine

In 2019, two years prior to the 2021 COVID-19-induced food supply disruptions and well before the food supply shocks brought on by Russia’s 2022 invasion of Ukraine, the UAE engaged India in the establishment of a massive $7 billion project to create an India-UAE Food Corridor to ensure the food security of the Emirates and other Middle Eastern countries, thus actualizing several of the CSP commitments.

The corridor initiative assumed its shape when the Dubai-based real estate development giant Emaar Group took on the task in September 2019 of coordinating the $7 billion of investments in the corridor by various Emirati entities. Approximately 70% of these funds were earmarked for investment in mega-food parks in various Indian cities. The $2 billion Emirati investment in food parks announced in the 2022 I2U2 joint statement appears to be a repackaging of part of the 2019 initiative. The remainder of the initiative’s $7 billion was reserved for contract farming, sourcing agricultural commodities, and related infrastructure.

As part of the 2019 initiative, the Dubai Chamber of Commerce started helping coordinate Emirati and Indian entities in the creation of a dedicated logistics infrastructure for the food corridor. Dubai-based global supply chain leader DP World started spearheading the effort to provide integrated supply chain solutions for foodstuff transportation and storage to enable the corridor to operate. Previously, in 2018, DP World and India’s National Investment and Infrastructure Fund (NIIF), India’s sovereign wealth fund, set the foundation for these investments when they formed a $3 billion ports and logistics investment platform called Hindustan Infralog Private Limited (HIPL). DP World holds a 65% share and NIIF has a 35% share in HIPL. To create an integrated transportation infrastructure to support integration across the Arabian Sea, HIPL’s first investment was to acquire a $400 million controlling stake in Continental Warehousing Corporation, a leading multi-modal logistics company with a pan-India presence.

DP World operates one of the leading container terminals at the Jawaharlal Nehru Port (JNPT) on Mumbai’s Arabian Sea coast, which handles about 50% of India’s containerized cargo. In January 2021, DP World began construction of a free trade zone facility just 3 miles (5 km) from the JNPT, with 93,000 square meters of covered storage, temperature-controlled warehouses, and state-of-the-art cargo handling facilities, designed to help spur the food corridor’s integration.

The Dubai-based conglomerate Sharaf Group similarly announced, in December 2020, that it was planning an investment of upward of $1 billion in the food corridor. Sharaf Group, which operates in over 40 countries and maintains diverse operations in the shipping, logistics, supply chain, and retail sectors, had already invested over $300 million to build logistics infrastructure services, warehousing, and storage that will support the food corridor. The Abu Dhabi-based retailing conglomerate Lulu Group, which currently sources vegetables, fruit, fish, and meat from India, is involved with the establishment of the corridor, as are other Emirati firms.

With the prospect of tripling the food trade between the UAE and India by 2025, the corridor seeks to connect India’s farms through the entire food production value chain to the UAE’s ports. The Dubai Multi-Commodities Centre created an agriculture trading platform called Agriota to link Indian farmers with food companies in the UAE. The UAE will be able to purchase food grains, fruits and vegetables directly from farmers in India to be delivered to the Emirati-financed, mega-park processing facilities being constructed in the country. The UAE’s Ministry of Economy estimates that 2 million Indian farmers will benefit from the food corridor, which will create an estimated additional 200,000 jobs.

Israel: India-Middle East Food Corridor’s agritech and innovation powerhouse

India’s ambition to be the food basket to the Middle East and beyond fundamentally rests on its ability to increase its agricultural yield, which in turn requires the careful management of its water resources. In parallel to India’s engagement with the UAE, Israel’s agritech and clean tech partnerships with India are providing pivotal support for the South Asian country to achieve both objectives. Between 2012 and 2015, Israel established 29 agricultural centers of excellence across India as a platform for the rapid transfer of technology and best practices. In 2019 alone, an estimated 150,000 Indian farmers received training at these centers. Beyond governmental development initiatives, Israeli agricultural companies have played a transformative role in the Indian farming and water management sectors.

Israeli crop protection company ADAMA Agricultural Solutions is one of India’s top firms in the industry, operating a formulation plant in Gujarat and a research and development center in Hyderabad. India is the world’s largest rice exporter, selling more than the next four largest exporters combined and accounting for 40% of the global rice trade. For several years, Israel’s Evogene worked with India’s Rasi Seeds Ltd to improve the Indian rice quality and yield. The Israeli leader in agricultural structures for novel farming, ProFit Agro Ltd, launched its first Indian Hydroponic Raft System in Bengaluru in 2019, helping to move India further toward industrialized agriculture. Various cutting-edge technologies in which Israel is an industry leader, such as fertigation and biostimulants, can also help mitigate the damage to crop yields caused by climate-driven extreme heat and drought, such as the severe weather India experienced this spring. The 15% drop in what otherwise would have been a record yield led India to ban wheat exports beyond already-existing export sales on credit and government-to-government agreements.

Israel’s contribution to the food corridor also derives from Israeli-Indian cooperation in innovative technologies and promotion of start-ups. While many of India’s largest firms have invested in Israel’s innovation ecosystem over the last several years, Israel has played a key role in the advancement of India’s own innovation ecosystem. India’s International Centre for Entrepreneurship and Technology, the meta-incubator commonly known as iCreate, was established in 2018 with advice and support from the Israel Innovation Authority and private sector Israeli stakeholders. Innovation and technology cooperation between start-ups and corporations from the two countries received an additional boost from the September 2020 cooperation agreement signed between iCreate and Israel’s non-profit, private sector innovation platform Start-Up Nation Central.

The close relationship between the Israeli and Indian innovation ecosystems has produced joint venture manufacturing of climate-smart agricultural equipment in India that forms an additional supportive layer to the integration of the India-Middle East Food Corridor. In 2018, a joint venture partnership between India’s agri-tech start-up Vyoda and Israeli start-up Agrosolar Irrigating Systems was facilitated by financing from the India-Israel Industrial R&D and Technological Innovation Fund (I4F), itself a joint project of the Indian government’s Department of Science and Technology and Israel’s Innovation Authority. Agrosolar previously developed an off-grid solar-powered pumping and irrigation system to allow farmers with small holdings to affordably irrigate 2.5- to 5-acre (1-2 hectare) farms during dry season conditions. Vyoda, a subsidiary company of Indian conglomerate NR Group, opened a research and development facility in Tel Aviv to utilize Israeli expertise in agricultural and start-up product development. In 2020, the two companies manufactured 50 pilot units, several of which have been installed at farms in the Indian state of Karnataka. Vyoda began production of the systems in a new plant in Mysuru, Karnataka, for sale in India and elsewhere.

Similarly, Israel’s drip irrigation systems manufacturer Metzer and Indian pipeline manufacturer Skipper established a production facility to build drip irrigation system components as a 50-50 joint venture. The dedicated plant housed within Skipper’s Hyderabad production site became operational in April 2020 with an initial annual capacity to construct 88 million meters of drip irrigation and sprinkler irrigation products for sale in India and other Asian markets. Israeli drip irrigation technology forms an essential part of India’s strategy to cope with rising water shortages that are forcing its growers to find alternatives to flood irrigation, in which 50% of the applied water never reaches the crop.

Trilateral future

In February 2022, the UAE signed a Comprehensive Economic Partnership Agreement with India that eliminates tariffs on about 90% of mutually traded products. The Emirati-Indian trade deal was then followed, in May 2022, by the signing of a similar free trade agreement between the UAE and Israel that will see the removal of tariffs on about 96% of traded goods. Since the Abraham Accords, UAE-Israeli bilateral trade has exceeded $2.45 billion, with their first quarter 2022 bilateral trade volume surpassing $1 billion. The Emirati-Israeli trade agreement is expected to boost that trade by $10 billion over the course of the next five years.

The conclusion of the two trade agreements has paved the way for the UAE, Israel, and India to initiate three-way coordination in developing the India-Middle East Food Corridor. As Israel’s ambassador to India noted following the signing of the second trade deal, the UAE-Indian trade agreement and the UAE-Israeli trade agreement in tandem hold “the potential for extensive trilateral cooperation and business partnerships.” The convening of a trilateral dialogue between the heads of government of the UAE, Israel, and India was the natural and logical next step in the advancement of the food corridor project. From this perspective, the novel aspect of the July 14, 2022, I2U2 summit was the quadrilateral format with the participation of the United States. Israel’s announcement on the same day that it had awarded the tender to purchase its Haifa port to the consortium led by an Indian port company served as a potent indication that the India-Middle East Food Corridor possesses its own commercial momentum and economic logic.

The UAE-Israel-India trilateral formation promises to have a robust future and could serve as the basis of a larger commercial configuration in the western half of the Indo-Pacific with the addition of other Arab Gulf states, Egypt, or countries from the greater Horn of Africa region. For the United States, participation in the India-Middle East Food Corridor is a strategic desideratum, forming an important part of Washington’s approach to the Arabian Sea and the wider Indo-Pacific.

Eurasia Press & News

Eurasia Press & News