The August employment report gave a somewhat mixed picture as the establishment survey showed a strong gain of 315,000 jobs, while the household survey showed the unemployment rate rising by 0.2 percentage points to 3.7 percent. However, the picture given by both surveys is somewhat more complicated.

In the case of the establishment survey, the prior two months of jobs numbers were revised down by 107,000. This still left a very strong three-month average of 375,000, but slower than it would be without the downward revision.

More importantly, the length of the average workweek fell by 0.1 hours. This led to a fall of 0.1 percent in the index of aggregate hours worked. That indicates some weakening in demand for labor.

Household Survey Still Shows Strength

In the case of the household survey, the rise in the unemployment rate went along with a 442,000 increase in employment. The labor force participation rate (LFPR) rose 0.3 percentage points, while the employment-to-population ratio rose by 0.1 percentage points — tying previous peaks for the recovery.

There had been some concerns about the lack of employment growth in the household survey even as the establishment survey was showing large gains. This report should alleviate those concerns.

The LFPR for prime-age workers (ages 25 to 54) rose 0.4 percentage points. It is now 0.3 percentage points below its pre-pandemic peak. For prime-age women, the increase was 0.8 percentage points, putting their LFPR 0.3 percentage points above its pre-pandemic peak. The increase was 0.2 percentage points for prime-age men, leaving their LFPR 1.0 percentage point below its pre-pandemic peak.

This is impressive because 523,000 people still report being out of the workforce because of COVID-19, but only 213,000 are prime-age workers.

Unemployment Rises Most Among Disadvantaged Groups

As is generally the case when the unemployment rate rises, those most disadvantaged in the labor market are hit hardest. The unemployment rate for Black workers rose 0.4 percentage points to 6.4 percent. The unemployment rate for Hispanics rose 0.6 percentage points to 4.5 percent. The unemployment rate for Hispanic women rose from 1.1 percent to 4.3 percent, largely reversing a 1.3 percentage point drop in July.

The unemployment rate for high school grads rose 0.6 percentage points to 4.2 percentage points, while the unemployment rate for college grads fell 0.1 percentage points to 1.9 percent, a new low for the recovery.

Wage Growth Still Strong

The average hourly wage increased at a modest 0.3 percent rate in August, but it rose at an annual rate of 4.9 percent when comparing the last three months (June, July, August) with the prior three months (March, April, May). That’s higher than what is consistent with 2.0 percent inflation, but down from 6.1 percent at the end of 2021.

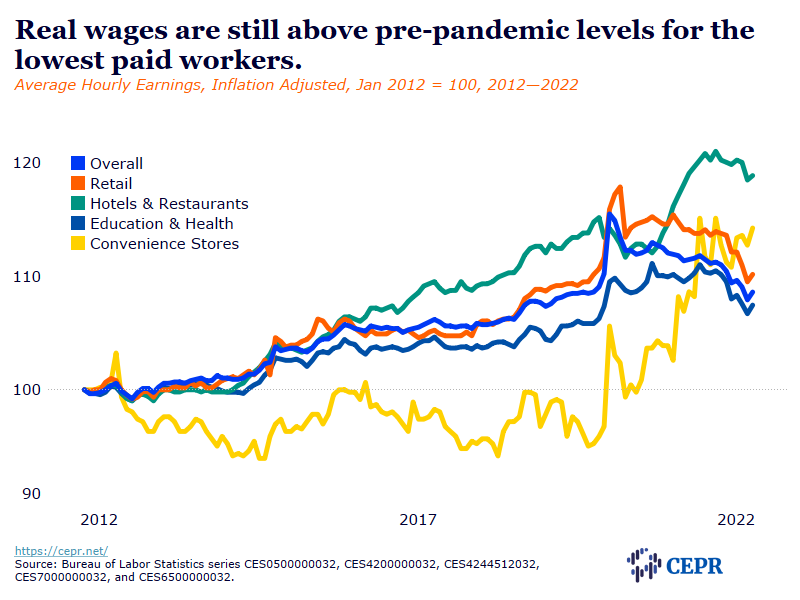

Wage growth continues to be more rapid for lower-paid workers. The annual rate for production and nonsupervisory workers when comparing the last three months with the prior three is 5.8 percent; in restaurants, it was 5.2 percent.

Employment Now Far Above Pre-Pandemic Level

Total jobs are now 240,000 above the pre-pandemic level, with private sector jobs up by 885,000. Adding in preliminary benchmark numbers the Bureau of Labor Statistics released last month, the total is up by 702,000, with private sector employment up by 1,456,000.

Construction Continues to Add Jobs Despite Fed Rate Hikes and Falling Housing Starts

Construction employment rose by 16,000 in August, with residential construction adding 10,900 despite the sharp drop in housing starts. Easing of supply chain problems is likely allowing for more work to be done even with fewer starts.

The biggest hit from Fed rate hikes to date has been on mortgage refinancing. Jobs in non-depository credit intermediation are down 14,200 from the May peak, a decline of 2.2 percent.

Most Sectors Saw Healthy Job Gains In August, but State and Local Government Still Lags

Manufacturing added 22,000 jobs in August, and employment is now 67,000 above pre-pandemic level. It would be up by 89,000 adding in the preliminary benchmark revision. Airline employment rose 2,200, it is now 48,400 above its pre-pandemic level.

Nursing homes added 2,300 jobs in August, while childcare added 2,800. These sectors, which have struggled to get workers, are now down 14.2 percent and 8.4 percent from pre-pandemic levels, respectively.

Job growth in restaurants slowed to 18,200 after rising 77,500 in July. Employment in the sector is still down 5.1 percent from pre-pandemic levels, even though sales are considerably higher. Jobs at Internet retailers were flat in August and are now down 4,600 from the peak last November.

State and local governments added 9,000 jobs in August, but employment is still 647,000 below pre-pandemic levels. This falloff will be close to 750,000 with the preliminary benchmark revision.

On the Whole, a Mostly Positive Jobs Report

This report is generally positive, with the establishment survey continuing to show large job gains. However, this does raise the concerns that the Federal Reserve Board will choose to raise rates more aggressively, which will mean a bigger hit to future employment.

The 0.2 percentage point rise in the overall unemployment rate to 3.7 percent is not too concerning since it was accompanied by big gains in employment and labor force participation. However, the much larger rises for Blacks, Hispanics, and high school grads bring home the point that the most disadvantaged will be the main victims of Fed rate hikes.

The decline in the length of the average workweek and the fall in the index of aggregate hours is very important and likely to be overlooked. Employers had been getting their existing workforce to put in more hours when they were unable to hire new workers. That no longer seems to be the case.

Also, hours worked is the measure of total demand for labor, which appears to be weakening as the Fed wants. With some evidence of moderation in wage growth, the Fed should be able to ease back on its pace of rate hikes.

Eurasia Press & News

Eurasia Press & News