China is the world’s most populous country (1.4 billion people in 2020) and has a fast-growing economy. It was the largest energy consumer and producer in the world in 2020.1 We expect that China’s energy demand will continue to increase.

China’s real GDP grew by 8.1% in 2021, which is a significant increase from the 2.2% growth in 2020 during the height of global COVID-19 lockdowns. The global coronavirus pandemic decreased industrial and economic activity and energy use within China, and the resurgence of COVID-19 cases and China’s policy of localized lockdowns are likely to make the Chinese government’s 2022 target GDP growth of 5.5% more difficult to achieve.2Prior to 2020, China’s economy grew by an average 8.9% per year between 2010 and 2019.3

China issued the 14th Five-Year Plan (2021–2025) for National Economic and Social Development of the People’s Republic of China (the Plan) in 2021. The Plan, which sets out China’s strategy for industry planning and policy through 2025, covers the following energy-related themes:

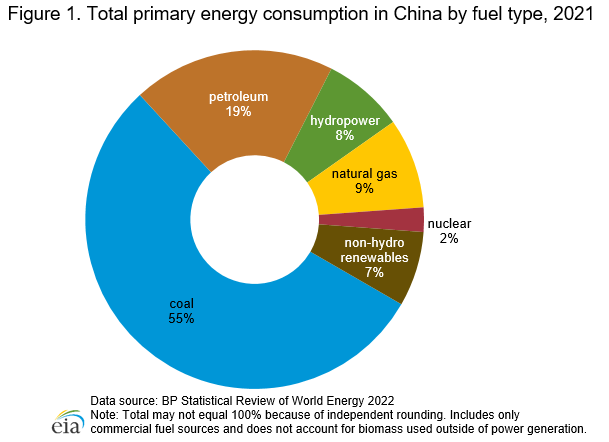

Coal supplied about 55% of China’s total energy consumption in 2021, down from 56% in 2020 and 70% in 2001.8 Petroleum and other liquids is the second-largest fuel source, accounting for 19% of the country’s total energy consumed in 2021. Although China has diversified its energy supplies and has replaced some oil and coal use with cleaner burning fuels in recent years, hydroelectric sources (8%), natural gas (9%), nuclear power (2%), and non-hydro renewables (7%) accounted for relatively small shares of China’s energy mix. However, natural gas, nuclear power, and renewable energy consumption steadily increased between 2001 and 2021, which offset the drop in coal use9 (Figure 1).

Petroleum and other liquids

Exploration and production

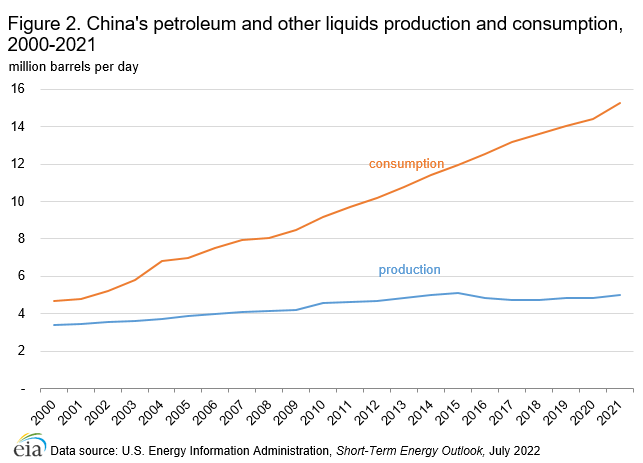

Although China was the fifth-largest petroleum and other liquids producer in the world in 2021, most of the production came from legacy fields that required expensive enhanced oil recovery techniques to sustain production. In 2021, production increased by 130,000 barrels per day (b/d) to just under 5 million b/d (Figure 2). Nearly 80% of the total liquids production was from crude oil, and the remainder was from converting coal and methanol to liquids, biofuels, and refinery processing gains.10

Coal-to-liquids (CTL) production was an estimated 124,000 b/d, and methanol-to-liquids production was around 508,000 b/d in 2021.11 China is attempting to monetize its vast coal reserves by converting some of the coal into cleaner-burning liquid fuels to bolster its petroleum sector.

After the government expressed the importance of exploration and production of crude oil in May 2022, China’s National Energy Agency set a domestic crude oil production target of approximately 1.5 billion barrels for 2022.12 This target is a 2% increase from 2021’s target.13

In response to China prioritizing energy security, the national oil companies (NOCs) have announced that capital expenditures (CAPEX) will increase by 4.6% in 2022 compared with 2021. If realized, PetroChina and Sinopec will have the second- and third-highest CAPEX globally for 2022 of any national oil company, behind only Saudi Aramco. Sinopec’s $31 billion in expenditures would be the highest in its history.14 Sinopec’s target for crude oil production is 281.2 million barrels in 2022, an increase of almost 1.5 million barrels from the previous year.15 PetroChina is targeting 898 million barrels, a 1.2% increase from 2021.16 CNOOC’s planned CAPEX is similar to last year at approximately $14.1 billion.17 CNOOC has several projects slated for startup in 2022 that will add 38 million barrels annually to the company output.18

The Bohai oil field, China’s largest producing field, is located offshore in the northeast and produced over 603,000 b/d in 2021. Bohai surpassed the Daqing field for the first time in 2021. Daqing field was the country’s largest oil field for several decades, and its output was slightly less than Bohai’s, at 600,000 b/d in 2021.19

Consumption

An estimated 15.3 million b/d of petroleum and other liquids were consumed in China in 2021, up 840,000 b/d, or approximately 6%, from 2020 (Figure 2).20

Diesel (24%) and gasoline (23%) accounted for the largest shares of oil products consumed since 2000. However, the pace of oil demand growth in the transportation sector has declined since 2015.21 In 2020, main drivers of an overall decrease in oil use for transportation were:

China’s battery electric, plug-in hybrid electric, and fuel cell electric vehicle industry, set a record in sales in 2021, when sales increased 181% from 2020.23 China implemented national fuel emission standards equivalent to Euro VI.24 These fuel emission standards, which were first introduced in 2005, will be fully implemented by 2030.25

Refining

China’s refining sector has undergone some changes recently that include eliminating market advantages for some refiners and improving efforts to decarbonize. In 2021, the government imposed a consumption tax on imported mixed aromatics and light-cycle oil.26

China’s oil refining capacity has increased during the past decade to meet growing demand for petroleum products and to improve the sector’s capability to process a wider range of crude oil types. Some of the new projects have integrated refining and petrochemical facilities into one complex. China’s installed crude oil refining capacity reached about 18.2 million b/d in 2021.27

An additional 1.1 million b/d of capacity will be added by the end of 2022. Zhejiang’s Rongsheng facility’s Phase II began commercial operation in early 2022 with 400,000 b/d of capacity.28 Shenghong’s refinery in Lianyungang, with a capacity of 320,000 b/d, started its trial operation in 2022.29PetroChina’s Jieyang refinery, with a capacity of 400,000 b/d, will start operations in the second half of 2022.30

Petroleum and other liquids storage

China releases limited information on its crude oil inventories and stockbuilding progress. Industry and trade press outlets assess that Beijing has been swiftly filling its strategic petroleum reserves (SPR) since 2016, and estimate that China has more than 300 million barrels of crude oil stored in at least 12 SPR facilities.31 In addition, China has a sizeable amount of commercial storage capacity that when combined with the country’s strategic reserves totaled 1.2 billion barrels at the end of 2020, according to industry analysts.32

In September 2019, China’s government announced that it had 80 days of crude oil inventories to cover its imports.33 Analysts believe China’s goal for its SPR program of 90 days of import coverage was likely achieved by the end of 2021.34 Industry analysts suggest that China continued to build its oil storage reserves through the first half of 2020 to take advantage of the low crude oil prices.35 In 2021, crude oil imports decreased from the previous year by approximately 5%.36

In 2021, China’s National Strategic Oil Reserve Centre had its first-ever public crude oil reserves auction, which was for about 7.4 million barrels.37

Trade

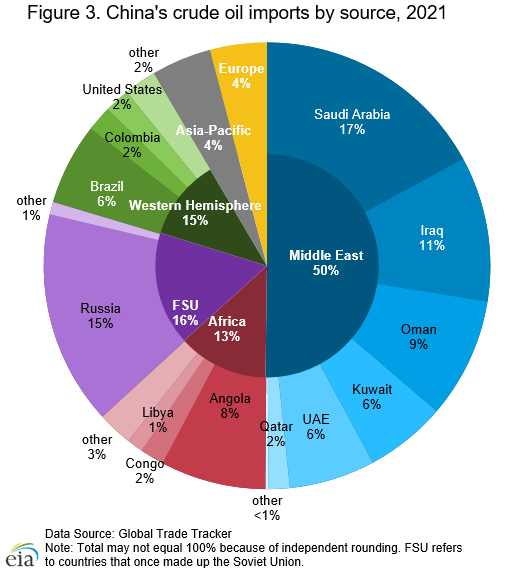

China has diversified its sources of crude oil imports in recent years. Although oil imports have greatly increased during the past decade, imports in 2021 decreased for the first time since 2001. China, which became the world’s largest crude oil importer in 2017, imported 10.3 million b/d of crude in 2021, a more than 500,000 b/d decrease from 2020.38

Saudi Arabia, which historically has been a significant source of China’s crude oil imports, became the largest source of imports in 2021, with a 17% share.39 Saudi Aramco signed new long-term crude oil supply agreements with Chinese companies in early 2019.40 Since then, imports from Saudi Arabia have increased by 86,000 b/d.41

Russia was China’s second-largest source of crude oil imports in 2021 (Figure 3).42 Crude oil imports from Russia began to increase following new upstream production from Eastern Siberian fields, construction of pipeline and transmission infrastructure between the countries, and China lifting a crude oil import ban on independent oil refineries in the country’s northeastern region in 2015. In early 2022, China National Petroleum Corp (CNPC) and Russian oil producer Rosneft extended an existing 10-year contract, which was signed in 2013. Rosneft will supply approximately 200,000 b/d to China over 10 years as part of the contract extension.43

Countries in the Middle East made up 50% of all crude oil imports in 2021, including Saudi Arabia, Iraq, United Arab Emirates, Kuwait, Qatar, and Oman.44

Sanctions on Iran’s crude oil and condensate exports have significantly reduced China’s imports of oil from Iran, starting in the latter half of 2018. Imports of oil from Iran fell to less than 1% of China’s imports in 2021 compared with 8% in 2016, according to China’s official import data.45However, in April 2022, analysts estimate imports from Iran ranged between 575,000 and 650,000 b/d, which would account for approximately 7% to 8% of imports for that month.46

Imports from United Arab Emirates (UAE) has more than doubled in the past three years, increasing from 307,000 b/d in 2018 to 642,000 b/d in 2021.47The increased imports from the UAE have, in part, offset the decrease in Iran’s share of China’s imports.

Crude oil imports from the United States declined significantly from the 2020 average of 481,000 b/d to 248,000 b/d in 2021.48

Natural Gas

Exploration and production

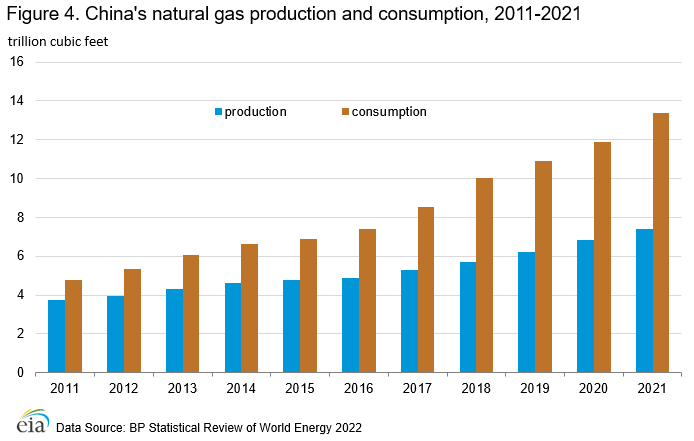

China’s natural gas production has been steadily rising during the past several years. China’s NOCs produced an estimated 7.4 trillion cubic feet (Tcf) of natural gas in 2021, 8% higher than in 2020 (Figure 4).49 China’s shale gas production in 2021 reached 803 Bcf and has grown annually at 21% since 2017. Coalbed methane reached 365 Bcf in 2021, which was 5% of total production.50

China’s 14th Five-Year Plan (2021–2025) for National Economic and Social Development of the People’s Republic of China (the Plan) and its Energy Works Guidance 2022 targets natural gas production to reach 7.6 Tcf in 2022 and 8.1 Tcf by 2025. However, to reach production targets set in 2022 and beyond, China will have to overcome certain obstacles.51 Although China has significant natural gas reserves, estimated at 235 Tcf at the end of 2021,52 much of the reserves have low permeability and porosity. Another challenge is technical difficulty associated with China’s shale gas. To date, only a few shale gas projects are ongoing, despite the government’s push to develop these resources.53

Sinopec plans to increase domestic natural gas production to 1.26 Tcf in 2022.54 PetroChina’s target of 4.6 Tcf in 2022 includes increased production from the Tarim Bozi-Dabei region, the central Sichuan province, and the shale development in southern Sichuan.55

China’s offshore natural gas production increased 11% from 2020 to 407 Bcf in 2021, mostly from production growth in the South China Sea. CNOOC, China’s major offshore producer, has two offshore projects coming online in 2022, which are expected to add 11 Bcf.56

Consumption

Natural gas accounted for 9% of total energy consumption in 2021.57 China’s natural gas consumption rose by 13% in 2021 to 13.4 Tcf from 11.9 Tcf in 2020.58 Between 2011 and 2021, China’s natural gas demand increased by about 11% per year on average, making it the world’s third-largest natural gas consumer behind the United States and Russia (Figure 4).59 Weather-based factors and a rebounding economy drove the demand growth in 2021.60

Several factors have contributed to growth in natural gas consumption during the past few years. Poor air quality (particularly in urban areas of northeastern China, where heightened coal use in the winter causes smog and dangerous levels of pollution) prompted the government to enforce fuel switching from coal to natural gas for industrial use, power generation, and residential and commercial heating. In 2021, main drivers of consumption growth were a decrease in the availability of hydropower combined with a cold winter and a summer that was warmer than average which increased residential demand. Increased industrial production also added to higher demand for the year.61

China’s coal-to-gas switching for heating has been an important factor in demand growth. China’s Clean Winter Heating Plan, which spanned from 2017 to 2021, had a target of 70% clean heating through natural gas-fired or electric-powered boilers.62 In 2020, the Ministry of Ecology and Environment (MEE) set a target goal for over 7 million households to switch from coal to natural gas in 28 northern cities.63

Liquefied natural gas

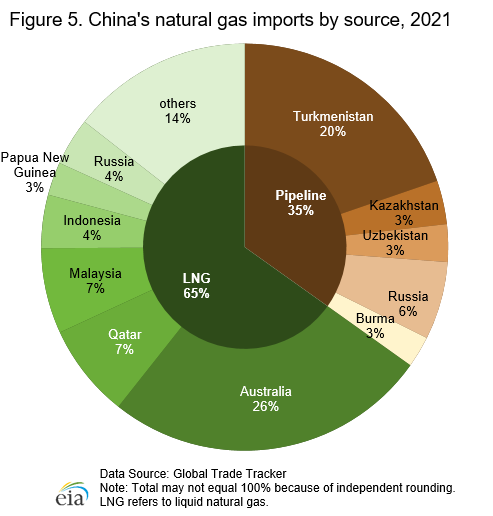

To fill the widening gap between China’s domestic natural gas production and demand, both pipeline and liquefied natural gas (LNG) trade has increased. China, the largest natural gas importer in the world, became the largest LNG importer in 2021, surpassing Japan.64 LNG imports accounted for 65% of total imports, and pipeline imports, mostly from Turkmenistan, accounted for 35% (Figure 5).65

LNG imports climbed to 3.8 Tcf in 2021, rising 19% compared with 2020. LNG imports have increased each year from 2015 to 2021 as a result of lower global LNG prices and China’s coal-to-gas switching policies.66 Even as China’s economic growth slowed in 2020 and COVID-19 outbreaks caused lockdowns, LNG imports still grew by 11% from the previous year. China’s LNG import facilities had their highest recorded regasification utilization in 2021, reaching 84%.67

China has diversified its LNG suppliers during the past few years, and Australia has been its largest supplier, accounting for 40% of LNG imports in 2021.68 Purchases from new natural gas liquefaction projects in Australia began in 2016.

In 2019, China raised the tariffs on LNG imports from the United States from 10% to 25%.69 In 2021, several long-term contracts to purchase LNG from the United States were signed, including a 20-year contract between Sinopec and U.S. Venture Global LNG to purchase 194 Bcf of LNG annually.70 LNG imports from the United States grew and reached 1.2 Bcf/d in 2021.71 The United States was also the largest spot LNG supplier to China in 2021.

As of 2022, China had 23 LNG regasification terminals, with a combined capacity of 4.8 Tcf.72 China completed expansions on three terminals in Qidong, Zhejiang Ningbo, and Shanghai in 2020, adding 235 Bcf in capacity. Companies in China are quickly building various terminals, and another 3.6 Tcf of import capacity is slated to come online by 2024.73

China’s rapidly growing natural gas demand during the past five years has opened up opportunities for independent, or non-NOC, energy companies in China to operate in the LNG market. Several local state-owned municipalities, natural gas distributors, and power developers own stakes in existing LNG terminals. Private company Chaozhou Huafeng Group converted one of its liquefied petroleum gas terminals into an LNG-receiving terminal.74

China’s government has initiated policies to promote LNG bunkering along its waterways. LNG bunkering is when LNG is transferring from distribution point to a ship as fuel (rather than fuel oil). In 2022, Shanghai Port became China’s first port to provide this capability.75

In late 2021, Shanghai Petroleum and Natural Gas Exchange started China’s first spot LNG price index. Both state-owned enterprises and independent LNG importers approve of a China-based spot price.76

Pipeline imports and infrastructure

China’s domestic pipeline infrastructure is undergoing significant development, and the government’s goals are to increase the country’s natural gas pipeline coverage and to improve market competition along the value chain of natural gas sales. The government created a national oil and natural gas pipeline company, the China Oil & Gas Pipeline Network Corporation (PipeChina), in December 2019. Its purpose is to centralize control of China’s oil and natural gas pipelines and storage facilities from NOCs China National Petroleum Corp (CNPC), China Petroleum and Chemical Group (Sinopec), and China National Offshore Oil Company (CNOOC). Centralizing control of these three companies will allow open access to non-state-owned entities to the infrastructure, which will create competition.77 In 2020, PipeChina purchased pipelines and storage facilities from PetroChina and Sinopec for $55.9 billion.78

In late 2021, PipeChina began construction on the middle segment of the West-to-East natural gas pipeline project. The pipeline’s full length is just short of 1,300 miles, which runs from the Ningxia Hui region to Jiangxi province and has an annual transmission capacity of 883 Bcf.79

Natural gas pipeline imports increased in 2021 to 2 Tcf, after a slight decline in 2020. Most of the imports were from Turkmenistan, which accounted for 57% of pipeline imports.80 In addition to the natural gas pipeline imports from Central Asia and Burma, China began to import natural gas from Russia through the Power of Siberia pipeline in December 2019. The Power of Siberia line delivered 353 Bcf to China in 2021.81 China and Russia signed a natural gas agreement in 2014, which has China importing an average of 1.3 trillion cubic feet per year (Tcf/y) of natural gas from Gazprom’s East Siberian fields during a 30-year period.82 This agreement was amended in early 2022 to add an additional 0.35 Tcf/y of imports for a total of approximately 1.7 Tcf/y.83

Line D, the pipeline that is slated to increase capacity from Turkmenistan by 1.1 Tcf/y to 2.3 Tcf/y, has encountered several delays over the years.84 This project has no announced completion date at this time.85

In 2019, China extended a contract with Kazakhstan and doubled the amount of imported natural gas to 350 Bcf/y until 2023.86

Coal

Exploration and production

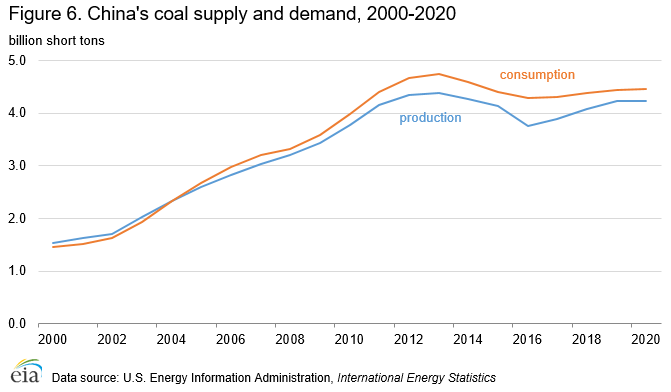

Coal production, which declined for three consecutive years through 2016, rose each year since then until 2019, and remained flat at 4.2 billion short tons in 2020 (Figure 6).87 China’s Premier, Li Keqiang, stated the country will increase coal production capacity by 331 million short tons in 2022.88 The target for coal production is approximately 5 billion short tons for 2022.89

China continues to replace outdated coal capacity with new, more efficient mine capacity and to close smaller mines in the eastern and southern regions.90 Furthermore, China’s recent expansion of long-range railway capacity, such as the Haoji Railway which opened in October 2019, to connect the coal-producing centers in the interior to eastern demand centers is instrumental to increasing domestic production and responding to coal demand.91

Consumption

After several years of declines, China’s coal consumption grew by nearly 2% in 2018 (4.38 billion short tons), then slowed to 1% in 2019 (4.43 billion short tons), and less than 1% in 2020 (4.46 billion short tons) (Figure 6).92According to the National Bureau of Statistics of China, coal consumption increased by approximately 5% in 2021.93 China is the world’s largest coal consumer, accounting for 55% of the world’s coal consumption in 2020.94

The electric power sector accounted for nearly 61% of China’s coal consumption in 2020, and the remainder of China’s coal consumption is from industry, such as steel and cement production, and residential heating.95

China’s consumption of thermal coal for non-power uses, such as residential heating, decreased by 4% in 2020.96 However, China is still the world’s largest consumer, by a significant amount, of thermal coal for non-power use. China is also the largest global metallurgical coal consumer.97 The majority of the metallurgical coal China consumes is used in steel production.

China’s coal demand over the next few years is likely to be determined by the magnitude of the COVID-19 pandemic in China and how it effects the electricity and industrial demand growth and how China balances its energy needs with its commitments to reduce carbon emissions. Expanding both its renewable and nuclear energy capacity (integral to China’s carbon emissions targets and programs, such as the national emissions trading scheme [ETS]) will likely lessen coal demand. However, coal is still a primary component of China’s energy structure and is important to energy security.

Trade

China’s coal imports, the largest in the world, rose from about 335 million short tons (MMst) in 2020 to about 357 MMst in 2021.98 The increase in imports was in response to electric power shortages that occurred throughout the country and rising domestic coal prices. China’s government did not impose an unofficial import cap in 2021 as it had done in the prior two years.99

Indonesia remains China’s largest source of imported coal, and it increased its share of China’s total coal imports to 60% in 2021 from 46% the previous year.100 Indonesia offers a low quality coal that blends well with China’s domestic coal.101 Russia (18%) and Mongolia (5%) were China’s second- and third-largest coal suppliers, passing Australia, which had been second for a few years prior to 2021.102 In 2020, China issued trade restriction on several Australian imports and an unofficial ban on coal from Australia.103

China’s imports of coal from the United States rose to 11.7 MMst in 2021, which was over 10 times higher than in 2020.104

Electricity

China plans to reach its CO2 emissions peak by 2030 and to reach carbon neutrality by 2060. As part of this goal, plans include increasing the share of non-fossil fuels in primary energy consumption to 25% and to bring the total installed wind and solar capacity to 1,200 GW by 2025.105 However, China’s 14th Five-Year Plan considers coal a necessary energy source for the next several years for energy security and economic efficiency.106

Generation

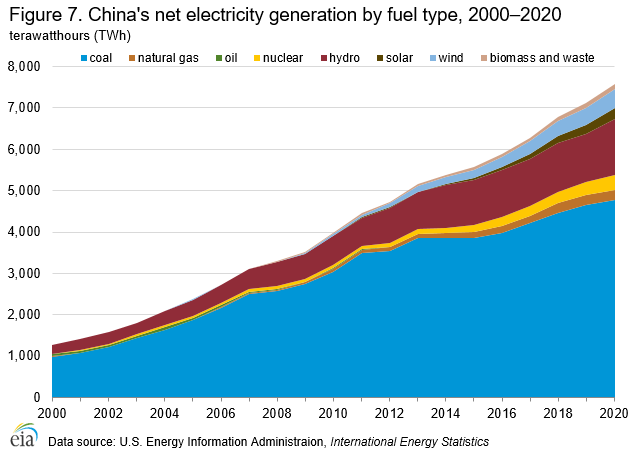

China generated about 7,600 terawatt hours (TWh) of net electricity in 2020, an increase of approximately 5% from 2019.107 China’s statistics indicate that power consumption grew by approximately 10% in 2021.108 Power generation growth continued in spite of COVID-19 lockdowns. Primary sector consumption grew by 10% from the prior year. This growth is attributed to upgraded rural power grids and to poverty alleviation programs. Electricity consumption by the manufacturing sector grew by 3%, and the residential sector electricity consumption grew by 7% in 2020.109

Fossil fuels, primarily coal, accounted for 67% of power generation sources in 2020 (Figure 7).110 Coal will remain an important fuel in China’s electric power sector in the coming years; 46.1 GW of coal-fired projects were approved in 2020.111 Natural gas is replacing some of the coal-fired capacity in the eastern part of the country, where power demand is higher than in the rest of the country, and in the northeastern region, where stricter environmental regulations have reduced coal-fired power production.112Natural gas is gradually gaining share in electricity generation, but it still accounted for less than 3% of total generation in 2020.113 The government intends to replace older coal-fired units with ultra-low emission technology and allow cities to build clean-coal heating systems.114

Hydropower and other renewable projects generated more than 2,200 TWh of net electricity in 2020, an 11% increase from 2019 levels.115

In 2020, most of the world’s wind generation, at about 471 TWh, was in China, which was 16% higher than in 2019.116 The government has encouraged investment in grid development and measures to improve flexibility in the transmission system, especially during peak hours. Several ultrahigh voltage (UHV) transmission lines that carry electricity over long distances began operating in 2014, and in 2020, China had 14 UHV alternating-current lines and 16 UHV direct-current lines in operation.117

Solar power is the fastest-growing electric generation source in China. Net generation in 2020 was 270 TWh, 21% higher than in 2019.118 Most of the solar equipment used globally is produced in China.

Although nuclear generation is a small share of the total power generation portfolio, China is actively promoting nuclear power as a clean, efficient, and reliable source of electricity generation. China generated about 366 TWh of net nuclear power in 2020. Although nuclear generation only accounted for about 5% of total generation, it was an 11% increase from 2019.119

Capacity

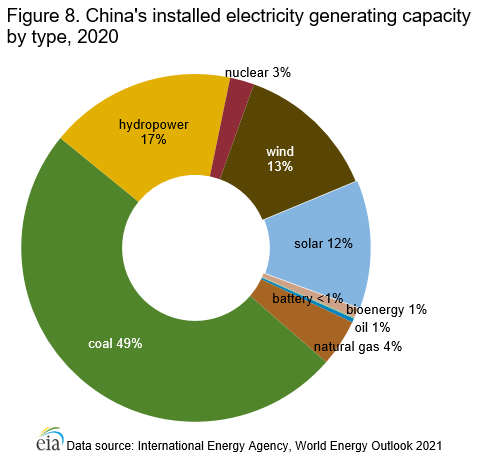

China’s installed electricity generating capacity increased 10% from 2019 to an estimated 2.2 terawatts (TW) at the end of 2020. According to China’s estimates, capacity grew almost 8% in 2021. China’s generating capacity became the highest in the world in 2013.121

Fossil fuel-fired power capacity has historically accounted for the bulk of installed capacity in China; however, its share dropped by almost 3 percentage points in 2020 to 56% of total capacity (Figure 8).

Of the 194 GW of installed capacity added in 2020, renewables, including hydroelectricity, accounted for 71% of the additions. China leads the world in renewable energy capacity, with 894 GW of installed capacity in 2020.122

China’s government’s goal in the 14th Five-Year Plan is to add at least 570 GW of solar and wind in the 2021–2025 period, along with over 1,200 GW of installed wind and solar capacity by 2030.123 The country’s solar manufacturing association expects China to add between 75 GW to 90 GW of solar capacity in 2022. China could average between 83 GW and 99 GW of new solar capacity per year through 2025, according to the China Photovoltaic Industry Association.124

China approved the construction of six nuclear reactors in 2022 as a step toward its goal to increase nuclear capacity to 70 GW by 2025 and to between 120 GW and 150 GW by 2030. At the end of 2021, China had 55 GW of installed capacity.125

Notes

Data presented in the text are the most recent available as of August 8, 2022.

Data are EIA estimates unless otherwise noted. Eurasia Press & News

Eurasia Press & News