Experts say the OPEC+ decision to cut oil production won’t hit Egypt as hard as some other countries.

The Organization of Oil Exporting Countries and associates, known as OPEC+, decided to cut oil production Oct. 5. The Egyptian cabinet’s associated think tank the Information and Decision Support Center posted a video on Facebook Oct. 11 explaining the move and its repercussions.

It called the move a “new blow” that could send global energy markets into a tailspin in light of the sanctions imposed on Russian and Iranian oil exports and the unwillingness of US producers to raise their production levels, and that the decision will have an impact on oil-importing and developing countries that are in economic crisis.

On Oct. 5, OPEC + decided to reduce oil production by 2 million barrels per day starting in November, news that immediately raised oil prices.

Former Egyptian Petroleum Minister Osama Kamal told Al-Kahera Wal Nas TV by phone Oct. 7 that the OPEC decision will negatively impact the world, including Egypt, but the effects for Egypt will not be “painful.”

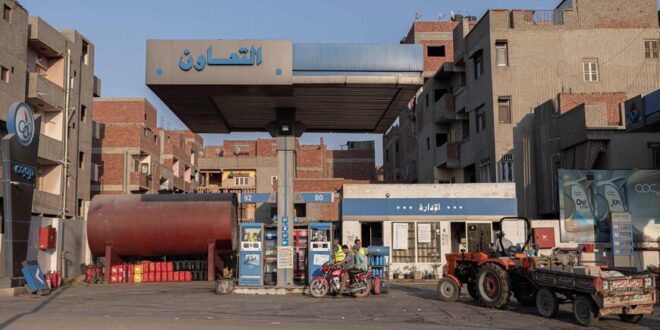

He stated that the fair price of a barrel of oil is $60 and the Egyptian budget was prepared based on an $80-per-barrel price. Egypt consumes 38 to 40 million tons of liquid petroleum products per year, of which nearly 8 million tons are imported.

He continued that Egypt had set a target of achieving self-sufficiency in oil products by 2023, but current events may affect achievement of that goal.

Medhat Youssef, a former vice president of the Egyptian General Petroleum Corporation, told Al-Monitor he expects the barrel price after the OPEC decision to range from $95 to $100. Youssef added that while the extent of the price increase’s impacts will depend on the prices of oil derivatives, such as gasoline and diesel, the hikes will be felt by Egyptian citizens.

World Energy Council member Maher Aziz told Al-Monitor that the rise in international oil prices will have only mild effects for Egypt. He explained to Al-Monitor that as both an importer of derivatives and an exporter of crude, Egypt will benefit somewhat.

Egypt imports 100 million barrels of oil annually. An Aug. 18 report by the Central Agency for Public Mobilization and Statistics indicated that Egypt’s crude oil exports during the first five months of this year increased to about $1.628 billion from $1.062 billion in the same period in 2021.

Aziz pointed out that Egypt is working to reduce its oil derivatives imports by expanding the use of natural gas vehicles and reducing dependence on gasoline in the local market.

Ramadan Abulula, a professor of petroleum engineering at Ain Shams University in Cairo, told Al-Monitor that Egypt could increase its natural gas exports, the revenues from which could compensate for the increase in oil prices.

Eurasia Press & News

Eurasia Press & News