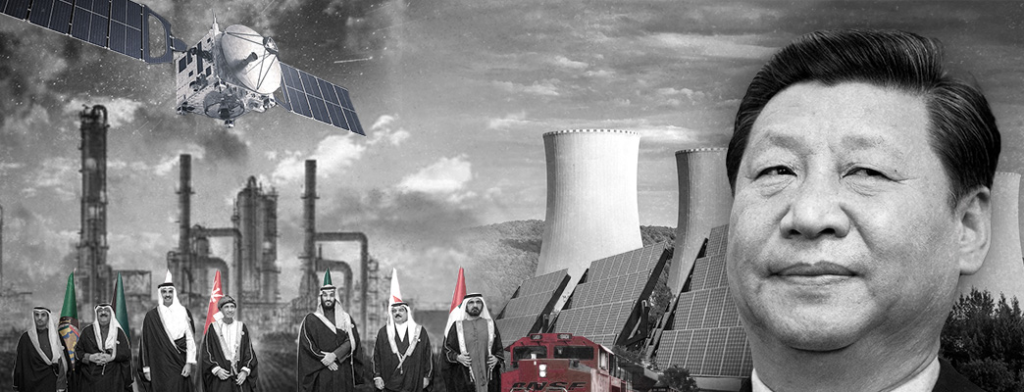

Xi Jinping has made an offer difficult for the Arabian Peninsula to ignore: China will be guaranteed buyers of your oil and gas, but we will pay in yuan.

It would be so tempting to qualify Chinese President Xi Jinping landing in Riyadh a week ago, welcomed with royal pomp and circumstance, as Xi of Arabia proclaiming the dawn of the petroyuan era.

But it’s more complicated than that. As much as the seismic shift implied by the petroyuan move applies, Chinese diplomacy is way too sophisticated to engage in direct confrontation, especially with a wounded, ferocious Empire. So there’s way more going here than meets the (Eurasian) eye.

Xi of Arabia’s announcement was a prodigy of finesse: it was packaged as the internationalization of the yuan. From now on, Xi said, China will use the yuan for oil trade, through the Shanghai Petroleum and National Gas Exchange, and invited the Persian Gulf monarchies to get on board. Nearly 80 percent of trade in the global oil market continues to be priced in US dollars.

Ostensibly, Xi of Arabia, and his large Chinese delegation of officials and business leaders, met with the leaders of the Gulf Cooperation Council (GCC) to promote increased trade. Beijing promised to “import crude oil in a consistent manner and in large quantities from the GCC.” And the same goes for natural gas.

China has been the largest importer of crude on the planet for five years now – half of it from the Arabian peninsula, and more than a quarter from Saudi Arabia. So it’s no wonder that the prelude for Xi of Arabia’s lavish welcome in Riyadh was a special op-ed expanding the trading scope, and praising increased strategic/commercial partnerships across the GCC, complete with “5G communications, new energy, space and digital economy.”

Foreign Minister Wang Yi doubled down on the “strategic choice” of China and wider Arabia. Over $30 billion in trade deals were duly signed – quite a few significantly connected to China’s ambitious Belt and Road Initiative (BRI) projects.

And that brings us to the two key connections established by Xi of Arabia: the BRI and the Shanghai Cooperation Organization (SCO).

The Silk Roads of Arabia

BRI will get a serious boost by Beijing in 2023, with the return of the Belt and Road Forum. The first two bi-annual forums took place in 2017 and 2019. Nothing happened in 2021 because of China’s strict zero-Covid policy, now abandoned for all practical purposes.

The year 2023 is pregnant with meaning as BRI was first launched 10 years ago by Xi, first in Central Asia (Astana) and then Southeast Asia (Jakarta).

BRI not only embodies a complex, multi-track trans-Eurasian trade/connectivity drive but it is the overarching Chinese foreign policy concept at least until the mid-21st century. So the 2023 forum is expected to bring to the forefront a series of new and redesigned projects adapted to a post-Covid and debt-distressed world, and most of all to the loaded Atlanticism vs. Eurasianism geopolitical and geoeconomic sphere.

Also significantly, Xi of Arabia in December followed Xi of Samarkand in September – his first post-Covid overseas trip, for the SCO summit in which Iran officially joined as a full member. China and Iran in 2021 clinched a 25-year strategic partnership deal worth a potential $400 billion in investments. That’s the other node of China’s two-pronged West Asia strategy.

The nine permanent SCO members now represent 40 percent of the world’s population. One of their key decisions in Samarkand was to increase bilateral trade, and overall trade, in their own currencies.

And that further connects us to what has happening in Bishkek, Kyrgyzstan, in full synchronicity with Riyadh: the meeting of the Supreme Eurasia Economic Council, the policy implementation arm of the Eurasia Economic Union (EAEU).

Russian President Vladimir Putin, in Kyrgyzstan, could not have been more straightforward: “The work has accelerated in the transition to national currencies in mutual settlements… The process of creating a common payment infrastructure and integrating national systems for the transmission of financial information has begun.”

The next Supreme Eurasian Economic Council will take place in Russia in May 2023, ahead of the Belt and Road Forum. Take them together and we have the lineaments of the geoeconomic road map ahead: the drive towards the petroyuan proceeding in parallel to the drive towards a “common paying infrastructure” and most of all, a new alternative currency bypassing the US dollar.

That’s exactly what the head of the EAEU’s macroeconomic policy, Sergey Glazyev, has been designing, side by side with Chinese specialists.

Total Financial War

The move towards the petroyuan will be fraught with immense peril.

In every serious geoeconomic gaming scenario, it’s a given that an enfeebled petrodollar translates as the end of the imperial free lunch in effect for over five decades.

Concisely, in 1971, then-US President Richard “Tricky Dick” Nixon pulled the US from the gold standard; three years later, after the 1973 oil shock, Washington approached the Saudi oil minister, notorious Sheikh Yamani, with the proverbial offer-you-can’t-refuse: we buy your oil in US dollars and in return you buy our Treasury bonds, lots of weapons, and recycle whatever’s left in our banks.

Cue to Washington now suddenly able to dispense helicopter money – backed by nothing – ad infinitum, and the US dollar as the ultimate hegemonic weapon, complete with an array of sanctions over 30 nations who dare to disobey the unilaterally imposed “rules-based international order.”

Impulsively rocking this imperial boat is anathema. So Beijing and the GCC will adopt the petroyuan slowly but surely, and certainly with zero fanfare. The heart of the matter, once again, is their mutual exposure to the Western financial casino.

In the Chinese case, what to do, for instance, with those whopping $1 trillion in US Treasury bonds. In the Saudi case, it’s hard to think about “strategic autonomy” – such as what’s enjoyed by Iran – when the petrodollar is a staple of the Western financial system. The menu of possible imperial reactions includes everything from a soft coup/ regime change to Shock and Awe over Riyadh – followed by regime change.

Yet what the Chinese – and the Russians – are aiming at goes way beyond a Saudi (and Emirati) predicament. Beijing and Moscow have clearly identified how everything – the oil market, global commodities markets – is tied to the role of the US dollar as reserve currency.

And that’s exactly what the EAEU discussions; the SCO discussions; from now on the BRICS+ discussions; and Beijing’s two-pronged strategy across West Asia are focused to undermine.

Beijing and Moscow, within the BRICS framework, and further on within the SCO and the EAEU, have been closely coordinating their strategy since the first sanctions on Russia post-Maidan 2014, and the de facto trade war against China unleashed in 2018.

Now, after the February 2022 Special Military Operation launched by Moscow in Ukraine and NATO has devolved into, for all practical purposes, war against Russia, we have stepped beyond Hybrid War territory and are deep into Total Financial War.

SWIFTly drifting away

The whole Global South absorbed the “lesson” of the collective (institutional) west freezing, as in stealing, the foreign reserves of a G20 member, on top of it a nuclear superpower. If that happened to Russia, it could happen to anyone. There are no “rules” anymore.

Russia since 2014 has been improving its SPFS payment system, in parallel with China’s CIPS, both bypassing the western-led SWIFT banking messaging system, and increasingly used by Central Banks across Central Asia, Iran and India. All across Eurasia, more people are ditching Visa and Mastercard and using UnionPay and/or Mir cards, not to mention Alipay and WeChat Pay, both extremely popular across Southeast Asia.

Of course the petrodollar – and the US dollar, still representing under 60 percent of global foreign exchange reserves – will not ride into oblivion overnight. Xi of Arabia is just the latest chapter in a seismic shift now driven by a select group in the Global South, and not by the former “hyperpower.”

Trading in their own currencies and a new, global alternative currency is right at the top of the priorities of that long list of nations – from South America to Northern Africa and West Asia – eager to join BRICS+ or the SCO, and in quite a few cases, both.

The stakes could not be higher. And it’s all about subjugation or exercising full sovereignty. So let’s leave the last essential words to the foremost diplomat of our troubled times, Russia’s Sergey Lavrov, at the international interparty conference Eurasian Choice as a Basis for Strengthening Sovereignty:

“The main reason for today’s growing tensions is the stubborn striving of the collective West to maintain a historically diminishing domination in the international arena by any means it can… It is impossible to impede the strengthening of the independent centers of economic growth, financial might and political influence. They are emerging on our common continent of Eurasia, in Latin America, the Middle East and Africa.”

All aboard…the Sovereign Train.

Eurasia Press & News

Eurasia Press & News