“Maritime transport is the backbone of international trade and the global economy. Over 80 percent of the volume of international trade in goods is carried by sea,” according to the United Nations Conference on Trade and Development (UNCTAD).

Coastal nations have varying degrees of economic importance based on their geographic location. The region of West Asia – from the Mediterranean Sea to the Persian Gulf – holds key strategic significance as the gateway between Asia and Europe’s economies. Its unique geographic position drives investment in infrastructure – to attract major economies into relying on its passageways, and to solidify the region’s role in transportation of goods between the two continents.

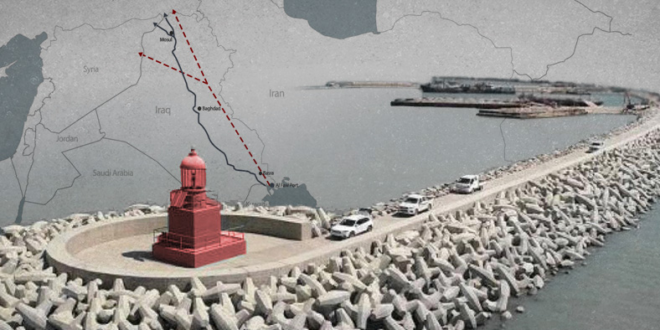

The Grand Faw Port

In this context, Iraq has launched two major projects aimed at becoming a vital link between Asia and Europe and enhancing its geopolitical significance. The Grand Faw Port project, initiated in 2010, is one such effort.

Located on the coast of Al-Faw in Iraq’s southern province of Basra which lies in the northern Persian Gulf, the port seeks to offer an alternative to traditional transit routes, including the Suez Canal. After Iraqi newspapers began promoting the Grand Faw Port as a substitute passage, it caused alarm in countries like Egypt, which derives significant financial benefits from the transit of goods through the Suez.

The project has faced long delays due to financial difficulties and other issues. However, in 2020, Baghdad signed a $2.625 billion contract with South Korea’s Daewoo Engineering & Construction to build the first phase of the port within four years.

Since then, the Iraqi Ministry of Transport has been working in cooperation with the private sector to accelerate the completion of the project, recognizing its strategic and economic importance to Iraq. The port is expected to begin operations in 2024 and to be fully completed by 2025, according to the ministry.

The Grand Faw Port is reportedly designed to include 50 berths (17 km long, 25 million containers/yr), 20 non-containerized berths (5 km, 50 million tons/yr) 20 berths for general goods (5 km), a car berth (400,000 cars/yr), 6 oil export berths (230,000 bpd), and tanks for oil product imports (300,000 cubic meters).

With 99 berths, Grand Faw will be West Asia’s largest port, surpassing Jebel Ali Port in the UAE, which has only 67 container berths.

The Dry Canal Project

In parallel, Iraq is working on the Dry Canal project, which will consist of railways, highways, and oil and gas pipelines to link Iraq’s Grand Faw port to Europe, either directly through Turkiye or via Syria. This will potentially transform Iraq into a major hub for transporting massive quantities of goods between Asia and Europe, and between east and west.

In December 2022, the conference “Grand Faw Port and Dry Canal: Future Visions and Investment Opportunities” was held in Basra. Farhan al-Fartousi, director general of the Iraqi Ports Company, referred to the port and canal as Iraq’s “Silk Road,” calling them the most important economic and strategic projects in the region.

Fartousi emphasized that the two projects will change the map of the global economy, reducing transit time for ships traveling from West Asia’s waterways and the Red Sea, via the Suez Canal, to Europe by 20 to 25 days, and reducing shipping costs by tens of millions of dollars.

Capturing China’s interest

According to calculations by the Washington-based Center for Strategic and International Studies (CSIS), about 20 percent of global maritime trade and 60 percent of China’s trade flows are moved through the Strait of Malacca and the South China Sea, making it the most important sea route for the Chinese economy.

Because of its geographical location connecting the major Asian economies of India, China, Taiwan, and the Philippines to the global economy, the Strait of Malacca has become an arena for political conflicts and piracy operations. These ongoing snags have prompted Beijing to seek alternative routes to the Indian Ocean, in order to avoid the “Malacca dilemma” or harassment of ships on the strait.

In 2013, China announced the China-Pakistan Economic Corridor (CPEC). It is part of Beijing’s ambitious, multi-trillion dollar Belt and Road Initiative (BRI), linking the northwest Chinese province of Xinjiang with the Pakistani port of Gwadar on the Indian Ocean – only 400 km from the Strait of Hormuz – through a network of roads, railways and pipelines to transport goods, oil and gas.

The corridor, which is slated for completion in 2030, provides China with a shorter and less expensive way to trade with most countries in Asia and Africa. It also connects China directly with the Indian Ocean and West Asia, and significantly, reduces Beijing’s dependence on the South China Sea, which has turned into a zone of conflict between China and a number of regional and international powers, such as Japan, the Philippines, and chiefly, the United States.

How Iraq ties in with the BRI

With the arrival of goods at the port of Gwadar overlooking the Arabian Sea, Iraq becomes of great importance to China, which is seeking out fast and inexpensive routes to deliver product to Europe.

The Grand Faw Port and Dry Canal provide Beijing with an essential passageway for transporting its goods to the Old Continent. Iraq therefore aspires for the Grand Faw Port to be part of the BRI, especially since the Dry Canal will reduce the arrival time of goods to Europe by 25 days and cut shipping costs by half.

Between 2005 and mid-2022, Chinese investments in West Asia and Arab African countries amounted to $2.25 trillion, accounting for 12.6 percent of China’s total investments abroad. During this period, Iraq ranked third among the countries that attracted Chinese investments in the region.

Since ports are an essential Chinese route to world markets, Beijing expressed interest in constructing the Grand Faw Port in Basra. In September 2019, Iraq struck a deal with China to help secure the necessary funds, known as Oil for Reconstruction.

The agreement established a fund into which Iraq would deposit revenues from 100,000 barrels of oil sold daily to two Chinese companies, while the rest would come from loans from Chinese banks with a limit of $10 billion.

But the deal, which was supposed to run for 20 years, was shelved due to sweeping Iraqi protests that erupted a month later, the global pandemic, a drop in oil prices, and Baghdad’s delay in approving the 2020 budget.

Some Iraqi political factions have accused former Prime Minister Mustafa Al Kadhimi of leaning too far toward the US and its allies – at China’s expense – and bowing to Washington’s demands to nix the China deal. Their campaign intensified after Kadhimi’s government in December 2020 selected South Korea’s Daewoo Engineering and Construction Company to build the Grand Faw Port.

A corridor for energy transit

After the outbreak of the NATO-Russia war in Ukraine, Europe decided to reduce its reliance on Russian energy sources, especially liquefied natural gas (LNG). Qatar, which boasts the world’s third largest gas reserves, became the most prominent option to replace Russian gas, but its high cost due to shipping expenses remained a challenge.

In the long term, with the completion of the construction of the Grand Faw Port and the Dry Canal, Iraq can become an essential transit route for Qatari gas to Europe via Turkiye. The shipping distance from Qatar to Europe will be greatly reduced if the Iraqi transit corridor is adopted, and will lower costs significantly. However, this requires an agreement between the two countries to link Qatari gas to Iraqi pipelines and to establish receiving stations for Qatari gas inside Iraq.

Relations with the Kurds

Likewise, the Dry Canal is an important passage for transporting Iraqi oil and gas to Europe. It includes pipelines from Al-Faw in southern Iraq to the Turkish border in the north, through the Kurdistan region, and then to the Syrian border. Thus, the Canal allows Iraq to deliver its oil and gas to Europe, either directly through Turkiye or Syria.

According to the proceedings of the aforementioned Grand Faw Port conference held in Basra late last year, “the opportunity to connect through the Kurdistan region seems more realistic than through Syria.” Yet in order for Europe to benefit from Iraqi energy resources, myriad problems between the central government in Baghdad and the Kurdistan Regional Government (KRG) must first be resolved.

Rapprochement between Erbil and Baghdad will enable Iraq to increase its energy production through investments in Iraqi Kurdistan, and will be reflected in a decrease in oil prices. The Kurdistan region also has proven gas reserves of more than 25 trillion cubic feet, equivalent to 20 percent of the total proven gas reserves in Iraq.

In this case, Iraq, which currently imports between 30 and 40 percent of its gas needs from Iran can reduce dependence by investing in Kurdistan gas fields and exporting gas to Europe via the Dry Canal in Turkiye.

Baghdad’s geopolitical standing

Perhaps this explains the recent activity of Amos Hochstein, the US Special Coordinator for Global Infrastructure and Energy Security, who visited Baghdad in mid-January to meet with Iraqi Prime Minister Mohammed Al Sudani. Hochstein also spoke by phone with the Prime Minister of the Kurdistan Region, Masrour Barzani, during which they reportedly agreed on the need to remove all obstacles to the development of Iraq’s energy sector.

While the Dry Canal and Grand Faw Port offer opportunities for Iraq to boost its geopolitical position, internal challenges such as mismanagement and political division, and external challenges such as investment competition between China and the US, present obstacles to success.

While the projects pose a threat to some regional countries, they offer benefits for others like Iran, Turkiye, Qatar, and Syria. Iran, for example, has expressed interest in linking its railways to the canal for trade opportunities. Despite the potential impact on Iraq’s economy and relationships with other countries, the challenges will not be easy to overcome.

Eurasia Press & News

Eurasia Press & News