As Russian officials play down the economic impact of President Vladimir Putin’s order to invade Ukraine, the emergence of end-of-year data from 2022 in recent weeks has painted a mixed picture of the economy’s performance.

There were some positive signs: inflation receded after hitting a peak in April, while oil and gas revenues reached record levels.

The International Monetary Fund last week even revised upward its forecast for the Russian economy, predicting 0.3% growth in 2023.

However, at the same time, remittances skyrocketed last year as a flood of people left the country, banking profits fell and the country’s budget deficit reached record levels.

“The main takeaway of the year: having somehow coped with the first blow, the Russian economy looked around and realized there are no good prospects,” Vladimir Milov, a former deputy energy minister and an ally of jailed opposition figure Alexei Navalny, wrote in a recent article.

The Moscow Times has compiled some of the most interesting data from 2022 to create five graphs that shed light on the state of the Russian economy.

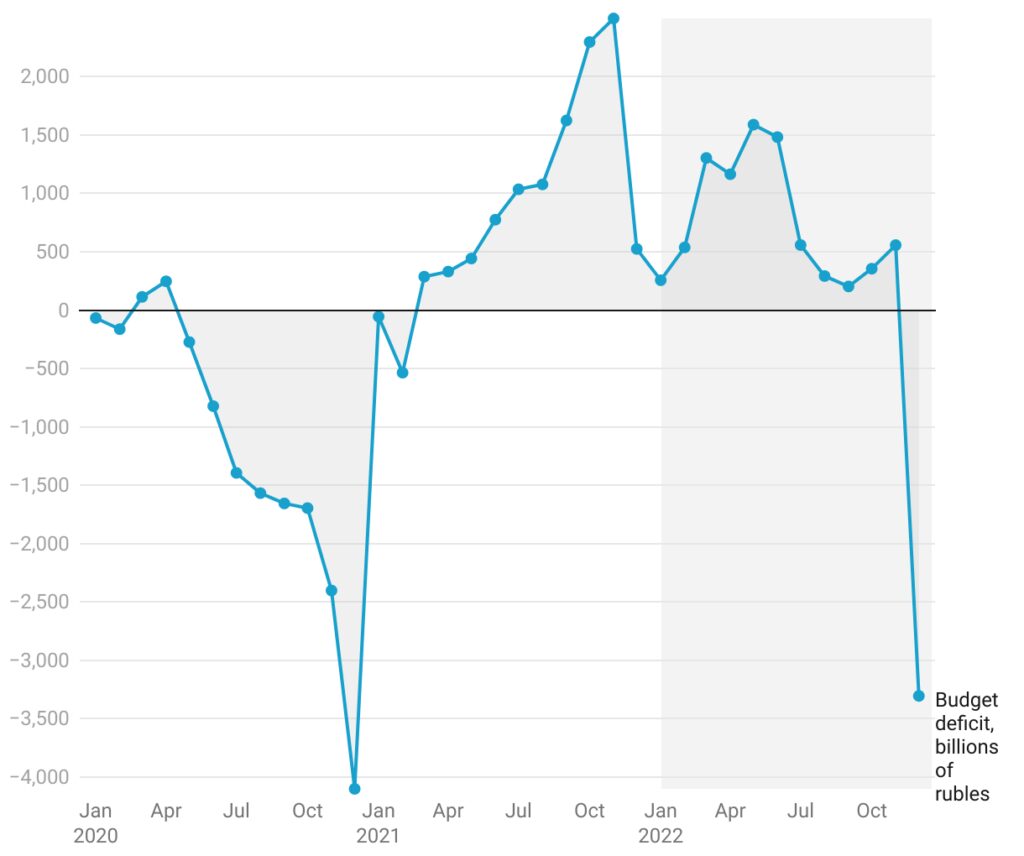

Budget Deficit and Surplus

Russia saw a budget deficit of 3.3 trillion rubles ($47 billion) last year, the second highest in the country’s recent history.

The 2.3% budget gap was exceeded only in 2020, when it hit 4.1 trillion rubles ($58 billion), or 3.8% of GDP, during the coronavirus pandemic.

Russia forecasts that its budget deficit could reach 3 trillion rubles ($43 billion) this year, while analysts say it could go as high as 4.5 trillion rubles ($64 billion). Amid the Ukraine war, at least one-third of the country’s expenditures are expected to go toward defense and security.

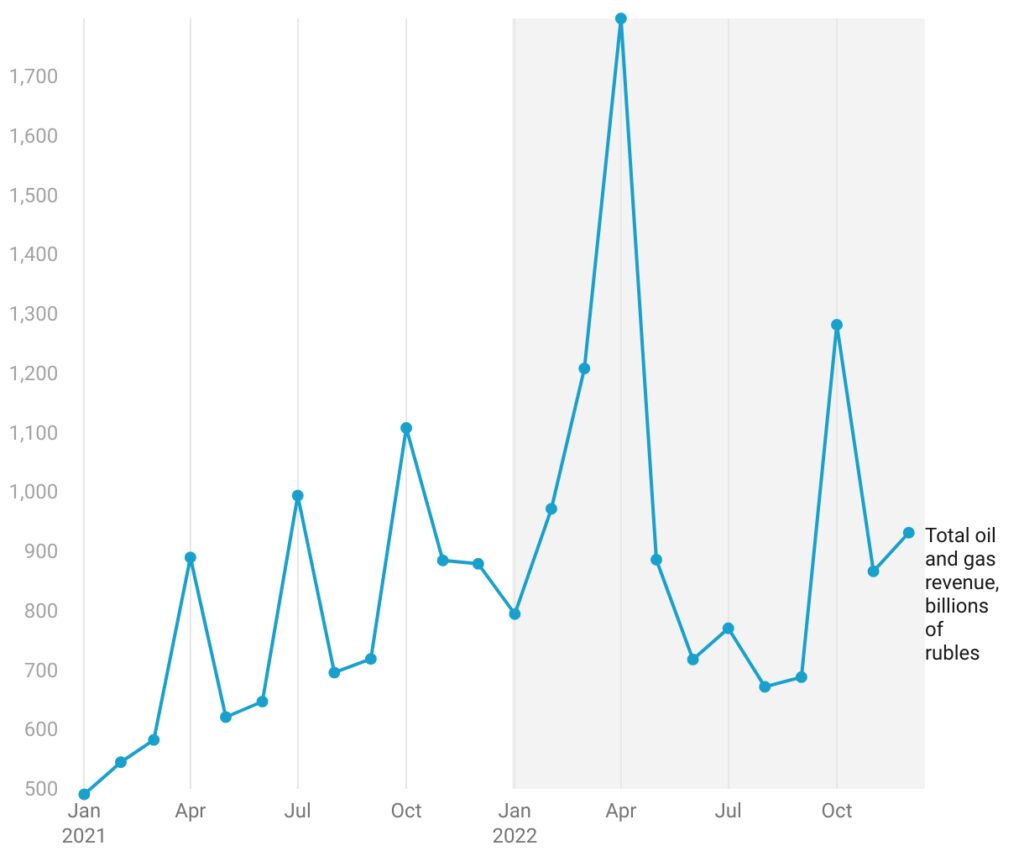

Oil and Gas Revenues

Revenues from the sale of oil and gas grew 28% last year to reach a total of 2.5 trillion rubles ($36.5 billion).

But, as the price for Russian oil appears to fall amid a Western price cap on Russian crude, these profits look set to shrink. Analysts also warn that a strengthening ruble could dent oil and gas revenues.

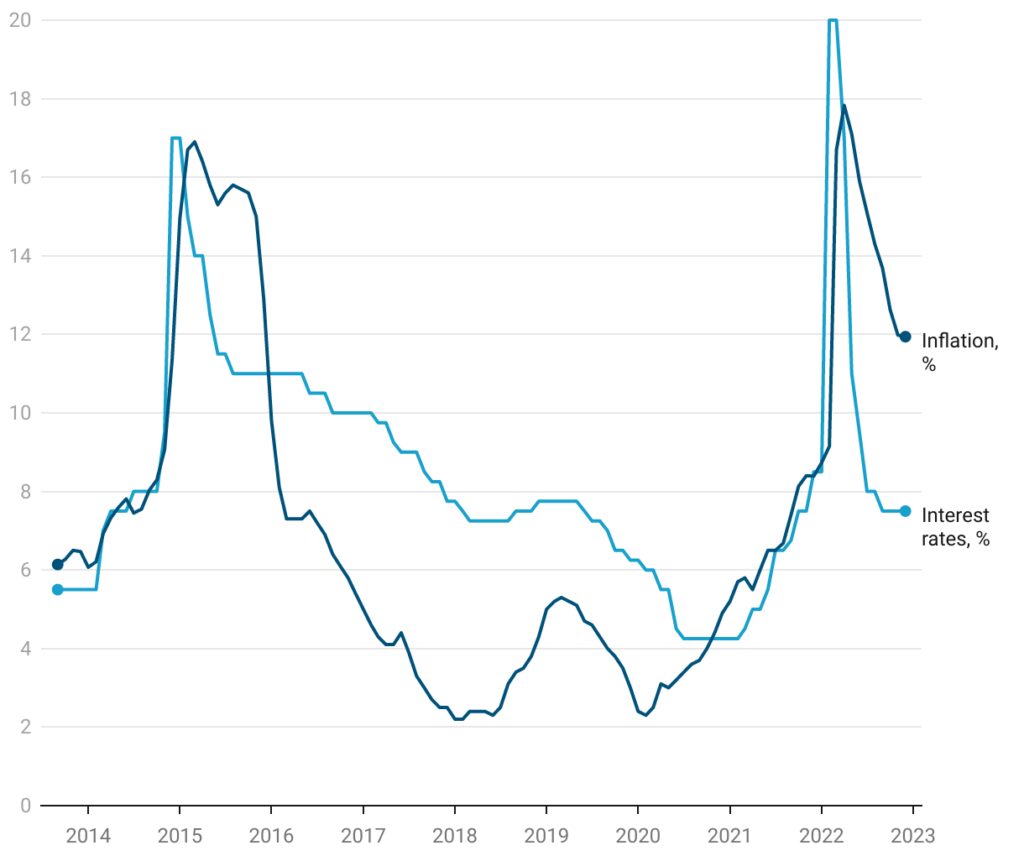

Inflation and Interest Rates

The war has helped to drive consumer prices upward, particularly after the first wave of Western sanctions in early 2022.

However, inflation declined in subsequent months, recording a year-end total of 11.9%. Economists like Milov have noted growth in the prices of some consumer goods in recent months.

The Central Bank drastically hiked interest rates at the start of the war, but rates have since been gradually lowered, ending the year at 7.5%.

The spending of Russia’s oil windfall money, the country’s “partial” mobilization weakening consumer demand and a supply chain reorientation toward Asia have all fueled price increases, Central Bank head Elvira Nabiullina said in December.

The Central Bank predicts consumer prices will grow 7% in 2023.

Remittances to Post-Soviet Countries

Money transfers from Russia have skyrocketed as a result of hundreds of thousands of Russians leaving the country in protest against the war and seeking to evade conscription.

Former Soviet republics — some of the most popular destinations for emigrating Russians — saw remittances increase up to 600% in 2022.

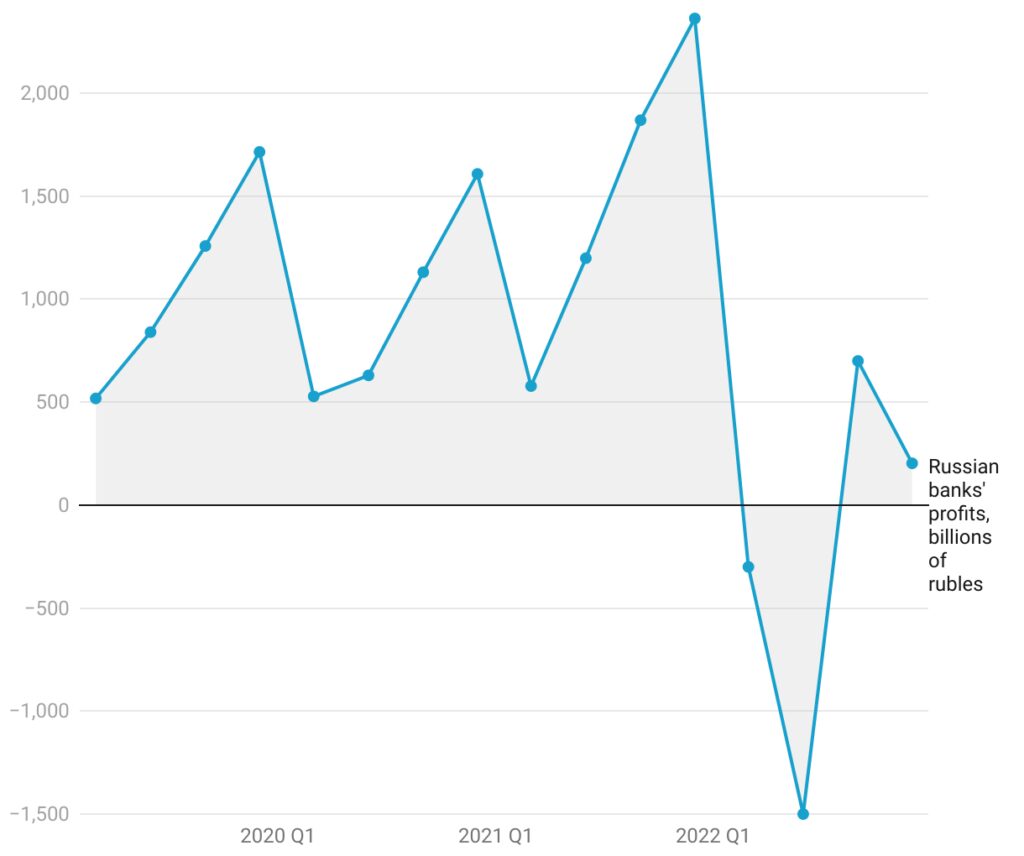

Banking Sector Profits

After posting record profits of 2.4 trillion rubles ($34 billion) in 2021, Russia’s banks had a much less lucrative year in 2022.

They ended the year with profits of just 203 billion rubles ($2.9 billion) in the face of an outflow of depositors and Western sanctions hitting bottom lines.

The Central Bank said last month that banking sector profits could exceed 1 trillion rubles in 2023.

Eurasia Press & News

Eurasia Press & News