Chinese President Xi Jinping this week traveled to Moscow to meet with his friend and ally, Vladimir Putin. It was the 40th time that the two have met since Xi took office more than a decade ago. The visit not only solidified China’s strategic partnership with Russia, but Xi also hopes it will help deliver a potential ceasefire in Ukraine. A call with Ukrainian President Volodymyr Zelensky will reportedly occur next.

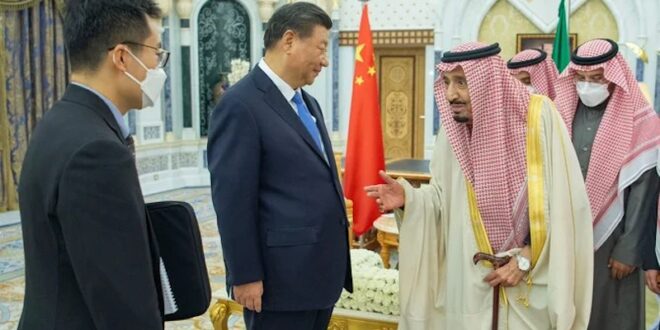

The reports of an attempted negotiated ceasefire by President Xi came on top of the recent news that China had brokered a major diplomatic deal between Saudi Arabia and Iran. For more than a decade, China has steadily expanded its influence across the Middle East. It has peppered the region with investments through its Belt and Road Initiative and grown to be the region’s largest trading partner. All the while, it has mostly avoided entangling itself in the messy politics and sectarian rivalries of the region.

These actions appear to reflect a new Chinese strategy characterized by a more aggressive foreign policy that suits its own interests — but also provides China with a larger role on the global stage. In the Middle East, this raises two questions: Does President Xi hope to supplant America’s role as the diplomatic heavyweight in the region? And what is driving China’s evolving interests?

The short answer to the first question is no. China plays — and will continue to play — a fundamentally different role in the Middle East than the US. It has no will to be the primary security guarantor in the region, nor can it offer the military resources provided by the US government. The arms trade between China and the Arab region, for example, is a small fraction of what is traded with the US.

But China’s interests in the region are indeed shifting. The country’s relationship with the Arab world has long been based on trade and economics. Increasingly, however, it will be animated by geopolitical and strategic concerns. And while it may not seek to supplant or replicate the US role in the region, it will undoubtedly wield its growing political and strategic clout in ways that are likely to aggravate tensions with Washington.

To understand what is driving this change, some history is instructional. During much of the Cold War, China’s relations with much of the Arab world were characterized by mutual hostility. China associated Gulf monarchies with Western imperialism and anti-communism. It supported an uprising in Oman in the 1960s. For its part, Saudi Arabia supported the nationalist government in Taiwan, voted against China’s admission to the UN in 1971 and initiated a trade ban against China in 1972.

This changed in the 1980s, as the Arab order was challenged by the Iran-Iraq War and the geopolitical order was overturned by the end of the Cold War. Between 1984 and 1990, China established diplomatic relations with the UAE, Qatar, Bahrain and Saudi Arabia.

Now, the global order is shifting again, creating new dynamics between the Arab world and the two global superpowers. While the US is widely perceived to be retreating from the region with its new focus on the Indo-Pacific, China is rapidly increasing its ties with Arab nations. In 1990, China’s bilateral trade with Saudi Arabia amounted to only $417 million. By 2020, it had grown to $65.2 billion. China’s trade with Saudi Arabia in 2020 was more than three times the amount it traded with the US that same year.

These growing economic ties are underpinned by strategic imperatives. China’s economy relies heavily on imported oil. And Beijing sees the energy-rich Arab region as a crucial supplier at a time when oil demand is expected to bounce back after nearly three years of COVID-19-related restrictions. China also sees significant potential to export more of its technologies and invest in critical infrastructure. It sees the Middle East as an attractive market, one without the regulatory and political restrictions that Chinese technology firms face in Europe and the US.

At the same time, China has been expanding its political relations with the region. A 2019 report by the Atlantic Council documents that China has signed comprehensive strategic partnerships with Saudi Arabia, the UAE, Iran, Egypt and Algeria. This level of partnership maintains “full pursuit of cooperation and development on regional and international affairs.” China also maintains lower-level partnerships with eight other regional states.

China’s expansive foreign policy goes well beyond the Middle East. In addition to its recent efforts to play a significant diplomatic role in the Russia-Ukraine war, China has engaged in a more activist foreign policy under Xi, concluding security and defense agreements with Djibouti and pledging $100 million in military aid to the African Union.

Meanwhile, the Biden administration’s ties with traditional allies and partners — Egypt, the UAE and Saudi Arabia — are all strained. When the US pushed for sanctions to punish Russia for invading Ukraine, not one of these three countries agreed to support it.

China’s transition from foreign policy observer to activist should not come as a surprise. As China’s economic interests have grown significantly overseas, it has used this economic might to promote its own diplomatic agenda. This new strategy by President Xi is less about a seismic shift in the global order than a shift in China’s own vision of its role internationally.

What does this mean for China’s future in the Middle East? Beijing has much to gain economically and geopolitically, especially if the US continues to deprioritize the region. For the Middle Eastern nations, they have gained an important economic ally, but increasingly they are becoming the competitive playing field for growing US-China bilateral tensions. How the region balances its economic interests with its foreign policy and national security priorities will remain a challenge for the foreseeable future.

Eurasia Press & News

Eurasia Press & News