Diversification and Less Confrontation After a Decade of an Activist Foreign Policy

(FPRI) — The United Arab Emirates (UAE) is in the last two years intensively pursuing a diversified foreign policy. This stems in part from disappointment with American reactions to the Houthi drone attacks on Abu Dhabi in February 2022, and to what they see as the debacle of the US retreat from Afghanistan.

However, on a broader level, de-escalation has developed into a foreign policy priority for Abu Dhabi, after a decade of activist, interventionist policy in Yemen, Libya, and Syria. The Emirati leadership wishes to carve out a non-aligned position, based predominantly on trade, energy, and technology. They also see themselves as well positioned to serve as international mediators, with contacts to everyone and shunning no one, and now afford diplomacy, engagement, and deconfliction a much more important role in government policy. In a recent exchange, one Abu-Dhabi-based expert noted to me that their eighteen-month stint in the UN Security Council also “taught them how global powers behave.” Their policy, as Narayanappa Janardhan of the Anwar Gargash Diplomatic Academy in Abu Dhabi told me, revolves around the “five C’s: capital, commerce, collaboration, connectivity, and climate.” The Emirates, similar to their doppelganger and arch-rival Qatar and ahead of Saudi Arabia, is engrossed in efforts to retain a leading position in the world economy in the post-fossil fuels era, including through significant policy initiatives, investment in environment and sustainability issues, and strategic use of their sovereign wealth funds to invest worldwide in banks and key industries.

An important aspect enabling nuance and nimbleness in policy is the compact and unitary structure of foreign policy-making, decided and implemented by Sheikh Mohamed bin Zayed al-Nahyan. Since May 2022, he has officially served as ruler of Abu Dhabi and as the UAE president (roles he filled de facto for eight years previously). Additionally, his brothers serve in key ministries: Abdullah, as foreign minister, and Tahnoon, as national security advisor. The latter was recently appointed deputy ruler of Abu Dhabi, as well as chair of Abu Dhabi’s main sovereign wealth fund, and has long been in control of other sovereign and private investment institutions. Abu Dhabi is dominant in the foreign policy and national security decision-making of the UAE, though there is reportedly dialogue with the leadership of the other Emirates.

On the global level, the UAE, like Saudi Arabia, has been irritated, but unmoved, by US attempts to enlist or coerce them into supporting the nation’s policies on Russia and China. They reject Western narratives regarding these powers and are simultaneously making efforts to insulate these relationships with them from that with the Americans. As a foreign diplomat in Abu Dhabi told me, the Emirati government is signaling at all levels that relations with Russia “are going to be kept normal.”

The UAE, and Dubai in particular, has gained enormously from the crisis between Russia and the West. Russian nationals (who do not need a visa) and Russian money have poured into the country, especially in Dubai. There, hundreds of thousands of Russians are estimated to have arrived in the past year, especially after the imposition of conscription in Russia, with over 50,000 since the beginning of 2023, according to a well-informed source in Dubai. Russians fill the shops, hotels, and restaurants, and have become the main foreign buyers of real estate in Dubai, where 10 percent of the GDP is now from the real estate sector. Prices and rents have hit historic highs.

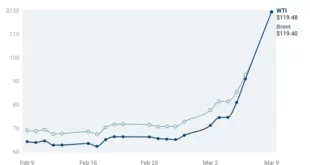

Non-oil trade between the the UAE and Russia increased 95 percent in 2022. The UAE is also reported to have become a key storage and re-export hub for Russian oil, as well as a logistical center for the Russian energy industry, taking advantage of deeply discounted prices for Russian oil to more than triple its oil imports from Russia to a record 60 million barrels in 2022. Senior US delegations have reportedly visited the UAE to discuss the nation’s use in circumventing Western oil sanctions on Russia, financial and corporate structures, as well as trade in sanctioned and dual-use—including US-origin—goods. The US Treasury Department on April 12 announced sanctions against two UAE-based firms for allegedly assisting the Russian invasion of Ukraine.

The UAE is also continually improving ties with India, which holds largely the same position regarding Russia. Another driver is the Emirati belief, similar to that of India, in an increasingly economic-centric rather than a security-centric world. The Gulf states’ security interests are centered in the West—China and India are not yet in the business of providing security backing and guarantees—and their economic ones in the East. World trade, as well the natural markets for Gulf energy, are increasingly concentrated in the Indo-Pacific realm, and the Gulf states are a natural link between Asia, especially the subcontinent—with which it has substantial historical and human ties—and the European and Mediterranean markets.

Reorienting in the Region: Neutralizing Toxic Relationships

On the regional level, Emirati foreign policy shifts in the past two years have been massive: it normalized relations with four major competing states in the region—Iran, Turkey, Israel, and Qatar. As Moran Zaga of the University of Haifa and Mitvim, the Israeli Institute for Regional Foreign Policies, told me, “the intensity and scope of the process, in such a short time, indicates a far-reaching strategic attempt to blur traditional fault lines and reshape the ‘axes’ in the region.”

The new emphases in foreign policy led the UAE to accelerate its re-engagement with Iran, which had already begun after disappointment with the American reaction to Iranian-linked attacks on Gulf shipping and Aramco facilities in September 2019. The Emirati ambassador, recalled in 2016, returned to Tehran in August 2022 (Saudi Arabia agreed to return their ambassador this month). The two countries are significant trading partners: the UAE was Iran’s primary link to the global economy under sanctions, and in 2020 was the largest exporter to Iran after China (much of it apparently re-sold Western goods). The two countries plan to increase bilateral trade from $15 billion in 2022 to $30 billion in 2025. Moreover, there are more than 400,000 Iranian expatriates living in the UAE (apart from the many Emiratis, especially in Dubai, of Iranian origin). Dubai has always been more oriented towards engagement with Iran and towards a soft power approach in general, since its heavily globalized service economy is much more exposed to negative externalities stemming from sanctions on Iran, Russia and Qatar. The Emiratis reportedly do not see any contradiction between their improved relations with Israel and with Iran, which are largely driven by a similar logic: reducing tension while opening economic possibilities. Western diplomats I met in the UAE estimate that Abu Dhabi is not interested in instability in Iran, which could adversely affect the Gulf.

Relations between Turkey and the UAE are also progressing rapidly: Many of my interlocutors were amazed at how quickly the relationship has changed. Abu Dhabi leader and the UAE President Sheikh Mohamed bin Zayed al-Nahyan (MBZ) visited Ankara in November 2021, with Erdogan paying a return visit in February 2022. During MBZ’s visit, he announced a $10 billion investment fund in multiple sectors of the Turkish economy, including energy, climate change, and trade. This should help the Turkish economy, but the fact that the money will be for investments and not aid, should also provide UAE with significant influence in the Turkish economy, leading to political sway as well. In January 2022, the two countries announced a $4.7 billion currency swap, boosting Turkey’s foreign exchange holdings and propping up the lira. They signed a free trade agreement on March 3, 2023, hoping to expand bilateral trade from $8 to $25 billion in five years. Some aspects of defense cooperation reportedly never stopped, even during the period of tension between the two countries. Today, this cooperation appears to be burgeoning. Turkey is able to provide weapons without US. restrictions, an important lesson Abu Dhabi learned from the Yemen conflict; there is reportedly talk of the co-production of Turkish weapons in the UAE. In addition, the two countries see eye to eye on the Russian-Ukrainian conflict and on American pressure to choose a side. However, this has not led the UAE to weaken its close ties with Greece and Cyprus, forged during the previous decade of trying to contain Turkish influence.

The UAE’s relations with Qatar seem to be rapidly developing. This is despite a slow start following the Saudi-led rapprochement at the al-Ula Summit in January 2021, and despite vestigial public hostility after six years of ceaseless negative messaging. This can be seen in the media prominence given to MBZ’s visit to Doha for the World Cup in December 2022, and Qatari Sheikh Tamim al-Thani’s participation in the Arab “mini-summit” in Abu Dhabi in January 2023. This meeting, convened at short notice by MBZ, included the heads of state of the UAE, Qatar, Oman, Bahrain, Jordan, and Egypt. Saudi Arabia and Kuwait did not participate, the Saudis reportedly due to Saudi Crown Prince and Prime Minister Mohammed bin Salman’s displeasure with the Emirati initiative. The UAE recently unblocked Qatari news sites. The UAE in March withdrew its bid to host the 2026 World Bank and International Monetary Fund meeting, instead supporting Qatar as a potential host.

The relatively new formal relationship with Israel is engaging the Emirati leadership vigorously in recent months. The rhetoric and proposed policies of Israel’s new right-wing government, led by Benjamin Netanyahu, has created challenges to all the conservative Arab states whose relations with Israel had improved in recent years. Symbolic steps are delayed indefinitely: no date has been set for Netanyahu’s much-desired state visit to the Emirates; the date for the next summit of the “Negev Forum,” planned for March in Morocco, has not been set. The UAE (and Bahrain) has condemned Israeli behavior in the West Bank and Jerusalem numerous times in recent weeks.

However, the compelling strategic, economic, and geopolitical logic which caused the UAE and the other Abraham Accords states to formalize relations with Israel have not changed. The Emirati government wants to preserve the long-term relationship but also avoid being perceived as an enabler of the current government. Informed Gulf sources note that the Emirati government sees the Abraham Accords as “a strategic direction” and the current Israeli government as a “road bump.” A signal in this vein seems to have been given when MBZ, who as noted has not yet set a date for Netanyahu to visit the UAE (though the pair spoke by phone on April 4), met on March 27 with former prime minister Naftali Bennet.

Deals with Israel which are seen as serving Abu Dhabi’s strategic geoeconomic goal of linking to the Eastern Mediterranean subregion continue. This is especially true of those related to gas exploration and exploitation in Egypt and Israel, and to renewable energy projects throughout the region. On March 26, the two countries signed into effect their free trade agreement, reached last May; the profile given the signing was low in UAE, and the trade minister did not journey to Israel to sign the deal. Emirati investments in Israel’s energy sector, perceived in Abu Dhabi as a long range interest, continue, as seen in the recent offer by ADNOC (with BP) to buy half of Israel’s New Med gas company, which holds 45 percent of the Leviathan gas field. The Mubadala sovereign wealth fund already owns 11 percent of the smaller Tamar field.

Another bilateral relationship that has significantly developed in the past two years is with Syria. The UAE has been at the forefront of efforts to return the Assad regime to the Arab fold, arguing the need to accept the reality of its survival, and the need for Arab engagement with it to reduce the Iranian influence. Foreign Minister Abdallah bin Zayed visited Damascus in November 2021; Bashar al-Assad made a surprise visit to Dubai and Abu Dhabi in February 2022, ostensibly to visit the Syrian pavilion at the Dubai Expo 2020 on Syria’s national day. This was his first reception by an Arab country since the Syrian civil war began. He arrived, accompanied by his wife, on a second, formal state visit on March 19, 2023. The recent earthquake in Turkey and Syria has enabled interested countries in the region to reach out to both states and improve relations with them, for ostensibly humanitarian reasons. Moran Zaga sees the desire to achieve significant influence and room for maneuver in Syria as another of the major drivers of the UAE’s emollient policy towards Russia.

In the Gulf, tension is growing between the UAE and Saudi Arabia. Several interlocutors noted that the close personal relationship between MBZ and Mohammad bin Salman, seen in the past even as a mentorship, has soured. The two countries have had severe disagreements regarding Yemen, where the Saudis saw themselves as blindsided and abandoned by the Emirati drawdown of forces in 2019 (the Emiratis are still heavily involved in protected geoeconomic interests in the South, through proxies, and Socotra Island). In addition, both are trying to position themselves as key mediators and as economic entrepots in the region, and are pursuing almost identical policies for economic diversification away from oil (a process in the implementation of which the UAE—like Qatar—preceded Saudi Arabia): the Emirati government claims that only 28 percent of GDP today is based on oil and gas.

Saudi Arabia hopes to rapidly draw a skilled expatriate workforce to become a services and transportation center, in addition to becoming a tourist destination; this would be at the expense of the UAE, especially Dubai. The two countries also disagree on OPEC+ production limits, with the UAE pressing to pump more oil; the UAE reportedly has been considering leaving OPEC. One recent indicator of the growing tension is Riyadh’s demand that multinational companies desiring contracts with the Saudi government must move their regional headquarters to Saudi Arabia by 2024, a demand widely perceived as directed against Dubai. Another is Saudi Arabia’s recent decision to create a global airline, Riyadh Air (whose CEO was until October the head of Etihad, Abu Dhabi’s flag carrier), which would compete with Emirates (Dubai) and Qatar Airways. On the political level, the Saudis feel that the Emiratis “have grown too big for their britches,” in the words of FPRI Senior Fellow Brandon Friedman, and are pursuing too independent a policy (including regarding a host of bilateral free trade agreements), without the consultation traditional among the Gulf monarchies.

Conclusion

In recent weeks, much attention has focused on Saudi Arabia’s shifting foreign policy orientation, towards a more multilateral approach, with stress on continued divergences from the United States. These include Xi Jinping’s visit to Riyadh in December 2022, close coordination with Russia on oil production (including the recent cut), and most recently, the Chinese-brokered agreement with Iran on restoring diplomatic relations. However, this (as in many other areas) was preceded by the UAE.

The UAE boasts a global and regional weight far exceeding that which its size and location might dictate: it is one of the five or six most significant strategic players in the Middle East and North Africa. In creating and maintaining this status, it has used its economic heft, as a significant oil producer but more importantly, as the regional actor most advanced (along with Qatar) in translating its energy endowments into a powerful and diversified globalized economy, based on services, finance, trade and logistics, to serve geostrategic aims. For instance, its sovereign wealth funds are among the largest global investors today, with at least $46 billion in foreign investments in 2022, and Dubai World Ports is one of the world’s five top container terminal operators (with some 10 percent of world capacity). It has used these, in combination with its focused and deft decision-making and implementation apparatus, driven by a long-term strategy, to seize opportunities to become a leader of the conservative camp during the Arab uprisings and beyond.

After a decade of activist, even adventurist policies in the region, Emirati foreign policy shifts in the past two years have been massive. It normalized relations with four of the major, and competing, states in the region: Iran, Israel, Turkey, and Qatar (its relation with the Sisi regime in a fifth, Egypt, has long been good), as well as with Syria. However, the current new directions in Emirati policy could be viewed as a function of the lack of success in its previous, “little Sparta” policy. The UAE’s current “no problems with neighbors” approach is also not ensured complete success.

Eurasia Press & News

Eurasia Press & News