China has become a global power, but there is too little debate about how this has happened and what it means. Many argue that China exports its developmental model and imposes it on other countries. But Chinese players also extend their influence by working through local actors and institutions while adapting and assimilating local and traditional forms, norms, and practices.

With a generous multiyear grant from the Ford Foundation, Carnegie has launched an innovative body of research on Chinese engagement strategies in seven regions of the world—Africa, Central Asia, Latin America, the Middle East and North Africa, the Pacific, South Asia, and Southeast Asia. Through a mix of research and strategic convening, this project explores these complex dynamics, including the ways Chinese firms are adapting to local labor laws in Latin America, Chinese banks and funds are exploring traditional Islamic financial and credit products in Southeast Asia and the Middle East, and Chinese actors are helping local workers upgrade their skills in Central Asia. These adaptive Chinese strategies that accommodate and work within local realities are mostly ignored by Western policymakers in particular.

Ultimately, the project aims to significantly broaden understanding and debate about China’s role in the world and to generate innovative policy ideas. These could enable local players to better channel Chinese energies to support their societies and economies; provide lessons for Western engagement around the world, especially in developing countries; help China’s own policy community learn from the diversity of Chinese experience; and potentially reduce frictions.

Introduction

This paper investigates Türkiye’s evolving relations with China’s Belt and Road Initiative (BRI), a large-scale program of infrastructure investment and project financing proposed by Chinese President Xi Jinping in 2013. The paper digs deeply into cases from two sectors—transportation and energy—focusing on how heightened and changing local expectations among Turks for these prospective BRI projects have shaped choices and outcomes, including China’s. In so doing, it explores how these shifting Turkish perceptions affect the implementation of BRI projects in Türkiye.

This paper has several goals: it seeks to understand the reasons behind these local changes, the role of the state and private sector in Türkiye in these changes, and the way China has responded so far. Of course, domestic factors are not the only ones that shape the implementation of BRI projects in Türkiye or elsewhere; regional and global trends have had an impact too.

For example, at the global and regional levels, the coronavirus pandemic, the war in Ukraine, and the shifting regional dynamics of the Middle East have affected Türkiye’s positioning within the BRI. The pandemic and war in Ukraine have boosted Türkiye’s status as a connector between regions; by contrast, shifting regional dynamics in the Middle East, especially the rise of the Gulf countries as hubs for Chinese financial and commercial activity, have sidelined Türkiye in the region. But a key finding from the authors’ fieldwork has been that domestic dynamics especially affect China’s BRI investments in Türkiye. And both the current Turkish economic crisis and changes to the country’s system of governance through the transition to a presidential system in 2016 have had particular salience in explaining how much has been invested and the conditions of these Chinese investments.

The BRI has been frequently framed as a “debt trap” with no “political conditionality.”1 These themes are especially prominent in public discussions in the West, as well as in media discussions about Middle Eastern countries.2 That argument would lead an observer to conclude that rising authoritarianism in Türkiye would not hinder, and would perhaps even facilitate, more BRI transactions. But, in fact, domestic changes linked to centralization and informalization of the state in Türkiye have led to decreasing Chinese investments in the transportation and energy sectors.

These findings from the authors’ fieldwork in Türkiye are in parallel with more critical literature on the BRI,3 underlining the importance of local Turkish actors, the diversity of Chinese actors engaged in Türkiye’s economy and with its politics, and, ultimately, the geographical and strategic ambiguity embedded in the whole BRI project. China’s adaptation to local dynamics in Türkiye in the context of a declining Turkish role in the region means that Türkiye is a lesser part of the BRI than its official state rhetoric and media hype claim. In Türkiye, as in many other countries, local skepticism has meant that “the initiative’s soaring rhetoric has not necessarily matched its realities on the ground.”4

This paper builds on fieldwork interviews with key stakeholders in Türkiye, including with those in relevant state institutions (presidency and ministries), the private sector (Chinese and Turkish companies), and civil society (professional associations and nongovernmental organizations, or NGOs). The interviewees are anonymized throughout the paper. To ensure anonymity, the interviewees will not be identified except to point to their domain of work: state sector, private sector, or civil society sector. To further protect these interviewees, the dates of the interviews are not specified. The authors also benefited from attending meetings organized by relevant professional associations.

The core of this paper is focused on Türkiye’s transportation and energy sectors and compares them with one another as necessary to give a more accurate and nuanced portrayal of Chinese involvement and adaptation in Türkiye in the late 2010s and early 2020s. The transportation sector was chosen because infrastructural investments in that sector relate to one of the key pillars of the BRI, namely economic connectivity. These infrastructural investments are also central to the current Turkish regime’s financial developmentalism, which aims to deploy state resources and attract foreign investments to support a major infrastructural buildout. There is sufficient involvement from both the state and private sectors in Türkiye’s transportation sector to demonstrate different modes of local engagement with the BRI and consequent Chinese response.

Renewable energy is another of the BRI’s pillars in the last decade and a major priority for Turkish President Recep Tayyip Erdoğan’s government. What started as China’s “Green BRI,” involving the bringing together of markets for renewables technologies and Chinese project finance along the BRI routes, was gradually mainstreamed into all BRI investments. Today, even the connectivity projects, such as transportation and logistics, are required to be digitalized and greened.

But even though it is an energy hub, Türkiye is a latecomer to renewables industries, in contrast with the country’s well-established transportation sector. The development of renewables markets in Türkiye coincided with the launch of the BRI—in other words, it has developed in the decade since 2013. Therefore, unlike the transportation sector, which predates the BRI, the Turkish renewables sector’s development overlaps with Türkiye’s entire period of engagement with the BRI. And because Türkiye’s first exposure to foreign investments in its renewables markets was from Europe, the paper compares Türkiye’s involvement with the BRI in this sector to how the country has interacted with a very different foreign actor than China.

As the paper will show, the BRI has been adaptive to local actors and contexts in Türkiye, meeting local demands, responding to Turkish requests, and navigating local complications. But the reality is that local actors have also been adaptive toward the BRI’s demands and conditions. As Dragvan Pavlićević and Nicole Talmacs have argued, “the notion of China and how any nation should engage with China is in a perpetual state of contestation, debated, and negotiated, within any local context.”5 In Türkiye, too, adaptation and contestation of China’s preferred BRI practices by local actors have been matched by the need to sometimes bend to Chinese demands as a condition of receiving BRI investment. So China’s engagement with Türkiye should be seen as an example of the mutual adaptations of Chinese and local actors to each other in different time periods and sectors.

Türkiye’s Involvement with China’s Belt and Road Initiative

Türkiye established diplomatic relations with China in 1971, but real improvements in bilateral relations came only later, when the Turkish government decided to distance itself from the Uyghur diaspora in the late 1990s. The Uyghurs are a Muslim Turkic people who speak a language related to Turkish, and there is much public sympathy in Türkiye for their plight. When prompted with relevant news, the public discussion on the Uyghurs often revolves around the human rights abuses of the Chinese governments against Uyghurs.

The following decades witnessed several phases in bilateral relations. Trade of semifinished products from Türkiye and end products from China dominated bilateral economic relations in the 2000s, until the Turkish state realized that its trade deficit with China was simply too large to be bridgeable only with enhanced exports. However, its strengthened attempts to enter China’s production markets and compete with early comers, such as European, North American, and East Asian companies and capital, proved to be unsuccessful. Thus, in the 2010s, Türkiye’s ruling Justice and Development Party (AKP) under then prime minister Erdoğan flirted with the BRI to attract more Chinese investment to Türkiye instead, most notably to its transportation and other infrastructure projects. At the same time, Turkish government representatives reached out to Chinese oil and gas companies and regulatory agencies in order to secure energy deals. In the 2020s, Chinese investments in Türkiye present a complex picture. Besides direct investments, Türkiye has also become a recipient of China’s other official flows, which are grants rather than loans made for essentially commercial purposes.

Türkiye officially joined the BRI in 2015, two years after Xi’s proclamation. As of summer 2022, total BRI investments in Türkiye amount to $4 billion. These make up just 1.3 percent of total BRI investments around the globe, making Türkiye a very minor recipient of Chinese funding.6 But as a geographical and geopolitical hinge country—intersecting Europe, the Middle East, and Central Asia—Türkiye is, in theory, an ideal BRI recipient. And yet, today, stakeholders in Türkiye mostly agree that whatever initial impetus there was to the earliest BRI collaborations has faded, especially when it comes to large-scale projects that could have made Türkiye a central player in China’s geostrategic vision for the Eastern Mediterranean, including the so-called Middle Corridor—a transportation megaproject that aimed to connect Europe to Central Asia. There have been oscillations in the dynamic between Türkiye and the BRI, which will be described in the industry case studies below.

Still, Türkiye has had multiple engagements with the BRI, including but not limited to infrastructure, finance, energy, technology, and health. Türkiye aspires to have a larger place within the BRI for two main reasons, one domestic and the other transnational. The domestic rationale is that the country seeks to court investment for several large-scale infrastructure projects, including in the transportation and energy sectors. These two sectors are a particular matter of prestige with political implications for the success of AKP rule in Türkiye, showcasing the party’s “accomplishments” to cement support for its rule. As Bülent Gökay has put it, the party expects these projects “to capture the public imagination, and bring to mind the grandeur of a long-gone imperial era. However, lack of transparency, crony capitalism, and environmental concerns have publicly plagued many of these projects.”7 Turkish business actors, by contrast, demand that the state develop long-term plans for attracting value-added, high-tech investments and knowledge and know-how transfers, not just construction and finance for mega-sized infrastructure. This is why, for example, Turkish business has been attracted to China’s national champion tech firm, Huawei (which transfers some technology and promotes skilling programs);8 the Turkish businesses are betting that their ties with Huawei can ensure Türkiye will not be left behind its regional neighbors who are working closely with the company.9 But the quality that these businesses criticize, namely the lack of long-term planning in the AKP era, stems from the transition from a parliamentary to a presidential system in Türkiye. This transition created another layer of bureaucracy within the state structure, residing in the presidential palace with ambiguous roles and authorities and introducing considerable confusion and inertia to Turkish policymaking, strategy, and implementation.10

Meanwhile, Türkiye has a transnational motivation to enhance its engagement with the BRI because its traditional foreign policy of increasing overall relations (political, commercial, and cultural) with Europe and Eurasia has meant trying to integrate the so-called Middle Corridor into the BRI. The vision of a Middle Corridor—a Turkish initiative for a transport route that would reach from Türkiye to China through the Caucasus, the Caspian Sea, and Central Asia—dates back to the late 1980s, the subsequent collapse of the Soviet Union, and the opening up of former Soviet Central Asia as a market of independent countries. Türkiye’s business actors view that region as a standalone component of their strategies, rejecting the view of the Turkish state that the Middle Corridor can be complementary to Türkiye’s involvement with China under the BRI. These businesspeople note, for instance, that Türkiye runs significant trade deficits with China (see figure 1)11 and the fact that “between 2013 and 2020, Turkey received just 1.31 percent of total Chinese investments.”12 They tend to favor the idea that Türkiye should deal directly with these countries commercially and financially, rather than making its involvement a component of, or subsidiary to, what China is doing with Central Asia and the Caucasus under its BRI schemes.

Indeed, the AKP government’s effort to become more involved with China’s BRI has contributed to Turkish authoritarianism and is integral to the party’s political legitimacy.13 Regional integration in transnational development and infrastructure schemes alters domestic decisionmaking structures, as well as relations among social forces and power distribution because of where and how money is allocated. This is one reason political and financial risks for China’s involvement have risen, leading Beijing and Chinese actors themselves to downscale their commitment to Türkiye under the BRI.

As a result, China has oscillated between shying away from Türkiye because of perceived political and financial risks and then reengaging with it in the face of regional crises and reconfigurations. One example of the latter is the promotion in Türkiye of the so-called Health Silk Road during the coronavirus pandemic, and the increasing importance of the Eastern Mediterranean maritime routes and Middle Corridor in the face of the war in Ukraine. The transportation and energy sectors in particular showcase this dynamic push and pull between standoffishness and reengagement.14

Türkiye and China collaborated on Türkiye’s transportation infrastructure almost a decade before the announcement of the BRI in 2013, so there is considerable history in this sector that has led to an outsized Chinese presence compared to other aspects of Chinese involvement in Türkiye. The Silk Road concept, tying all of Eurasia to West and East Asia, has been a part of Chinese and Turkish policy rhetoric for some time.15 Türkiye also aspired to be a role model for the newly independent Central Asian states in the 1990s. This pan-Turkic foreign policy ultimately failed but did shape the Middle Corridor project.16 And even though the Middle Corridor and the BRI never merged, China and Türkiye collaborated on a critical infrastructure project over the decade of the 2000s: the second phase of the Ankara-Istanbul high speed railway, a project that has been described even by China Railway Construction Corporation Limited as China’s first overseas railway construction effort.17

Railway construction collaborations did not end with the Ankara-Istanbul high speed railway. Türkiye invited China to collaborate on the construction of the Edirne-Kars railway in 2011. This was two years before Xi’s announcement of the BRI in 2013 and four years before Türkiye officially signed up to join the BRI in 2015. The two countries even signed an agreement in 2010 that encompassed both the Ankara-Istanbul line and the Edirne-Kars line.18 These were publicized as the “Iron Silk Road” (a bit of a marketing ploy). However, these agreements and an invitation to collaborate did not lead to significant results.

By contrast, Türkiye and China came late to renewable energy sector collaboration, even though China has been a major player in this sector since the second half of the 2000s. The steady increase in China’s share of the global renewable energy market is now institutionalized through Green BRI projects overseen by Chinese state entities. For production, China’s investments in overseas renewables markets have been dominated by state-owned enterprises (SOEs).19 Consequently, the scale of China’s overseas investments in renewables has grown alongside the Chinese state’s commitment to the Green BRI framework. The Masdar City and Benban Solar Park projects, in the United Arab Emirates and Egypt respectively, are two cases in point.20 For green finance, China’s overseas green funds have mostly gone to BRI countries. Greening of BRI funding first began regionally, with the Middle East as the leading pilot case.21 In 2021, China’s Ministry of Commerce issued its Green Development Guidelines for Overseas Investment and Cooperation, which obliged all Chinese SOEs to observe the European Union’s (EU) Green Deal standards in their overseas investments.22

China adapts to local conditions and demands when it comes to many aspects of overseas renewable energy projects. In Europe, for instance, Chinese investors in renewable energies are mostly privately owned companies, whereas large-scale Chinese green investments in the Eastern Mediterranean are by Chinese SOEs. China’s state-led BRI goals are the principal reason for this difference in investment strategies. Europe and China have a “dialectical” relationship of competition and collaboration when it comes to technology markets; thus China’s investments in Europe are part and parcel of an established production chain.23 In the Eastern Mediterranean, including Türkiye, however, China is predominantly concerned with the political economy of energy relations in the region.24 A case in point that shows China’s political motivations for its economic activities in the Eastern Mediterranean is Shanghai Electric investing in renewable energy in Gulf Cooperation Council countries through its acquisition of ACWA Power in Saudi Arabia but investing in a coal-operated power plant in Türkiye. The former is a part of China’s long-term plans to increase its presence in the region, while the latter is driven by quick profit for the involved Chinese SOE.25

Türkiye relied on traditional energy for a long time because renewable energy was unaffordable for developing countries until the 2000s. And even after Türkiye passed the relevant laws and regulations to begin its transition toward renewable energy, coal plants and natural gas remained the country’s main mode of power production. The latter also remained central to Türkiye’s geoeconomic presence in both the Black Sea and the Eastern Mediterranean.

But once it came to power, Erdoğan’s AKP government pursued an active foreign policy to attract renewable energy investments, subsidized by climate leaders such as the EU. But when these all failed, Türkiye temporarily turned against the global climate agenda by not ratifying the Paris Agreement between 2016 and 2021.26 Not ratifying the agreement cost Türkiye subsidies and funding to support its domestic renewables buildout. Thus, Türkiye turned to China, which at that time had not synchronized its green standards for energy investments with those of the EU, whether for traditional or green projects. In fact, most of the Chinese investments in Türkiye’s energy sector were in so-called brown energy—in other words, ecologically damaging projects such as coal-fired plants. Contracts for two coal plants, Adana Hunutlu and Konya Ilgın were signed in the mid-2000s, and the former began production in 2022.27 These coal-based technologies were criticized by Turkish opinion leaders and the public at large for being environmentally degrading and economically inefficient, yet the Turkish state continued to pursue financial aid, loans, and guaranties for the traditional technologies associated with these projects.28

The Local Turn in China’s Investments in Türkiye

Chinese private companies and SOEs are involved in many fields of transportation and energy, but the best way to understand the localization of China’s approach to Türkiye in recent years is to confine our analysis to its increasing renewable energy investments, especially in solar energy, and the suite of specific transportation projects, particularly ports and railway construction, that lie at the core of Ankara’s developmental agenda. Comparison of these two specific sectors reveals the role of Türkiye’s own local state and business elites in the BRI, and how Chinese players have adapted to their demands and political and economic needs.

For their part, private Chinese companies have sought collaborations with the pro-government business elite for investments in the renewables industry, while the Chinese SOEs that have been able to enter the highway projects have become a part of the prestige-seeking transportation megaprojects. They could achieve this by cultivating the Turkish ruling party. By responding to both the business and state elites, Chinese players have learned to play politics in Türkiye as a strategy for market entry.

Transportation Infrastructure

Building out Türkiye’s transportation sector has been a major priority for the AKP, as it builds Türkiye’s infrastructure, steers largesse to favored Turkish elites, and connects Türkiye to the broader region, interlinking the country through both commerce and investment. There were, of course, important Chinese investments in Türkiye’s transportation infrastructure prior to the advent of the BRI in 2013. However, the announcement of the Chinese initiative coincided with the AKP’s increased desire to attract foreign direct investment and its foreign policy strategy of diversifying ties to extra-regional allies. This naturally led the AKP to want to boost economic relations with China.

There have been three phases to China’s BRI investments in Türkiye’s transportation sector.

In phase 1, from 2013 to 2015, Türkiye initially tried to capitalize on its geographical advantage by merging its own Middle Corridor project to China’s BRI. China seemed open to this conception. But from a practical standpoint, the Middle Corridor routes are neither cheap nor efficient for land-based transportation. For one, goods transported by land must still eventually cross the Caspian Sea to reach China, which one specialist from Türkiye with expertise in sea freight described to the authors as difficult waters due to changing weather patterns and frequent storms.29 For another, the corridor at this point was largely unbuilt. While its conception went back to the early 1990s, construction only began in 2007 and the corridor would be inaugurated in 2017.30

Phase 1 has, therefore, been all about negotiating the integration of the Middle Corridor into several infrastructure projects planned, financed, and often built by China. So in this first phase, a “Memorandum of Understanding on Aligning the Belt and Road Initiative and the Middle Corridor Initiative” was signed as a symbol of Türkiye’s efforts to incorporate its vision into the BRI. China adapted to this AKP demand, even conceding pride of place to the Turkish corridor concept in the very title of the memorandum. The Turkish Ministry of Foreign Affairs has called this integration “a natural synergy” and a “win-win” situation.31 So, in this phase, Türkiye not only entered into the BRI but succeeded in winning concessions from Beijing in the form of China’s acceptance of Türkiye’s parallel discourse. Beijing talks often about the BRI around the world but rarely, especially in this early phase, willingly watered down its priority national project by connecting it to, much less making it semi-derivative of, existing connectivity projects sponsored by other countries. In Türkiye’s mainstream media and in the AKP government’s representation of the deal, Türkiye’s entry could, therefore, be framed in a triumphal way. It reflected, the Turkish side claimed, “not only economic pragmatism but also [an] historical and traditional background that dates back to ancient times,” which in turn legitimized the BRI in Türkiye, handing China a means of market entry through conceding to the AKP’s preferred conceptual framework.32

In phase 2, which ran from 2015 to 2020, there was both mutual adaptation and some contestation. Türkiye, for its part, began to pay special attention to attracting Chinese investments for infrastructure projects that could deliver, above all, both profit and prestige to the Turkish regime. There have been moments of success for China’s investments in Türkiye’s transportation and logistics sectors, such as the purchase of Kumport in Istanbul by a Chinese consortium; Kumport is now the biggest Chinese transportation investment in Türkiye. But this Chinese success was leavened by the inconclusive negotiations over the port of Çandarlı, where the Turkish side would not simply concede to Chinese negotiating points. Other potential Chinese investments failed to materialize as well: initial negotiations started for the Konya intercity tramway project but never came to fruition. This period also saw Turkish state invitations to China to join the construction of Kanal İstanbul, an ambitious and highly controversial project, and to become shareholders in the Third Bridge over the Bosphorus in Istanbul. Türkiye sought greater Chinese involvement in ports, highways, railways, and intercity tramways, yet most of these negotiations foundered on an inability on both sides to close the deal. The authors’ fieldwork suggests that after initial proposals were shared and drafts revised, Turkish institutions sought to compromise to close the deal, yet China refused to finalize. As a result, China looked elsewhere in its regional BRI plans. Facing heightened financial and political risk in Türkiye, the Chinese side stalled negotiations, demanded conditions that Türkiye could never have accepted, and finally sought non-Chinese shareholders through larger consortiums so that the Chinese could share local risk with other foreign players, such as European firms. But even those discussions have not come to fruition.

Ultimately, Chinese companies simply withdrew from negotiations—for instance, China Merchants Group exited talks to become a shareholder in important tolled highways in western Türkiye. They adapted to the high political and financial risk that Türkiye presents by changing their involvement from acting as a single creditor to being a part of consortium that includes Turkish and European counterparts.

Phase 3, from 2020 to the present, has been characterized by renewed Chinese interest in Türkiye’s Middle Corridor after the onset of the coronavirus pandemic in 2020 and the war in Ukraine in early 2022. The pandemic slowed down sea freight, with the container shortages impacting the speed of transportation; this, in turn, led to renewed Chinese willingness to take Türkiye’s land-based schemes seriously. The war in Ukraine, meanwhile, led to the closure of the overland Northern Corridor through Russia, which gave new impetus to land transportation along the Middle Corridor.33 As state bureaucrats in Türkiye recite frequently, 96 percent of the transit freight from China to Europe is operated through sea freight. The remaining 4 percent uses the Northern Corridor. So, slowing down of the sea freight and closure of the Northern Corridor made a significant impact on trade and led to renewed Chinese interest in accommodating Turkish requests and demands.

Türkiye’s Middle Corridor passes through Central Asia and the Caspian Sea en route from China to Türkiye and onward to Eastern and Central Europe. During the first year of the pandemic, Turkish logistics companies faced significant obstacles in using their traditional routes in Central Asian countries because the states along the route decreased the number of transit permits granted. The Turkish state negotiated vigorously with these Central Asian governments to assure no disruption to overland Chinese transit loads, and it even facilitated additional services by roll-on/roll-off ships as a state–private sector collaboration.34 Even though the maximum capacity of the Middle Corridor was still not enough for the Chinese transit load, there was nevertheless a renewed Chinese interest in these Middle Corridor transportation projects, leading to ministerial visits to Türkiye’s Ministry of Transportation and Infrastructure and talks on reopening frozen credit lines. In short, China was compelled to rethink its standoffish BRI policy toward Türkiye when regional dynamics changed. Thus, the adaptation and localization of the BRI in Türkiye’s transportation sector can only be understood within a broader regional and global context.

Two cases from Türkiye’s transportation sector, the Kumport purchase and the Edirne-Kars railway construction negotiations, illustrate both this renewed Chinese interest in Türkiye and the localization of China’s approach to projects and investments in the country. Kumport proved to be a successful case because Turkish and Chinese actors adapted to one another’s conditions and needs. The Edirne-Kars railway construction negotiations, by contrast, present a case where China did not have to localize its approach because the Turkish side simply made concessions—and yet even that was not enough to close a deal.

Kumport: Purchase First, Operate and Update Later

The overwhelming majority of BRI-related freight uses maritime corridors, making ports essential to the smooth functioning of the trade aspect of the BRI. China’s flagship BRI port in the Mediterranean region is Piraeus in Greece, purchased and later developed further by a Chinese firm, COSCO, with a 67 percent majority share. Despite collaborations in the past and the onset of the BRI in 2013, China was reluctant to invest in a similar way in Türkiye’s ports. This choice disappointed the Turkish business and state elites35 even though they readily admit in interviews that Piraeus port has more suitable infrastructure, including railway connections than do any counterpart Turkish ports, and also that Greek local actors have more experience than their Turkish counterparts in handling maritime freight.36

When the plan to make the Çandarlı port part of the BRI failed, negotiations between the Turks and Chinese ended in complete stalemate, so Türkiye’s state elites came to understand that their preferred “build-operate-transfer” model would not work for their Chinese counterparts. The AKP government, therefore, changed strategies to attract investment in Türkiye’s ports after its Çandarlı failure. Instead of attracting investment for construction, the state began to hold a bidding process to sell partial shares or to rent for a limited time the ports that had already been built.

One expert in maritime freight frames this updated Turkish approach as a “purchase first, operate and update later” model.37 Ankara conveyed this revised proposal directly to the Chinese state, and China accepted it, adapting to a preferred local demand and model of port ownership.

In the purchase process, the Chinese state asked Chinese SOEs to form a consortium to spread financial risks. This approach in Türkiye’s ports’ case was quite a bit different from how the Chinese state has behaved in, for example, its investments in Türkiye’s energy sector. In the energy sector, by contrast, the Chinese state has not stepped into the bidding process, even though it is sometimes needed for support.38 This difference demonstrates that China’s adaptation toolbox includes strategies not only for different countries but for different sectors within the same country.

In acceding to this new Türkiye-preferred approach, two Chinese firms operating in a joint venture, China Merchants Holdings International and CIC Capital (subsidiaries of COSCO Pacific), acquired a 65 percent share in Kumport.39 The whole purchase totaled $940 million,40 the largest BRI investment in Türkiye. COSCO’s justification for its purchase mentioned its parallel investment in the competitor Piraeus port: “The (COSCO) Board believes that Kumport Terminal has good development prospects given the potential business synergy between the Kumport Terminal and the Company’s existing investment in Piraeus Container Terminal S.A. in Greece.”41 In the same public statement, COSCO also mentioned the strategic location of Türkiye within the BRI corridors.

Kumport subsequently succeeded in attracting research and development (R&D) investment through an “R&D center that Kumport launched with a 4.5 million Turkish lira investment in 2019. Accredited by Türkiye’s Ministry of Industry and Technology, it became the first R&D center in Türkiye’s port-management sector.”42

Overall, Kumport presents a case in which China adapted to local conditions, namely to the Turkish political elite’s demands not just for more investment in ports but also regarding R&D and a particular own-and-operate model. This occurred partially because of the strategic location of Kumport, in Ambarlı, connecting the Black Sea and the Marmara Sea, and partially because that location was viewed by the Chinese players as complementary to the Piraeus port, unlike Çandarlı, which would have been a straightforward competitor for Piraeus on the Aegean Sea.

But despite the completion of the purchase, and the scale of the Chinese investment, Kumport did not deliver as much as promised. Today, it operates under full capacity, and it is not used frequently even by Chinese companies. Its profits were also under the expected margins because of changes to Türkiye’s laws regulating port management. These changes were made immediately after the purchase, signaling a highly unpredictable administrative environment in Türkiye. Having made a deal that, in part, accommodated Türkiye’s political elite, Chinese players have subsequently discovered that it sometimes makes more sense to just walk away.

Turkish Railways and the BRI

Railways showcase a different story. Kars is the entry point for Chinese and Central Asian goods into Türkiye, using the Baku-Tbilisi-Kars railway. Edirne is then the exit for transhipped goods from Türkiye toward Europe. But in the words of Chinese officials, this is a shorter but more expensive route than the Northern Corridor via Russia.43 It is expensive because although the mileage is shorter, the railway lines are not high speed, so goods simply cannot be shipped as quickly. And even when freight is carried smoothly, customs procedures in Türkiye at both its eastern and western borders take much time, increasing freight prices in turn. Indeed, Türkiye sits astride two different customs zones: Eurasia and Europe. This creates many bureaucratic problems, slowing down the overall customs process.44 So railways are problematic for Chinese investors because both the lines and the customs procedures are slow, which chips away at the competitiveness of Türkiye’s preferred Middle Corridor. This may be why when Türkiye invited Chinese companies to invest in the Edirne-Kars modernization project, the negotiations took so long that twenty-one drafts were exchanged between Turkish and Chinese officials.45

From the standpoint of the Turkish delegation in these negotiations, points of contestation included: (1) interest rates on the debt-backed project finance, with China asking slightly more than globally typical rates and Türkiye asking slightly below these rates; (2) the grace period before the start of repayment, with China offering five years and Türkiye demanding ten years (which is the grace period in Türkiye’s agreement with Japan in the financing and construction of the Marmaray rail line); (3) China demanding final approval on the lines and any additions; (4) China insisting on using Chinese labor brought from China, while Türkiye asked for the employment of local labor (one suspicion and fear being that China might use inmates from Chinese prisons as labor and leave them in Türkiye when the construction is completed); (5) China asking for mortgage and right to confiscate if there were ever a failure to repay, and the Turkish treasury insisting on not allowing possible confiscation of state-held lands; and (6) China asking for a share of 51/49 percent in the operations, with Türkiye offering a pure joint venture at 50/50 percent shares.46

The Turkish teams involved in these negotiations included the Ministry of Foreign Affairs, Ministry of Treasury and Finance, Turkish State Railways (TCDD), and the Ministry of Transportation and Infrastructure. The authors’ fieldwork included interviews only with the Turkish side, but the overall impression is that Türkiye adapted to China’s conditions and agreed to most of them. But still, even Türkiye’s final offer, the twenty-first draft exchanged, did not receive an answer from China. So, despite the benefits of accelerating and enhancing the Middle Corridor and perhaps running Türkiye into debt (as advocates of the “debt trap” theory of the BRI would have predicted), China chose to invest in the Gulf countries and Israel instead.

As of 2022, Türkiye had improved the Edirne-Kars railway connection but could not significantly increase its transit capacity without foreign investment. The freight operations of TCDD were privatized in the hope that this would increase their speed and volume. However, the privatization process fell victim to corruption and nepotism, and the result was the monopoly of one company with strong ties to the political elite and leadership.47 The private company even intended to limit the Chinese transit load when it first took over the railways.48

While Türkiye could not afford to invest in its own railways, China also did not invest in big modernization projects that would have increased Turkish capacity. There were issues that made moving the project forward difficult, not least problems with Turkish railways’ technical integration with EU standards, but our fieldwork reveals that the main issues that held China back included the following: (1) China’s high risk assessment for Türkiye, with nationalist anti-China sentiments potentially becoming a point of vulnerability; (2) the volatility of Türkiye’s domestic political transformation; (3) the example of lower-than-expected profits at Kumport due to regulatory changes and price ceilings; and (4) high financial risk, especially with the last two years seeing a drastic decrease in the Turkish treasury’s reserves. Compared to the mid-2010s, neither debt repayment prospects nor financial returns looked to be as attractive in the early 2020s. TCDD itself is in critical debt to the Turkish Ministry of Treasury and Finance.49

This is why Kumport (in 2015) was a Chinese purchase that was finalized, with China adapting to Türkiye’s demand to invest in ports, while Türkiye reciprocated the Chinese interest in its port development schemes by accommodating elements of Chinese fears about building a port from scratch in Türkiye’s volatile political and economic environment. But the Edirne-Kars railway construction had to make do without Chinese investment. And the railway project has basically failed, with construction coming to a halt because it is almost impossible for the Turkish treasury to finance it domestically.50 By the time the railway negotiations stopped in 2019, four years after the Chinese Kumport purchase, the risk emanating from Türkiye’s political and economic environment had increased considerably. Türkiye had also experienced an attempted coup d’état, a controversial transition to a presidential system, and alienation from regional actors in the Middle East, including Israel and the Gulf countries, where there is significant Chinese BRI investment. This is unfortunate because China and Türkiye actually had a prior history of railway construction on which they could have built—notably, the Ankara-Istanbul high-speed railway construction project from 2008, five years before the BRI was announced.

As of 2023, there has been news that the aforementioned Konya intercity tramway project may restart, following a meeting between Xi and Erdoğan in Uzbekistan during a Shanghai Cooperation Organisation summit in the fall of 2022. The authors’ fieldwork suggests that China has adapted to Türkiye’s increased insistence on using a Turkish firm connected to the ruling elite as the main local contractor, which is in line with the increased acceptance of a smaller circle of firms in state bids in Türkiye. China, which previously insisted on a different contract model, seems to have made this adaptation in exchange for less vocal opposition to China’s Xinjiang policy. Increased nepotism in Türkiye appears to have opened up a new space for maneuvering on the part of Chinese actors. However, to ensure its success, this negotiation was delayed until the two presidents could meet.51

To be sure, ports are inherently more profitable than any other transportation modes, with an expected profit margin of 40 percent.52 But China’s investments in Turkish ports coupled with staunch resistance to Türkiye’s interest in attracting Chinese investment in railways may be explained in part by that desire for larger profit among Chinese SOEs that seek to balance profit and risk. When there is a possibility for a strategic political gain, this also gives impetus for China’s adaptation, but that requires high-level political guarantees.

Renewable Energy

The story of Chinese firms in Türkiye’s renewables sector has involved adaptation and recalibration in the face of initial failure. Chinese firms thought they could leverage connections to Türkiye’s political elite but quickly learned that their competitors were in fact much better connected. Having failed to win bids that they would have won if price and market considerations had been the sole decision factors, Chinese firms adapted not by learning to play Türkiye’s political game more skillfully but instead by refocusing on a different part of the Turkish business ecosystem entirely—small and medium-sized Turkish firms that had different business lines and were friendlier to Chinese partners.

This adaptation is both striking and, perhaps, unexpected because so many observers around the world have argued that Chinese stakeholders practice cronyism in many countries. China’s engagement with local capital is either through SOEs in the destination country or large businesses with good political relations with the existing government. When they could not establish crony relations in either way in Türkiye, they responded first by exiting the market in the sectors where they had initially bid, then by turning down requests to reenter the Turkish market in those sectors, and finally by refocusing on the SME segment of Türkiye’s corporate ecosystem. Working with SMEs is a novel adaptation strategy for China because renewable energy is a capital-intensive, high-end technological sector and China has so far engaged with local SOEs elsewhere.53

Türkiye’s Renewables Sector Emerges

Türkiye is a latecomer to renewable energy production even though its natural resources are estimated to be among the highest in the greater European area.54 Its Renewable Energy Law was not enacted until China and the EU, the two main technology providers for Türkiye’s renewable energy sector, already dominated global markets.

It took the AKP government a decade to put together the “National Renewable Energy Action Plan,” which was published in 2014. This plan aimed to have renewable energy sources cover 30 percent of Türkiye’s total energy supply, including meeting 10 percent of the energy demand of the transportation sector through renewables.55 Türkiye’s renewable energy planning categorizes thermal and hydroelectric plants, as well as natural gas, as green; yet, by 2023, neither target seems attainable, and, moreover, these numbers are not enough to meet Türkiye’s 2053 carbon neutrality pledge based on the authors’ interview with a responsible ministerial bureaucrat as recently as 2022.

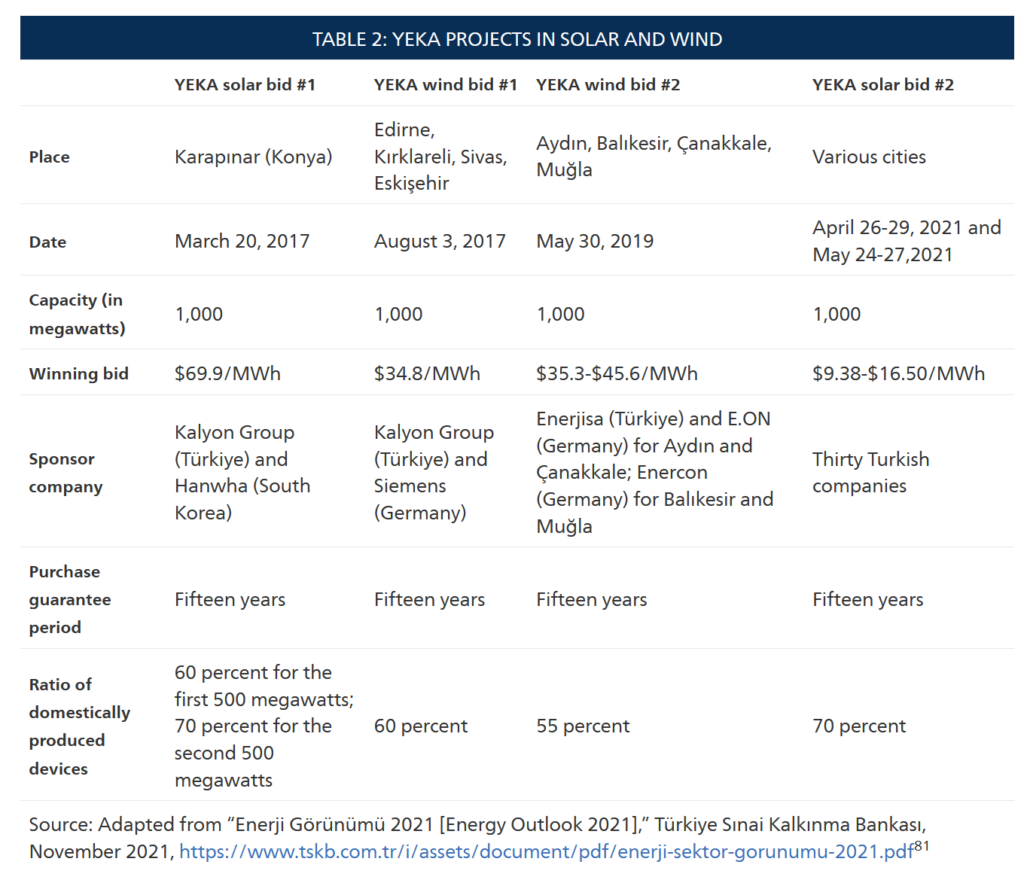

Türkiye’s Ministry of Energy and Natural Resources attempted to regulate public bids for renewable energy plants in 2011 by introducing the Renewable Energy Support Mechanism (YEKDEM) system. According to this system, the state committed to support small-scale wind and solar plants financially if these facilities used locally produced technologies for 60 percent of their production. In 2015, the Ministry of Energy and Natural Resources revised its support plan and introduced the Renewable Energy Resource Area (YEKA) policy for locally built and operated power plants above 1 megawatt.

The switch from small-scale domestic investments to large solar and wind plants was the brainchild of a former minister of energy, Berat Albayrak, who had close family ties to Erdoğan. He enjoyed considerable autonomy in decision making thanks to these personal ties. He also visited China multiple times and met with SOE CEOs and the head of the energy regulatory agency in an effort to secure Chinese investment in Türkiye’s energy sector, including for renewables.

However, two concurrent and related developments interrupted his China pivot. Türkiye’s principal energy diplomats lost their positions either by falling from grace or through formal corruption investigations. In Türkiye, a private conglomerate, again with close ties to the president’s office, replaced the fallen energy minister to influence the energy decisions.

The Ministry of Energy and Natural Resources has continued the YEKA policy, with adjustments in subsidies. The subsidies were meant to help the SMEs keep up with the EU’s (and later Chinese) green standards and helped Türkiye’s domestic renewables industry to finally take off. However, according to sector experts, the burgeoning Turkish industry suffered a blow when the latest round of subsidies was distributed in Turkish lira instead of euros.56 The shift to the use of local currency was in response to the currency crisis Türkiye has been going through since the pandemic but also reflects fragmentation within the Turkish bureaucracy.

The transition to a presidential system also undermined Türkiye’s energy diplomacy by creating a duality in public policymaking in Türkiye.57 In the case of renewable energy, the Ministry of Energy and Natural Resources cannot release the YEKA subsidies without the approval of the Presidency of Strategy and Budget, a department of the president’s office. Türkiye’s carbon neutrality pledge for 2053 was made without consulting the ministry; as a result, the ministry has still not released the decarbonization road map. In 2022, the energy minister’s office organized a stakeholder meeting to discuss the decarbonization road map with the participation of state and business elites as well as experts. According to participants, the consensus was to phase out coal, but then a roundtable on the last day of the meeting, attended by the presidential bureaucracy, yielded a meeting memorandum that did not include a coal phaseout.58 On top of this duality, the ministerial bureaucracy is also divided and lacks coordination.59 For example, the energy markets’ regulatory agency and the electricity infrastructure SOE are known not to coordinate for bids. As a result, the YEKA conditions, such as the ratio reserved for domestic products, changes frequently and unpredictably.

YEKA allowed domestic capital to commit to large-scale renewable energy plants with either foreign collaborators or domestic mergers. The former is preferred by big capital, which has both the access and financial architecture to collaborate with major renewable energy multinationals. Foreign collaborators are also preferred by the state, as the Turkish state is not content with letting go of its initial policy of building sizable energy plants for industrial use instead of local electricity producers for households and SMEs.60 Domestic mergers are, on the other hand, an unintended consequence of the YEKA policy. The wind and solar SMEs attain market entry by coming together for a YEKA application, but, when they are granted state support, they continue working separately.61 That is how Türkiye’s renewable energy production increased but was not consolidated for industrial production.

Another concurrent development involved SMEs lobbying the state to let unlicensed small-scale power plants use imported devices. Türkiye’s 60 percent domestic content rule is biased toward big capital, which can open factories with foreign partners.62 By doing so, these larger companies kill two birds with one stone: (1) they bypass domestic content conditionality since they own the majority of the shares in these factories and use imported devices in their own power plants; and (2) they sell their products to SMEs for prices higher than direct imports.63 In fact, yielding to the lobbying of these factory owners, the state imposes anti-dumping duties on selected products so that cheaper products are not available in the market.

The Two Phases of China’s Involvement in Türkiye’s Solar and Wind Sector

Türkiye’s focus on renewable energy fit well with one of the BRI’s pillars during the last decade in the Eastern Mediterranean: the mainstreaming of renewable technologies. What started as the “Green BRI”—that is, converging the markets for renewables technologies and finances along the BRI routes—was gradually mainstreamed into many Chinese BRI investments, ranging from construction to logistics. Mainstreaming renewables involves integrating climate criteria and green technologies into traditional industries. As an example, in 2021, China released its Green Development Guidelines for Overseas Investment and Cooperation to regulate the construction industry abroad.64 Another field where China has become increasingly competitive is green logistics. On paper, China has imposed green rules for all BRI investments in the regions where Türkiye is involved, such as the Middle East.65 But while the BRI was becoming greener, Chinese investments in Türkiye’s renewables sector were experiencing a domestic backlash.

In the 2000s, Türkiye’s energy sector slowly but steadily developed renewable energy projects with the support of state subsidies. Private Chinese companies enjoyed free market access and, with a strong competitive offering, quickly came to dominate Türkiye’s renewables market.66 At this time, since private Chinese companies dominated China’s overseas renewables investments, the Turkish market, too, was composed mostly of Chinese SMEs.

In the 2010s, however, both Türkiye and China moved toward consolidating renewables markets to enhance their global competitiveness. In China, SOEs took over the large-scale and high-risk renewables investments within the BRI; in Türkiye, meanwhile, YEKA bids allowed private big capital to seek overseas partners for the construction of large-scale and high-risk solar and wind power plants.

In the mid-2010s, Türkiye’s ministerial bureaucracy revised the YEKA policy to enable the construction of large-scale solar and wind power plants by domestic companies. However, the presidential bureaucracy under Erdoğan crippled these initiatives by steering opportunities through patronage relationships to the pro-AKP business elite. Chinese companies were among those that were negatively affected by this intra-state rivalry between AKP-connected players and those left on the outside for lack of political connections or patronage. The ministerial bureaucracy was unable to intervene because of its isolation from decisionmaking dynamics in the president’s office and its general unwillingness to intervene given its negative experiences in a civil nuclear power deal.67 The affected Chinese companies could have contacted the president’s office directly but, unable to play local politics initially, continued their transactions with the ministerial bureaucracy, which they possibly saw as the institutionalized (and therefore most reliable) pillar of the Turkish state.68

In the wind sector, Türkiye conducted its first successful YEKA bid in 2017. A major Chinese wind energy SOE, Mingyang, was a strong competitor in the bid, partnering with Ilk Insaat, a Turkish company known for its crony relations with the AKP government. However, a consortium between Kalyon Group of Turkey and Siemens of Germany won the bid, in part because Kalyon Group had even better connections to those in power.69 Both Chinese and Turkish interviewees, including actors in the bureaucracy and Türkiye’s public sphere, told the authors that the winning consortium used strong crony relations with the government to win the bid, arguing this because (1) its offer was too low to be accepted by the supervisory organs without political pressure from above; and, (2) the Turkish partner of the winning consortium is well known as one of the five big conglomerates with the closest ties to the government, a political connection that has grown exponentially during the AKP’s two-decade tenure in power.70

In 2019, two German companies—Enercon independently, and E.ON as the foreign partner of Enerjisa, a Turkish company—won the second successful bid for wind power plants.71 For this reason, some sector insiders in Türkiye claim that the European business elite has been able to leverage political connections in order to lobby for pushing the Chinese out of Türkiye’s renewables market. Others suggest that the impetus came from the Turkish side, with the ruling elite attempting to rekindle relations with Germany after the political fallout of the post-coup state of emergency in Türkiye in 2016. These sources note that energy deals, such as those with Russia, are always politically motivated in Türkiye.72

In the solar sector, too, Chinese bidders lost out for lack of political connections. The first successful YEKA bid was completed in 2017 in this sector. Solargiga, a Chinese company, entered the bid with one of the five biggest pro-government conglomerates in Türkiye.73 However, yet again, the winning bid came from a consortium composed of Kalyon Group, the same politically connected Turkish company that had won the wind energy bid, and Hanwha, a South Korean solar partner. Once again, the winning consortium’s offer was significantly lower than market prices; this, and the fact that the Turkish partner of the consortium was Kalyon, also the winner of the wind power bid in the same year, led sector insiders to conclude that crony relations were at work here too.74

In response to losing these bids, the Chinese companies initially withdrew from the Turkish market, and Solargiga even contemplated closing its office in Türkiye entirely.75 Mingyang has been building hydropower plants in Türkiye since the 1980s but, after losing its bid, has limited its investment in Türkiye to real estate projects.76

In the 2020s, it became apparent that the YEKA bids in both solar and wind were not feasible. There were several external factors, such as the disruption of supply chains due to the pandemic and the Ukraine war, but generally speaking the winning offers were not financially realistic to begin with.77 Hanwha withdrew from the consortium in the solar plant project in 2019, before the pandemic began. Kalyon Group extended an offer instead to China Electronics Technology Group Corporation, a major Chinese SOE, but after communicating with Hanwha, the Chinese SOE only agreed to build a factory in Ankara to supply solar panels for the power plant Kalyon Group was obligated to build in Karapınar in Konya.78 Similarly, sector insiders told the authors that Siemens now wants to increase the price for the construction of the wind plant and, therefore, Kalyon is courting a Chinese company to replace its German partner in wind energy.79

Both elite and expert interviewees concurred that China assesses Türkiye as high-risk and is unlikely to commit to these large-scale investments. Chinese risk assessments owe much not just to Türkiye’s recent currency crisis but also to a lack of sufficient connections to play politics in the Turkish way. The fragmentation of the Turkish policymaking structure is perceived by Chinese firms as an inherent political risk. And state fragmentation causes frequent policy changes, such as the transition from YEKDEM to YEKA and, most recently, to unlicensed YEKA, that affect the size of planned investments. For example, after the same Turkish company won both the wind and solar bids, the YEKA policy changed once again to make it easy for bid winners to sell their shares.80

Meanwhile, even as the Turkish presidential bureaucracy was relying on crony relations with big capital, Turkish SMEs lobbied the ministerial bureaucracy to rethink their decision to impose antidumping measures specifically on the Chinese products, because the exclusion of Chinese technology from Türkiye’s domestic markets was driving prices up and causing an unfair monopoly by the pro-government business elite. The Ministry of Energy and Natural Resources was able to successfully modify the YEKA system to allow a larger number of smaller companies to share in government subsidies. In the latest YEKA bid, completed in 2021, thirty companies won solar plants around the country.

One lesson from the Turkish case is that Chinese firms prefer wholesale exit when they lack the political ability and skill to play local politics well. Instead of simply replacing the German and South Korean partners in the solar and wind consortiums when invited to do so, Chinese companies recalibrated their businesses in Türkiye and shifted instead to a focus on SMEs that are more sympathetic to Chinese goods and capital.

Having recalibrated their strategy to focus on an entirely different part of the Turkish system, these Chinese companies engage with Turkish SMEs on renewables in several ways. The first is to establish a special purpose acquisition company, more often called a SPAC, as a front company to financially support SMEs in the renewables sector. The Chinese SOE State Development and Investment Corporation also pursued this strategy on the Aegean coast to finance wind power investments of local SMEs.82 Another approach is to sell solar panels to hydropower plants run by big capital,83 since the latter is the only interest group in Türkiye that can currently offer above-the-market prices for Chinese goods due to the anti-dumping duties.

Turkish big capital, however, seems not entirely happy with SMEs’ access to Chinese products. The larger firms, by contrast, lack options: for instance, the factory that the large Turkish company that won both the solar and wind bids established in Ankara with a Chinese SOE only provides for that Turkish company’s own needs at a plant in Karapınar. Similarly, a Chinese SOE that signed an agreement with another pro-government Turkish conglomerate only provides for that Turkish firm’s plant in Bingöl.

Türkiye ended up, therefore, with contestation between China-aligned SMEs and big capital that defeated the early Chinese bids. But playing politics is still dispositive in AKP-ruled Türkiye, so these large conglomerates successfully lobbied to impose anti-dumping taxes specifically targeting Chinese products, leveraging the same political connections that had won them the wind and solar bids in the first place.84

Of course, there have been adaptations here too. Chinese companies faced the potential loss of market share because they were selling photovoltaic panels to individual Turkish SMEs. As a result, these SMEs now buy Chinese products via Malaysia instead of directly in order to bypass the anti-dumping duties and prolonged customs procedures.85 Türkiye is not able to impose anti-dumping duties on Malaysian imports because Malaysia, unlike China, has a trade agreement with Türkiye that precludes them.

This continuing Chinese presence via adaptation continues to rankle Türkiye’s political and big capital elites. Most recently, representatives of professional associations announced that European companies were planning to invest in Türkiye’s offshore wind power plants to challenge China’s near-monopoly in the sector.86 Concurrently, Türkiye’s Minister of Industry and Technology Mustafa Varank claimed in a press meeting that collaborating too much with China would lead to energy “dependency.”87 China has adapted to local realities by avoiding the kind of large-scale, high-visibility investment it prefers elsewhere in the region. But by cultivating a different part of the Turkish business ecosystem, it has made lemonade out of lemons in Türkiye while focusing its larger regional aspirations on other Middle Eastern countries and markets.

Lessons Learned

China’s presence in three Turkish sectors—ports, railways, and renewable energy—has changed dynamically in response to domestic and regional political and economic conditions.

In the renewable energy sector, especially, we have a counterintuitive finding in light of the widespread assumption that Chinese firms’ game is to seek crony opportunities with those closest to power. In Türkiye, China has found other business touch points. And it has adapted its investment strategy to the complexities it faced in linking to powerful domestic state-business coalitions. The crony relations protected by Türkiye’s presidential bureaucracy require well-honed informal relations with key actors in the sector. The China-Türkiye dialogues on energy that happened in the 2010s faded because the key actors, especially on the Turkish side, fell from grace. Consequently, Chinese companies failed to secure bids for large-scale investments but immediately switched strategies by dropping Türkiye from regional Green BRI networks that include other major regional countries (such as Egypt and the Gulf countries), recalibrating their Turkish business, and diversifying the range of putative partners. While Türkiye’s pro-government business elite has again begun to court Chinese capital in an effort to realize large investments in, for example, solar parks, Chinese SOEs continue to avoid these large investments and prefer instead to do business with the country’s SMEs. Besides, China may also reconsider alternative investment tools if there is a political gain on the horizon, as in the case of the Konya tramway project. This project appears to be closely connected to the high-level inner elite circle of the ruling party, offering opportunities for high-level political negotiations on an otherwise very sensitive topic, the Uyghur issue.

These cases demonstrate that Chinese adaptation to local conditions happens in diverse ways. The Turkish case is surprising in part because it flies in the face of popular assumptions from elsewhere in the world. Domestically, Chinese players have adapted to Türkiye’s local political economic environment in the last decade by investing in local, smaller-scale transportation and energy projects, mostly through consortiums instead of via the usual large standalone BRI projects. The bottom line from these Turkish stories is that there is considerable variation in Chinese responses to local stimuli across sectors and periods.

Notes

1 John Hurley, Scott Morris, and Gailyn Portelance, “Examining the Debt Implications of the Belt and Road Initiative From a Policy Perspective,” Center for Global Development, Policy Paper 121, March 2018, https://www.cgdev.org/publication/examining-debt-implications-belt-and-road- initiative-policy-perspective; and Nilgün Eliküçük Yıldırım, “Kuşak Ve Yol Girişiminin Finansmani: Çin’in Borç Tuzaği Mi? [Financing the Belt and Road Initiative: China’s Debt Trap?],” Alternatif Politika 12, no. 3 (October 2020): 621–643, https://alternatifpolitika.com/site/cilt/12/sayi/3/8-Elikucuk_Yildirim-Kusak-ve-Yol-Girisimi.pdf.

2 John Pomfret, “China’s Debt Traps Around the World Are a Trademark of Its Imperialist Ambitions,” Washington Post, August 28, 2018, https://www.washingtonpost.com/news/global-opinions/wp/2018/08/27/chinas-debt-traps-around-the-world-are-a-trademark-of-its-imperialist-ambitions/.

3 Tim Summers, “Negotiating the Boundaries of China’s Belt and Road Initiative,” Environment and Planning C: Politics and Space 38, no. 5 (2020): 809–813, https://doi.org/10.1177/2399654420911410b; Min Ye, The Belt Road and Beyond: State-Mobilized Globalization in China: 1998–2018 (New York, NY: Cambridge University Press, 2020); and Ivan Franceschini and Nicholas Loubere, Global China as Method (Cambridge, UK: Cambridge University Press, 2022), doi:10.1017/9781108999472.

4 Todd H. Hall and Alanna Krolikowski, “Making Sense of China’s Belt and Road Initiative: A Review Essay,” International Studies Review 24, no. 3 (September 2022): 3, https://doi.org/10.1093/isr/viac023.

5 Dragan Pavlićević and Nicole Talmacs, “Answering the ‘China Question’: Local Responses to Global China,” in The China Question: Contestations and Adaptations, eds. Dragan Pavlićević and Nicole Talmacs (Singapore: Palgrave Macmillan, 2022), 3, https://doi.org/10.1007/978-981-16-9105-8.

6 The total of BRI investments in Türkiye is very difficult data to find since traditional institutions such as the Ministry of Trade stopped gathering data following the transition to a presidential system. The Turkish Statistics Institution does not always provide specialized statistics such as foreign direct investment data. The numbers mentioned in this report were provided by a ministerial bureaucrat. Authors’ interviews, summer 2022.

7 Bülent Gökay, Turkey in the Global Economy: Neoliberalism, Global Shift and the Making of a Rising Power (Montreal: McGill-Queen’s University Press, 2021), 170.

8 Authors’ interviews with business actors, spring 2022.

9 Authors’ interviews with business actors, spring 2022.

10 Ceren Ergenç and Derya Göçer, “BRI Engagement and State Transformation in the Middle East,” in The China Question: Contestations and Adaptations, eds. Dragan Pavlićević and Nicole Talmacs (Singapore: Palgrave Macmillan, 2022), 93–112, https://doi.org/10.1007/978-981-16-9105-8.

11 Dış Ekonomik İlişkiler Kurulu (Foreign Economic Relations Board), Turkey-China Business Council, “China’s Belt and Road Initiative, Aftermath of the COVID-19 Pandemic, Opportunities, Risks and Suggestions for Turkey,” accessed July 15, 2022, https://www.deik.org.tr/contents-fileaction-29061; “Türkiye-Çin Ekonomik İlişkileri [Turkey-China Economic Relations] 2020 and 2022,” TÜSİAD (Turkish Industry and Business Association), accessed September 20, 2022, https://tusiad.org/en/reports/item/11040-economic-relations-between-tuerkiye-and-china; and authors’ interviews, summer 2022 .

12 Burak Gürel and Mina Kozluca, “Chinese Investment in Turkey: The Belt and Road Initiative, Rising Expectations and Ground Realities,” European Review 30, no. 6: 806–834, https://doi.org/10.1017/S1062798721000296

13 Ergenç and Göçer, “BRI Engagement and State Transformation.”

14 Gürel and Kozluca, “Chinese Investment in Turkey,” 807.

15 Turgut Özal led Türkiye during the transition of the Central Asian states to a post-Soviet era and encouraged bilateral and multilateral relations, including transportation investments. Muhittin Ataman, “Leadership Change: Özal Leadership and Restructuring in Turkish Foreign Policy,” Alternatives: Turkish Journal of International Relations 1, no. 1 (2005): 134–135.

16 Igor Torbakov, “Ankara’s Post-Soviet Efforts in the Caucasus and Central Asia: The Failure of the Turkic World Model,” Eurasianet, December 26, 2002, https://eurasianet.org/ankaras-post-soviet-efforts-in-the-caucasus-and-central-asia-the-failure-of-the-turkic-world-model.

17 China Railway Construction Corporation Limited, “Turkey Istanbulì Ankara Railway Reconstruction Project,” February 19, 2008, https://english.crcc.cn/art/2008/2/19/art_21578_2435555.html.

18 For the text of the agreement, see TCDD (Turkish State Railways), “T.C. Ulaştırma Bakanlığı ve Çin Halk Cumhuriyeti Demiryolu Bakanlığı arasında Demiryolu İşbirliği Konusunda Mutabakat Zaptı [Memorandum of Understanding on Railway Cooperation between the Ministry of Transport of the Republic of Türkiye and the Ministry of Railway of the People’s Republic of China]”, https://static.tcdd.gov.tr/webfiles/userfiles/files/1141.doc.

19 Geoffrey C. Chen and Charles Lees, “Growing China’s Renewables Sector: a Developmental State Approach,” New Political Economy 21, no. 6 (2016): 574–586, https://doi.org/10.1080/13563467.2016.1183113.

20 Steve Griffiths and Benjamin K. Sovacool, “Rethinking the Future Low-Carbon City: Carbon Neutrality, Green Design, and Sustainability Tensions in the Making of Masdar City,” Energy Research & Social Science 62 (April 2020), https://doi.org/10.1016/j.erss.2019.101368; and Clemens Hoffmann and Ceren Ergenç, “A Greening Dragon in the Desert? China’s Role in the Geopolitical Ecology of Decarbonisation in the Eastern Mediterranean,” Journal of Balkan and Near Eastern Studies 25, no. 1 (2023), https://doi.org/10.1080/19448953.2022.2131079.

21 Ossman Elnaggar, “China’s Growing ‘Green’ Engagement in MENA,” Diplomat, September 19, 2019, https://thediplomat.com/2019/09/chinas-growing-green-engagement-in-mena/.

22 Christoph Nedopil et al., “What China’s New Guidelines on ‘Green Development’ Mean for the Belt and Road,” China Dialogue, August 18, 2021, https://chinadialogue.net/en/business/what-chinas-new-guidelines-on-green-development-mean-for-the-belt-and-road/.

23 Sırma Altun and Ceren Ergenç, “The EU and China in the Global Climate Regime: a Dialectical Collaboration-Competition Relationship,” Asia-Europe Journal, February 2023, https://doi.org/10.1007/s10308-023-00664-y

24 Ergenç and Göçer, “BRI Engagement and State Transformation.”

25 Ergenç and Göçer, “BRI Engagement and State Transformation.”

26 Malak Altaeb, “Turkey Finally Ratified the Paris Agreement. Why Now?” Middle East Institute, October 27, 2021, https://www.mei.edu/publications/turkey-finally-ratified-paris-agreement-why-now#.

27 Laura Pitel, “Turkey’s New Power Plant Exposes ‘Huge Contradictions’ of Net Zero Pledge,” Financial Times, July 27, 2022, https://www.ft.com/content/1aa8c98b-ff80-461b-bad6-b3232377f904.

28 Ergenç and Göçer, “BRI Engagement and State Transformation.”

29 Authors’ interviews with state officials, summer 2022 (all state officials interviewed for this study are working in Türkiye’s state institutions).

30 Utikad, “Bir bakışta: Bakü-Tiflis-Kars demiryolu projesi [At a Glance: Baku-Tbilisi-Kars Railway Project],” October 19, 2021, https://www.utikad.org.tr/Detay/Sektor-Haberleri/10325/bir-bakista:-baku-tiflis-kars-demiryolu-projesi.

31 “Türkiye’s Multilateral Transportation Policy,” Ministry of Foreign Affairs, Republic of Türkiye, accessed September 22, 2022, https://www.mfa.gov.tr/turkey_s-multilateral-transportation-policy.en.mfa.

32 Gökçe Özsu and Ferruh Mutlu Binark, “Representation of the ‘Belt and Road Initiative’ in Turkish Mainstream Newspapers,” Communication and the Public 4, no. 4 (2019): 300, https://doi.org/10.1177/2057047319895448.

33 James Jay Carafano, “Central Asia’s Middle Corridor Gains Traction at Russia’s Expense,” GIS, August 29, 2022, https://www.gisreportsonline.com/r/middle-corridor/; Majorie van Leijen, “4 Months of War and Sanctions – an Assessment of the Alternatives,” RailFreight.com, June 17, 2022, https://www.railfreight.com/beltandroad/2022/06/17/4-months-of-war-and-sanctions-an-assessment-of-the-alternatives/.

34 Authors’ interviews with state officials and business actors, summer 2022.

35 Gökçen Tuncer, “Pire Limanı’na rakipti, 10 yılda ancak bir dalgakıran inşa edildi: 45 yıllık proje Çandarlı Limanı neden bitemiyor? [It Was a Rival to Piraeus Port, but Only One Breakwater Was Built in ten years: Why the Forty-five-Year Project Çandarlı Port Cannot Be Finished],” Independent Türkçe, June 30, 2021, https://www.indyturk.com/node/380761/ekonomi%CC%87/pire-liman%C4%B1na-rakipti-10-y%C4%B1lda-ancak-bir-dalgak%C4%B1ran-in%C5%9Fa-edildi-45-y%C4%B1ll%C4%B1k-proje.

36 Authors’ interviews with state officials and business actors, spring and summer 2022; and TÜSİAD, “Türkiye-Çin Ekonomik İlişkileri [Turkey-China Economic Relations]”; this comparison between maritime infrastructure and experience on the two shores of the Aegean is also reflected in the mainstream academic discourse on the topic; Necmettin Mutlu, “Kuşak ve Yol Girişimi (KYG) Projelerinin İncelenmesi; and Türkiye İçin Öneriler [Analysis of Belt and Road Initiative (BRI) Projects: Suggestions for Türkiye],” Asya Araştırmaları Uluslararası Sosyal Bilimler Dergisi 5, no. 2 (2021): 129–150.

37 Authors’ interviews with state officials, summer 2022.

38 Authors’ interviews with state officials, spring 2022.

39 “Corporate,” Kumport, accessed August 13, 2021, https://www.kumport.com.tr/en-US/corporate/627405.

40 “Chinese Consortium Buys into Turkish Port With USD 940 Million Investment,” Investment Office of the Presidency of the Republic of Türkiye, September 27, 2015, https://www.invest.gov.tr/en/news/news-from-turkey/pages/280915-cosco-pacific-buys-turkish-kumport.aspx.

41 “Cosco Pacific to Acquire Istanbul Container Terminal for 940m,” Freight Waves, September 17, 2015, https://www.freightwaves.com/news/cosco-pacific-to-acquire-istanbul-container-terminal-for-940m.

42 Altay Atlı, “Turkey’s Relations With China and the Belt and Road Initiative,” in Routledge Handbook on China-Middle East Relations, ed. Jonathan Fulton (London: Routledge, 2022), 160.

43 Authors’ interviews with government officials and business actors from Türkiye and China, summer 2022.

44 Authors’ interviews with state officials, summer 2022.

45 Authors’ interviews with state officials, summer 2022.

46 Authors’ interviews with state officials, spring and summer 2022.

47 Authors’ interviews with state officials and business actors, spring 2022.

48 Authors’ interviews with state officials and business actors, spring 2022.

49 Mustafa Bildircin, “Demiryolları borç çıkmazında [Railways in a Debt Impasse],” BirGün, April 4, 2022, https://www.birgun.net/haber/demiryollari-borc-cikmazinda-382812.

50 Authors’ interviews with state officials and business actors, spring 2022.

51 Authors’ interviews with business actors, January 2023.

52 Authors’ interviews with business actors involved in Kumport purchase and management. The numbers here reflect the expectations around that particular sale.

53 Hoffmann and Ergenç, “A Greening Dragon.”

54 “Enerji Görünümü 2021 [Energy Outlook 2021],” Türkiye Sınai Kalkınma Bankası, November 2021, https://www.tskb.com.tr/i/assets/document/pdf/enerji-sektor-gorunumu-2021.pdf.

55 İbrahim Akdoğan and Birol Kovancilar, “Avrupa Birliği ve Türkiye’de Çevre Dostu Yenilenebilir Enerji Politikalarının Teşvik Türleri Açısından Değerlendirilmesi [Evaluation of Environmentally Friendly Renewable Energy Policies in terms of Incentive Types in the European Union and Türkiye],” Yönetim ve Ekonomi Dergisi 29, no. 1 (2022): 69–91, https://doi.org/10.18657/yonveek.1004872.

56 Authors’ interviews with NGOs, summer 2022.

57 Ergenç and Göçer, “BRI Engagement and State Transformation.”

58 Authors’ interviews with NGOs, spring 2022.

59 Authors’ interviews with NGOs, spring 2022.

60 Authors’ interviews with state officials, summer 2022.

61 Authors’ interviews with state officials, summer 2022.

62 Authors’ interviews with state officials, summer 2022.

63 Authors’ interviews with NGOs, spring 2022.

64 Nedopil et al., “China’s New Guidelines on Green Development.”

65 Ceren Ergenç, “China’s Green Investment in the BRI Countries: The Case of Turkey,” Middle East Institute, January 14, 2023, https://www.mei.edu/publications/chinas-green-investment-bri-countries-case-turkey.

66 Authors’ interviews with state officials, summer 2022.

67 Authors’ interviews with state officials, summer 2022.

68 Authors’ interviews with state officials, summer 2022.

69 Merve Tahiroğlu, “Snapshot – Cronies in Crisis: Economic Woes, Clientelism, and Elections in Turkey,” Project on Middle East Democracy, October 28, 2022, https://pomed.org/publication/snapshot-cronies-in-crisis-economic-woes-clientelism-and-elections-in-turkey/.

70 Authors’ interviews with state officials, business actors, and NGOs, summer 2022.

71 Türkiye Sınai Kalkınma Bankası, “Enerji Görünüm [Energy Outlook]”; “Turkey Adds 1 GW to Its Renewable Energy Capacity,” Fastener Eurasia, July 20, 2019, https://fastenereurasia.com/?h1149/turkey-expands-its-renewable-energy-capacity-.

72 Authors’ interviews with state officials and business actors, summer 2022.

73 “Karapınar YEKA ihalesi sonuçlandı [Karapınar YEKA Tender Finalized],” Dünya, March 20, 2017, https://www.dunya.com/sektorler/enerji/karapinar-yeka-ihalesi-sonuclandi-haberi-354530.

74 Authors’ interviews with state officials and business actors, summer 2022.

75 Authors’ interviews with state officials and business actors, summer 2022.

76 “CMEC Dünyadaki İlk Tanıtım Toplantısını İstanbul’da Gerçekleştirdi [CMEC Organized Its First Introduction Meeting in Istanbul],” Yeni Enerji, October 11, 2013, https://www.yenienerji.com/haberler/cmec-dunyadaki-ilk-tanitim-toplantisini-istanbul-da-gerceklestirdi.

77 Authors’ interviews with state officials and business actors, summer 2022.