Kazakhstan is the largest producer and exporter of uranium globally, mining and exporting more than 40 percent of the world’s supply. Up to now, it has been the major supplier for Russia and before that the Soviet Union.

But today, other countries are becoming involved, including Western countries such as the United States, which wants to limit its imports of Russian-processed uranium, and China, which hopes to transition from the coal-fired production of electricity to a heavy reliance on nuclear power plants over the next decade. That, in turn, has triggered a geo-economic competition that is rapidly growing into a geopolitical one—given that, at least in the short term, Kazakhstan may not be able to increase exports to one country without reducing them to another, or at least holding the latter roughly constant.

Two decisions in Astana in May 2023 have both highlighted and exacerbated the situation, though they are likely to be dismissed by some as yet another example of Astana’s efforts to maintain a balance between Moscow and Beijing. In the first decision, the Kazakhstani authorities allowed a Russian firm to take control of a uranium mine. Senior officials at Kazatomprom, Kazakhstan’s atomic industry agency, were opposed; and several of them publicly resigned in the wake of that decision (Kaztag.kz, May 17). They had compelling reasons to do so: Once this mine is fully operational, Kazatomprom’s control of the uranium industry in Kazakhstan will be reduced from its current 50-percent dominance and will ensure that Moscow can acquire at least some of the supplies it needs.

Currently, Russia uses more than twice as many tons of uranium as its domestic mines produce, 5,500 tons against 2,500 for last year (World-nuclear.org, accessed May 31, [1]; [2]). That will also have the effect of bypassing Western sanctions at a time when the US is trying to tighten them (Radio Free Europe/Radio Liberty, May 16).

The second, and likely more important reason given the length of time it will take before Russia can make the mine operational, involves Astana agreeing to sell Beijing more than 30 tons of atomic power station fuel over the coming decades to allow China to shift from coal to atomic power by the mid-2030s (Kazatomprom.kz, Kapital.kz, May 31).

To meet this commitment, Kazakhstan has decided to increase its production of uranium and processed uranium components by more than 50 percent, a dramatic turnaround given its statement two years ago that it was cutting production by 10 percent to maintain prices given the declining demand for nuclear power plant fuel. Given that China is even more dependent than Russia on imported uranium—Beijing produces little of its own—this will link those two countries more tightly together in ways at least as important as the construction of new rail routes (EADaily.com, May 26).

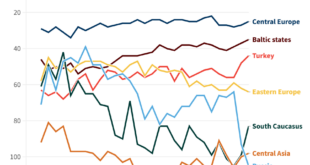

At present, China and Russia remain the two largest purchasers of Kazakhstani uranium. However, their competition for this increasingly scarce resource is growing, and that is further complicated by the fact that Astana is exporting processed uranium to other countries as well, albeit in smaller amounts. Among these are Uzbekistan, Turkey, the Netherlands, the United Kingdom, Japan, Kyrgyzstan, Georgia and Afghanistan (Zakon.kz, May 22). All are likely to be affected by the intensified competition between Russia and China for Kazakhstan’s uranium.

These latest moves highlight three important realities about Central Asia and its relationship to outside actors that are often overlooked. First, China has interests in the region that are far larger than just building transportation routes to carry goods across and from Europe. Most, but not all, discussions not surprisingly focus on this. (See, for example, EDM, April 10, May 24.) Uranium is one of them, but it is hardly the only one. China also looks to Central Asia as a key market for Chinese-produced consumer goods and as a source of various minerals and, increasingly, water (Ritmeurasia.org, November 23, 2011; Cabar.asia, July 29, 2021).

Second, Beijing’s interest in these additional factors will only add to the differences it has with Moscow on how to deal with the Central Asian countries. Indeed, the Kremlin may be more worried about Chinese involvement within these countries on behalf of its interests than it is by China’s promotion of rail and highway routes bypassing Russia. The former will cement these countries far more closely to Beijing than the latter, which, after all, is directed not primarily at Central Asian markets but at European ones. Consequently, while Moscow may complain loudly about all the projects that seek to route goods “around Russia” rather than through it, Beijing’s plans with Astana’s uranium supplies will matter far more in tying countries of the region to China rather than to Russia—all the more so due to Moscow’s rapidly declining influence within these countries (see EDM, November 15, 2022).

And third, the focus of outsiders on the resources of the Central Asian countries is a reminder of two things that seem to be forgotten even more often than the impact of Chinese interests and actions in the countries of the region. On the one hand, the Central Asian states have significant resources that make them critical to the world at-large. Kazakhstan is a superpower in terms of raw and processed uranium—not just one of “the stans” as some often treat it. And on the other, what happens in Central Asia as a result of these abundant resources will have a major impact on many countries, including those far away whose elites may not be fully aware of how these lines of influence work. For them, tensions over Kazakhstan’s uranium and which countries will have access to it should be a wake-up call for them to pay closer attention to a region that, in recent years, has been all too often neglected.

Eurasia Press & News

Eurasia Press & News