Days after welcoming Secretary of State Antony Blinken as part of efforts to reset relations with the U.S., Saudi Arabia turned its attention to boosting ties with one of Washington’s main competitors: China, says Bloomberg.

A Bloomberg report — Saudi Arabia Looks to China for Business as US Influence Wanes — said on June 13, 2023:

For the past two days, the Saudi capital has played host to the largest ever Chinese-Arab business gathering.

In the conference, Saudi officials spoke of integrating China into the Arab region and Chinese executives said they stood ready to “de-Americanize” the world’s top oil exporter. At lunch they mingled over a fusion of dim sum and local mutton.

“The time has come, in my view, for China to be a principal investment partner in the Arab world’s development drive,” Saudi Investment Minister Khalid Al-Falih said in a keynote address on Sunday, suggesting the Arab economic powerhouse act as a “bridge” to the rest of the region.

As the Middle East has become less of a strategic priority for the U.S., it has left a political and economic vacuum in the region that its rival is rushing to fill.

The conference was attended by 2,000 Chinese business delegates.

The Bloomberg report said:

Crown Prince Mohammed bin Salman, Saudi Arabia’s de facto ruler shortly referred as MBS, began his tenure by courting his traditional allies, embarking on a grand tour of the U.S. and building ties with Donald Trump’s administration. But relations soured after the killing of a Washington Post columnist by Saudi agents in 2018.

Relations have since improved, with Blinken’s visit the latest sign of progress, though deep disagreements remain over issues including China’s forays into the Middle East, particularly in defense and security.

Having failed to influence American policy on Iran’s nuclear program or elicit U.S. help in fending off attacks by Iranian-backed militia, MBS turned to Chinese mediation to restore ties with his Gulf rival instead.

It said:

Business appears to be the next step in that outreach.

“We have been told Saudi is trying to ‘de-Americanize’ and they want to embrace Chinese technology,” said Nuo Shi, senior investment manager at the Hong Kong-based North Beta International Asset Management Limited. “They would not be able to pull off the grand vision by themselves and that’s why we are here.”

China, the world’s second-largest economy, is already the number one buyer of Saudi oil, making it the country’s largest trading partner with transactions worth $116 billion last year.

Nevertheless, the Gulf’s top sovereign wealth funds have traditionally tended to deploy their investments in the U.S. and Europe, where markets are deep and rules transparent.

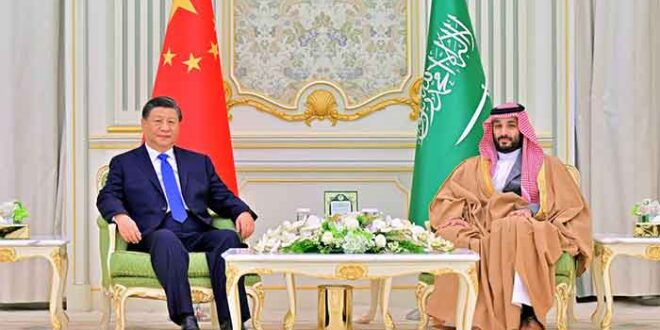

Since President Xi Jinping’s landmark visit to the kingdom in December, however, Chinese executives have been emboldened to seek out Gulf investment and a potential role in Vision 2030, MBS’s plan to transform the economy.

Nuo travelled to Riyadh with several colleagues and the heads of seven Chinese tech companies in which her firm has stakes. They planned to ask Saudi Arabia’s sovereign wealth fund to invest in a new $200 million fund and explore the possibility of bringing Chinese tech to the kingdom.

Karim AlWadi, co-founder of Beltway Group which co-invests with Chinese companies in Middle Eastern infrastructure projects, came to persuade Gulf sovereign wealth funds to look for opportunities further east.

“My argument is that U.S. money is pulling out of China for political reasons,” said the Syrian-Russian entrepreneur who has lived in China for 22 years. “Now is the best time for Arab money to get into China because Arabs missed the first stage of the Chinese miracle.”

A Reuters report — Saudi Arabia seeks cooperation with China, ‘ignores’ Western worries — said on June 11, 2023:

Saudi Arabia wants to collaborate, not compete, with China, the kingdom’s energy minister declared on Sunday, saying he “ignored” Western suspicions over their growing ties.

As the world’s top oil exporter, Saudi Arabia’s bilateral relationship with the world’s biggest energy consumer is anchored by hydrocarbon ties. But cooperation between Riyadh and Beijing has also deepened in security and sensitive tech amid a warming of political ties – to the concern of the U.S.

Prince Abdulaziz bin Salman said: “We do not have to be facing any choice which has to do with (saying) either with us or with the others.”

Oil Deals

The Reuters report said:

In March, state oil giant Saudi Aramco announced two major deals to raise its multi-billion dollar investment in China and bolster its rank as China’s top provider of crude.

They were the biggest announced since Chinese President Xi Jinping’s visit to Saudi Arabia in December where he called for oil trade in yuan, a move that would weaken the dollar’s dominance.

“Oil demand in China is still growing so of course we have to capture some of that demand,” Prince Abdulaziz said.

The two nations’ momentum has also raised prospects for a successful conclusion to negotiations for a free trade deal between China and the Saudi Arabia-dominated Gulf Cooperation Council (GCC), ongoing since 2004.

Saudi Investment Minister Khalid Al Falih said any agreement would have to protect emerging Gulf industries as the region starts to diversify towards non-oil economic sectors.

“We need to enable and empower our industries to export, so we hope all countries that negotiate with us for free trade deals know we need to protect our new, emerging industries,” Falih said, adding he hoped a deal would soon be struck.

China And Arab Countries Are Swiftly Expanding Economic And Trade Cooperation

Other media reports said:

China and Arab countries are swiftly expanding economic and trade cooperation in all fields, as more than 3,500 Chinese and Arab officials and business representatives gathered in Riyadh from Sunday to Monday for a major business conference, in which dozens of deals worth billions of dollars were inked.

The business deals and great enthusiasm for cooperation seen at the Arab-China Business Conference offered the latest sign of closer diplomatic and economic ties between China and Arab countries, following a slew of recent major developments, including the first China-Arab States Summit at the end of 2022 and China’s contribution to the agreement on the resumption of diplomatic ties between Saudi Arabia and Iran.

The increasingly close ties between China and Arab countries have drawn widespread global attention, as well as criticism from some Western countries, particularly the U.S., which has tried to dominate the Arab world for decades.

On the first day of the conference, a total of 30 investment agreements worth $10 billion were signed, covering a wide range of sectors, including technology, renewables, agriculture, real estate, minerals, supply chains, tourism, and healthcare.

The deals include a $5.6 billion agreement between Saudi Arabia’s Investment Ministry and Chinese carmaker Human Horizons for a joint venture and a $266 million deal signed by Saudi Arabia with Hong Kong-based Android developer Hibobi Technology for tourism and other apps, media reports showed.

The conference focused on 16 industry sectors, including finance, agriculture, mining, artificial intelligence and e-commerce.

Highlighting this great interest among Arab countries, several Arab officials on Monday extended an invitation to Chinese firms to invest in their countries. Speaking at the event, Abdulla bin Adel Fakhro, Bahrain’s minister of commerce and industry, emphasized the importance of collaboration with China, noting that it is a very important player in their future industrial strategy.

While both China and Arab countries are seeking to further boost win-win cooperation, the U.S. is reportedly concerned about the deepening cooperation between Riyadh and Beijing in security and sensitive high-tech sectors.

On Sunday, when asked about U.S. criticism of Saudi Arabia’s ties with China, Saudi Energy Minister Prince Abdulaziz bin Salman said, “I totally ignore it.”

“We came to recognize the reality of today that China is taking, had taken a lead, will continue to take that lead. We do not have to compete with China, we have to collaborate with China,” he said, “We are Saudi Arabia, we do not have to be engaged in what I call a zero-sum game. We believe that there are so many global opportunities.”

“It is a thinly veiled jab at those who want Arabs to choose sides; it would not happen. Here, he speaks for all Arabs,” Hashem said of the Saudi minister’s remarks.

Last week, a delegation from the Arab League visited Northwest China’s Xinjiang Uygur Autonomous Region and said that allegations of “ethnic genocide” and “religious persecution” are completely false.

Egypt To Abandon Dollar In Trade With BRICS

Another media report said:

Egypt, a key African economy, is planning to shift away from the U.S. dollar in mutual trade with several member states of the BRICS economic bloc, Egyptian Supply Minister Ali Moselhy said Monday, as quoted by Reuters.

According to Moselhy, Egypt is seeking to use local currencies to pay for its imports from India, China, and Russia – key members of the BRICS group, which also includes Brazil and South Africa.

“Nothing of the sort has been implemented but there are discussions so that we can trade in local currencies like India, Russia or China,” Moselhy told the agency.

The BRICS group makes up 40% of the world’s population and almost a third of the global economy. The bloc members have recently outpaced the G7 in terms of economic growth.

In April, 19 countries expressed interest in joining BRICS, which is gearing up to hold its 15th annual summit in South Africa over August 22-24. The United Arab Emirates, Argentina, Algeria, Egypt, Bahrain, Indonesia, Saudi Arabia, and Iran are among the countries that have formally requested membership.

Egypt is currently trying to buoy its struggling economy, which has been dragged down by a notable decline in revenues from tourism and a surge in commodity prices. Geopolitical tensions have also reportedly prompted foreign investors to pull about $20 billion out of Egypt’s financial markets.

The nation has experienced a sharp surge in inflation over the last year following several waves of currency devaluations, a prolonged shortage of foreign currency, and continuing delays in procuring imports.

Egypt has recently agreed on a $3 billion deal with the International Monetary Fund (IMF), while its Gulf allies have also pledged to come to Cairo’s aid with billions in investments.

Bloomberg earlier reported, citing Moselhy, that India was providing Egypt with a credit line of unspecified size. However, the minister himself denied the claim in an interview with Reuters.

Eurasia Press & News

Eurasia Press & News