The Reserve Bank of India (RBI) issued a circular on 19 May 2023 notifying the withdrawal of INR 2000 denomination banknotes from circulation. This high-value banknote—introduced in November 2016 to meet the immediate currency requirement following the demonetisation—although being withdrawn from circulation, will continue to be treated as legal tender.

The INR 2000 note served its purpose of mitigating the currency crunch following the demonetisation of INR 500 and INR 1000 banknotes and was taken out of printing in 2018-19. Unlike the calamity that was the demonetisation of 2016, the withdrawal of notes this time does not leave the public in the lurch, giving them a window till September 30 to deposit or exchange their holding of INR 2000 notes.

A discussion tracing the divergence of this withdrawal from demonetisation is pertinent. On 8 November 2016, banknotes of denomination INR 500 and INR 1000, called specified bank notes (SBNs), which accounted for 86.9 percent of currency in circulation, were decided to be demonetised. It was the ultimate manoeuvre in a series of operations targeted at reducing corruption, black money, and terror financing and ushering in an era of greater digitisation and formalisation of the economy. The crucial differentiating factor this time is the modus operandi of withdrawal of notes from the system, as well as the status as legal tender of the banknotes in question. Demonetisation was a swift strike on black money and counterfeit currency whereas INR 2000 notes are being phased out of the system, while still being considered as legal tender.

What has brought relief to most analysts and economists is the stark difference in the percentage volume of INR 2000 notes, as compared to INR 500 and INR 1000 notes in 2016. As of end-March, 2023, INR 2000 notes constitute only 10.8 percent of the entire currency in circulation, standing at INR 3.62 trillion, in value. A macroeconomic impact assessment of demonetisation showed that the overall effects of demonetisation were transient and most shocks dissipated by February-March, 2017. Gross Value Added (GVA) growth was affected in the cash-intensive industries (construction, real estate, etc.), while headline inflation was mostly unaffected. There was a huge injection of liquidity into the banking system with the return of SBNs, leading to a significant lowering of bank deposits and lending rates. The export sector which relies heavily on MSMEs, faced a productivity slowdown with demonetisation, as they primarily depend on cash for their working capital requirements. The move was successfully targeted at greater formalisation of the economy and broadening of the tax base, as it led to a rise in personal income tax collection from INR 2.87 trillion in 2015-16 to INR 6.96 trillion in 2021-22.

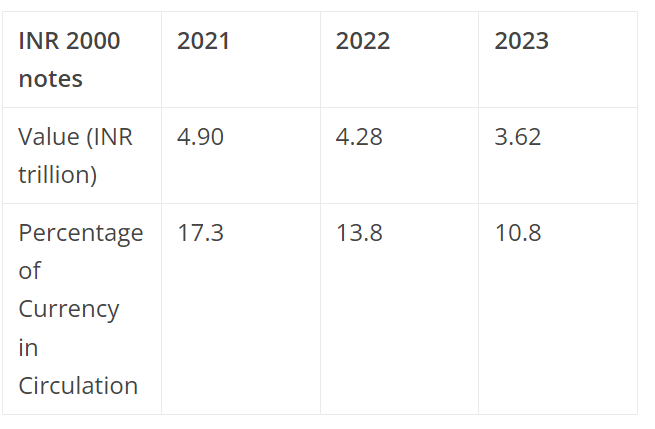

Table 1: Banknotes in circulation as on end-March

No equivalence drawn

The withdrawal of INR 2000 notes is driven by RBI’s Clean Note Policy which falls under the domain of the Central Bank, as the issuer of currency. The Clean Note Policy deals with removal of soiled notes and torn notes and with the maintenance of the physical condition of banknotes, in general. Thus, the removal of INR 2000 notes from circulation appears to be a routine RBI action under its currency wing, as well as an apt measure, since INR 2000 notes have met their obligation of remonetising the economy. Therefore, even if the dissimilarity in motivation is ignored, the immense difference in the scale of the two operations raises the question of whether they are comparable actions.

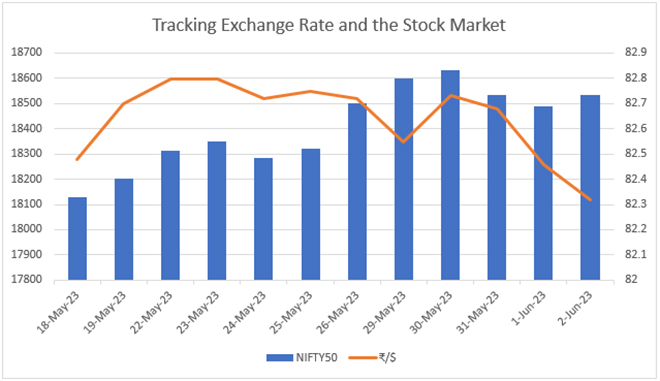

Fig. 1: Tracking exchange rate and the NIFTY50 Index after the notification to withdraw INR 2000 notes

A preliminary screening of the exchange rate shows that the rupee depreciated as a reaction to the RBI’s circular, but soon strengthened itself against the US dollar. Similarly, the NIFTY50 Index has developed an upward momentum and closed at a strong 18,500+ benchmark, two weeks after RBI declared the withdrawal of the magenta notes. Traded value on 22 May was INR 577.91 million compared to INR 550.84 million on 19 May. As on 2 June, traded value stands at INR 591.50 million. No major swings in the currency suggests that big deviations in expectations have not been formed and there is no external pressure on the rupee following the change. Similar conclusions can be drawn about the revision in expectations in the stock market, where the ongoing rally initiated around 18 May, a part of a large upswing that developed towards the end of the previous fiscal year. The markets do not seem to portray any reshaping of expectations as efficiency in the stock and foreign exchange markets tends to adjust quickly.

The trend in traded value, on the other hand, is indicative of retail investors shifting their portfolio towards securities in the cash segment, as they are depositing their INR 2000 notes in their savings accounts. It is plausible that the overall bullish sentiment was further aided by the compulsion to reduce household cash holdings, as regular investors have a tendency to chase higher returns and equities on average outperform the nominal bank returns.

A vital problem daunting the economy in the post-demonetisation period was the plea of the daily wage earners, whose payments were either withheld or made in demonetised notes. This obviously directly led to productivity loss but also severely affected the well-being of the workers and the health of the MSME sector, in general. In the present circumstance, this situation is a lot less likely since INR 2000 is almost six-fold that of the average daily wage in India. Although not completely inadmissible, it would be burdensome on the end of the employers to pay out weekly wages. Moreover, with the spread-out currency deposit and exchange window, it is also more convenient for workers to accept the INR 2000 notes, especially since it continues to be legal tender.

At the outset, the predominant effect that was anticipated and has already materialised, is the injection of liquidity into the banking system. Using pure economic jargon, currency flowing back to the central bank will not have any effect on the monetary base, which through the multiplier effect determines the money supply (M3). A deeper look into this multiplier mechanism necessitates the decomposition of the money multiplier into the currency-deposit ratio and the reserve-deposit ratio, both of which inversely affect the multiplier. While the reserve-deposit ratio is a Central Bank-determined parameter, the currency-deposit ratio is endogenous and fluctuates highly with public sentiment.

It is not absurd to assume that the public will turn precautionary, recollecting the long queues and multiple bank visits post-demonetisation, and will prefer to have their INR 2000 notes deposited. Moreover, with the proliferation of digital payments, and the average ticket size of P2P UPI transactions around INR 2700, it is more convenient and prudent to switch to online payments. Thus, with a dipping currency-deposit ratio, we are looking at a more potent money multiplier which will unambiguously lead to higher money supply.

Following conventional wisdom, an expansionary monetary shock will lead to short-term lowering of banking rates, promoting an already robust credit market in the economy. Although lowering of interest rates does not necessarily translate into higher investment, it is expected to grow but at a subtle pace. The growth rate is unlikely to exhibit any major variation since the INR 500 note, which dominates CIC, is prevalent in the economy and will not substantially alter consumption behaviour. It is irrational to expect all of the INR 3.62 trillion to find its way back home to RBI since leakages are common with high-denomination banknotes. An estimated INR 800 billionhas made its way back into the banking system over a week after the banks initiated the withdrawal procedure. INR 2000 notes are the most likely to be used in the black economy and wrongdoers will be compelled to dispose of a certain fraction of their cash holdings to avoid legal action. This would imply a reduction in the liabilities of the Central Bank, the surplus from which would be transferred to the government.

Although poles apart from demonetisation, the public sentiment developed in 2016, can play a crucial role in the outcomes of the phasing out of the INR 2000 notes. Most shocks are expected to be short- to medium-run, mostly imperceptible and minuscule. The Clean Note Policy justifies this operation but it is unconvincing that the highest denomination in the country has been subject to the most wear and tear. Small-denomination bank notes of INR 10 and INR 20 exhibit the highest velocity and should come under the purview of the CNP prior to INR 2000 notes. Unless, the Clean Note Policy is directed at a clean economy, to abate future clandestine, black economy transactions.

Eurasia Press & News

Eurasia Press & News