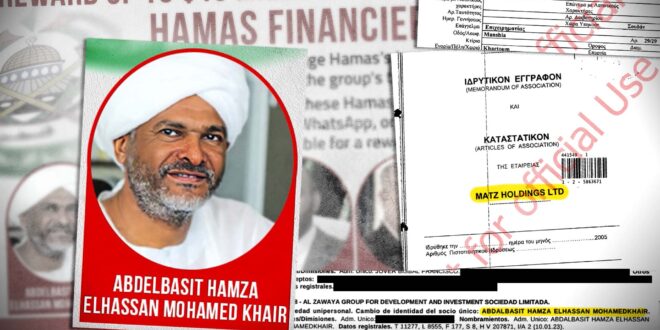

Sudanese businessman Abdelbasit Hamza — whose company holdings feature in Cyprus Confidential documents — has been accused of being “a central figure in Hamas’ investment portfolio.”

An accused financier of Hamas has extensive business ties in Europe and owns a stake in a lucrative Cyprus firm that mines Egyptian gold, a new investigation by the International Consortium of Investigative Journalists and the Israeli news outlet Shomrim reveals.

Sudanese businessman Abdelbasit Hamza, an ally of former Sudanese President Omar al-Bashir, was sanctioned by the United States in the aftermath of the Oct. 7 Hamas terror attack on Israel for managing Hamas’ investments and for his involvement in the transfer of almost $20 million to the organization, including funds sent directly to a senior Hamas financial officer.

The U.S. Treasury Department accused Hamza of “longstanding ties to terrorism financing,” including past links with companies connected to al-Qaida and Osama bin Laden. He was also sanctioned by the United Kingdom in November.

Leaked documents analyzed by ICIJ and Shomrim reveal Hamza’s longstanding ownership interest in the Cyprus holding company in partnership with a Swiss firm, and that the company’s assets totaled roughly $35 million as of 2018. Hamza has not been sanctioned by the European Union.

The files come from the Cyprus Confidential leak, a trove of more than 3.6 million documents analyzed by ICIJ and 68 media partners, including Shomrim, as part of a recent global investigation.

Udi Levy, the former head of the Mossad unit that tracked the financing of the U.S.-designated terrorist organization, told Shomrim that Hamza was “a central figure in Hamas’ investment portfolio.” Levy said that the fact that the U.S. and Israel did not disrupt Hamza’s efforts earlier represented a significant oversight by both countries’ security establishments.

In written responses to ICIJ and Shomrim, Hamza denied any connections to Hamas or al-Qaida. He said that he had never transferred money to the Hamas official and had never even heard the individual’s name before the sanctions listing. He added that he had no relationship with the company that the U.S. government claims he used to help Hamas launder money. Hamza also said that he was “very surprised” to have been sanctioned by the Treasury Department, and “immediately sen[t] an email to them and told them [their information] is not correct.”

Hamza has maintained business ties in Europe for nearly two decades, ICIJ and Shomrim found. He has been an owner of Matz Holdings, a Cyprus firm incorporated in February 2005 that holds lucrative concessions from Egypt to exploit two gold mines in the country. Around the time of al-Bashir’s fall from power in 2019, Hamza sold a large portion of his shares in Matz Holdings; he currently owns a 10% stake in the company. In addition to having a Swiss business partner in Matz Holdings, he also owns a Spanish real estate company that was sanctioned by the Treasury Department roughly a week after the sanctions were imposed on Hamza himself.

Hamza owns his stake in Matz Holdings through the Zawaya Group for Development and Investment, a Sudan-based company that was also sanctioned by the Treasury Department in October, which cited the firm’s links to Hamas’ investment portfolio through Hamza. Under the terms of the concession agreements, Matz Holdings and the Egyptian government receive a roughly equal share of the profits from gold extracted from the mines.

Sudanese authorities arrested Hamza in April 2019, in the days after al-Bashir was overthrown. Hamza was subsequently convicted on corruption charges in April 2021 and sentenced to 10 years in prison. He resigned from Matz Holdings’ board of directors the next month. Following Sudan’s October 2021 military coup, Reuters reported that Hamza was one of several al-Bashir allies who was released from prison.

But even before his release, Hamza worked to protect his financial interests in Matz Holdings. The leaked documents include a letter from Hamza sent on May 31, 2021, in which he and his Swiss business partner, Jakob Felix Bliggenstorfer, threatened legal action against a separate Cyprus firm that the pair claimed owed them nearly $20 million for the purchase of a large portion of their stake in Matz Holdings.

Bliggenstorfer, who owns a stake in Matz Holdings through his company Kaloa AG, denied that Hamza had any ties to Hamas and described the sanctions imposed on him as “a case of mistaken identity” in a statement to Tamedia, ICIJ’s media partner in Switzerland.

News reports dating back more than two decades have detailed Hamza’s links to extremists. A 1998 Wall Street Journal article reported Hamza as saying he had overseen the construction of a road project for a bin Laden company during the al-Qaida leader’s years of exile in Sudan, and that Hamza had tried to convince bin Laden to invest in a weapons factory. A Sudanese media outlet referred to Hamza as “the financial manager of Omar al-Bashir’s family.” Sudan’s anti-corruption task force, which was set up after al-Bashir was deposed, also stated that Hamza held assets worth up to $1.2 billion.

In the same month as al-Bashir’s ouster, Hamza sold the majority of his shares to Matz Dungash, another Cyprus firm. As a result of this and other purchases, Matz Dungash acquired over 80% of the company’s shares by April 2019. Matz Dungash’s director, Egyptian businessman Hesham ElHazek, is also tied to a toppled autocrat: In the aftermath of President Hosni Mubarak’s resignation in 2011, Canada sanctioned him for corruption, and Egyptian authorities froze his assets. However, ElHazek appears to have found himself back in the good graces of Egypt’s military-dominated government and remains on the board of Matz Holdings.

Hamza told ICIJ and Shomrim in an email that ElHazek owns Matz Dungash and its Cayman Islands-based parent company. He wrote that neither he nor Bliggenstorfer ever received payment from Matz Dungash for their shares in Matz Holdings and that ElHazek has not communicated anything to them about the company’s activities since taking control.

ElHazek did not respond to a request to comment on the findings of this story.

In 2022, Matz Holdings announced plans to invest more than $25 million into expanding production at the Hammash gold mine, one of its two mines. By all accounts, the company continues to oversee production there. An Egyptian government website describes it as holding the concession to the mine. The Egyptian embassy in Washington, D.C., did not respond to questions sent by ICIJ about Matz Holdings and Hamza’s role in the company.

Hamza, through his minority stake in Matz Holdings, still stands to profit from the mine’s production. Last year, the Egyptian media reported that the company’s board of directors approved financial statements showing that the mine produced half a ton of gold in 2020 and 2021, with a total value of roughly $25 million. If the mine maintains that level of production, the revenues from its operation could represent a financial windfall for the accused Hamas financier.

Eurasia Press & News

Eurasia Press & News