Signed just days before UN sanctions snapped back into place, the $25-billion Russia–Iran nuclear deal signals a defiant alignment against western pressure, with small modular reactors at the heart of Tehran’s long-term energy ambitions.

Just days before the return of UN sanctions on Iran, Russia hosted a major nuclear deal with Iran. Following an initial agreement between Russian President Vladimir Putin and Iranian President Masoud Pezeshkian in January 2025, the two sides signed a $25-billion memorandum of understanding (MoU) to build four small-scale nuclear power plants in Sirik, in the southern Hormozgan Province. Rosatom chief Alexei Likhachev and Iranian Vice President and nuclear chief Mohammad Eslami finalized the deal on 24 September.

On the sidelines of Russia’s World Atom Week (WAW) and the Atom Expo 2025 exhibition in Moscow, a follow-up executive agreement was signed on 26 September between Iran Hormoz Company, representing the Atomic Energy Organization of Iran (AEOI), and REP Company, a subsidiary of state-owned Rosatom. This accord provides for the construction of four advanced third-generation small nuclear power plant units in the coastal town of Sirik.

Just days before the return of UN sanctions on Iran, Russia hosted a major nuclear deal with Iran. Following an initial agreement between Russian President Vladimir Putin and Iranian President Masoud Pezeshkian in January 2025, the two sides signed a $25-billion memorandum of understanding (MoU) to build four small-scale nuclear power plants in Sirik, in the southern Hormozgan Province. Rosatom chief Alexei Likhachev and Iranian Vice President and nuclear chief Mohammad Eslami finalized the deal on 24 September.

On the sidelines of Russia’s World Atom Week (WAW) and the Atom Expo 2025 exhibition in Moscow, a follow-up executive agreement was signed on 26 September between Iran Hormoz Company, representing the Atomic Energy Organization of Iran (AEOI), and REP Company, a subsidiary of state-owned Rosatom. This accord provides for the construction of four advanced third-generation small nuclear power plant units in the coastal town of Sirik.

Details of the agreement

According to the agreement, REP Company is responsible for constructing the nuclear power plants in Iran. The “Iran Hormoz” nuclear power plant site in Hormozgan Province, with a planned total capacity of 5,000 megawatts (MW), will soon enter the design and equipment phase. Each of the new power plant units in the Sirik region will have a capacity of approximately 1,255 MW, collectively reaching the planned 5,000 MW. The project will be implemented in the Kuhstak district of Sirik, southeastern Iran, covering a land area of 500 hectares.

Nasser Mansour Sharifloo, CEO of the Iran Hormoz Atomic Power Plants Company, affiliated with the AEOI, stated on the sidelines of the Atom Expo 2025 exhibition, “Iran’s strategic and long-term goal is to achieve the production of 20,000 MW of nuclear power in the country. We hope that the first power plant unit will enter orbit by 2031 [1410 in the Iranian calendar] and thus, 5,000 MW of the goal of producing 20,000 MW of nuclear electricity will be achieved.”

Beyond Bushehr: Expanding Iran’s nuclear capacity

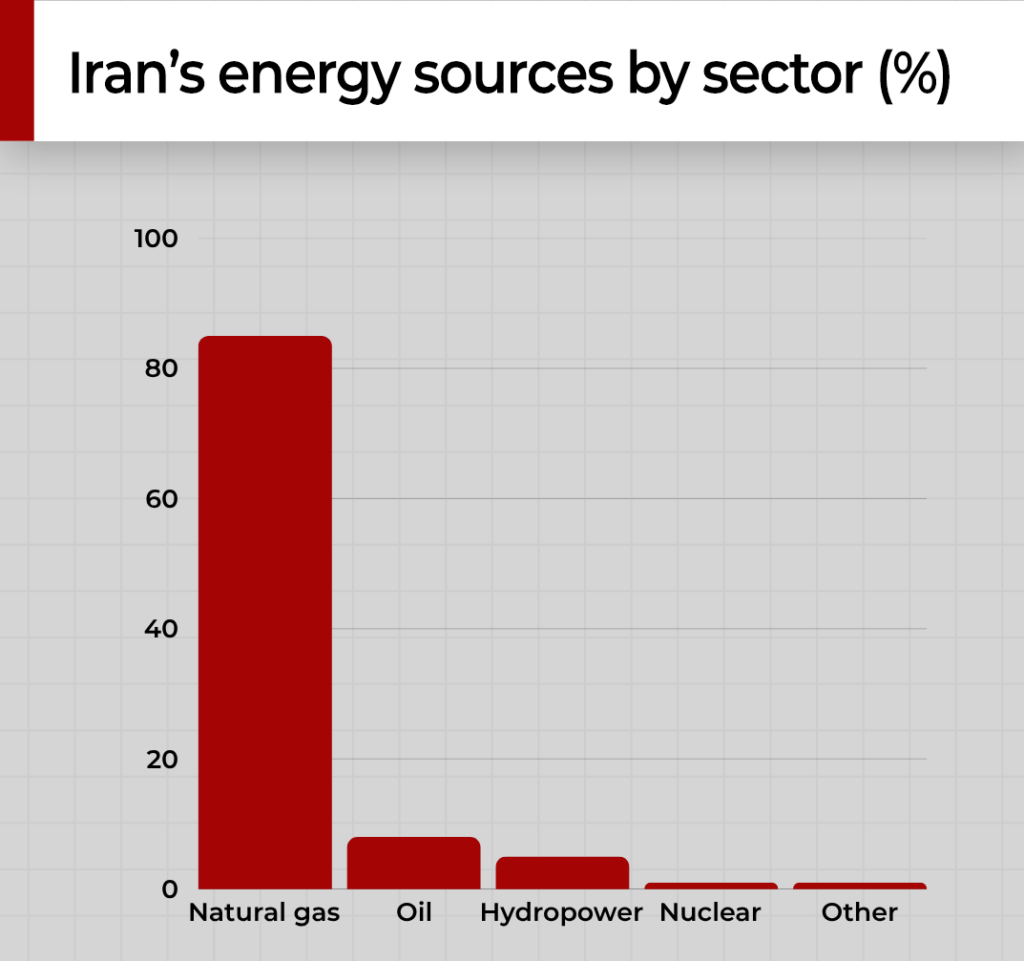

In recent years, Iran has faced severe imbalances in electricity, gas, and water shortages. Despite Iran’s progressive steps in nuclear power generation, some existing data indicates that nuclear power still holds a negligible share in the current electricity generation mix in Iran.

Experts believe that for Iran to reach a global level of electricity production, it needs to produce five to nine times its current nuclear power output. To match the level of advanced countries, approximately 18 times the current nuclear power production is required. One of the key principles of the 20-year strategic document for the nuclear industry is achieving the production of 20,000 MW of nuclear power. Based on the planned strategies, within a 20-year outlook, 10 percent of the country’s electricity should be supplied through nuclear energy.

Iran has a single operational nuclear power plant located in Bushehr in the south, with a capacity of 1,000 MW – covering only one percent of the country’s energy needs. “Iran’s Hormoz Nuclear Power Plant” will be the country’s second nuclear facility, after the Bushehr Nuclear Power Plant. Iran hopes that the four advanced third-generation small nuclear power plant units will help address part of the nation’s energy imbalance and water shortage. With an average consumption of 77,000 MW, completing these projects would account for 11 percent of Iran’s current electricity consumption – a figure that, despite the completion of a 1,000-MW reactor in Bushehr, currently stands at only 1.29 percent of consumption.

On the other hand, a 1,000-MW reactor can desalinate between 100,000 and 150,000 MW-hours of water daily, which annually equals 36 million to 55 million cubic meters of potable water. Considering the completion of 8,000 MW of nuclear capacity, Iran will be able to desalinate up to 440 million cubic meters of seawater yearly. Given that the average annual water consumption is 6.155 billion cubic meters, this amount corresponds to seven percent of potable water consumption in Iran.

Iran’s new nuclear policy: Small Modular Reactors (SMR)

In recent years, Iran has been pursuing the construction of Small Modular Reactors (SMR), which can be built outside coastal areas or near large rivers and require fewer water resources to operate. These power plants also take less time to build. Iran needs such power plants due to its vast size and sparse population, especially in the eastern region of the country.

Russia has been active in reactor construction in global markets, alongside the US, China, France, and South Korea. In four major projects in the region, the Russians have built power plants for Iran, Turkiye, and Egypt. Almost coinciding with the signing of the Russia–Iran SMR MoU, Turkiye reached a similar agreement with Washington during Turkish President Recep Tayyip Erdogan’s meeting with US President Donald Trump. Therefore, Iran’s recent agreement with Russia is the first step towards Iran’s new nuclear priority of building and developing SMRs.

Partnership in the shadow of war

It is important to note that the nuclear deal between Russia and Iran was signed three months after the 12-day Israel–Iran war in June. During the war, in which Israel and the US targeted Iranian nuclear sites, the Bushehr nuclear power plant – whose construction was completed by the Russians in 1993 and has been in operation since 2011 – was not attacked by Israel. Although Iran did not enrich uranium at the Bushehr site – as it did at Natanz and Fordow – Moscow’s ties with Tel Aviv appear to have been crucial in deterring an Israeli strike on the facility.

Such an attack could have exposed Rosatom’s participation and investment to significant risk. While the ceasefire between Iran and Israel is very fragile and there is a possibility of a resumption of war between the two sides, the SMR construction agreement signed by Russia and the Islamic Republic indicates that Moscow will not be concerned about the risk of a possible attack on the agreed-upon nuclear facilities.

Iran–Russia cooperation under pressure

The “snapback mechanism” was activated on 28 September. This means that UN Security Council sanctions that had been in place before 2015 – including resolutions 1696, 1737, 1747, 1803, 1835, and 1929 – have been reinstated against Iran. Russia and China failed to pass a Security Council resolution to postpone the six-month snapback mechanism and criticized the reinstatement, while the EU and Japan confirmed their compliance with the sanctions, and the UK introduced two additional measures against Iran.

From Iran’s perspective, the two Security Council resolutions proposed by Russia and China signal that Moscow and Beijing view the reimposition of international sanctions on Iran as illegal, and unlike the 2006–2013 sanctions, Russia in particular is unlikely to comply with UN sanctions resolutions against Tehran.

The prevailing atmosphere in the Security Council, along with the positions of the European Joint Comprehensive Plan of Action (JCPOA) troika – France, Britain, and Germany – and the US, left no doubt that the snapback mechanism would be activated and UN sanctions reinstated. As a permanent member of the UN Security Council, Russia was fully aware of this process. Yet, just days before the sanctions came back into effect, it finalized the nuclear deal with Iran, sending a clear message to the Western powers.

Undoubtedly, sanctions have been a key driver of rapprochement and cooperation between Russia and Iran in recent years. Aside from a three-year hiatus following the 2015 JCPOA agreement, Iran has faced either UN sanctions or broad unilateral US sanctions for nearly two decades, which resumed in full after the US’s withdrawal from the JCPOA in May 2018. At the same time, Russia remains under extensive western sanctions, with no clear end in sight to the war in Ukraine.

Strategic significance

In the broader context, the $25-billion deal between Russia and Iran to build four SMRs – signed amid heightened tensions between Iran and the west over the nuclear issue, and between Russia and the west over the Ukraine war – reflects the alignment of interests in the current multipolar world. The agreement also forms part of Russia’s wider strategy to invest in and construct nuclear power plants across West Asia. Following the signing, Rosatom CEO Alexey Likhachev described the project as a “strategic project,” highlighting its significance for expanding Russia’s nuclear energy presence in the region.

In recent years, Russia has played a key role in developing nuclear energy infrastructure in several Persian Gulf countries. Through its state nuclear corporation, Rosatom, Russia has signed agreements and is actively involved in constructing nuclear power plants in the UAE and Saudi Arabia. The UAE’s Barakah Nuclear Power Plant – the first in the Arab world – was built using Russian technology and expertise. Russia has also expressed interest in cooperating on nuclear projects with Saudi Arabia and other Arab countries, supporting their efforts to diversify energy sources and reduce dependence on fossil fuels. This strategy reflects Russia’s broader competition with western powers while signaling to regional countries that they can rely on Russian nuclear technology amid current global tensions.

Eurasia Press & News

Eurasia Press & News