High debt and rising interest rates put a premium on improved governance to anchor fiscal policy in EU member states.

Given the central role of fiscal policy in addressing both recent crises and future challenges, the call to reform fiscal governance in Europe resonates like never before.

Fiscal policy provides essential support when households and firms are hit by large shocks, such as the pandemic, or when monetary policy is constrained. However, that requires healthy public finances. High debt and rising interest rates are making it harder for governments to address today’s multiple priorities, including tackling extreme increases in the cost of living and addressing the climate emergency.

Against this backdrop, the European Union needs revamped fiscal rules that have the flexibility for bold and swift policies when needed, but without endangering the sustainability of public finances. It is critical to avoid debt crises that could have large destabilizing effects and put the EU itself at risk. This will require building greater fiscal buffers in normal times.

A new IMF paper proposes reforms to the EU fiscal framework to help manage the tremendous policy challenges.

The overhaul should be economically sound and politically acceptable, building on the lessons from several past attempts to improve the fiscal rules. It will be critical to balance the respect for the sovereignty of national fiscal policies while strengthening the incentives for adopting sound policies for the EU.

The proposal centers on three pillars: revamping numerical fiscal rules to take explicitly into account the fiscal risks countries face while having a clear medium-term orientation; strengthening national fiscal institutions to improve domestic debate and ownership of policies; and creating an EU fund to help countries better manage economic downturns and provide essential public goods.

Ambitious reforms needed

The existing rules have had some success, especially by increasing public awareness that fiscal deficits should be below 3 percent of gross domestic product, enhancing government accountability. But they have not prevented an undesirable buildup of public debt and fiscal sustainability risks among some members.

As we saw with the European sovereign debt crisis, these risks have threatened the stability of the monetary union in the past and continue to create vulnerabilities today. This is despite numerous efforts to refine the numerical rules and strengthen central oversight over the years.

To some extent, weak national institutions, political pressures and large negative shocks have led to poor compliance. Combined with design limitations of the framework, which sets ceilings on deficits in bad times without providing sufficient incentives to build buffers in good times, this has led to the build-up of fiscal imbalances. The framework has also fared poorly at stabilizing output and lacks tools to provide common public goods for member countries.

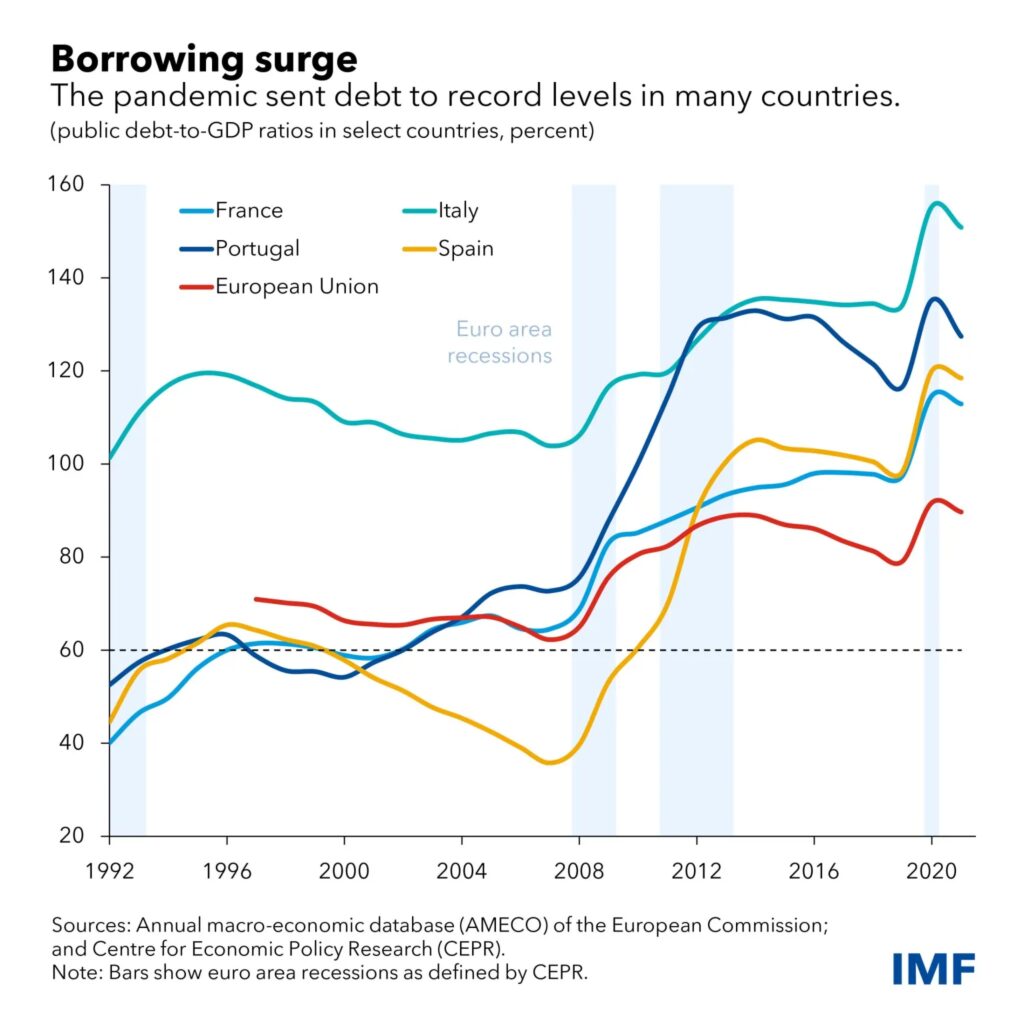

In response to the pandemic, in March 2020, the European Commission triggered the general escape clause—which allows a temporary deviation from the EU fiscal rules—enabling member countries to respond more forcefully and flexibly. But the increase in deficits has pushed debt levels even further above the Maastricht Treaty reference value of 60 percent of GDP in many countries, posing additional challenges in transitioning back to the existing rules.

The IMF’s proposal has three interconnected pillars:

Risk-based EU-level fiscal rules: While the current 3 percent deficit and 60 percent debt reference values remain, the speed and ambition of fiscal adjustments would be linked to the degree of fiscal risks. These are identified by debt sustainability analysis using a common methodology, developed by a new and independent European Fiscal Council, or EFC, in consultation with other key stakeholders. Countries with greater fiscal risks would need to converge to a zero or positive overall fiscal balance over the next three to five years. Countries with lower fiscal risks and debt below 60 percent would have more flexibility but still need to consider risks in their plans. The framework would incentivize buildup of fiscal buffers allowing for significant flexibility to respond to adverse shocks and conduct countercyclical policy.

Strengthened national fiscal institutions: All EU countries would have to enact medium-term fiscal frameworks and set multi-year annual spending caps consistent with their overall balance anchor over the period. Independent national fiscal councils would play a stronger role to strengthen checks and balances at the country level, including making or endorsing macroeconomic projections, assessing fiscal risks, and ensuring the consistency of the expenditure ceilings and fiscal plans. The European Commission would continue to play its key surveillance role and the EFC would serve as the central node for a network of national fiscal councils, helping to promote good practices and providing an independent voice both on debt risks and the execution of the framework.

A well-designed EU fiscal capacity: This would be established to achieve two key roles: improving macroeconomic stabilization, especially when monetary policy is operating at the effective lower bound, and allowing the provision of common public goods at the EU level, such as climate change and energy security infrastructure. Delivering these has become more urgent due to the green transition and common security concerns. A dedicated climate investment fund is an important part of the proposal.The proposal should be seen as a package of interlinked elements to promote an effective reform. It requires a mutually reinforcing relationship between EU rules and national implementation, particularly greater domestic ownership of the rules and better alignment between country frameworks and EU rules. The former can only be achieved by balancing the needs of member countries with safeguarding them from negative spillovers from other parts of the union. This argues for a risk-based approach—the first pillar of the IMF proposal. The latter requires a stronger role for our second pillar: significantly upgraded national frameworks—including enhancing the capacity and mandates of independent fiscal institutions.

Amid extraordinary economic uncertainty and fiscal challenges ahead, reform of the EU fiscal framework cannot wait. The extension of the general escape clause through 2023 provides a window of opportunity to do just this; further delays would force countries to go back to the old rules with all of their problems. The opportunity should not be wasted.

Eurasia Press & News

Eurasia Press & News