The overall Consumer Price Index rose 0.1 percent in August, core was up 0.6 percent; up 8.3 percent and 6.3 percent year-over-year, respectively. Overall, the picture shows inflation persisting in a wide variety of areas where it seems that supply chain issues are being overcome. This is not a good story.

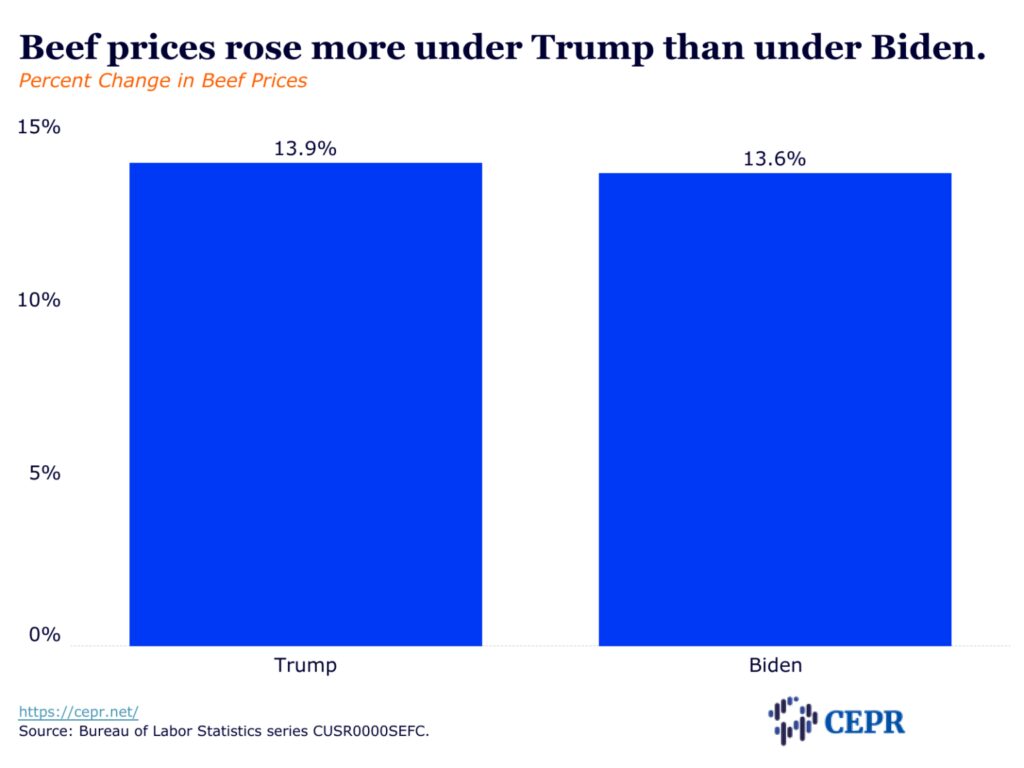

Food at home prices went up 0.7 percent in August, 13.5 percent year-over-year. Beef, chicken, and milk were up 0.8 percent, 0.5 percent, and 0.2 percent, respectively. These rises are somewhat surprising since price indexes had shown declines.

Car prices are still rising sharply: new vehicles up 0.8 percent in August, 10.1 percent year-over-year, added 0.03 percentage points to the month’s inflation.

The car and truck rental index was down 0.5 percent in August, 6.2 percent year-over-year. This implies that rental agencies have rebuilt fleets and more cars are available for households. The index is still up 39.9 percent from its pre-pandemic level.

Car insurance went up 1.3 percent in August, 8.7 percent year-over-year.

The health insurance index (profits and expenses, not premiums) went up 2.4 percent in August, up 24.3 percent year-over-year.

Car and health insurance together added 0.05 percentage points to the month’s inflation.

Prescription drug prices were up 0.4 percent in August, 3.2 percent year-over-year.

Both rental indexes rose 0.7 percent in August: rent proper up 6.7 percent year-over-year, owners’ equivalent rent up 6.3 percent. The divergence in rental inflation continues with expensive cities seeing smaller rises: San Francisco, New York City, and DC were up 1.9 percent, 2.9 percent, and 3.1 percent year-over-year, respectively. Detroit was up 6.7 percent, Atlanta 13.5 percent, and Phoenix 21.4 percent.

College tuition rose 0.5 percent in August, up 2.8 percent year-over-year.

Apparel prices were up 0.2 percent in August, 5.1 percent year-over-year.

Appliance prices fell 1.2 percent after dropping 0.6 percent in July, but are still up 3.0 percent year-over-year. Supply chain issues are being overcome.

Eurasia Press & News

Eurasia Press & News