Behind the Scenes, They Are Deepening Their Defense Partnership

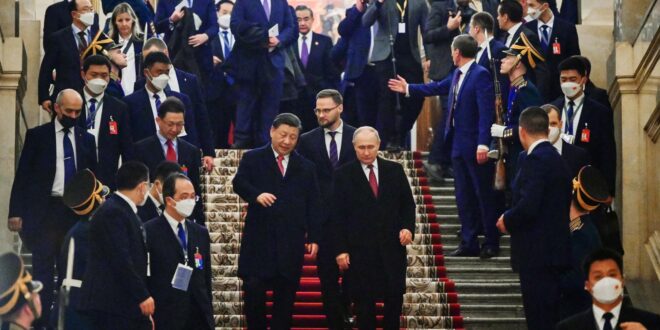

“There are changes happening, the likes of which we haven’t seen for 100 years,” Chinese leader Xi Jinping said to Russian President Vladimir Putin last month at the end of a state visit to Russia. “Let’s drive those changes together.” To this, the Russian leader responded, “I agree.”

This seemingly improvised yet carefully choreographed scene captured the outcome of Xi’s trip to Russia and the trajectory on which he and Putin have set Sino-Russian relations. Xi’s visit last month was first and foremost a demonstration of public support for the embattled Russian leader. But the truly significant developments took place during closed-door, in-person discussions, at which Xi and Putin made a number of important decisions about the future of Chinese-Russian defense cooperation and likely came to terms on arms deals that they may or may not make public.

The war in Ukraine and ensuing Western sanctions on Russia are reducing the Kremlin’s options and pushing Russia’s economic and technological dependence on China to unprecedented levels. These changes give China a growing amount of leverage over Russia. At the same time, China’s fraying relationship with the United States makes Moscow an indispensable junior partner to Beijing in pushing back against the United States and its allies. China has no other friend that brings as much to the table. And as Xi prepares China for a period of prolonged confrontation with the most powerful country on the planet, he needs all the help he can get.

FRIEND FROM AFAR

Senior figures in the Chinese Communist Party have openly discussed the need for a closer partnership with Russia because of what they perceive as an increasingly hostile U.S. policy aimed at containing China’s rise. Chinese Foreign Minister Qin Gang told Chinese state media after the trip that the partnership with Russia is very important at a time when some forces are advocating “hegemonism, unilateralism, and protectionism” and are driven by a “Cold War mentality”—all CCP code words for U.S. policy toward China. Putting this reason front and center is revealing, and it explains why Xi decided to go to see Putin in person, despite the unfavorable optics of visiting just after the International Criminal Court had issued an arrest warrant for the Russian leader. The message of Xi’s trip was clear: China sees many benefits in its relationship with Russia, it will continue to maintain those ties at the highest level, and it will not be deterred by Western critics.

To deflect growing U.S. and European criticism of China’s support of Russia, Beijing came up with an elaborate diplomatic scheme, presenting a position paper on the Ukrainian crisis on February 24, the one-year anniversary of the Russian invasion of Ukraine. The paper is a laundry list of talking points that Beijing has voiced throughout the war, including respect for the territorial integrity of states and opposition to unilateral sanctions. The proposal’s lack of specific details on crucial issues, such as borders and accountability for war crimes, is a feature, not a bug. Beijing is perfectly aware that neither Kyiv nor Moscow has much interest in talking at the moment, since both want to keep fighting to increase their leverage whenever they do sit down at the negotiating table. The Chinese proposal was little more than window dressing for Xi’s visit. The real action took place behind the scenes, in private negotiations between Putin and Xi.

MORE THAN MEETS THE EYE

At the conclusion of the trip, the Kremlin published a list of 14 documents signed by both China and Russia, including two statements by Xi and Putin. At first glance, these were largely insignificant memorandums between ministries; no major new agreements were announced. Yet a closer look reveals a very different picture, one that Beijing and Moscow have reason to conceal from the outside world.

In a departure from its usual practice, the Kremlin did not publish the list of officials and senior business leaders present at the talks. Their names can be discerned only by going through footage and photos from the summit and by reading into comments made to the Kremlin press corps by Yuri Ushakov, Putin’s foreign policy aide. A close look reveals that more than half of Putin’s team participating in the first round of formal talks with Xi were officials directly involved in Russia’s weapons and space programs. That list includes former President Dmitry Medvedev, who is now Putin’s deputy in the presidential commission on the military-industrial complex; Sergei Shoigu, the defense minister; Dmitry Shugaev, who heads the federal service for military-technical cooperation; Yury Borisov, who runs the Russian space agency and who until 2020 had spent a decade in charge of the Russian weapons industry as deputy defense minister and deputy prime minister; and Dmitry Chernyshenko, a deputy prime minister who chairs a bilateral Chinese-Russian intergovernmental commission and is in charge of science and technology in the Russian cabinet. This group of officials was likely assembled to pursue one main goal: deepening defense cooperation with China.

Although China wields great influence in the Kremlin, it does not exert control.

Even though Beijing and Moscow have not made any new deals public, there is every reason to believe that Xi’s and Putin’s teams used the March meeting to come to terms on new defense agreements. After prior Xi-Putin summits, the leaders have privately signed documents related to arms deals and only later informed the world. In September 2014, for example, following Russia’s annexation of Crimea, the Kremlin sold its S-400 surface-to-air missile system to China, making Beijing the first overseas buyer of Russia’s most advanced air-defense equipment. The deal was not revealed until eight months later, however, in a Kommersant interview with Anatoly Isaykin, the CEO of Rosoboronexport, Russia’s main arms manufacturer.

After the U.S. Congress passed the Countering America’s Adversaries Through Sanctions Act in 2017, Moscow and Beijing stopped disclosing their military contracts altogether. This U.S. law led to the sanctioning of the Chinese army’s armaments department and its head, General Li Shangfu (who was appointed China’s defense minister in March). Nevertheless, on rare occasions, Putin boasts about new deals, such as in 2019, when he announced that Moscow was helping develop a Chinese missile early-warning system, and in 2021, when he revealed that Russia and China were jointly developing high-tech weapons.

ARMS LINKED

China has relied on Russian military hardware since the 1990s, and Moscow was its only source of modern foreign weapons following the arms embargo imposed by the EU and the United States after the 1989 Tiananmen Square massacre. Over time, as China’s own military industry progressed, its reliance on others decreased. Beijing can now produce modern weapons on its own and has a clear lead over Russia in many areas of modern military technology, including drones. But to boost its own research and development and production, Beijing still covets access to Russian technology to use in surface-to-air missiles, engines for fighter jets, and underwater warfare equipment such as submarines and submersible drones.

A decade ago, the Kremlin was reluctant to sell cutting-edge military technology to China. Moscow worried that the Chinese might reverse engineer the technology and figure out how to produce it themselves. Russia also had broader concerns about arming a powerful country that borders the sparsely populated and resource-rich Russian regions of Siberia and the Far East. But the deepening schism between Russia and the West following the 2014 annexation of Crimea changed that calculus. And after launching a full-scale war in Ukraine and prompting the complete breakdown of ties with the West, Moscow has little choice but to sell China its most advanced and precious technologies.

Even before the war, some Russian analysts of China’s defense industry had advocated entering into joint projects, sharing technology, and carving out a place in the Chinese military’s supply chain. Doing so, they argued, offered the best way for the Russian military industry to modernize—and without that progress, the rapid pace of China’s own R & D would soon render Russian technology obsolete. Today, such views have become conventional wisdom in Moscow. Russia has also started opening up its universities and science institutes to Chinese partners and integrating its research facilities with Chinese counterparts. Huawei, for example, has tripled its research staff in Russia in the wake of a Washington-led campaign to limit the Chinese tech giant’s global reach.

JUNIOR PARTNER

Neither Beijing nor Moscow has any interest in disclosing the details of any of the private discussions held during the Xi-Putin summit. The same goes for details on how Russian companies could gain better access to the Chinese financial system—which was the reason why Elvira Nabiullina, chair of Russia’s central bank, was a significant participant at the bilateral talks. That access has become critical for the Kremlin, since Russia is rapidly becoming more dependent on China as its main export destination and as a major source of technological imports, and as the yuan is becoming Russia’s preferred currency for trade settlement, savings, and investments.

The participation of the heads of some of the biggest Russian commodity producers indicates that Xi and Putin also discussed expanding the sale of Russian natural resources to China. Right now, however, Beijing has no interest in drawing attention to such deals, in order to avoid criticism for providing cash for Putin’s war chest. In any case, Beijing can afford to bide its time, since China’s leverage in these quiet discussions is only growing: Beijing has many potential sellers, including its traditional partners in the Middle East and elsewhere, whereas Russia has few potential buyers.

Eventually, the Kremlin may want at least some of the deals reached in March to become public to demonstrate that it has found a way to compensate for the losses it suffered when Europe stopped importing Russian oil and reduced its imports of Russian gas. But China will decide when and how any new resource deals are signed and announced. Russia has no choice but to patiently wait and defer to the preferences of its more powerful neighbor.

WHO’S THE BOSS?

The Chinese-Russian relationship has become highly asymmetrical, but it is not one-sided. Beijing still needs Moscow, and the Kremlin can provide certain unique assets in this era of strategic competition between China and the United States. Purchases of the most advanced Russian weapons and military technology, freer access to Russian scientific talent, and the rich endowment of Russia’s natural resources—which can be supplied across a secure land border—make Russia an indispensable partner for China. Russia also remains an anti-American great power with a permanent seat on the UN Security council—a convenient friend to have in a world where the United States enjoys closer ties with dozens of countries in Europe and the Indo-Pacific and where China has few, if any, real friends. China’s connections are more overtly transactional than the deeper alliances Washington maintains.

That means that although China wields great influence in the Kremlin, it does not exert control. A somewhat similar relationship exists between China and North Korea. Despite the enormous extent of Pyongyang’s dependence on Beijing and shared animosity toward the United States, China cannot fully control Kim Jong Un’s regime and needs to tread carefully to keep North Korea close. Russia is familiar with this kind of relationship since it maintains a parallel one with Belarus, in which Moscow is the senior partner that can pressure, cajole, and coerce Minsk—but cannot dictate Belarusian policy across the board.

Russia’s size and power may give the Kremlin a false sense of security as it locks itself into an asymmetrical relationship with Beijing. But the durability of this relationship, absent major unforeseeable disruptions, will depend on China’s ability to manage a weakening Russia. In the years to come, Putin’s regime will have to learn the skill that junior partners the world over depend on for survival: how to manage upward.

Eurasia Press & News

Eurasia Press & News