This analysis looks at Spain’s involvement with the European Defence Fund. After two years of investments, it is possible to use publicly available data to probe the ways in which Spain is positioning itself within the Fund. The data not only show us how far Spanish entities are engaging in the Fund but also reveal important aspects of Spain’s overall defence industrial strategy. Building on the available data, this analysis provides some critical remarks on how Spain can engage with EU-level defence industrial initiatives and how best to position itself as a leading defence actor in Europe.

Analysis

Ever since the operational launch of the European Defence Fund (EDF) in 2021, the EU has been working to invest €8 billion into defence capabilities and innovation. With a view to 2027, when the first investment term for the EDF ends, the logic has been to stimulate European defence cooperation while also strengthening the European Defence Technological and Industrial Base (EDTIB). So far, the European Commission has issued three calls for proposals for defence projects since 2021 and two of these calls have already resulted in successful grant results. The EDF is therefore fully operational, even though questions remain about the promise of the projects funded thus far. In particular, Russia’s war on Ukraine has shaken European defence and the European defence industry. Instead of a sole focus on technological innovation, the war has raised serious questions about manufacturing capacity –this is particularly the case for ammunition–. Additionally, there is a need to track whether EDF projects can meet the needs of European militaries today as they face conventional warfare in Europe.

Spain was an early supporter of the EDF and has actively participated in projects since 2021, plus it was also engaged in the precursor programmes of the EDF called the Preparatory Action on Defence Research (PADR) and the European Defence Industrial Development Programme (EDIDP), which were initiated in 2017 and 2019 respectively. Under both of these preparatory financial mechanisms, which were worth €590 million combined from 2017 to 2020, Spanish firms and institutes were engaged in several projects. Under the PADR, Spain led three defence research projects and 19 Spanish entities were involved in projects totalling €70 million. Under the EDIDP, Spanish entities led eight projects and 64 of its entities were involved in EDIDP projects worth €371 million. Having been involved in these precursor programmes, Spain has been able to shape the EDF and also understand how EU-funded projects work in practice.

Analysis before the Fund started financing defence projects understood that the EDF would be a good opportunity to better integrate Spain’s defence industrial sector into the EDTIB, as well as to include Spanish firms into European-wide supply chains.[1] Indeed, this aim has only been underlined during the Spanish Presidency of the Council of the EU. As the Spanish government has reiterated, ‘the Presidency will seek to develop defence capabilities, so as to guarantee freedom of action with European forces and capabilities […] we will promote the development of our own capacity and that of the European industrial and technological base’.[2] Whatever government takes power in Spain after the recent elections, it is highly likely that this logic will prevail. As one of Europe’s important defence markets, Spain will attempt to maintain its own national industrial strength while investing in European cooperation when it makes sense. This echoes an aim in the recently published Spanish Defence Industrial Strategy, which aims to ‘promote an adequate positioning of the national defence industrial and technological base in cooperative initiatives’ at the EU level.[3]

Understanding how Spain has engaged in European defence industrial efforts has become much clearer since the 2021[4] and 2022[5] results of the EDF were publicly released by the European Commission. This paper has probed the data and provides an in-depth overview and analysis of how Spanish actors are engaged in the EDF. In particular, the analysis looks at the capability and innovation areas in which Spain is involved and it compares its involvement with that of other EU member states. By looking at the available data, it is possible to show in what defence technology areas Spain has most invested and this can reveal a picture of Spain’s overall defence industrial strategy.

Two years of the European Defence Fund: an overview

Since the official unveiling of the EDF in 2021, the EU has successfully invested €2 billion in defence projects related to air combat, air and missile defence, cyber, information superiority, digital transformation, disruptive technologies, energy and the environment, force protection and mobility, ground combat, naval affairs, sensors, space and much more. So far, 101 projects have been financed by the EDF (41 projects in 2022 and 60 in 2021) worth a total of around €2 billion. What is clear is that in the past two years the EU has generally invested the bulk of the EDF in areas such as naval, air and ground combat, space, air and missile defence and information superiority. The Commission has approved projects totalling in excess of €300 million in each of these domains. As Figure 1 shows, the naval domain takes the largest share of the investments over the two EDF calls with an amount of €540 million –€449 million has been invested in ground combat capabilities and €439 million in space–. In all project areas, the EU has contributed upwards of 77% of the total costs for each military domain but in areas such as underwater and disruptive technologies it has contributed 100% of the total costs.

Overall, the results of the first two EDF calls reveal a rather balanced approach between defence innovation, which is geared to the future, and capability areas related to high intensity warfare and strategic enablers, which are better geared to Europe’s more immediate defence needs. For a member state such as Spain, the investments made under the EDF are beneficial. In particular, EU contributions to naval, space, air and missile defence technologies are key for Spain, but so too are the increasing investments in digital transformation, cyber, defence innovation, disruptive technologies and energy and the environment. One can say, therefore, that the last two EDF calls have not only met Spain’s national defence industrial interests, but its broader political interests in stimulating European defence and European defence cooperation too. Additionally, investment in these defence industrial domains meets Spain’s NATO vocation and the need to develop major capabilities for the defence of Europe.

Figure 1. Investment levels under the EDF by domain, 2021 and 2022

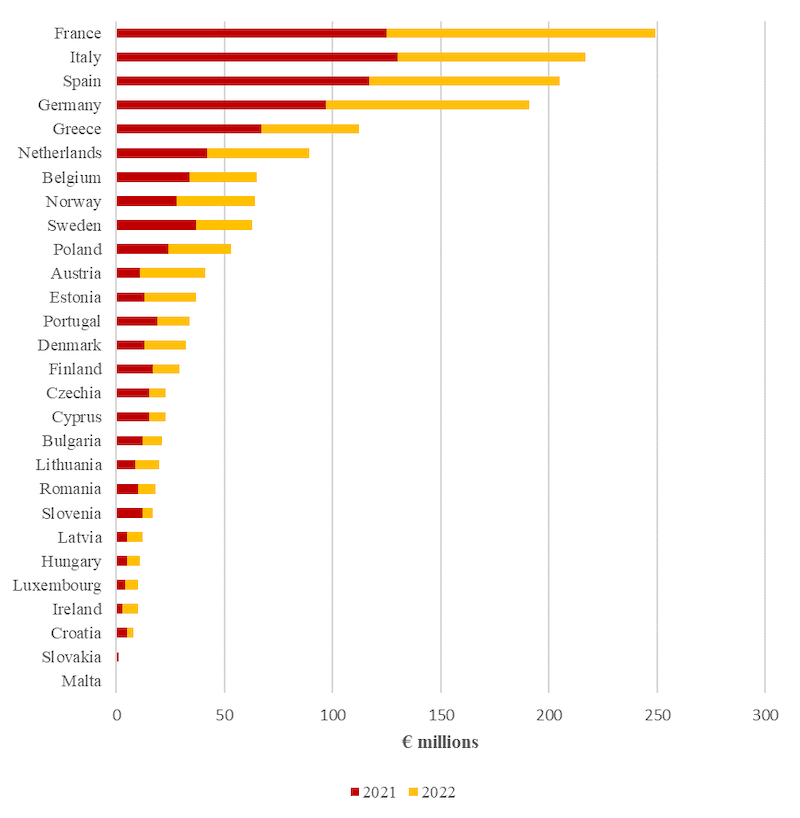

As Figure 2 shows, Spain has taken an early and active interest in the EDF and over the two first years is the third highest-ranking country in terms of how many of its firms and institutes are involved in projects. Only France and Italy rank higher than Spain, with Germany just behind. This is a significant achievement when one considers that France, Italy and Germany spend more on defence than Spain. Indeed, according to NATO data Germany’s defence budget in current prices for 2023 stands at US$68.1 billion, France’s at US$56.7 billion, Italy’s at US$31.6 billion and Spain’s at US$19.2 billion.[6] It is clear, therefore, that in the EDF Spain punches above its weight. A continued increase in Spain’s defence budget –it has increased by 51% since 2014– would afford the country more room to fill capability gaps and to develop future capability programmes such as the Future Combat Aircraft System.

Figure 2. EDF investments by EU member state, 2021 and 2022

Of the 60 projects financed in 2021 under the EDF, Spain was involved in 42 (or 70%). Of the 41 EDF projects funded in 2022, Spain is part of 32 (or 78%). Overall, Spain is currently involved in 73% of all EDF projects funded so far (74 of 101 projects). This level of involvement in the EDF not only demonstrates Spain’s interest in the full range of defence industrial areas being supported by the EU, but it also shows that Spain’s defence and technological ecosystem is able to participate in a wide range of technology and innovation areas. In effect, Spain is a vital partner in the EDF as its firms and institutes play an important role in developing defence projects and ensuring that they can make a real difference to European defence. Given its size and industrial reach, Spain is also a key state in ensuring the future success of the EDF.

How does Spain engage with the EDF?

Looking in more detail at how Spain engages with the EDF reveals a number of important features of Spain’s overall defence industrial strategy. As Figure 3 shows, Spanish firms and institutes have engaged heavily in the air combat, digital transformation, open defence innovation and space domains over the past two years. However, Spanish entities are engaged in every possible domain financed by the EDF, and the specific focus on the high-tech, digital and innovation domains speaks to Spain’s wider interest of positioning itself as an important digital market in Europe. If one looks at the specific Spanish entities that are engaged in EDF projects so far, one not only observes the active role of defence firms but also institutes and small and medium enterprises (SMEs) that are involved in a broad range of innovation activities, even outside the defence sector. For example, of the 74 out of 101 projects funded by the EDF thus far 10 large defence firms,[7] 19 specialised defence technology producers,[8] 45 dual-use technology firms and centres,[9] 13 universities,[10] eight specialised institutes[11]and two national and international bodies[12] from or based in Spain are involved. The involvement of civil and SME firms in the EDF is, however, not necessarily an indication of their interest in the defence sector but rather a function of how the EDF has stressed the importance of dual-use technologies and civil-defence synergies.

However, it is not just Spain’s involvement in individual EDF project that is of relevance. Of the 101 projects funded since 2021, 19 are led by Spanish entities including Indra Sistemas (three projects), Navantia (two) and Sener Aeroespacial (two) as the major consortium leaders and Seaplace, GeoNumerics, La Palma Research Centre for Future Studies, Tracasa Instrumental, Tecnalia, CT Engineering, GMV Aerospace and Defence, Universidad de Zaragoza, Lortek, Gahn Logistica, IntegraSys and ARPA EMC each leading one project. For example, the 2021 ‘EDINAF’ project worth €30 million on developing a digital ship architecture is led by Navantia and includes Aertec Solutions, Indra Systems and the Universidade da Coruña as project partners, as well as entities from Belgium, France, Germany, Italy, the Netherlands, Norway and Sweden.[13] What is more, Spain plays a leading role in the only project devoted to air and missile defence (EUHYDEF) worth €110 million. Sener Aeroespacial leads the project that seeks to develop a hypersonic defence interceptor, and it works alongside Escribano, GMV Aerospace and Defence, Instalaza, the Instituto Nacional de Técnica Aeroespacial Esteban Terradas and Navantia, as well as entities from Belgium, the Czech Republic, Germany, Norway, Poland and Sweden.[14] Overall, therefore, Spain is able to lead on significant defence technology projects by bringing together Spanish entities and working alongside firms in other EU member states.

Furthermore, Spain’s involvement in EDF projects appears to result in a substantial return on investment. On average, Spain’s annual contribution to the EDF sits at about 9%-10% each year,[15] which is based on an approximate calculation of Spain’s overall GNI-based annual contribution to the EU budget.[16] Based on this calculation of a higher level of a 10% contribution, Spain has therefore contributed approximately €200 million to the €2 billion invested so far under the EDF calls of 2021 and 2022. One has to be careful, however, in trying to calculate Spain’s return on investment under the EDF. It is not possible to calculate a single figure based on Spain’s contributions to the EDF, not least because EU contributions towards each EDF project include numerous entities from across the EU and individual participants do not extract only financial benefits from EDF projects –intangible returns such as technology transfers count too–. Furthermore, it is not yet possible to calculate the full return on investment from EDF projects because most have not yet made it to a stage of commercialisation: in time, it would be necessary to calculate how many EDF projects make it to market, and to what degree Spanish economic operators benefit from sales. However, it is interesting to note that so far Spanish firms and institutes are part of EDF projects worth a total of €1.9 billion (€1.2 billion in 2021 and €726 million in 2022), which marks a far higher level than the approximately €200 million invested by Spain so far.

Conclusions

The data publicly released by the European Commission in 2021 and 2022 as part of its communication on the EDF has proved useful in attaining a clearer picture of how Spain engages with the Fund. We have observed how Spain has played an active role in the EDF and this is best seen by how many Spanish firms and bodies are involved in the 101 projects so far funded by the EU. In some cases, Spain has also demonstrated its leadership by coordinating and advancing certain projects, especially in key and new military domains such as counter hypersonic technologies. While the data reveal that Spain has a diverse defence ecosystem that includes a range of prime firms, mid-caps, SMEs and specialised firms, agencies and academic institutions, it is also clear that defence firms provide the backbone for Spain’s engagement in the EDF –defence firms remain extremely relevant to Spain’s defence ecosystem–. This is not only a reflection of the current state of Spain’s defence technological and industrial base, but a positive signal for the future that Spain has the industrial heft required to fully participate in EDF projects. This was not a foregone conclusion before the introduction of the Fund.[17]

These conclusions chime with much of the existing research and analysis on Spain’s defence industry. Past studies have called on Spain to diversify its defence partnerships and to nurture its defence industrial base as a strategic national industry.[18] Both of these objectives are being pursued through the EDF, even if the Fund is one among many forms of multilateral cooperation in which Spain is engaged (eg, with NATO or its bilateral defence cooperation with the US). In this respect, we must understand Spain’s enthusiastic engagement with the EDF and other EU defence cooperation tools through its specific understanding of strategic autonomy, which posits that any EU defence efforts can only make NATO and the transatlantic relationship stronger.[19] Making EU defence industrial efforts compatible with NATO is in Spain’s interests, not least because Europe is now engaged in territorial defence and deterrence. Any EU efforts that can contribute to the defence of Europe through the development of robust military capabilities is to be celebrated.[20]

However, in the coming months and years there will be a need for Spain to play its role in defining the direction of EU security and defence policy. Even though there has been a period of hyperactivity in developing new EU initiatives, questions remain about the overall strategic guidance of EU defence industrial policy.[21] Providing direction will be increasingly necessary, not least because the EU has developed new tools such as the Act in Support of Ammunition Production (ASAP) and the European Defence Industry Reinforcement through Common Procurement Regulation (EDIPRA). In the coming months, the European Commission also wants to continue shaping the future European Defence Investment Programme (EDIP), which could unlock further EU-level funds for the defence industry. We should not forget that the European Commission has already proposed a package for the mid-term review of the Multi-annual Financial Framework (MFF), where it has called for an additional €1.5 billion for the EDF (which would take the Fund to a total of €9.5 billion up to 2027).[22] Finally, we should also bear in mind that the Commission wants to inject an additional €10 billion into strategic areas under the new Strategic Technologies for Europe Platform (STEP), which will also touch upon defence innovation and the defence industry.[23]

When thinking about Spain’s participation in the EDF, it is necessary to think about whether Spain can maintain its high level of performance and involvement. Realistically, one could say that there could be a saturation point in which Spanish firms and institutes are unable to take on more projects due to diminishing investment, technological resources and skills. In particular, if Spain wants to play an outsized role in core defence capability areas such as naval combat technologies, then it needs to continue to invest in its national defence industrial base. It will, as the 2023 National Defence Industrial Strategy points out, need to invest in skills and talent. Here, the focus on ‘developing curricula in cooperation with universities, educational centres and companies for the skills Spain needs in defence’ is of the utmost importance.[24] Encouraging the development of skills and innovation goes hand-in-hand with larger and sustained investments in the defence sector.

With all of these changes, it will be necessary for Spain to ensure that its defence industry can benefit from any increase in EDF funding, while also ensuring that the growing number of EU financing tools are coherent with other defence initiatives such as Permanent Structured Cooperation (PESCO). Here, a task for the incoming government in Madrid and for the Spanish Presidency of the Council of the EU will be to ensure that tools such as the EDF remain solidly geared to Europe’s strategic needs. In this respect, the EDF cannot simply be viewed as an industrial programme, but as the location where debates about European capability development are increasingly occurring. Given Spain’s prominent role in the Fund to date, it can influence what types of capabilities the EU develops in the coming years. In particular, while it is absolutely necessary to continue to invest in innovation there is a need for major strategic programmes that can both have a payoff for European defence and the EDTIB.

Eurasia Press & News

Eurasia Press & News