High-end American, German, and Swiss spectrum analyzers and signal generators, which can be used for developing and fine-tuning radio-electronic intelligence and warfare devices, continued to be freely supplied to Russia even after the start of the full-scale invasion of Ukraine, The Insider has discovered. Electronic warfare (EW) equipment is a critical component in Russia’s ongoing war. Russia lacks the necessary know-how to produce the equipment domestically, but manages to acquire it through Chinese intermediaries – despite international sanctions.

Electronic warfare and radio-electronic reconnaissance tools are indispensable in modern warfare. They can perform several tasks: protect personnel and equipment, detect enemy weapons, jam enemy communications, disorient missiles and drones (for example, by spoofing satellite navigation coordinates), intercept enemy communications, and protect their own communications from jamming and interception.

Two types of expensive and complex devices are critical for such equipment: spectrum analyzers and radio frequency spectrum generators . Spectrum analyzers allow drone users to understand which frequencies the enemy’s communication systems – including control channels and video signals – operate on, and to detect whether such enemy systems are within range. Signal generators then jam the necessary channel with noise.

Spectrum analyzers are essential for ensuring that one’s own EW systems are working properly. They are also used in the development and creation of radio-electronic equipment.

Why isn’t basic field equipment enough for a modern military?

In field conditions, simple Chinese-made devices — boxes with a single power button and one tuning knob — are often used against drones. According to Ukrainian military electronics expert Serhii “Flash” Beskrestnov, “trench” EW systems are essentially white noise generators calibrated to operate around commonly used communication frequencies. They feature only one adjustable setting – the width of the jamming band – and can be operated by soldiers without an engineering background.

“Trench” EW systems can be operated by soldiers without an engineering background.

Simple radio frequency spectrum analyzers can be acquired for €40 online. A wideband jammer, based on early radio-era technology (using spark discharges), can even be assembled from parts of a stun gun and a construction bracket.

These systems also require careful calibration. They must be capable of tuning to jam specific frequency bands, and they must undergo testing for durability and temperature resistance. This is where higher-end equipment becomes essential — including signal generators, spectrum analyzers, oscilloscopes, vibration testers , and climate chambers. (Factories also use reference instruments to calibrate the devices and ensure they are fully functional.)

The accuracy of low-cost, off-the-shelf radio frequency signal generators is often not sufficient for tasks like quickly identifying enemy equipment, which requires analyzing the radio environment. This requires a sophisticated array of receivers capable of covering a wide range of frequencies and the use of multiple antennas — equipment too heavy for a drone to carry.

Another challenging task is dealing with enemy devices that use frequency hopping . In order to jam these devices, one must understand how the enemy transmitter’s frequency changes so that its behavior can be replicated. This requires creating a nearly identical signal.

Aviation EW systems also rely on high-precision equipment to protect aircraft from radar detection. These systems are capable of sending decoy signals in response to radar pulses, effectively confusing enemy radar and preventing them from accurately pinpointing the aircraft’s location and speed.

For more effective performance, militaries tend to opt for significantly more expensive equipment, with pricing influenced by factors such as frequency stability , bandwidth, and the number of channels. Germany’s Rohde & Schwarz and the US-based Keysight are among the leading manufacturers of this high-end technology. In its Russian-language manual , Technologies and Methods for Generating Signals in EW Systems , Keysight highlights the benefits of its signal generators: high-frequency switching speeds, a wide dynamic range, and low noise levels.

Keysight noise generators are priced 8-10 times higher than those of the company’s competitors. The manufacturer justifies the premium by the devices’ “special” features, which include electronic calibration and an advanced thermal compensation system. These capabilities enable Keysight’s devices to function autonomously for extended periods – without human intervention – military expert Leonid Dmitriev explained in an interview with The Insider .

A signal generator from Swiss manufacturer AnaPico, a company that became part of Keysight earlier this year, is priced at €34,000 ($37,500). Keysight’s spectrum analyzers can cost more than €40,000 ($44,000) each, while Rohde & Schwarz analyzers are priced at around €33,000 ($36,000). Many advanced signal generators depend on microchips. (The Insider has previously reported on how microchips are being illicitly supplied to Russia.)

Rohde & Schwarz products can solve any radio engineering task in modern warfare, Ukrainian aviation and radio-electronics expert Anatolii Khrapchynskyi told The Insider :

“Most of this equipment operates in a range from 8 kHz to 40 GHz, covering the main needs for radio monitoring, radar, and communication systems. It can be used both for performance analysis and tuning — it can also act as a high-precision component in an advanced system.

These generators, priced between $6,000 and $50,000, are not designed for ‘trench electronic warfare’ but rather for sophisticated, large-scale systems. A controlled generator can produce a signal with such precise form, type, and density that, when paired with the appropriate amplifier, it creates an almost impenetrable electronic warfare system.”

In wartime, installations equipped with this technology can disrupt low-orbit satellites, simulate missile launches to deceive the enemy, and engage in spoofing — altering GPS coordinates. “One only needs to recall the navigation problems experienced by European aircraft near [Russia’s] Kaliningrad Region,” Khrapchynskyi notes. “In Russian Orlan drones, this technology may have been used to intercept mobile phone signals. Undoubtedly, this equipment will also be used to protect large and strategically important sites, such as airports, military bases, and command posts.”

Western aid to Russia’s defense industry

According to experts from NPP Gamma, which works in information security for Russia’s Ministry of Internal Affairs and Federal Security Service (FSB), Russia practically did not produce its own advanced spectrum analyzers until 2022 – most of the certified products came from foreign companies , with only a few devices from several local manufacturers . According to Gamma’s analysis of the market, in 2023 Russian concerns purchased 57 Russian-made spectrum analyzers and 669 imported ones. In some areas, Western spectrum analyzers were considered “irreplaceable” — particularly in the extremely high-frequency range. In the portable spectrum analyzer market, domestic options are nearly nonexistent, with Western companies Rohde & Schwarz and Keysight accounting for half of all sales.

Russia practically did not produce its own spectrum analyzers until 2022.

Trade data reveal that even after the annexation of Crimea, Keysight continued supplying Russia with frequency generators. In 2021, Russia imported $7 million worth of signal generators directly from Keysight, and in 2022, the figure was $3.8 million.

According to US regulations, the export of signal generators (code 854320) to Russia has been under embargo since Feb. 27, 2023, while the export of spectrum analyzers (code 903084) has been banned since May 23, 2023. However, among the below-mentioned exporters, only AnaPico AG has ceased sending its products to Russia.

In the European Union, signal generators were banned from export to Russia starting from June 24, 2023. The shipment of spectrum analyzers (and other devices with codes beginning with 9030) was banned on Dec. 19, 2023. This means that entities of Russia’s military-industrial complex could still legally acquire European spectrum analyzers for a year and a half after the start of the full-scale invasion. The responsibility for this reality rests with European justice – not with exporters or importers.

Russia’s military-industrial complex could still legally acquire European spectrum analyzers for a year and a half after the start of the full-scale invasion of Ukraine.

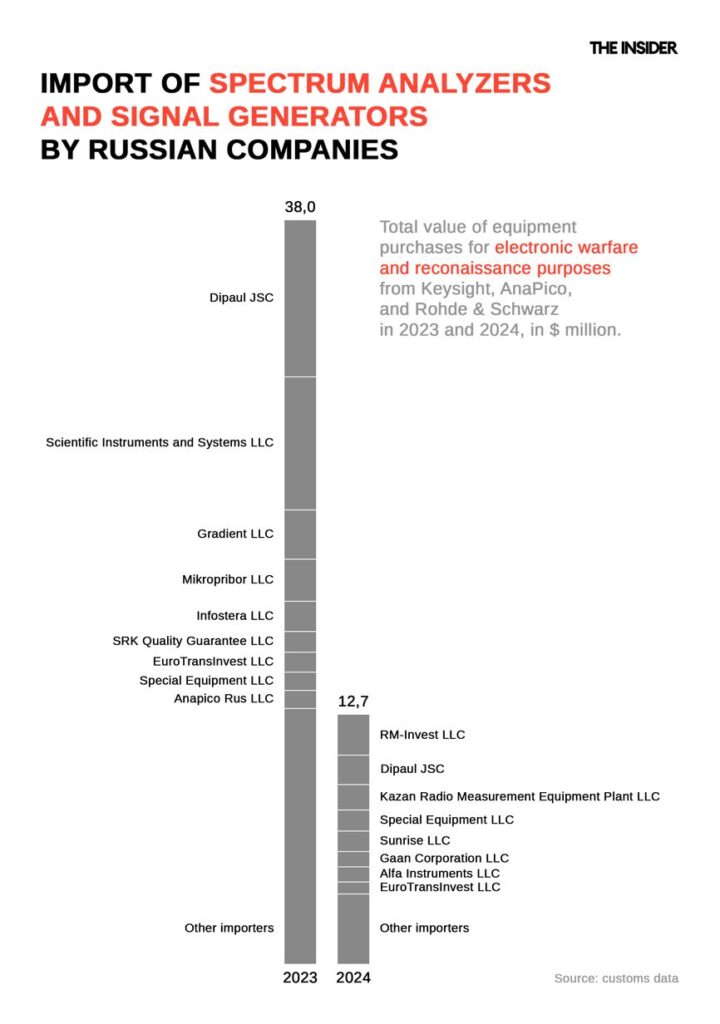

Analyzing customs data, The Insider found that in 2023 alone, Russia imported $38 million worth of spectrum analyzers and signal generators from the California-based U.S. firm Keysight, Munich-based German firm Rohde & Schwarz, and the Swiss firm AnaPico (now part of Keysight), based just outside Zürich . In 2024, these imports amounted to $12 million, with the average device priced around $43,000.

As a result, the coalition supporting Ukraine may literally be helping Russia jam its own equipment – affecting civil and military aircraft from NATO countries in the Baltic region, as well as Western equipment used by the Ukrainian military. The Insider has reached out to Rohde & Schwarz and Keysight for comment.

In 2023, the leading buyers of Keysight, Rohde & Schwarz, and AnaPico analyzers and generators were Dipaul JSC . Following them in terms of volume were companies including Scientific Instruments and Systems LLC, Gradient LLC, Mikropribor LLC, and Infostera LLC.

These companies, according to the Russian SPARK-Interfax database, appear to be simple resellers: their high revenues (up to billions of rubles annually) and virtually non-existent fixed assets suggest that they do not produce anything themselves. Their active involvement in foreign economic activities suggests that their work is centered on export-import operations.

In 2023, AnaPico’s Russian subsidiary, Anapico Rus LLC (Anapico Rus LLC), continued to trade its parent company’s products.

In 2024, the leaders in purchasing Keysight, Rohde & Schwarz, and AnaPico products changed, with RM-Invest LLC (ООО «РМ-Инвест») taking the top spot. Most other purchases were made by companies including Kazan Radio Measurement Equipment Plant LLC (ООО «Казанский завод радиоизмерительной аппаратуры»), Special Equipment LLC (ООО «Специальное Оборудование»), Sunrise LLC (ООО «Санрайз»), Gaan Corporation LLC (ООО «Корпорация Гаан»), and Alfa Instruments LLC (ООО «Альфа Инструментс»).

Supplies via China

In 2023, market leader Dipaul operated mainly through Chinese intermediaries. Nearly half of the company’s imports that year were supplied by Tyranhe Technology Co., Ltd. — a shell company with no website or phone number.

In 2023, Dipaul procured the following:

Signal generators with ultra-low phase noise, phase noise analyzers, and other equipment manufactured by Swiss company AnaPico.

Signal generators from the American firm Stanford Research Systems.

Signal generators from the American company Keysight Technologies, along with various spectrum analyzers also produced by Keysight.

Signal generators from Germany’s Rohde & Schwarz.

A CNT-90 spectrum analyzer from Swedish company Pendulum Instruments, purchased through South African firm Burndale Technologies. This device is noted for its high frequency stability (0.01 ppm).

From January to May 2024, Dipaul acquired Rohde & Schwarz and Keysight-manufactured equipment worth $2.9 million.

According to Russia’s state procurement system, Dipaul has been an active government contractor in the past (at least until much of the procurement data was classified). Some of its major clients include the Ministry of Education and Science (for an epitaxial center), the Ministry of Industry and Trade, Russian Space Systems (for control and measurement equipment), BPO Progress, and the defense enterprise TsNIIKhM (FSUE TsNIIKhM, lit . “Central Research Institute of Chemistry and Mechanics”).

In 2024, RM-Invest LLC became the leading importer, having previously specialized in medical equipment. The company made only two purchases – both large batches of Keysight generators and spectrum analyzers – through the Hong Kong-based CR Kesha Trading & Logistics.

The third-largest importer in 2024, Kazan Radio Measurement Equipment Plant LLC, also worked with the same Chinese intermediary. The company procured AnaPico analyzers and Rohde & Schwarz generators.

The most expensive single device — purchased for half a million dollars — was an analyzer from Keysight, capable of operating across a wide range (from 10 MHz to 67 GHz), acquired by Scientific Instruments and Systems LLC through China’s Shenzhen Alvite Foreign Trade.

Among the exporting firms, Hong Kong’s CR Kesha Trading & Logistics led the market in 2024. Other active intermediaries, according to documents, included the Hong Kong-based Turan Technology (closed in 2021, with Kyrgyzstan national Nurillo Khashimov as director), China’s Jiujiang Xinchen Technology, Hong Kong’s Mkpl Technology, and Turkey’s CS Yonetim ve Destek Hizmetleri.

Satellites and fighter jets: How does Russia apply high-end EW equipment?

Equipment from leading global manufacturers like Keysight Technologies, Rohde & Schwarz, Meatest AnaPico, KYORITSU, and others is extensively used in the development and enhancement of Russia’s radio-electronic reconnaissance satellites and the “Liana” system, military expert Leonid Dmitriev told The Insider . With support from Dipaul, companies acquire control and measurement devices such as rubidium frequency standards, analyzers, and oscilloscopes, as well as components for passive radio reconnaissance and satellite group management systems.

N9XXX series spectrum analyzers are widely used in electronic warfare and reconnaissance systems – such as the Leer-3, Borisoglebsk-2, Shipovnik, and Murmansk-BN – which are built to monitor and disrupt wireless communication and navigation systems. They can substitute cellular base stations and interfere with satellite navigation by jamming signals or spoofing GPS/GNSS coordinates.

N4001A noise generators are well-suited for use in modern electronic warfare systems like the R-330Zh “Zhitel,” which integrates the capabilities of both an autonomous radio reconnaissance system and a jamming station, Dmitriev noted. These devices can also be deployed in the onboard “Proran” electronic reconnaissance and “Regata” jamming systems in the Su-34 and Su-35 fighter jets.

Dmitriev pointed out that the large-scale production of onboard EW systems for Russian aircraft only became feasible in the mid-2010s, despite development efforts dating back to the late 1970s. The industries of both the Soviet Union and of Russia in the 1990s and 2000s struggled to produce equipment with the necessary precision, reliability, and speed.

The rise in Russia’s production of “domestic” radio-electronic reconnaissance and EW systems that meet modern standards coincided with the certification and supply of imported instruments and components — particularly precision frequency analyzers, essential for any radio-technical reconnaissance and monitoring system, and high -quality jammers capable of delivering dense signals within a specified range without overheating.

The continued import of high-end Western equipment has essentially allowed Russia to engage in technological plagiarism.

In short, Russia’s much vaunted electronic warfare capabilities still depend on Western technologies that the country’s military-industrial complex is not capable of producing by itself, and which Chinese manufacturers are incapable of providing.

Eurasia Press & News

Eurasia Press & News