Increasingly intensifying U.S. economic sanctions targeting Russia’s financial system have deepened concerns in China over its extensive dollar asset holdings and the Chinese financial system’s reliance on dollars.

Increasingly intensifying U.S. economic sanctions targeting Russia’s financial system have deepened concerns in China over its extensive dollar asset holdings and the Chinese financial system’s reliance on dollars. Worries that a similar sanctions regime may one day be implemented against the Chinese financial system—and reports indicating that some Chinese financial firms involved in Russia-related transactions could soon be targeted by U.S. economic sanctions1—help explain why prominent voices in China are calling to reduce the Chinese financial system’s exposure to the dollar.

Yet despite significant recent growth in China’s use of the renminbi in cross-border payments, the Chinese financial system is still highly reliant on dollars and its largest state-owned financial institutions are deeply interconnected with the U.S. financial system. Beijing will face significant obstacles trying to “sanctions proof” its financial system. One emerging question is the extent to which China will embrace non-dollar, non-renminbi currencies in pursuit of its dedollarization ambitions. Some Chinese officials and academics have broadly embraced the idea of both the renminbi and the euro playing a larger global role2—a view that is seemingly congruent with the perspectives of European policymakers who envision an increasingly multipolar financial system in which the euro’s significance expands.3 But Chinese scholars and thought leaders seem to hold differing views over the potential role of the euro in enabling China’s own diversification away from the dollar.

China’s significant interconnectivity to the dollar financial system is, in the near term, likely to persist. Ironically, the depth of these financial interlinkages has, in the past, deterred U.S. policymakers from implementing economic sanctions against China’s largest banks. The possibility of economic sanctions targeting some small or mid-sized Chinese financial firms over Russia-related transactions could give political momentum to calls in China for more accelerated currency diversification efforts. This dynamic, along with some European policymakers embracing the prospect of a multipolar financial order, growing frustrations in China and other emerging markets with existing U.S. economic sanctions targeting Russia, intensifying disputes in the South China Sea, and indications that the supply of U.S. government debt is set to grow enormously, all underscore why it is important to better understand Beijing’s deep dollar reliance—and challenges facing its dedollarization ambitions.

Can China Copy Russia’s Playbook?

In response to growing U.S.-China tensions, U.S. economic sanctions targeting Russia’s central bank and largest financial institutions, and reports that the administration of U.S. President Joe Biden may sanction some smaller Chinese financial institutions over connectivity with Russia, Chinese policymakers are facing increasing calls to reduce the Chinese financial system’s exposure to dollar assets.

Former Chinese central bank monetary policy committee member Yu Yongding, an influential Chinese economist, recently endorsed reducing Chinese foreign exchange reserves’ holdings of U.S. government debt securities (treasuries) due to the growing risk of U.S. economic sanctions targeting Chinese financial institutions or China’s foreign exchange reserves.4 An April 2024 study in a top Chinese state-backed think tank’s journal similarly warned that the Chinese official sector’s dollar assets are at risk of “increasingly becoming ‘hostages,’” pointing to the fact that U.S. economic sanctions froze the Russian central bank’s dollar assets.5 In May 2024, a researcher from the state-backed National Institution for Finance and Development endorsed further diversification of China’s foreign exchange reserves away from dollar assets.6

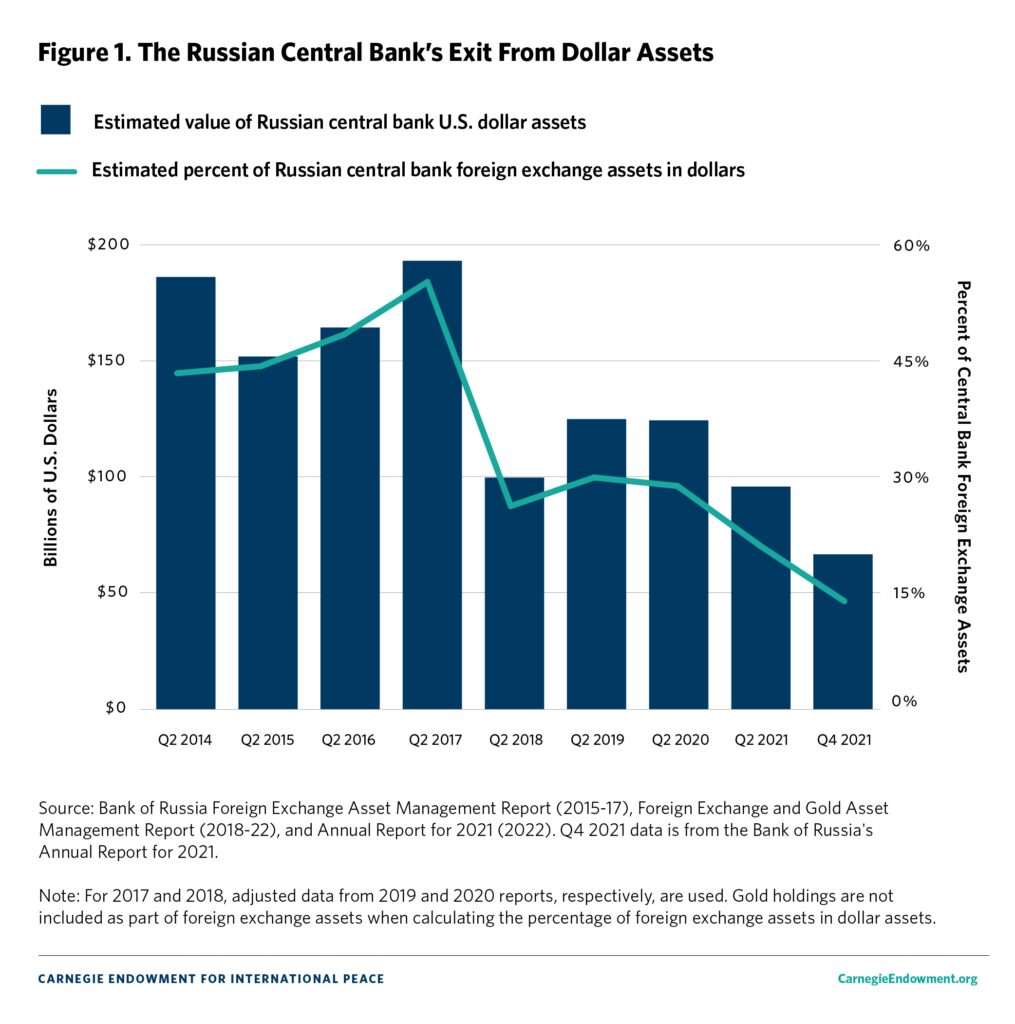

In other words, some are seemingly calling for China to begin copying elements of the so-called Fortress Russia strategy implemented by Russia’s central bank in the years between the Russian government’s 2014 annexation of Crimea and the 2022 onset of a full-scale Russia-Ukraine war.7 These tactics dramatically reduced the dollar’s share of Russia’s official foreign exchange reserves. Data from Russia’s central bank indicates that dollar assets’ share of Russia’s foreign exchange reserves declined dramatically between 2017 and 2018, and again between 2020 and 2021 (see Figure 1).

Despite these efforts, an estimated $300 to $350 billion in Russian central bank foreign exchange reserve assets—of which most are euro assets but over $65 billion are estimated to be dollar assets—are frozen as a result of economic sanctions implemented in 2022.8

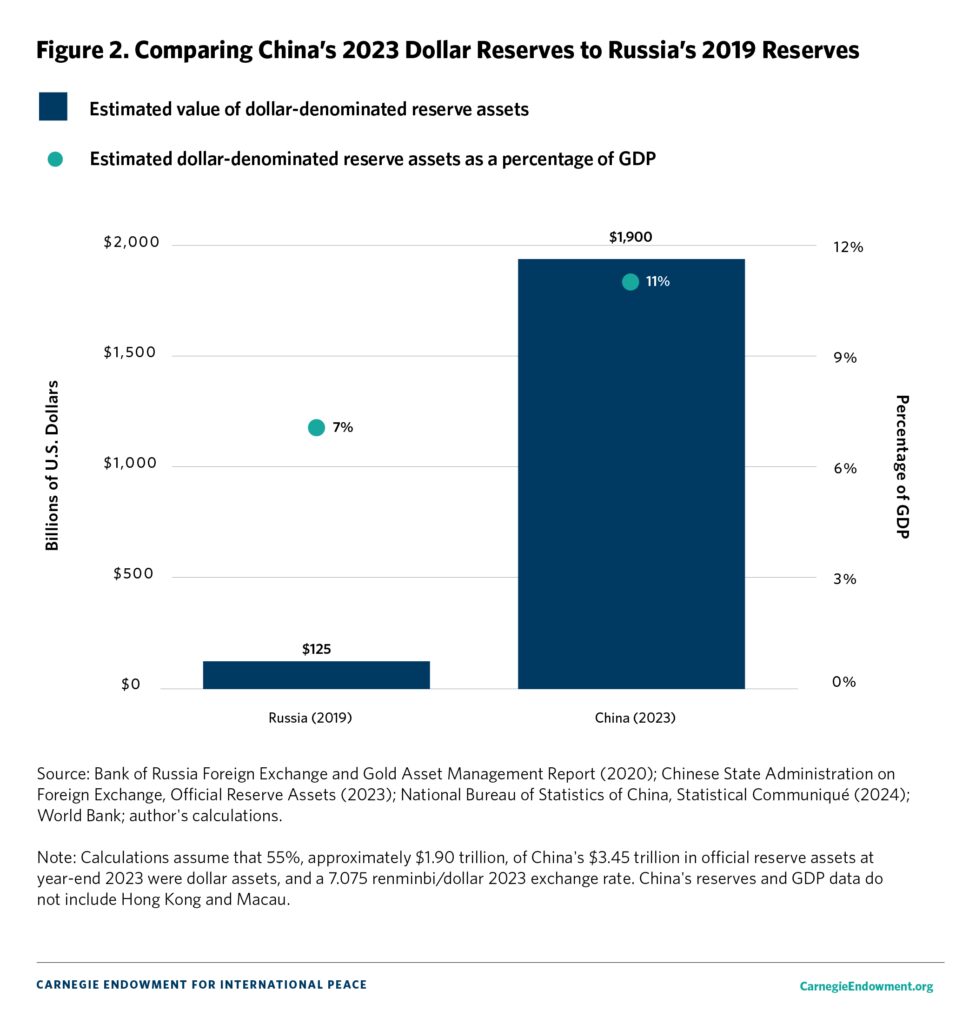

By comparison, China’s foreign exchange reserves are much larger than Russia’s. Mainland China’s official foreign exchange reserves—excluding gold, International Monetary Fund reserve assets, and China’s International Monetary Fund reserve position—were reported to be between $3.10 and $3.29 trillion from January 2023 through August 2024.9 While China’s government does not regularly disclose the currency breakdown of these assets, a 2023 analysis estimated that around 50 percent of China’s overall reserves are in dollars.10 This estimate is in line with a 2017 currency breakdown published by China’s foreign exchange regulator reporting that roughly 60 percent of mainland China’s foreign exchange reserves are dollar-denominated and with a recent estimate that 60 percent of mainland China’s reserves were in dollar assets in 2022.11 (Separately, at the end of 2023, over 80 percent of Hong Kong’s Exchange Fund foreign currency reserves were in dollar assets, worth approximately $420 billion.12)

This suggests that the 2023 value of mainland China’s dollar reserve assets is likely over fifteen times greater than the value of Russia’s dollar reserve assets recorded in 2019, well before Russia’s central bank significantly reduced dollar-denominated foreign reserve assets from 2020 through 2021 in the lead-up to the onset of full-scale war between Russia and Ukraine. Notably, when China’s much-larger economy is taken into consideration, data indicate that China’s 2023 level of dollar-denominated reserves is disproportionately higher than Russia’s in 2019 (see Figure 2).

The sizable amount of Chinese foreign exchange reserve dollar assets complicates Beijing’s ability to take meaningful steps to mirror the Fortress Russia playbook. It also reflects the reality that China’s financial markets and important Chinese policy goals remain highly connected with the dollar financial system.

Understanding the Chinese Financial System’s Dollar Connectivity

Only a small portion of China’s high level of debt outstanding is foreign currency–denominated,13 but nearly half of mainland China’s external debt is dollar-denominated And by late 2023, the mainland Chinese economy recorded over $1.1 trillion in external dollar-denominated debt, which accounted for 84 percent of China’s registered external debt in foreign currencies.14 Much of this debt is attributable to the banking sector; in the fourth quarter 2023, mainland China’s banking sector reported $418 billion in cross-border dollar liabilities.15 China’s external dollar-denominated debt is also attributable to local government financing vehicles (LGFVs), which at the start of 2024 had approximately $30 billion in offshore U.S. bonds set to mature within the year, accounting for an estimated 7 percent of total LGFV 2024 debt maturities.16 (Financial stability worries associated with LGFVs’ onshore and offshore debts, which together were reportedly $8.5 trillion in 2023, are a major concern to Chinese authorities.17)

China’s four largest state-owned commercial banks—the world’s four largest commercial banks by asset size18—are particularly interconnected with the dollar financial system. These institutions often rely on dollar funding to finance overseas activities, and in recent years at times maintained dollar-denominated liabilities worth significantly more than dollar-denominated assets—a financial system vulnerability identified in a late 2022 research paper published by the Federal Reserve Bank of Boston.19 The size of these institutions’ dollar exposures can be massive: in 2023, one of these banks reported dollar liabilities of approximately $460 billion (versus approximately $410 billion in dollar assets).20 China’s four largest state-owned commercial banks also reported approximately $300 billion of dollar-denominated securities holdings as financial investments in 2023.21 (These dollar figures are all calculated using a 7.14 renminbi-to-dollar exchange rate for December 2023.22)

Through the purchase and sale of dollar assets, these institutions play an important role in influencing the renminbi’s value.23 In particular, these institutions can be highly active in treasury markets, serving as a link for Chinese official sector treasury purchases and facilitating Chinese currency policy objectives.24 An affiliate of one large Chinese state-owned bank is a member of the United States’ only clearing agency for treasury transactions.25 (Due to recent U.S. regulatory changes, this clearing agency is likely to become more important to treasury markets.26) Through this relationship, it can act as an intermediary for governments, hedge funds, and proprietary traders transacting treasuries.27

Dollar financial markets are also interwoven with Beijing’s geopolitical objectives and Chinese industrial policy. Historically, most of China’s Belt and Road Initiative (BRI) loans have been dollar-denominated.28 Chinese companies innovating in economic sectors prioritized by Chinese leadership often tapped dollar equity financing over the last decade, although U.S. venture capital investment into Chinese firms has dropped precipitously in recent years.29 Still, large non-U.S., China-focused dollar funds continue to play an important role in financing Chinese start-ups aligned with Beijing’s industrial policy objectives.30 Data also indicate that, from 2018 through mid-2023, approximately 20 to 50 percent of initial public offering exits each year by venture capital firms from mainland Chinese company investments involved U.S. listings.31 And despite Chinese companies increasingly not raising capital in U.S. public markets, in part due to regulatory pressure from Chinese authorities,32 many Chinese technology, energy, and electric vehicle companies are still listed on U.S. stock exchanges—with the overall value of all Chinese companies listed in U.S. markets being $848 billion as of early 2024.33

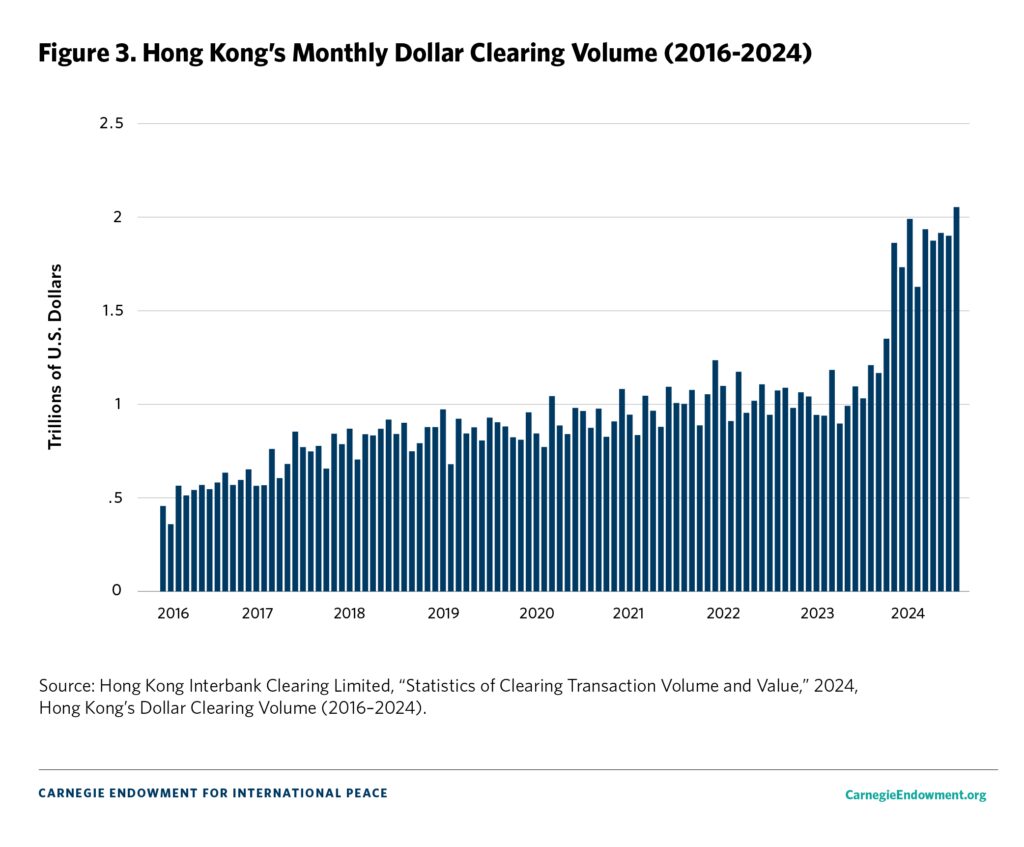

Chinese regulators are increasingly urging relatively large and growing global Chinese companies to list in Hong Kong.34 Yet in Hong Kong, most publicly traded securities are still priced, bought, and sold in Hong Kong’s local currency that is pegged to the dollar (the exception being several large listed companies participating in a recently announced “dual counter model” that facilitates dual trading of renminbi-denominated securities35).36 As of late 2023, the leader of Hong Kong’s monetary authority stated that it has “no intention, no interest, no plans to change the linked exchange rate system” for Hong Kong’s currency.37 As such, the vast majority of Hong Kong’s over $400 billion Exchange Fund foreign currency reserves are dollar assets.

Relatedly, Hong Kong’s status as an “international financial center bringing east and west together,” as recently articulated by China’s top financial regulator,38 is aided by it being allowed to maintain one a few large-value dollar payments systems outside of the United States.39 In September 2024, this arrangement, called U.S. dollar CHATS, counted around thirty financial institutions affiliated with mainland Chinese entities as direct participants—including affiliates of various Chinese technology companies and Chinese state-owned enterprises, as well as the China Development Bank.40 As Figure 3 illustrates, this arrangement’s monthly transaction volume of over $2 trillion in July 2024 is double its volume in early 2023 and over quadruple its volume in early 2016. (Also notable is that, of the over twenty non-U.S. bank affiliates that are direct participants in the preeminent U.S.-based large-value dollar payments clearinghouse, which in 2023 cleared 30 times the transaction volume of U.S. dollar CHATS,41 four are Chinese; three of these are large Chinese state-owned commercial banks while one is a bank affiliate of a Hong Kong–based Chinese state-owned transportation conglomerate heavily involved in BRI projects.42)

Finally, Chinese financial markets’ connectivity with the dollar is deeply influenced by Beijing’s approach to managing the renminbi’s exchange rate. The renminbi is subject to a robust capital controls regime and its exchange rate is actively managed by Chinese authorities relative to the dollar’s value.43 As suggested earlier, this approach involves frequent intervention in foreign exchange markets through, among other things, the purchase or sale of dollar assets by China’s central bank and its large state-owned commercial banks.44 Beijing’s goals of tightly controlling the renminbi’s value and the extent of its overseas use while also expanding its overall global role arguably necessitate that Chinese authorities maintain a market perception that renminbi held outside of mainland China is readily convertible into dollars—including by maintaining sizable dollar reserves.45 As research published by France’s central bank recently concluded: “internationalization without full capital account liberalization . . . requires the [renminbi] to be backed by dollar reserves.” 46 Notably, data in 2022 indicated that the dollar was on one side of the trade for over 94 percent of over-the-counter renminbi foreign exchange transactions.47

Assessing Beijing’s Steps Toward Decreasing Dollar Reliance

Despite China’s deep dollar dependencies, Beijing does seem to be undertaking policy efforts aimed at diversifying its reserves away from dollars and increasing the use of the renminbi in cross-border trade and finance. These efforts, however, face limitations.

Between November 2022 and April 2024, China’s gold reserves grew each month, with gold’s share of its official reserve assets increasing from 3.4 percent to 4.9 percent.48 During this time, foreign currency assets were reportedly being sold to purchase gold, thus diversifying reserves away from foreign currency assets.49 These gold purchases, however, have been paused since May 2024.50 Also, even though U.S. government data show an 11 percent decline in the dollar value of mainland China’s treasury holdings between November 2022 and April 2024,51 this data does not reflect China’s reserve holdings of treasuries held at custodial accounts in Europe and other offshore locations or through global funds, and any decline in China’s treasury holdings was likely offset at least in part by Chinese official sector purchases of dollar assets issued by U.S. government-sponsored enterprises.52 As mentioned, according to one analysis, the value of China’s dollar reserves has in fact likely remained relatively constant in recent years.53

Beijing is having success increasing the renminbi’s use in cross-border payments through rapidly expanding renminbi financial infrastructure across emerging markets, domestic Chinese policy efforts to incentivize the renminbi’s use in invoicing, and the proliferation of central bank swap lines.54 Critical to this effort has been China’s Cross-Border Interbank Payment System (CIPS), which launched in 2015 and has enabled renminbi-denominated payments to be carried out much more efficiently relative to previous channels.55 This infrastructure, however, is hardly sanctions-proofed, due to its participants’ connectivity with the dollar and the potential reach of U.S. economic sanctions. CIPS relies heavily on over 150 so-called direct participants, which are authorized by the other roughly 1,400 participants to handle cross-border payment and settlement through CIPS. 56 Most CIPS direct participants are entities within financial groups highly interconnected with the dollar financial system—generally either Chinese affiliates of large global banks or offshore affiliates of large Chinese state-owned commercial banks—and are thus quite vulnerable to potential consequences of noncompliance with U.S. economic sanctions. Also, CIPS payments involving indirect participants generally are carried out using Society for Worldwide Interbank Financial Telecommunication (SWIFT) payments messages; SWIFT is the world’s dominant financial messaging platform from which major Iranian and Russian banks were cut off in 2018 and 2022, respectively (in the case of the Iranian banks, these were reportedly cut off from SWIFT in response to the threat of U.S. economic sanctions).57

Due in part to the stand-up of CIPS and other policy efforts,58 the dollar’s share of mainland China’s cross-border payments has declined significantly since 2016, from around 70 percent to less than 50 percent in 2023, while the renminbi’s share reportedly approximately doubled and surpassed the dollar’s for the first time in early 2023, reaching 48 percent.59 In mid-2024, data showed the renminbi’s share of mainland China’s cross-border payments grew to over 50 percent.60 But these statistics are not necessarily reflective of the renminbi’s use in global trade payments and are meaningfully influenced by financial flows between Hong Kong and mainland China.

Indeed, a large share of these cross-border renminbi payments are actually attributable to purchases of renminbi-denominated securities through Hong Kong rather than trade payments.61 As researchers at two prominent Chinese state-backed think tanks recently wrote: “the increase in the share of renminbi cross-border settlement is mainly related to the expansion of northbound capital flows [from Hong Kong to mainland China] and the increase in the frequency of inflows and outflows brought about by the opening of the [mainland China] financial market in recent years.”62 Indeed, during the first nine months of 2023, the renminbi reportedly accounted for just 24.4 percent of China’s cross-border good trade—meaning that a relatively larger share of Chinese trade payments is still in dollars, despite significant increases in the renminbi’s use.63

One reason why the dollar still plays a very important role in China’s cross-border payments for goods is that global commodity markets largely remain priced in dollars, despite Beijing’s policy efforts to advance the renminbi’s use in payments for commodities.64 Data indicate that almost 30 percent of China’s imports are raw materials.65 Also, given Chinese restrictions on the renminbi’s overseas use and relatively much higher liquidity of the dollar in foreign exchange markets, it is often likely just much more practical—and a less expensive, more established approach—for trading partners of Chinese firms to transact in dollars.66

China’s Varying Currency Diversification Perspectives

Commentary by Chinese economic experts suggests that, in theory, a significant opening of China’s financial markets and lifting of restrictions on the renminbi’s global use could help curb China’s reliance on the dollar.67 However, despite a March 2024 statement by a senior Chinese foreign exchange regulatory official indicating that Beijing may soon take steps to ease restrictions on capital flows in and out of mainland China,68 much wider-spread efforts appear unlikely anytime soon due to fears that a significant capital account loosening could bring about financial stability risks.69 The degree of capital account liberalization and economic shifts necessary for China to reduce its need for sizable foreign exchange reserves is unlikely to take place in the near term.70

Given these constraints, there are growing calls by some Chinese scholars for the country’s foreign exchange reserves to be increasingly diversified into non-dollar currencies.71 Recent estimates indicate that the majority of China’s reserves in non-dollar, non-gold reserve assets are likely denominated in euros, with much of the remainder split between assets denominated in the Japanese yen and the British pound.72 A key question for Chinese policymakers and experts concerned about China’s dollar exposure surrounds what role these major non-dollar currencies could play in currency diversification ambitions.

In 2023, several researchers at important state-backed think tanks endorsed the idea of further diversifying China’s foreign exchange reserves into euros and yen.73 More broadly, Chinese officials at the Ministry of Finance and the State Council’s Development Research Center have endorsed global currency diversification, with the renminbi, the euro, and the dollar each playing leading roles in their respective regions.74 A senior researcher at a top Chinese state-backed think tank recently stated that he sees the euro and yen emerging as “important poles” alongside the renminbi as the dollar loses its “hegemonic status.”75

Yet despite this embrace of so-called currency diversification involving the euro and perhaps the yen, some prominent Chinese scholars appear to oppose the idea that China’s foreign exchange reserves should be diversified with euro and yen assets. For example, Yu Yongding recently warned that this approach may not be sensible and suggested that he views the geopolitical risk profile of these assets as similar to dollar assets.76 The president and deputy secretary of the Chinese Communist Party committee at the Shanghai University of Finance and Economics has decried that some European currencies are, like the dollar, “tools for external expansion and establishing world hegemony,”77 and believes that greater global renminbi use is actually very likely to come from reduced use of the euro and yen.78 (Notably, in 2020, before U.S. and European economic sanctions in 2022 targeting Russia’s central bank and largest financial firms, the euro was reportedly used in almost two-thirds of Russian exports to China;79 in early 2024, a senior Russian official reportedly said that over 90 percent of China-Russia trade is settled in renminbi.80)

Could Beijing Actually Diversify China’s Reserves?

Even if Beijing decides to try further diversifying Chinese foreign exchange reserves away from dollar assets, there are likely to be practical limitations.

Second quarter 2024 data from the International Monetary Fund indicate that global central bank foreign exchange reserves are approximately $12.3 trillion, and that the euro and yen are the distant second- and third-most prevalent currencies in which central bank foreign exchange reserves are denominated, together accounting for less than half the dollar’s share—19.76 percent and 5.59 percent, respectively, versus 58.22 percent.81 As data above indicate, China’s foreign exchange reserves account for roughly 25 to 30 percent of global central bank foreign exchange reserve assets, and its dollar-denominated reserve assets may be around $1.9 trillion. Together, these figures suggest that any significant reallocation of these reserves to euro or yen assets would involve very large purchases of high-grade euro- and yen-denominated government debt securities.

Were Chinese authorities to decide to try to meaningfully diversify China’s reserve assets into such securities, policymakers in Europe and Japan could act in response to concerns over the effects that large Chinese purchases could have on the euro’s and yen’s respective values and thus these jurisdictions’ trade competitiveness.82 More fundamentally, diversification of Chinese reserves away from the dollar and into euro and yen assets could be constrained by structural market factors. The supply of high-grade euro-denominated assets is relatively limited and markets for these assets is relatively modest and market depth for these assets can be limited (eurozone countries each issue their own euro-denominated government debt securities, and a high portion of these securities are held by European banks or the European Central Bank).83 The supply of high-grade yen-denominated assets is also constrained—over half of Japanese government bonds are held by Japan’s central bank.84 Data from late 2023 suggest that 17 percent (approximately $2.0 trillion) of over $11.5 trillion in eurozone government debt was held outside the eurozone,85 and that 13.5 percent (approximately $1.2 trillion) of Japan’s roughly $8.7 trillion in government debt was held by foreigners.86 In contrast, approximately 30 percent ($8.1 trillion) of U.S. treasuries was recorded as being held by foreigners by the end of 2023.87

Looking further ahead, the greater global role for the euro and renminbi endorsed by some prominent Chinese economic policy experts and officials actually seemingly aligns with the policy vision of certain European financial policymakers. In 2021, the then head of the powerful European Stability Mechanism stated, “our objective should be to move to a multipolar currency system with about equal rates for dollar, euro, and renminbi.”88 In 2023, France’s central bank governor endorsed the euro’s “greater international role” in a “more multipolar” international financial system, and he believes that policy efforts in Europe aimed at increasing the supply of high-grade euro-denominated debt securities could increase euro assets’ use in foreign exchange reserves.89 More recently, an Italian member of the European Central Bank’s executive board wrote that, in “an increasingly multipolar world,” building a “stable, technically resilient and deeper market” for euro debt securities is essential to meeting demands by some central bankers to grow euro-denominated asset reserve holdings.90 A September 2024 report by Mario Draghi, former European Central Bank president, endorses “the issuance of a common safe asset” by the European Union (EU) with the goal of “enhancing the role of the euro as a reserve currency.”91 For now, however, Beijing’s ability to diversify reserves into euro assets is likely to remain constrained.

China could also, in theory, modestly diversify some reserves away from the dollar into government debt securities denominated in currencies of relatively small and open economies.92 Research by the International Monetary Fund indicates that this is a global trend.93 But these assets—which account for the vast majority of non-renminbi, non-dollar, non-euro, non-yen reserve assets—are largely government securities issued by countries whose currencies, from Beijing’s perspective, may not present meaningfully less geopolitical risk than the dollar, including Australia, Canada, and the United Kingdom.94 Also, China’s enormous appetite for foreign currency assets, driven by its current monetary policy approaches and its persistent trade imbalances,95 means that meaningful reserves diversification is unlikely to be achieved through sizable purchases of the modest supply of assets denominated in the currencies of relatively small and open economies.

Outside of these jurisdictions, the United States, the European Union, and Japan, the markets for most other jurisdictions’ high-grade sovereign debt securities are simply too small to sufficiently absorb significant Chinese official sector purchases96—such purchases could ultimately make those markets meaningfully less liquid. It is worth noting that Chinese authorities have supported a number of efforts aimed at increasing local currency usage in payments across emerging markets.97 However, these efforts are unlikely to make much of a difference in the overall near-term supply of high-grade assets denominated in non-dollar currencies. More broadly, recent research by the ASEAN+3 Macroeconomic Research Organization (which counts the Chinese government as a member) suggests that neither the yen nor the renminbi will significantly curb the dollar’s dominant role in East or Southeast Asia in the near term.98

In short, Russian authorities diversified the country’s foreign exchange reserves in large part by buying renminbi assets,99 but a similar option is not possible for Chinese authorities. China’s supply of foreign exchange reserves is significantly larger than Russia’s, there is no single currency into which Chinese authorities could meaningfully diversify reserves, and even meaningful near-term reserves diversification across a range of currencies—given the options that exist—faces significant market and geopolitical impediments.

Considerations for U.S. Economic Statecraft

Although Chinese financial authorities are likely to face increased domestic pressure to sanctions-proof China’s financial system, this will be a difficult ask. China’s financial system relies heavily on deep connections with the dollar financial system.

Importantly, the depth and breadth of certain large Chinese institutions’ interconnectivity with the U.S. financial system implicates U.S. economic statecraft policy options. Media reports indicate that, in recent years, U.S. policymakers decided against economic sanctions targeting two of China’s largest state-owned commercial banks due to concerns over the effects on U.S. financial stability.100 If U.S.-China tensions grow, should steps be taken to make such policy options less costly to the U.S. economy? Or could such steps, by facilitating greater dedollarization in China, ultimately constrain U.S. economic statecraft policy options? In the same vein, as the Biden administration reportedly considers economic sanctions targeting some Chinese financial institutions—presumably smaller banks—for business dealings with Russia,101 could such actions lead Beijing to accelerate the build-out of more efficient non-dollar payments channels less vulnerable to U.S. economic sanctions? How could these developments implicate future U.S. policy choices in scenarios involving destabilizing escalations in the South China Sea?

Furthermore, with political changes afoot in Europe, and given some European policymakers’ desire to grow the euro’s global role, it is important for Washington to consider how the EU might respond to significant U.S. economic sanctions targeting China’s financial system in the event of future crises, and to what extent alignment between EU authorities and the U.S. government could be expected. Only a few years ago, a European Parliament study noted that greater global euro use would “water down the ability of the [U.S. government] . . . to impose unilateral sanctions.”102 More recently, in 2023, French President Emmanuel Macron reportedly suggested Europe should reduce its vulnerability to the “extraterritoriality of the U.S. dollar” in a meeting with Chinese leader Xi Jinping, presumably referencing the power of the U.S. government to threaten economic sanctions against non-U.S. companies over dealings with U.S.-sanctioned entities.103

Despite these currents, a recent survey of global central bankers indicates that, through 2026, net demand by global central banks for dollar assets will likely be more pervasive than demand for euro, renminbi, yen, and pound assets combined.104 Moreover, Chinese policymakers appear unlikely to take steps that meaningfully reduce China’s interconnectivity with the dollar financial system in the near term. But it is clear some officials in China—as well as certain policymakers in emerging markets projected to become some of the world’s largest economies105—are keen to reduce official sector exposure to dollar assets and expand use of non-dollar payments channels due in part to concerns over how the U.S. government is using economic sanctions. Against the backdrop of these concerns, if efforts to improve and expand the market for high-grade euro assets are ultimately successful and Chinese capital controls are eventually significantly loosened, to what extent could global demand for dollar assets be affected? With the U.S. federal debt projected to double from around 100 to 200 percent of gross domestic product by 2050,106 the answer to this question could ultimately implicate not only future U.S. economic statecraft decisions, but also future treasury market dynamics.

Notes

1Trevor Hunnicutt and Lananh Nguyen, “Exclusive: G7 Plans to Warn Small Chinese Banks Over Russia Ties, Sources Say,” Reuters, June 9, 2023, https://www.reuters.com/world/g7-plans-warn-small-chinese-banks-over-russia-ties-sources-say-2024-06-09/; “Exclusive: Russia Payment Hurdles With China Partners Intensified in August,” Reuters, August 30, 2024, https://www.reuters.com/business/finance/russia-payment-hurdles-with-china-partners-intensified-august-sources-say-2024-08-30/. See also infra note 101 and accompanying text.

2See infra notes 74–75 and accompanying text.

3See infra notes 88–90 and accompanying text.

4Yu Yongding, “China’s Foreign Exchange Reserves: Past and Present Security Challenges,” Tricontinental, May 17, 2024, https://thetricontinental.org/wenhua-zongheng-2024-1-china-foreign-exchange-reserves/.

5翟东升 and 王雪莹, 美国国债的嚣张特权与新时代的中国选择, 现代国际关系, (2024, 4th Issue), https://weibo.com/ttarticle/p/show?id=2309405028149342896167.

6刘瑶, “去美元化”加速 人民币国际化迎新机遇, 中国城乡金融报, May 2023, https://www.zgcxjrb.com/zgcxjrb/gjjr/webinfo/2023/05/1683722772376392.htm.

7Douglas Rediker and David Dollar, “What You Should Know About Sanctions on Russia,” Dollar & Sense: The Brookings Trade Podcast, Brookings Institution, March 1, 2022, https://www.brookings.edu/wp-content/uploads/2022/03/Dollar-and-Sense-Rediker-20220301-.pdf (noting that: “Russia has made a big point of being Fortress Russia and, quote, “sanctions-proofing” their economy. That means over the years, Vladimir Putin has not only accumulated $630 billion worth of reserves, but he has divested from U.S. reserves, U.S. dollar treasuries and other U.S. dollar assets, into a wide range of euros, of yen, of sterling, of Swiss franc, of gold, of SDRs, a wide range in the assumption that those reserves would provide him with a means by which to resist any sanctions that the U.S. might impose on him.”).

8Marc Jones and Jan Strupczewski, “Explainer: How Will the West Use Russia's Frozen Assets?,” Reuters, March 21, 2024, https://www.reuters.com/world/europe/how-will-west-use-russias-frozen-assets-2024-03-21/; Martin Sandbu, “Russian Central Bank Reserves: The Numbers,” Financial Times, January 4, 2024, https://www.ft.com/content/9529da2e-963e-4b46-956f-3d78548fa3be; “Kremlin warns West against using frozen Russian assets as collateral for Ukraine,” Reuters, February 4, 2024, https://www.reuters.com/world/kremlin-warns-west-against-using-frozen-russian-assets-collateral-ukraine-2024-02-05/.

9State Administration of Foreign Exchange (SAFE), “Official Reserve Assets,” 2024, https://www.safe.gov.cn/safe/2022/0207/23934.html; State Administration of Foreign Exchange (SAFE), “Official Reserve Assets,” 2023, https://www.safe.gov.cn/safe/2022/0207/20625.html.

10Brad W. Setser, “China Isn’t Shifting Away From the Dollar or Dollar Bonds,” Council on Foreign Relations, October 3, 2023, https://www.cfr.org/blog/china-isnt-shifting-away-dollar-or-dollar-bonds.

11SAFE, 2021 Annual Report, 2021, https://www.safe.gov.cn/en/file/file/20221226/9186b372d33e4a6b9d156ab154cc2979.pdf?n=Annual%20Report%20of%20the%20State%20Administration%20of%20Foreign%20Exchange%20, 53; Matthew Ferranti, “Estimating the Currency Composition of Foreign Exchange Reserves” (working paper, May 2023), https://arxiv.org/pdf/2206.13751.

12Hong Kong Monetary Authority, Annual Report 2023, 2024, https://www.hkma.gov.hk/media/eng/publication-and-research/annual-report/2023/17_Reserves_Management.pdf, 183. Estimate of dollar value of reserves computed using an exchange Rate of 7.8 Hong Kong Dollars to U.S. Dollar. For more information on the Exchange Fund, see Chi Lo, The Hong Kong dollar peg: Your questions answered, BNP Paribas Asset Management, August 8, 2022, https://www.bnpparibas-am.com/en-us/front-of-mind/the-hong-kong-dollar-peg-your-questions-answered/.

13International Monetary Fund (IMF), “People's Republic of China: Staff Report for the 2023 Article IV Consultation,” February 2, 2024, 76, https://www.imf.org/en/Publications/CR/Issues/2024/02/01/People-s-Republic-of-China-2023-Article-IV-Consultation-Press-Release-Staff-Report-and-544379.

14SAFE, “SAFE Releases China's External Debt Data at the end of September 2023,” December 12, 2023, https://www.safe.gov.cn/en/2023/1228/2157.html.

15BIS Data Portal, “Locational Banking Statistics,” accessed July 2024, https://data.bis.org/topics/LBS/BIS,WS_LBS_D_PUB,1.0/Q.S.L.A.USD.F.5J.A.CN.A.5J.A. This data captures some of activity by Chinese affiliates of non-Chinese banks. Laura E. Kodres, Leslie Sheng Shen, and Darrell Duffie, “Dollar Funding Stresses in China,” Federal Reserve Bank of Boston, November 1, 2022, https://www.bostonfed.org/publications/risk-and-policy-analysis/2022/dollar-funding-stresses-in-china.aspx (explaining that the BIS banking data reflects “internationally-active reporting banks in China . . . which include a small proportion of non-Chinese banks with affiliates in China”).

16Sherry Zhao and Lan Wang, “Policy Risk Remains High for Local-Government Financing Vehicles in China,” Fitch Ratings, January 17, 2024, https://www.fitchratings.com/research/international-public-finance/policy-risk-remains-high-for-local-government-financing-vehicles-in-china-17-01-2024, 5. Dollar figure estimated using 7.14 renminbi to dollar exchange rate for January 2024. Board of Governors of the Federal Reserve System, Historical Rates for the Chinese Renminbi, August 26, 2024, https://www.federalreserve.gov/releases/h10/hist/dat00_ja.htm.

17Cheng Siwei and Zhang Yuku, “In Depth: Local Governments Ditch Financing Vehicles to Offload Hidden Debt,” Caixin Global, July 14, 2024, https://www.caixinglobal.com/2024-06-14/in-depth-local-governments-ditch-financing-vehicles-to-offload-hidden-debt-102206146.html.

18Adrian Jimenea, John Wu, and Harry Terris, “The World’s Largest Banks by Assets, 2024,” S&P Global, April 30, 2024, https://www.spglobal.com/marketintelligence/en/news-insights/research/the-worlds-largest-banks-by-assets-2024.

19Kodres, Shen, and Duffie, “Dollar Funding Stresses in China,” 6 (citing Aldasoro, I., T. Ehlers, P. McGuire, and G. von Peter. 2020. “Global banks’ dollar funding needs and central bank swap lines.” BIS Bulletin, Number 27, July, 2020).

20Bank of China Limited, 2023 Annual Report, April 2024, https://pic.bankofchina.com/bocappd/report/202403/P020240328682010029214.pdf, 418 (reporting 3,269,027 million renminbi and 2,924,727 million renminbi in dollar-denominated liabilities and assets, respectively, as of year-end 2023).

21Bank of China Limited, 2023 Annual Report, https://pic.bankofchina.com/bocappd/report/202403/P020240328682010029214.pdf, 32 (1,023,152 million renminbi); Industrial and Commercial Bank of China, 2023 Annual Report, https://v.icbc.com.cn/userfiles/Resources/ICBCLTD/download/2024/Announcement20240426_2.pdf, 27 (554,737 million renminbi); China Construction Bank, 2023 Annual Report, http://en.ccb.com/eng/attachDir/2024/04/2024042517033349685.pdf, 30 (228,917 million renminbi); Agricultural Bank of China, 2023 Annual Report, https://www.abchina.com/en/investor-relations/performance-reports/annual-reports/, 25 (378,964 million renminbi).

22International Monetary Fund, Representative Exchange Rates for Selected Currencies for December 2023, https://www.imf.org/external/np/fin/data/rms_mth.aspx?SelectDate=2023-12-31&reportType=REP.

23Brad W. Setser, “China’s New Currency Playbook,” Council on Foreign Relations, February 5, 2024, https://www.cfr.org/blog/chinas-new-currency-playbook.

24Ibid.; Costas Mourselas, Kate Duguid, and Cheng Leng, “Cyber Attack Shines Light on Role of China’s Largest Lender in US Treasury Market, Financial Times, November 15, 2023, https://www.ft.com/content/877c9b22-a459-49b0-8745-0e941e93c272; Yusho Cho, What is behind the 40% drop in China's U.S. Treasury holdings?, Nikkei, November 4, 2023, https://asia.nikkei.com/Spotlight/Datawatch/What-is-behind-the-40-drop-in-China-s-U.S.-Treasury-holdings.

25FICC, Government Securities Division, Member Directory (June 17, 2024), https://www.dtcc.com/client-center/ficc-gov-directories.

26Hester M. Peirce, “Careening Toward Clearing: Statement on Rules to Improve Risk Management in Clearance and Settlement and to Facilitate Additional Central Clearing for the U.S. Treasury Market,” statement, U.S. Securities and Exchange Commission, December 13, 2023, https://www.sec.gov/newsroom/speeches-statements/peirce-statement-rules-improve-risk-management-12-13-23; SIFMA, Treasury Clearing, https://www.sifma.org/explore-issues/treasury-clearing/.

27Mourselas, Duguid, and Leng, “Cyber Attack Shines Light on Role of China’s Largest Lender in US Treasury Market.”

28Kodres, Shen, and Duffie, “Dollar Funding Stresses in China ,” 6-7.

29Max Navas and Kaidi Gao, “Examining US Investments in China,” PitchBook, September 13, 2023, https://files.pitchbook.com/website/files/pdf/Q3_2023_PitchBook_Analyst_Note_Examining_US_Investments_in_China.pdf.

30Jane Zhang, Zheping Huang, and Lulu Yilun Chen, “Early ByteDance Backer Plans Out of China’s Biggest New VC Funds,” Bloomberg, May 24, 2024, https://www.bloomberg.com/news/articles/2024-05-24/early-bytedance-backer-plans-one-of-china-s-biggest-new-vc-funds; Tim Burroughs, “China’s TH Capital Hits First Close on Debut US Dollar Fund,” AVCJ, September 4, 2023, https://www.avcj.com/avcj/news/3029934/chinas-th-capital-hits-first-close-on-debut-us-dollar-fund.

31Navas and Gao, “Examining US Investments in China.”

32Meaghan Tobin, “Where Have All the Chinese I.P.O.s Gone?,” New York Times, June 25, 2024, https://www.nytimes.com/2024/06/25/business/china-ipo-initial-public-offer.html; U.S.-China Economic and Security Review Commission, “Chinese Companies Listed on Major U.S. Stock Exchanges,” updated January 8, 2024, https://www.uscc.gov/sites/default/files/2024-01/Chinese_Companies_Listed_on_US_Stock_Exchanges_01_2024.pdf.

33Ibid. Notably, China-headquartered electric vehicle company Zeekr underwent an initial public offering on the New York Stock Exchange in May 2024. Niket Nishant, Echo Wang and Sarah Wu, “Chinese EV maker Zeekr soars nearly 35% in stellar US market debut,” Reuters, May 10, 2024, https://www.reuters.com/business/autos-transportation/chinas-zeekr-set-debut-nyse-after-upsized-ipo-2024-05-10/.

34Securities and Futures Commission, "SFC welcomes CSRC’s announcement of five measures on capital market cooperation with Hong Kong," April 19, 2024, https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=24PR72; 陈雨康, 方星海最新发声!, 证券时报网, June 19, 2024, https://www.stcn.com/article/detail/1235317.html.

35Government of Hong Kong, “SFST’s Speech at Luncheon ‘Hong Kong for Vietnam: Financial Gateway to GBA, Asia and the World’ in Vietnam,” December 13, 2023, https://www.info.gov.hk/gia/general/202312/13/P2023121300379.htm; Hong Kong Stock Exchange, “Hong Kong and Mainland Market Highlights,” https://www.hkex.com.hk/Mutual-Market/Stock-Connect/Statistics/Hong-Kong-and-Mainland-Market-Highlights; HKEX, HKD-RMB Dual Counter Model, Explained, HKEX Insight, August 2, 2023, https://www.hkexgroup.com/Media-Centre/Insight/Insight/2023/HKEX-Insight/HKD-RMB-Dual-Counter-Model-Explained?sc_lang=en.

36Ibid.; Enoch You, “As Hong Kong’s Currency Peg Marks 40th Birthday With Little Fuss, Some Traders Dither Over its Future,” South China Morning Post, October 16, 2023, https://www.scmp.com/business/article/3238009/hong-kongs-currency-peg-turns-40-analysts-are-divided-if-it-should-be-aligned-chinese-yuan-instead.

37Ibid.

38Li Yunze, “Promoting high-quality financial development and boosting Asian financial cooperation,” speech by Li Yunze, January 24, 2024, https://www.cbirc.gov.cn/en/view/pages/ItemDetail.html?docId=1149715; see also, “Hong Kong to Consolidate Position as International Financial Center,” Global Times, February 23, 2023, https://www.globaltimes.cn/page/202302/1286095.shtml (quoting Dong Shaopeng, senior research fellow at the Chongyang Institute for Financial Studies at Renmin University of China).

39“Mr Yam Looks at the Benefits a US Dollar Clearing System Will Bring to Hong Kong, speech by Joseph Yam, March 9, 2000, https://www.bis.org/review/r000313b.pdf. For a list of other offshore large-value dollar payment systems, see Morten Bech, Umar Faruqui, Takeshi Shirakami, Payments without borders, BIS Quarterly Review, March 2020, https://www.bis.org/publ/qtrpdf/r_qt2003h.pdf.

40Hong Kong Interbank Clearing Limited, “List of USD Clearing Participants Eng (September 2024),” https://www.hkicl.com.hk/eng/information_centre/clearing_members_participants_list.php.

41Hong Kong Interbank Clearing Limited, “Statistics of USD Clearing Transaction Volume,” https://www.hkicl.com.hk/files/page_file/116/9521/2407USD_Clg_Vol.pdf; Clearing House, “CHIPS Annual Statistics From 1970 to 2024,” https://media.theclearinghouse.org/-/media/New/TCH/Documents/Payment-Systems/CHIPS-Volume-and-Value_May.pdf?rev=2393796a8ff642a3848758b204914cd3.

42Clearing House, “CHIPS Participants,” https://media.theclearinghouse.org/-/media/New/TCH/Documents/Payment-Systems/CHIPS_Participants_Revised_11-06-2023_v1.pdf?rev=f66479c8265145388439ff9f394eb72d; Karen M. Sutter, Andres B. Schwarzenberg, and Michael D. Sutherland, “China’s ‘One Belt, One Road’ Initiative: Economic Issues,” Congressional Research Service, May 16, 2024, https://crsreports.congress.gov/product/pdf/IF/IF11735.

43IMF, “People's Republic of China: Staff Report for the 2023 Article IV Consultation—Informational Annex,” 2-3; U.S. Department of the Treasury, Report to Congress: Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States, June 2024, 20-22; Brad W. Setser, “China’s New Currency Playbook,” Council on Foreign Relations, February 5, 2024, https://www.cfr.org/blog/chinas-new-currency-playbook.

44Ibid.; U.S. Department of the Treasury, Report to Congress: Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States.

45Barry Eichengreen et al., “Is Capital Account Convertibility Required for the Renminbi to Acquire Reserve Currency Status?,” Banque de France, November 2022, https://www.banque-france.fr/en/publications-and-statistics/publications/capital-account-convertibility-required-renminbi-acquire-reserve-currency-status.

46Ibid.

47Bank for International Settlements, “Triennial Central Bank Survey: OTC Foreign Exchange Turnover in April 2022,” October 27, 2022, https://www.bis.org/statistics/rpfx22_fx.pdf.

48SAFE, “Official Reserve Assets (2022),” “Official Reserve Assets (2023),” and “Official Reserve Assets (2024),” https://www.safe.gov.cn/en/DataandStatistics/index.html.

49Daisuke Wakabayashi and Claire Fu, “China Is Buying Gold Like There’s No Tomorrow,” New York Times, May 5, 2024, https://www.nytimes.com/2024/05/05/business/china-gold-price.html.

50Yvonne Yue Li and Sybilla Gross, “Gold Dips Below $2,300 as Jobs Dash Fed Bets, China Buying Pause,” Bloomberg, June 7, 2024, https://www.bloomberg.com/news/articles/2024-06-07/china-s-pboc-halts-gold-purchases-after-price-hits-record-in-may; 程婕, 央行为何连续三个月不买黄金?, 北京青年报 (Aug. 9, 2024), http://www.xinhuanet.com/fortune/20240809/70612d4563ff4201bdf09818351417d3/c.html.

51U.S. Department of the Treasury, “Major Foreign Holders of Treasury Securities,” https://ticdata.treasury.gov/resource-center/data-chart-center/tic/Documents/slt_table5.html; U.S. Department of the Treasury, “Major Foreign Holders of Treasury Securities,” March 15, 2023, https://ticdata.treasury.gov/Publish/mfh.txt.

52Setser, “Power and Financial Interdependence”, Ifri Papers, Ifri, May 2024, https://www.ifri.org/sites/default/files/atoms/files/ifri_setser_power_financial_interdependence_2024.pdf; Setser, “China Isn't Shifting Away From the Dollar or Dollar Bonds.”

53Ibid.

54Robert Greene, “The Difficult Realities of the BRICS’ Dedollarization Efforts—and the Renminbi’s Role,” Carnegie Endowment for International Peace, December 5, 2023, https://carnegieendowment.org/research/2023/12/the-difficult-realities-of-the-brics-dedollarization-effortsand-the-renminbis-role?lang=en.

55Greene, “Southeast Asia’s Growing Interest in Non-dollar Financial Channels—and the Renminbi’s Potential Role,” Carnegie Endowment for International Peace, August 22, 2022, https://carnegieendowment.org/research/2022/08/southeast-asias-growing-interest-in-non-dollar-financial-channelsand-the-renminbis-potential-role?lang=en.

56Cross-Border Interbank Payment System, accessed September 2, 2024, https://www.cips.com.cn/;

People's Bank of China, “Notice of the People's Bank of China on Issuing the Rules for Business Conducted through the Cross-Border Interbank Payment System,” March 2018, http://www.pbc.gov.cn/english/130733/3778780/index.html.

57张明 and 王喆, 俄乌冲突对国际货币体系的冲击与人民币国际化的新机遇, Caixin, June 17, 2023, https://zhang-ming.blog.caixin.com/archives/268286?originReferrer=caixinsearch_pc; Peter Eavis, Important European Financial Firm Bows to Trump’s Iran Sanctions, The New York Times, November 5, 2018, https://www.nytimes.com/2018/11/05/business/dealbook/swift-iran-sanctions.html; Greene, “How Sanctions on Russia Will Alter Global Payments Flows,” Carnegie Endowment for International Peace, March 4, 2022, https://carnegieendowment.org/posts/2022/03/how-sanctions-on-russia-will-alter-global-payments-flows?lang=en¢er=global; Mark Dubowitz, “SWIFT Sanctions: Frequently Asked Questions,” Foundation for Defense of Democracies, October 10, 2018, https://www.fdd.org/analysis/2018/10/10/swift-sanctions-frequently-asked-questions/; Liana Wong and Rebecca M. Nelson, “International Financial Messaging Systems,” Congressional Research Service, July 19, 2021, https://crsreports.congress.gov/product/pdf/R/R46843.

58Greene, “Southeast Asia’s Growing Interest in Non-dollar Financial Channels—and the Renminbi’s Potential Role”; Greene, “The Difficult Realities of the BRICS’ Dedollarization Efforts—and the Renminbi’s Role.”

59“Yuan Overtakes Dollar as China’s Most Used Cross-Border Currency,” Bloomberg (April. 26, 2023), https://www.bloomberg.com/news/articles/2023-04-26/yuan-overtakes-dollar-as-china-s-most-used-cross-border-currency; “China’s Currency Rises in Cross-Border Trade but Remains Limited Globally,” Goldman Sachs, July 26, 2023, https://www.goldmansachs.com/intelligence/pages/chinas-currency-rises-in-cross-border-trade-but-remains-limited-globally.html.

60William Sandlund, China’s international use of renminbi surges to record highs, Financial Times, August 29, 2024, https://www.ft.com/content/ae08b6ed-d323-4a95-a687-0172a98857f4.

61“China’s Currency Rises in Cross-Border Trade but Remains Limited Globally,” Goldman Sachs.

62张明 and 王喆, 人民币国际化:六大领域亟待发力, NIFD, November 27, 2023, http://www.nifd.cn/ResearchComment/Details/4051.

63Xinhua, “China’s Cross-Border RMB Use Up 24 pct in January – September,” State Council, People’s Republic of China, October 30, 2023, https://english.www.gov.cn/archive/statistics/202310/30/content_WS653f1eecc6d0868f4e8e0c8f.html.

64Greene, “The Difficult Realities of the BRICS’ Dedollarization Efforts—and the Renminbi’s Role”; Zongyuan Zoe Liu, “China Wants to Ditch the Dollar” Noema Magazine, Berggren Institute, January 11, 2024, https://www.noemamag.com/china-wants-to-ditch-the-dollar/.

65World Integrated Trade Solution, “Overall Exports and Imports for China,” https://wits.worldbank.org/CountryProfile/en/Country/CHN/Year/LTST/Summarytext.

66Greene, “Southeast Asia’s Growing Interest in Non-dollar Financial Channels—and the Renminbi’s Potential Role.”; Greene, “The Difficult Realities of the BRICS’ Dedollarization Efforts—and the Renminbi’s Role”; “New Commerzbank survey,” Commerzbank, June 11, 2018, https://www.commerzbank.de/group/newsroom/press-releases/commerzbank-survey-2.html.

67张礼卿, 稳慎扎实推进人民币国际化:发展历程与路径探析, “人民论坛·学术前沿,” January 2024, http://www.rmlt.com.cn/2024/0126/694024.shtml; 石光, 构建新发展格局需要推进人民币国际化, 中国经济时报, February 2, 2024, https://www.drc.gov.cn/DocView.aspx?chnid=379&leafid=1338&docid=2907555; Yongding, China’s Foreign Exchange Reserves: Past and Present Security Challenges.”

68“China Will Further Enhance Capital Account Opening, FX Official Says,” Reuters, March 28, 2024, https://www.reuters.com/business/finance/china-will-further-enhance-capital-account-opening-fx-official-says-2024-03-29/.

69张礼卿, 稳慎扎实推进人民币国际化:发展历程与路径探析; 张明 and 王喆, 人民币国际化:六大领域亟待发力; 陈卫东, 熊启跃, and 赵雪情, 全球储备资产:历史趋势、形成机制和中国启示, 国际金融研究, June 21, 2023, http://www.cbca.org.cn/news/ztbd/2023-06-21/be55e2869bed00d3094abcdc8924fa65.html; Yongding, “China’s Foreign Exchange Reserves: Past and Present Security Challenges.”

70John Wu, “Chinese Yuan on Slow Path to Globalization Due to Capital Account Controls,” S&P Global, July 11, 2023, https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/chinese-yuan-on-slow-path-to-globalization-due-to-capital-account-controls-76484922; Michael Pettis, “Will the Chinese Renminbi Replace the US Dollar?,” Review of Keynesian Economics 10, no. 4 (October 28, 2022): https://www.elgaronline.com/view/journals/roke/10/4/article-p499.xml#ref_bib-003.

71汪川 and 钟春平, 金融制裁与中国海外资产安全, 国际合作中心 (March 2024), https://www.icc.org.cn/publications/policies/2237.html; 刘东民 and 倪淑慧, 美国主权信用风险与中国外汇储备结构优化, 国合中心, September 2023, https://www.icc.org.cn/publications/policies/1933.html; 陈卫东, 熊启跃, and 赵雪情, 全球储备资产:历史趋势、形成机制和中国启示, 国际金融研究.

72Falk Hendrik Laser and Jan Weidner, “Currency Compositions of International Reserves and the Euro Crisis,” Open Econ Review 33, no. 5 (August 23, 2022), https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9395879/, 917–944; Matthew Ferranti, “Estimating the Currency Composition of Foreign Exchange Reserves,” working paper, May 2023, https://arxiv.org/pdf/2206.13751.

73刘瑶, “去美元化”加速 人民币国际化迎新机遇, 中国城乡金融报, May 2023, https://www.zgcxjrb.com/zgcxjrb/gjjr/webinfo/2023/05/1683722772376392.htm; 刘东民 and 倪淑慧, 美国主权信用风险与中国外汇储备结构优化.

74石光, 构建新发展格局需要推进人民币国际化; 王石玉 and 王力为, 廖岷:国际社会应推动全球治理体系朝更加公正合理方向发展, Caixin, May 28,2024, https://economy.caixin.com/2024-05-28/102200677.html.

75王晓泉, 全球“去美元化”催生世界货币新秩序, 人民论坛, December 16, 2022, http://www.rmlt.com.cn/2022/1216/662685.shtml.

76Yongding, “China’s Foreign Exchange Reserves: Past and Present Security Challenges.”

77杨志锦, 专访上海财大校长刘元春:金融强国要为科技强国、制造强国建设提供有力支撑, 21世纪经济报道, November 27, 2023, https://www.zj.icbc.com.cn/page/902515031475048448.html (quoting 刘元春).

78刘元春, 重大拐点已现,稳步推进人民币国际化, Sina.com, June 6, 2023, https://finance.sina.cn/zl/2023-06-01/zl-imyvtwap2904093.d.html?&m=c6fc63ba83819278d0c414d56f64d398.

79Mrugank Bhusari and Maia Nikoladze, Russia and China: Partners in Dedollarization, Atlantic Council, February 18, 2022, https://www.atlanticcouncil.org/blogs/econographics/russia-and-china-partners-in-dedollarization/.

80“Trade With China Mainly Settled in Yuan, Rubles: Russian Deputy PM,” Global Times, March 28, 2024, https://www.globaltimes.cn/page/202403/1309666.shtml.

81IMF, “World Currency Composition of Official Foreign Exchange Reserves (Q2 2024),” https://data.imf.org/regular.aspx?key=41175

82Pettis, “Will the Chinese Renminbi Replace the US Dollar?”

83François Villeroy de Galhau, “Multipolarity and the Role of the Euro in the International Financial System," May 16, 2022, https://www.bis.org/review/r220516a.pdf; Piero Cipollone, “Why Europe must safeguard its global currency status,” June 12, 2024, https://www.ecb.europa.eu/press/blog/date/2024/html/ecb.blog20240612~10575cd172.en.html; AMRO, “Expanding Local Currency Transactions in ASEAN+3 Cross-Border Payments,” December 2023, https://amro-asia.org/wp-content/uploads/2023/12/AMRO-PPP_Expanding-LCT-in-ASEAN3-Cross-Border-Payments_Dec-2023.pdf, 3-4. The supply of euro debt securities issued by the European Commission remains limited (equaling about one-fifth of Italy’s debt outstanding), and although this supply is projected to nearly double by 2026, the market for these securities faces many structural challenges. Ian Johnston and Mary McDougall, “EU becomes ‘real player’ in debt markets but faces investor scepticism,” Financial Times, October 12, 2023, https://www.ft.com/content/85ed3082-483a-4637-b755-41844ed0c95f.

84AMRO, “Expanding Local Currency Transactions in ASEAN+3 Cross-Border Payments"; Japanese Ministry of Finance, “Japanese Government Bonds”, June 2024 newsletter, https://www.mof.go.jp/english/policy/jgbs/publication/newsletter/jgb2024_06e.pdf.

85Bundesbank, “Government Debt in the Euro Area: Current Developments in Creditor Structure,” April 2024, https://publikationen.bundesbank.de/publikationen-en/reports-studies/monthly-reports/government-debt-in-the-euro-area-current-developments-in-creditor-structure--929590; Eurostat, “Government Debt Down to 88.6% of GDP in Euro Area,” April 22, 2024, https://ec.europa.eu/eurostat/web/products-euro-indicators/w/2-22042024-bp. The dollar estimate above is calculated using a 1.1062 euro to dollar exchange rate for year-end 2023. Board of Governors of the Federal Reserve System, Historical Rates for the EU Euro, August 26, 2024, https://www.federalreserve.gov/releases/h10/hist/dat00_eu.htm.

86Japanese Ministry of Finance, “Japanese Government Bonds.” The dollar estimate above is calculated using a 140.92 yen to dollar exchange rate for year-end 2023. Board of Governors of the Federal Reserve System, Historical Rates for the Japanese Yen, August 26, 2024, https://www.federalreserve.gov/releases/h10/hist/dat00_ja.htm.

87Marc Labonte and Ben Leubsdorf, “Foreign Holdings of Federal Debt,” Congressional Research Service, updated June 28, 2024, https://sgp.fas.org/crs/misc/RS22331.pdf.

88“EU Should Aim for Multi-Polar Currency System as China Rises: Bailout Fund’s Regling,” Reuters, May 5, 2021, https://www.reuters.com/article/idUSKBN2CM1QU/.

89François Villeroy de Galhau, “The euro as a complementary asset in a more multilateral system,” June 16, 2023, https://www.bis.org/review/r230619c.pdf; Villeroy de Galhau, “Multipolarity and the Role of the Euro in the International Financial System."

90Piero Cipollone, “Why Europe must safeguard its global currency status,” Financial Times, June 12, 2024, https://www.ft.com/content/05a7755a-6213-4998-9bb7-3a5b6bd77009.

91Mario Draghi, “The Future of European Competitiveness – A Competitiveness Strategy for Europe,” September 2024, 60, https://commission.europa.eu/document/download/97e481fd-2dc3-412d-be4c-f152a8232961_en?filename=The%20future%20of%20European%20competitiveness%20_%20A%20competitiveness%20strategy%20for%20Europe.pdf.

92Pettis, “Will the Renminbi Replace the US Dollar?”

93Serkan Arslanalp, Barry Eichengreen, and Chima Simpson-Bell, “Dollar Dominance in the International Reserve System: An Update,” IMF, June 11, 2024, https://www.imf.org/en/Blogs/Articles/2024/06/11/dollar-dominance-in-the-international-reserve-system-an-update.

94Ibid; IMF, “World Currency Composition of Official Foreign Exchange Reserves (Q2 2024).”

95Pettis, “Will the Renminbi Replace the US Dollar?”

96The International Monetary Fund reported that, globally, in early 2024 only $438 billion foreign currency reserve assets were denominated in currencies other than the dollar, euro, renminbi, yen, pound, Australian dollar, Canadian dollar, and Swiss francs. IMF, “World Currency Composition of Official Foreign Exchange Reserves (Q2 2024).” This figure is equivalent to only about a quarter of the estimated value of Chinese central bank dollar assets.

97Greene, “Southeast Asia’s Growing Interest in Non-dollar Financial Channels—and the Renminbi’s Potential Role”; Greene, “The Difficult Realities of the BRICS’ Dedollarization Efforts—and the Renminbi’s Role.”

98AMRO, “Expanding Local Currency Transactions in ASEAN+3 Cross-Border Payments.”

99Anastasia, Stognei, Russia embraces China’s renminbi in face of western sanctions, Financial Times, March 26, 2023, https://www.ft.com/content/65681143-c6af-4b64-827d-a7ca6171937a

100Christian Berthelsen, “U.S. Considered Blacklisting Two Chinese Banks Over North Korea Ties,” Bloomberg, April 13, 2018, https://www.bloomberg.com/politics/articles/2018-04-13/china-banks-aiding-north-korea-are-said-too-big-to-punish.

101Takayuki Tanaka and Rintaro Tobita, “U.S. Weighs Sanctions on Chinese Banks Over Russia Military Support,” Nikkei Asia, May 11, 2024, https://asia.nikkei.com/Politics/Ukraine-war/U.S.-weighs-sanctions-on-Chinese-banks-over-Russia-military-support; Iain Marlow, US Plans Sanctions Over China’s Russia Aid, Top Biden Aide Says, Bloomberg, July 19, 2024, https://www.bloomberg.com/news/articles/2024-07-19/us-plans-sanctions-over-china-s-russia-aid-top-biden-aide-says; Christopher Condon and Charles Ayitey, Yellen Says Big Chinese Banks Are Adhering to Russian Sanctions, Bloomberg, June 13, 2024, https://www.bloomberg.com/news/articles/2024-06-13/yellen-sees-more-concern-on-smaller-china-banks-on-sanctions.

102European Parliament, “Extraterritorial Sanctions on Trade and Investments and European Responses,” November 2020, https://www.europarl.europa.eu/RegData/etudes/STUD/2020/653618/EXPO_STU(2020)653618_EN.pdf.

103Jamil Anderlini and Clea Caulcutt, “Europe Must Resist Pressure to Become ‘America’s Followers,’ Says Macron,” Politico, April 9, 2023, https://www.politico.eu/article/emmanuel-macron-china-america-pressure-interview/.

104Official Monetary and Financial Institutions Forum, “Stick or Twist? Reserve Managers Battling Low Returns Face Tough Choices,” 2024, https://pdf.omfif.org/view/v_4QBoeNP, 10.

105Kevin Daly and Tadas Gedminas, “The Path to 2075 — Slower Global Growth, But Convergence Remains Intact,” Goldman Sachs, December 6, 2022, https://www.goldmansachs.com/intelligence/pages/gs-research/the-path-to-2075-slower-global-growth-but-convergence-remains-intact/report.pdf. Policymakers in Nigeria, India, and Indonesia have advocated for reducing connectivity with the U.S. financial system due to concerns over recent uses of U.S. economic sanctions. See: Dirisu Yakubu, “Keep External Reserves in Chinese Yuan, Reps Advise CBN,” Punch, December 21, 2023, https://punchng.com/keep-external-reserves-in-chinese-yuan-reps-advise-cbn/; Reserve Bank of India, Report of the Inter-Departmental Group (IDG) on Internationalisation of INR, July 2023, https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=1244; “Jokowi Wants Local Governments to Ditch Visa, Mastercard,” Jakarta Post, March 16, 2023, https://www.thejakartapost.com/business/2023/03/16/jokowi-wants-local-governments-to-ditch-visa-mastercard.html.

106U.S. Government Accountability Office, “The Nation's Fiscal Health: Road Map Needed to Address Projected Unsustainable Debt Levels,” GAO-24-106987, February 2024, https://www.gao.gov/products/gao-24-106987. Eurasia Press & News

Eurasia Press & News