Every crisis is boom for some and bane for others. Over $8 trillion economic package have been announced by north American and European nations plus $1 trillion by Japan whereas total known lobal gold reserves amounts to $9.5 trillion. But where this money will go: business elite or commons. Is this helicopter money as discussed in economic textbooks or win for proponents of Modern Money Theory (MMT). Is this pandemic provide hidden refuge to coming recession as envisaged by analysts from mid-2019? Will it provide another quantitative easing for financial and capital markets in advanced countries? Bailing out the falling markets to continue the ponzi scheme of elites not contravene the basic principles of market economy for unregulated entry and exit of business based on success and failure.

This look more like continuation of crony capitalism arising out of neoliberals’ economics. In the end it will socialism for elite and market capitalism for poor. Neoliberalism initiated by Reagan and Thatcher should explain why healthcare in US fails to coup with pandemic which was first officially announced by China on 8th January. Healthcare sector in US has 20 percent share in GDP. Why healthcare system consisting of cabal of pharma, insurance, and healthcare need financial rescue despite their size? In US they will be getting $180 billion out of free pie.

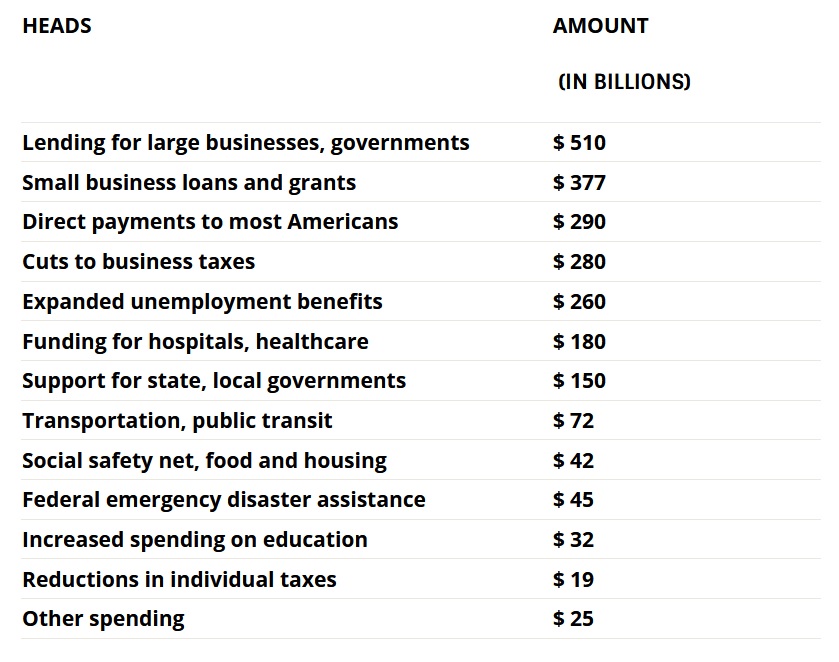

The Committee for a Responsible Federal Budget, a non-profit group that tracks US budget deficits, scored total spending under the rescue bill at approximately $2.3 trillion. Here is a look at where most of the money will go, according to the budget watchdog:

Unequal largesse to common is evident in only one head: tax cuts. Tax cuts to business amounts to $280 billion whereas reductions in individual taxes which includes dirty rich elite is paltry $19 billion which is 6.8% of what big businesses will avail. Out $2,282 trillion $1,379 or 60% went to business in way or another and booty for commons was just $569 trillion or 25%.

As in the bailout of banking sector in 2007-8 mortgage cost of Cantillon effect should not be ignored. Richard Cantillon was an economist in the 18th century France who mainly wrote about money and how it circles around the economy.

The so-called Cantillon effect describes the uneven expansion of the amount of money. If a central bank pumps more money into the economy, the resulting increase in prices does not happen evenly. The Austrian economist Friedrich August von Hayek compared this monetary expansion with honey. If you pour honey into a cup, it won’t spread out evenly. It will clump in the middle of the cup first before spreading out.

Same with money: in case of a monetary expansion, the ones who profit from it are the ones who are close to the money. “Close to the money” in this case means everyone who can access the money right at the beginning, i.e. big companies, banks, etc. They get loans and make investments. Prices then start to rise even though the rest of the population has not received any of the new money yet. This part of the population usually is not the one with too much money. Nonetheless, they have to pay the higher prices even though they have not profited from the increase in money at all. And they will never profit from it in the same way as the ones who received the money first. The result is a redistribution from the poor to the rich. Even John Maynard Keynes who was in no way opposed to government intervention and central banks accepted the Cantillon effect as a valid problem.

A very vivid example of Cantillon effect is recent sugar scandal in Pakistan, in which four out of five beneficiaries were close to power corridor in Islamabad. Even in the relief cash and non-cash distributions relief distributions beneficiaries are those who are close to Men in Power (MiP).

The package worth 900 billion rupees ($5.66 billion) was approved in a Cabinet meeting chaired by Prime Minister Imran Khan and also attended by army chief Gen. Qamar Javed Bajwa. It includes 200 billion rupees ($1.25 billion) for low-income groups, particularly laborers, 280 billion rupees ($1.76 billion) for wheat procurement, apart from a significant reduction in petroleum prices. Speaking to journalists in the capital Islamabad, Khan said over 5 million people will be provided a monthly stipend of 3,000 rupees ($20) for the next four months. This amount to Rs.60 billion or 30% of the package.

Also, loan interest payments for exporters had been deferred temporarily, while a package of 100 billion rupees ($63 million) was provided to support small industries and the agriculture sector, he added. So, businesses will be getting 50% of the package. Great divide of neoliberal fascism where businesses are more important than who work for it.

Economic policies should be made in concert with administrative policies otherwise benefits are uneven to different strata of population and detriment to commons. Economists in Pakistan should now move beyond neoliberal, neoclassical, and Keynesian mindset to more innovative solutions targeted to wellbeing of commons.

Instead of dishing out money to business elites, GoP should also contribute to some percentage of the salaries of workers on the basis of delayed interest free loan and collateral should be the equity of the corporate units. This should also be after due diligence that the corporate need emancipates from ‘shutdown’ and not from absence of risk management on the part of business which is their corporate responsibility. If a business has failed to manage its risk it should face financial slap on wrist as per market mechanism. Looming crisis was evident from de-globalization, global oil crisis, falling demand, accumulatio and rise of gold prices, liquidity crisis in US bank and repo markets. A good business should have anticipated it and have developed plan B.

Covid-19 is a tragedy of the common-but we can collectively mitigate the tragedy. This contagion has provided us a rare opportunity to move from economics from “me” to economics of “us”. This provide economists at IBA to pioneer in innovatively designing an economic system for “us”. Not recommending but citing as an example the work of Elinor Ostrom, the recipient of 2009 noble prize in economics, we should provide academic and intellectual environment to design innovative economic paradigm from over-obsessed focus on “self-interest” to economic models of “collective wellbeing”. This is the time we move from economics of 1% to economics of 100%. In Pakistan, it is the society which is bailing out commons not business elite or government.

Lastly, government should prioritize agriculture sector instead of construction, as food self-sufficient is vital in pandemic crisis and surplus can be stored and export after supply chain is re-established and supply deficiency will exist until the next cultivation period. Agriculture has large poverty-stricken population which income depend upon completion of harvest and they should have priority income relief program. Rural areas have almost no philanthropy support as urban dwellers have.

Eurasia Press & News

Eurasia Press & News