Russia was the world’s third-largest producer of petroleum and other liquids (after the United States and Saudi Arabia) in 2020; it had an annual average of 10.5 million barrels per day (b/d) in total liquid fuels production. Russia was the second-largest producer of dry natural gas in 2020 (second to the United States), producing an estimated 22.5 trillion cubic feet (Tcf).

Europe is Russia’s main market for its oil and natural gas exports, and by extension, Europe is its main source for revenues. Russia is a major source of oil and natural gas for Europe; a significant share of Europe’s oil and natural gas imports come from Russia.

Since 2014, Russia has been subject to sanctions imposed by the United States and the European Union (EU). The sanctions were imposed in response to the actions and policies of the Russian government with respect to Ukraine. The U.S. sanctions mainly affect Russian energy companies’ access to U.S. capital markets and to goods, services, and technology in support of deepwater exploration and field development.

Since April 2020, Russia has been actively coordinating oil production with a number of OPEC and other non-OPEC producers, collectively known as the OPEC+ agreement. The OPEC+ agreement aimed to curb crude oil production in response to rapidly declining demand resulting from the COVID-19 pandemic.1

On July 18, 2021, OPEC+ agreed to begin increasing production quotas for the participating countries and to extend the duration of the OPEC+ agreement through the end of 2022. The deal followed an impasse in negotiations a few weeks earlier when the representative of the United Arab Emirates (UAE) demanded a revision to its crude oil production baseline, which is used to calculate countries’ respective production quotas. The July 2021 deal resulted in an increase in Russia’s production baseline from 11.0 million b/d to 11.5 million b/d starting in May 2022 and also allowed Russia’s production quota to increase by 100,000 b/d per month beginning in August 2021.2

Petroleum and other liquids

Sector organization

Domestic companies dominate most of Russia’s oil production. Approximately 81% of Russia’s total crude oil production in 2020 came from Russian firms Rosneft, Lukoil, Surgutneftegas, Gazprom, and Tatneft.3

In October 2020, the Russian government approved changes to the hydrocarbon sector’s tax regime that eliminated tax exemptions for oil and natural gas companies operating in extra-viscous or heavily depleted fields (primarily oil sands and mature fields). The elimination of tax exemptions, particularly for extra-viscous fields, pose a challenge for oil sand operators because the tax changes significantly increase the tax burden and may lead to oil sands production becoming uneconomical.4 Additional changes include:

—The phase–out of export duties on crude oil and refined products

—The phase–out of the Tax on Additional Income that was introduced in 2019 and aimed to calculate taxes based on profits accrued by hydrocarbon companies

—An annual incremental increase on the minerals extraction tax (MET), which would in effect shift the tax base away from exports toward upstream production

—Tax breaks and fiscal incentives for companies seeking to develop new fields in eastern Arctic regions.

The amendments to the tax regime were made to increase government revenue and favor companies operating in the Arctic region, where development has been limited because of sanctions as well as the technical complexity of extracting hydrocarbons from the reservoirs, factors that had made Arctic upstream development uneconomical. The tax breaks and incentives for Arctic upstream development aim to bring more projects online without the need for partnerships with Western international oil companies (IOC). International sanctions have made participating in Russian upstream development difficult for IOCs.5

In June 2020, the Russian government approved its Energy Strategy to 2035, which seeks to diversify energy exports, modernize the country’s energy infrastructure, increase national competitiveness, and develop greater technological innovation and digitalization within its energy system.6 The Energy Strategy to 2035 prioritizes the increase in energy exports and revenue and the expansion of natural gas infrastructure, particularly midstream in eastern Siberia and the far eastern regions, to ensure the resilience of the country’s energy system. The prioritization of exports and revenue is indicative of the central role hydrocarbons play for the Russian government. Crude oil and natural gas revenue comprised approximately 43%, on average, of the government’s total annual revenue between 2011 and 2020.7 This includes export and tax revenue that the government collected from oil and gas production and sales.

Exploration and production

Russia’s proved oil reserves were 80 billion barrels as of January 2021, according to the Oil & Gas Journal.8

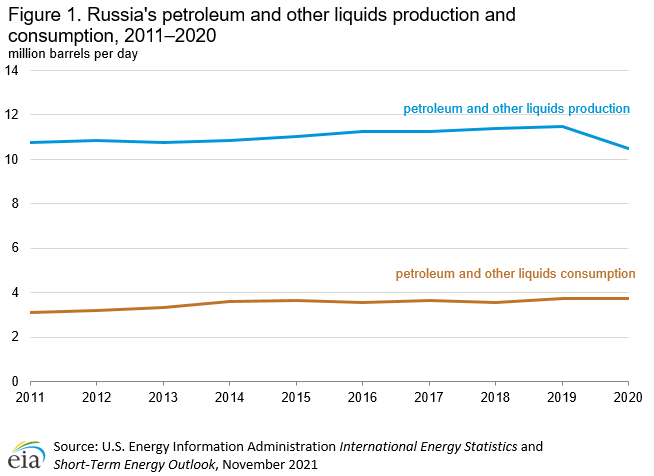

In 2020, Russia’s production of petroleum and other liquid fuels was 10.5 million b/d (of which 9.9 million b/d was crude oil including lease condensate). Russian economy consumed about 3.7 million b/d (Figure 1).

A number of greenfield projects in Russia have been under development in the past few years that will provide a boost to Russia’s crude oil production in the short term when the projects come online and reach their peak production levels. (Table 1) However, declining output from Russia’s more mature fields (primarily in Western Siberia, Russia’s largest oil producing region) may offset the production growth coming from greenfield development, which may result in Russia’s crude oil production declining by the end of the 2020s decade. In addition to greenfield development, companies are increasing drilling at some existing mature oil fields and are tying in smaller fields to existing infrastructure at larger fields to help increase recovery rates and mitigate some of the production decline. However, brownfield development efforts in Russia are unlikely to reverse the decline in production in the longer term.9

In 2020, Rosneft created Vostok Oil LLC, a special purpose entity, to develop a group of crude oil and natural gas fields collectively known as the Vostok Oil project in the northern part of the Krasnoyarsk region. The Vostok oil project seeks to tie in fields in the Vankor cluster (which consists of the Vankorskoye, Tagulskoye, Suzunskoye, and Lodochnoye fields and is currently producing about 300,000 b/d) as well as some existing discoveries in the Taymyr peninsula. Collectively, these fields could potentially produce about 1 million b/d to 2 million b/d at peak production, according to Vostok Oil. Moreover, much of the infrastructure required to fully develop the project into an industrial hub still needs to be built. Vostok Oil aims to have the project come online in 2024, reach an initial production level of 600,000 b/d, and reach its plateau production level by 2030.10

Transport and storage

Pipelines

In March 2020, state-owned Transneft reached a settlement with TotalEnergies over the contaminated crude oil and condensate that led to the shutdown of the Druzhba pipeline in April 2019. The Druzhba crude oil and condensate pipeline was shut down after importers found the crude oil to be contaminated with high levels of organic chlorides, disrupting Russia’s crude oil and condensate exports to Germany, Poland, and Belarus and to a lesser extent, Czech Republic, Slovakia, and Hungary. It also affected exports out of Russia’s Baltic Sea port of Ust Luga.11

The Caspian pipeline transports crude oil to Novorossiysk, Russia, from the Tengiz, Kashagan, and Karachaganak fields in Kazakhstan as well as Russian fields in the Caspian region. The Caspian Pipeline Consortium (CPC), the legal entity that owns and operates the Caspian pipeline, is implementing a de-bottlenecking program, which aims to increase throughput of its oil pipeline network from 1.3 million b/d to 1.6 million b/d. The program will increase throughput not by building additional pipeline infrastructure, but by replacing midstream equipment and building new storage tanks and a pump station that would enable it to better optimize the current capacities and throughput of the pipeline network. CPC expects to complete the program by the end of 2023. 12

Port terminals

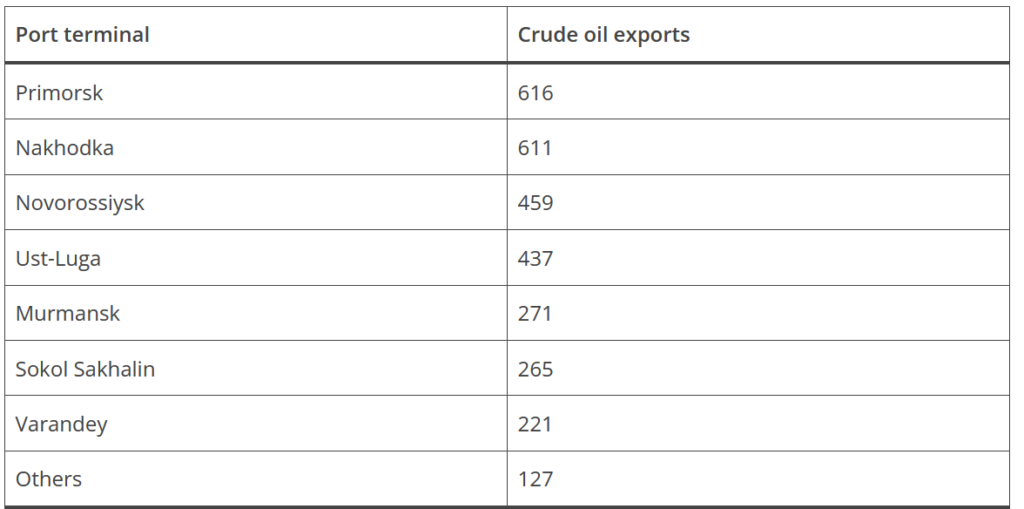

Russia’s four largest ports (Primorsk, Nakhodka, Novorossiysk, and Ust-Luga) for crude oil exports together accounted for 71% of Russia’s seaborne crude oil liftings in 2020 (Table 2)13.

Refining and refined oil products

According to Oil & Gas Journal, as of January 2021, Russia had 5.5 million b/d of crude oil refining capacity from more than 25 refineries. Rosneft, the largest refinery operator, owns more than 2 million b/d of crude oil refining capacity.14

Gazprom Neft is currently upgrading its refinery at Omsk, located in Western Siberia. Gazprom expects the second phase of the refinery’s modernization plan to be completed by the end of 2022. The refinery’s upgrades include the construction of an advanced oil refining complex that uses a combination of hydrocracking and sulfur-removing technologies to remove sulfur compounds to produce higher value petroleum products, such as internationally compliant jet fuel and low sulfur marine fuel that can meet more stringent emission standards.15

Lukoil began the construction of a catalytic cracking complex at its refinery in Perm in August 2021. The new complex has an expected feedstock capacity of about 36,000 b/d and will include a catalytic cracking unit as well as a high-octane gasoline components unit. Lukoil expects that the new complex will begin commercial operations in 2026.16

In June 2021, Lukoil announced that it completed the construction of a new isomerization plant and a deep-conversion, delayed coking unit at its Kstovo refinery located in the Nizhny Novgorod region in central Russia. The completion of the isomerization plant and the delayed coking unit enables Lukoil to reconfigure the facility and to reduce production of heavier petroleum products such as fuel oil and increase production of higher quality and higher value products such as diesel fuel and motor gasoline. Lukoil expects to begin commercial operations of the new units in the fourth quarter of 2021.17

Petroleum and other liquids exports

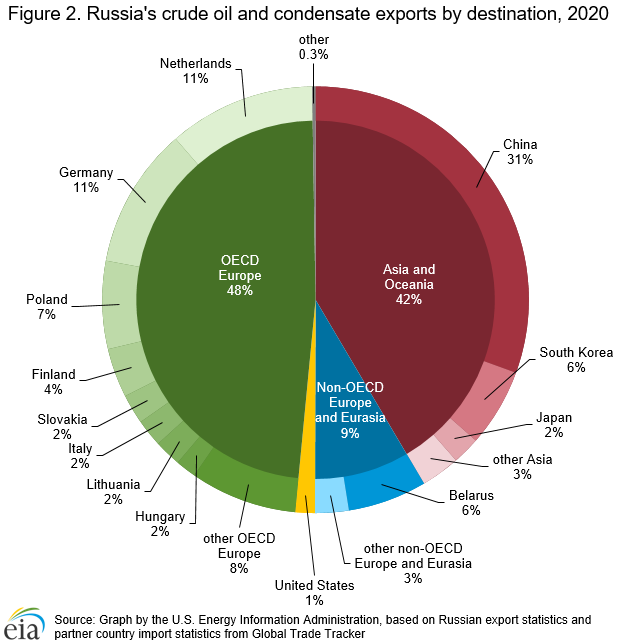

Russia exported almost 5 million b/d of crude oil and condensate in 2020. Most of Russia’s crude oil and condensate exports in 2020 went to European countries (48%), particularly Germany, the Netherlands, and Poland. Asia and Oceania accounted for 42% of Russia’s total crude oil and condensate exports, and China was the largest importing country of Russia’s crude oil and condensate, at 31%. About 1% of Russia’s total crude exports in 2020 went to the United States (Figure 2).18

Hydrocarbon gas liquids

The Manzhouli Far East Gas cross-border rail terminal for liquefied petroleum gases (LPG) and propylene, which is located on the Russia-China border, began commercial operations in 2019, enabling Russia to increase its LPG exports to China. The operator of the Manzhouli terminal is currently capable of shipping approximately 60,000 b/d of LPG, including propane, butane, various propane-butane blends, as well as propylene, across the border. After completion of an expansion project, the capacity of the terminal is expected to reach approximately 100,000 b/d by 2022. The additional capacity would accommodate output from Gazprom’s Amur Gas Processing Plant in Svobodny, which is currently being commissioned under a phased completion schedule.

In late 2019, Sibur completed a 1.5 million ton per year ethylene cracker in Tobolsk,19 which was the first ethylene cracker in Russia that was designed to consume ethane as its feedstock, in addition to propane and normal butane. Increased demand for these feedstocks at the Tobolsk ethylene cracker reduces their availability for export. The $9.5 billion plant produces ethylene, propylene, and butylene/butadiene that serve as feedstock for the production of derivative products, including high- and low-density polyethylene and polypropylene.20

Sibur is also constructing a petrochemical complex near Svobodny in the Amur region. Co-located with Gazprom’s Amur Gas Processing Plant, Sibur’s petrochemical cracker (with a capacity of 2.3 million tons per year) will consume ethane as well as smaller quantities of propane as feedstock for the production of ethylene and propylene, which, in turn, will be used on-site for the production of polyethylene and polypropylene. The plant’s proximity to China’s border will provide Sibur with ready access to its export market.21

The Irkutsk Oil Company is constructing a polymer plant in Ust-Kut in East Siberia, which it expect to complete in 2023. The ethylene and polyethylene complex has a planned capacity of 650,000 tons per year, and is expected to consume approximately 45,000 b/d of ethane feedstock.22

For more on hydrocarbon gas liquids in Russia, see Russia’s Background Reference.

Natural Gas

Overview

The Russian government aims to become a global supplier of natural gas; in 2020, the Russian government approved its latest energy policy plan, Energy Strategy to 2035, which prioritizes the development and diversification of energy exports and seeks to significantly increase investment in liquefied natural gas (LNG), particularly in the Arctic region. Specifically for natural gas, the strategy aims to increase LNG exports to approximately 4.5-4.9 Tcf per year by 2024 and to about 8.3–9.6 Tcf per year by 2035.23 Increasing LNG export capacity would enable Russia to compete for export markets beyond Europe. Russia has traditionally been the chief supplier of natural gas to Europe via its pipeline network.24

Exploration and production

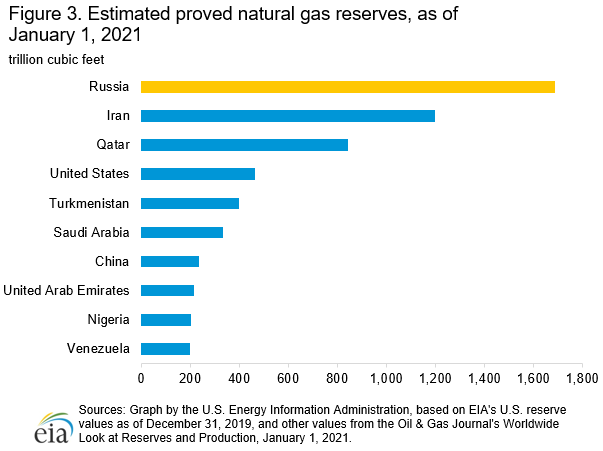

According to the Oil & Gas Journal, Russia held the world’s largest natural gas reserves at 1,688 trillion cubic feet (Tcf), as of January 1, 2021 (Figure 3).25

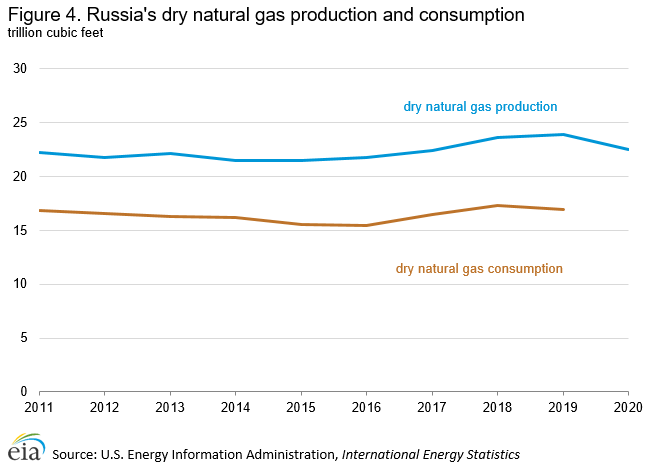

Russia produced approximately 22.5 Tcf of dry natural gas in 2020. Russia consumed 16.9 Tcf of dry natural gas in 2019 (Figure 4).26

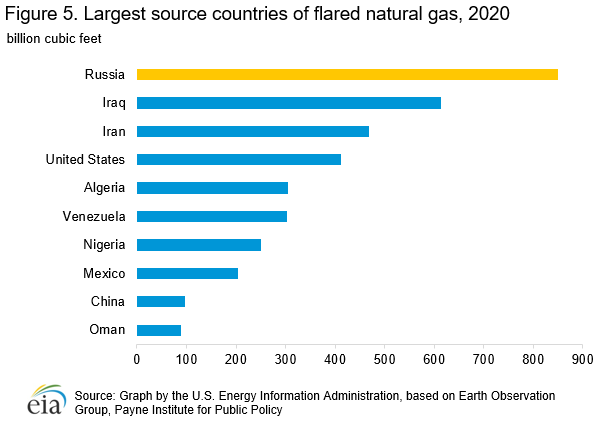

According to the U.S. National Oceanic and Atmospheric Administration’s (NOAA) Earth Observation Group, Russia flared an estimated 849 Bcf of natural gas in 2020, the most of any country, accounting for about 17% of the total volume of natural gas flared globally in 2020. (Figure 5).27

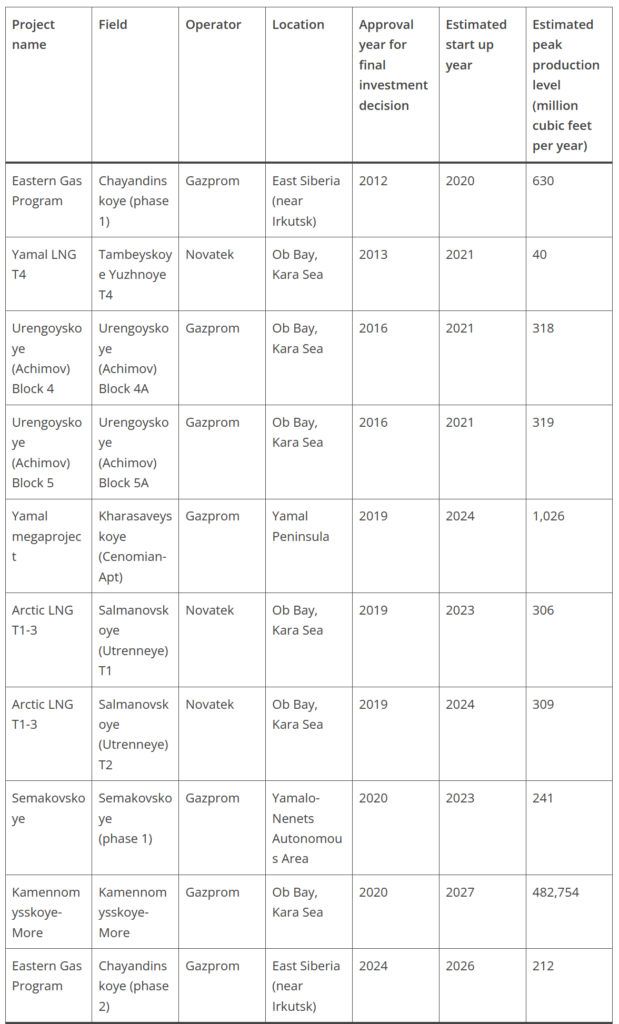

A string of recent natural gas discoveries in Russia’s Arctic region, particularly in the Yamal Peninsula and Ob Bay, may increase natural gas production over the next decade and lead to the region becoming a natural gas hub that would complement West Siberia, where most of Russia’s natural gas has been historically produced. In 2018, Novatek announced the discovery of the North Obskoye field located in Ob Bay and estimated that it held over 11.3 Tcf of natural gas reserves. In May 2020, Gazprom estimated that its 75 Let Pobedy (75 Years of Victory) field, which is located in the Yamal Peninsula, held more than 7.1 Tcf of total recoverable reserves. Both discoveries, if fully realized, would significantly increase Russia’s natural gas production (Table 3).28

Transport and storage

Pipelines

In September 2021, Gazprom completed construction of the Nord Stream 2 (NS2) natural gas pipeline, which is an offshore pipeline that runs across the Baltic Sea from the Russian port of Ust-Luga to Greifswald in Germany.29 NS2 is expected to have a capacity of about 1.9 Bcf per year, identical to the capacity of NS1, and is estimated to have cost around $10 billion. The pipeline is entirely owned by Gazprom via a Swiss-based special purpose entity, but reportedly it received financing for about half of the cost from Engie, OMV, Shell, Uniper, and Wintershall for its construction. Gazprom has not yet announced the start date for commercial operations.30 In May 2021, the U.S. government waived sanctions imposed on the project company, its CEO, and corporate officers involved in constructing the NS2 pipeline, which cleared the way for Gazprom to finish constructing the pipeline and begin delivering natural gas to Germany.31 A State Department report sent to Congress asserted that the project company Nord Stream 2 AG, its CEO Matthias Warnig, four Russian ships, and four other entities engaged in sanctionable activity, but the Secretary of State waived sanctions for Nord Stream 2 AG, its CEO, and staff on the grounds of national interest.32 Completion of the pipeline enabled Russia to increase its piped natural gas exports to Germany and other EU member states and bypass Ukraine, and so denying Ukraine potential revenue gained from transit fees.

The TurkStream natural gas pipeline began operations in January 2020. The natural gas export pipeline connects Russia’s largest natural gas reserves to Turkey’s natural gas transport system and enables Turkey to provide an alternative route for Russia’s piped natural gas to southern Europe. The TurkStream system consists of two parallel pipelines that each have a capacity of about 556 Bcf per year and stretch 580 miles across the Black Sea from the Russian coast at Anapa to the Turkish border. The first pipeline supplies natural gas for Turkey’s domestic consumption, while the second pipeline (also referred to as TurkStream 2) extends further onshore for about 550 miles to deliver natural gas to Hungary, Serbia, and Bulgaria.33

The natural gas pipeline called the Power of Siberia began transporting natural gas in December 2019, providing an initial capacity of about 177 Bcf per year. The pipeline is the first natural gas pipeline to deliver Russia’s natural gas exports to China; the 1,400-mile long pipeline is connected to the Chayandinskoye field and crosses China’s border at the Heilongjiang province. The pipeline is expected to reach full capacity of about 1.3 Tcf per year by 2025, providing a substantial amount of natural gas supply and an attractive alternative fuel source for power generation to a region in China that uses high levels of coal.34

Gazprom approved a feasibility study on the construction of a natural gas pipeline that could deliver natural gas to China via Mongolia. The resulting Soyuz Vostok pipeline has a planned export capacity of up to about 1.7 Tcf per year and, if completed, would become an extension of the Power of Siberia natural gas pipeline and provide an alternative route for Russia’s natural gas into China.35

LNG

Novatek’s Yamal LNG project began commercial operations at its fourth train in the first half of 2021 and, by June, reportedly reached full production capacity. The Yamal LNG project is Novatek’s first liquefaction project and second large-scale project in Russia. Novatek reached its final investment decision in 2013 to initially build three LNG trains with a total capacity of 792 Bcf per year, but in 2017, it approved the construction of an additional train with a capacity of approximately 43 Bcf per year. The fourth train’s initial start-up date was as early as 2019, but it had been delayed to 2021, reportedly as a result of technical issues with some components.

The Arctic LNG-2 project reached its final investment decision in September 2019 and is currently under construction. The Arctic LNG-2 project is located in the Gydan Peninsula in the northern part of Siberia and is a $21 billion project that will involve constructing three liquefaction trains, each with a production capacity of about 317 Bcf per year for a total of 951 Bcf per year. Novatek expects the first train to be completed in 2023 and the second and third trains in 2024 and 2025, respectively. The project is owned by a consortium that includes:

—Novatek (which will operate the facility)

—TotalEnergies

—China National Petroleum Corporation (CNPC)

—China National Offshore Oil Corporation

—Japan Arctic LNG (which is itself a consortium that consists of Mitsui & Co. and the Japan Oil, Gas and Metals National Corporation [JOGMEC])37

Gazprom’s second large-scale LNG export facility, Baltic LNG, is reportedly under development and has an expected start date of 2023 for commercial operations. Baltic LNG is a two-train LNG export facility with a total capacity of 624 Bcf per year. Baltic LNG is located near the Baltic Sea port of Ust-Luga near the Estonian border, and the LNG facility is part of a larger complex that includes other natural gas processing plants that will produce ethane and LPG.38

Natural gas exports

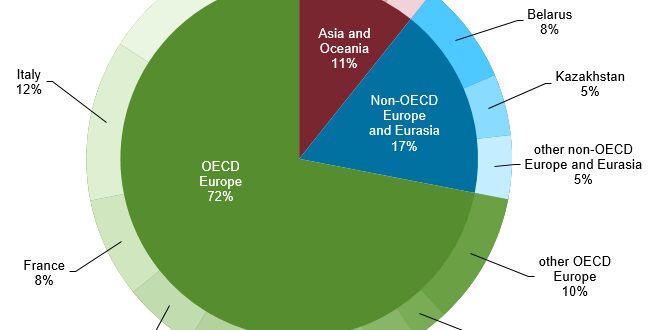

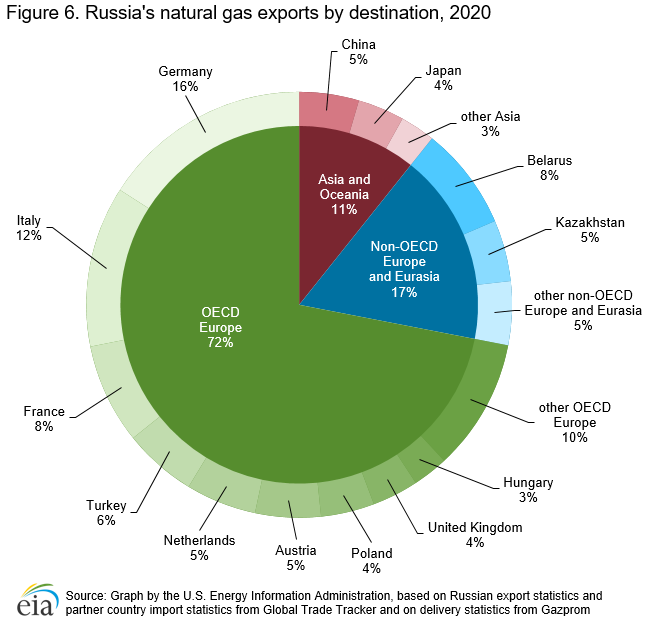

In 2020, customers in Europe and Eurasia received approximately 89% of Russia’s 8.5 Tcf of natural gas exports; Germany, Italy, France, and Belarus received almost half of the volumes exported to Europe and Eurasia (Figure 6).39

For more on natural gas in Russia, see Russia’s Background Reference.

Energy consumption

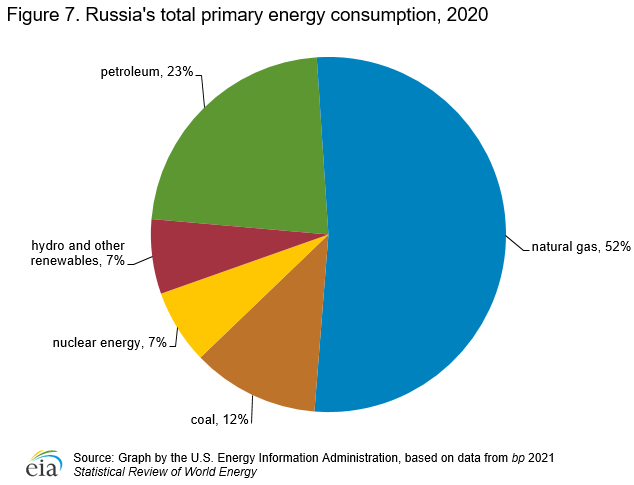

Russia consumed 26.8 quadrillion British thermal units (Btu) of energy in 2020, most of which was natural gas (52%). Petroleum and coal accounted for 23% and 12% of Russia’s consumption, respectively (Figure 7).40

Electricity

Overview

In January 2019, the Russian government approved a $29 billion modernization plan for its domestic power plants. The modernization plan, expected to be implemented between 2022 and 2031, will allow investors to bid on upgrading infrastructure at domestic power plants. This plan also allows investors to negotiate 16-year term agreements with end-use customers who may opt to pay a premium to receive priority access to electricity generated from the upgraded infrastructure. However, the Russian government is reportedly incorporating local content rules that will require investors to use domestically produced equipment to upgrade infrastructure.41

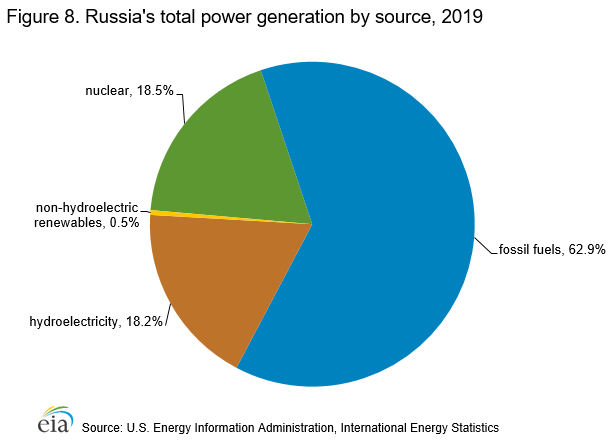

Russia’s gross electric power generation totaled 1,058 billion kilowatthours (kWh) in 2019. Over 60% of Russia’s electric power generation came from fossil fuel-derived sources, and the remainder came mostly from nuclear and hydroelectric sources (Figure 8). Russia generates a marginal amount of electricity from other renewable sources such as wind and solar.

Coal

Russia’s coal reserves stood at approximately 179 billion short tons of coal at the end of 2019, making it the second-largest holder of recoverable coal reserves in the world, after the United States.

Russia produced 482 million short tons in 2019 and is ranked the sixth-largest coal producer in the world behind China, India, the United States, Australia, and Indonesia. About 43% of the coal produced in that year was bituminous coal. Russia also produces a significant amount of metallurgical coal, about 109 million short tons in 2019.

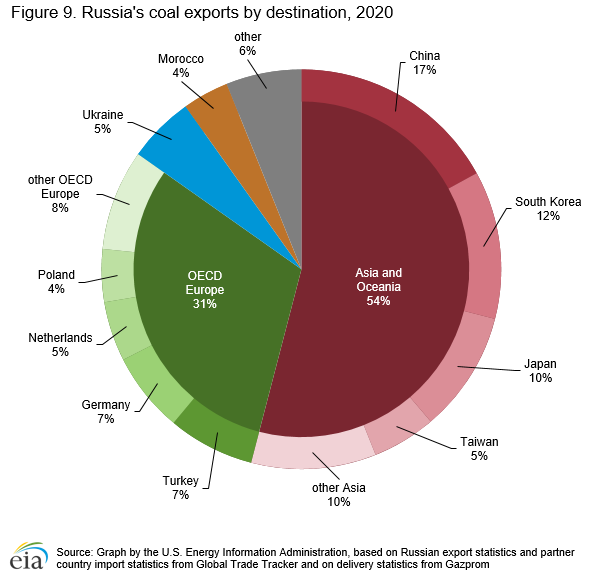

In 2020, 54% of Russia’s coal exports went to Asia, with China, South Korea, and JPN importing most of the coal by volume (Figure 9). About 31% of Russia’s total coal exports were destined for OECD Europe.42

In 2018, a consortium made up of Inter RAO and the State Grid Corporation of China proposed to build a power plant with a capacity of 1 gigawatt (GW) and a coal mining facility in the Amur province in eastern Russia in order to extract coal from the Erkovetsky deposit to generate electricity to export to China. The original, more ambitious plan for this project in 2013 sought to build an 8 GW power plant that would have made it the world’s largest coal-fired power plant. However, the original plans were scrapped in June 2017 because of China’s lower level of power consumption. In addition to the project’s downsized capacity, Inter RAO and State Grid Corporation of China are considering using an alternative fuel source such as natural gas.43

Nuclear power

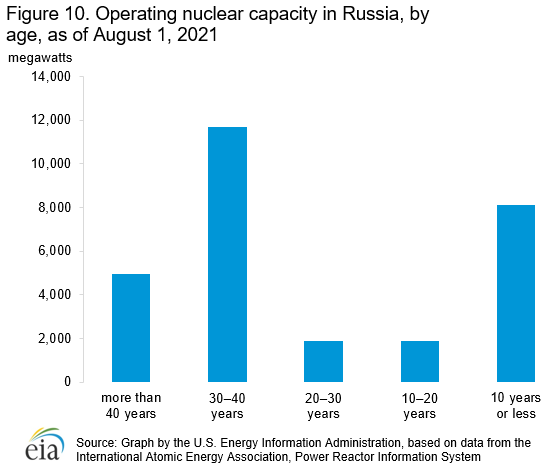

Russia has an installed nuclear capacity of more than 28 GW from 38 operating nuclear reactors, and nuclear energy generated over 215 gigawatthours (GWh) of electricity in 2020.44 Many of Russia’s nuclear power facilities are aging; 24 of Russia’s nuclear reactors, accounting for about 58% of the country’s operating nuclear capacity, have been operating for at least 30 years, (Figure 10). Rosenergoatom, a division of Rosatom and Russia’s sole utility company operating the country’s nuclear plants, is planning to build 27 additional nuclear reactors that would potentially provide up to approximately 24 GW of additional capacity over the course of the next 15 years.45

Russia has three nuclear reactors under construction that will provide an additional 3.5 GW of nuclear capacity.46 Two of the nuclear plants under construction, Kursk II-1 and Kursk II-2, are expected to each provide 1.3 GW of capacity and to be operational by April 2022 and 2023, respectively. Construction of the third nuclear reactor, BREST-OD-;300, began in June 2021 and has an expected capacity of 300 megawatts (MW) upon its completion in 2026.47

Russia’s newest nuclear power facility is the Academician Lomonosov, the world’s first floating nuclear power plant, located at Pevek on the eastern Arctic coast and about 600 miles from the Bering Strait. The Academician Lomonosov is based on technology used for nuclear icebreaker ships and consists of two 32 MW reactors that provide heat and power to the town. Commercial operations began in May 2020, and the power plant is expected to reach full capacity for heat and power generation before the end of 2021.48

Eurasia Press & News

Eurasia Press & News