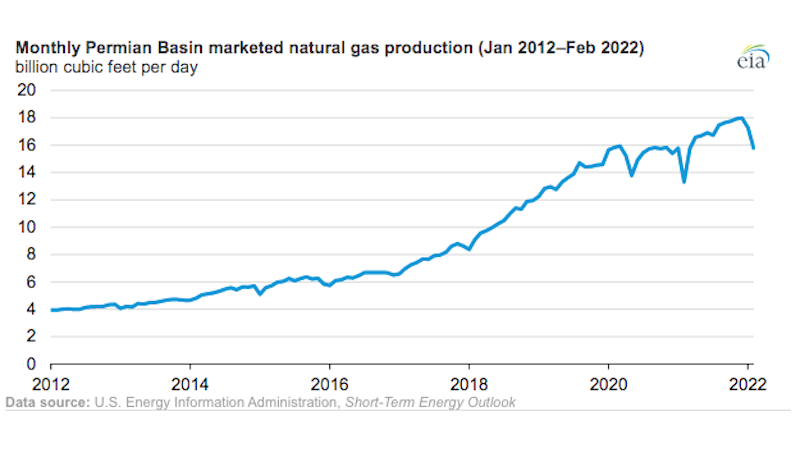

Marketed natural gas production from the Permian Basin in western Texas and eastern New Mexico reached a new annual high of 16.7 billion cubic feet per day (Bcf/d) in 2021. Annual marketed natural gas production in the Permian Basin has been rising steadily since 2012.

The Permian Basin is the second-largest shale gas-producing region in the United States after the Appalachian Basin (spanning Pennsylvania, West Virginia, and Ohio), which produced, on average, 34.8 Bcf/d of marketed natural gas in 2021.

Unlike in the Appalachian Basin, where natural gas is produced from natural gas wells, most of the natural gas production in the Permian Basin is associated gas produced from oil wells. As a result, producers in the Permian Basin respond to fluctuations in the crude oil price in planning their exploration and production activities, including whether to deploy drilling rigs or take rigs out of operation.

Amid elevated crude oil prices from mid-2017 to the end of 2019, the number of drilling rigs operating in the Permian Basin remained high and peaked at an average of 492 rigs in November 2018. Crude oil prices and rigs both declined in 2020. In 2021, the West Texas Intermediate (WTI) price increased steadily, averaging $68 per barrel (b) for the year compared with $39/b in 2020, and has continued to increase in 2022. Over the same period, the number of rigs operating in the basin has also been rising.

Additions of pipeline takeaway capacity facilitate natural gas production and its delivery to market. Pipeline takeaway capacity in the Permian Basin is estimated to be 18 Bcf/d as of May 2022, according to PointLogic.

Three new projects, with a total of 5.5 Bcf/d of takeaway capacity, came online in 2021: Kinder Morgan Energy Partners’ Permian Highway Pipeline (January), WhiteWater’s Whistler Pipeline (July), and Summit Midstream Partners’ Double E Pipeline (November). The additional capacity allows producers to send natural gas to demand centers in Mexico and along the Texas Gulf Coast, including liquefied natural gas export terminals.

Several pipeline projects have been announced recently that would add nearly 5.0 Bcf/d of pipeline takeaway capacity out of the Permian Basin by the end of 2024:

Kinder Morgan Energy Partners, WhiteWater, and Summit Midstream Partners have announced expansion projects on their respective 2021 pipeline projects, collectively totaling 1.8 Bcf/d of additional capacity.

Kinder Morgan plans to expand the Gulf Coast Express Pipeline, adding 0.6 Bcf/d of capacity by the end of 2023.

EnLink Midstream reached a final investment decision to construct the Matterhorn Express Pipeline, which would add 2.5 Bcf/d of takeaway capacity by the fourth quarter of 2024. Eurasia Press & News

Eurasia Press & News