Most of the world’s central banks have already agreed they should help fight climate change, a critical challenge that necessitates reductions in both energy consumption, which is our focus here, and the carbon emissions associated with the energy consumed.

To meet these aims, it’s important to pay attention to the energy used by the payment systems that central banks regulate and oversee. Monetary authorities now have a unique opportunity to improve efficiency as the way people pay is undergoing rapid changes worldwide. Digital currencies, from crypto assets to central bank digital currencies, can play a role in the transformation that policymakers envision.

With a desire to limit the energy consumption comes a need to understand what drives it. Policymakers confront researchers like us with several questions yet to be fully explored. These include how crypto assets compare with existing payment systems, what factors influence the energy use of the networks, and how new technology can make payments cleaner and greener.

Choice matters

News coverage of digital currencies and energy often spotlights Bitcoin, which is infamous for its reliance on raw computing power and electricity. Our new paper goes beyond these discussions by establishing the main components and technological options that determine the energy profile of digital currencies.

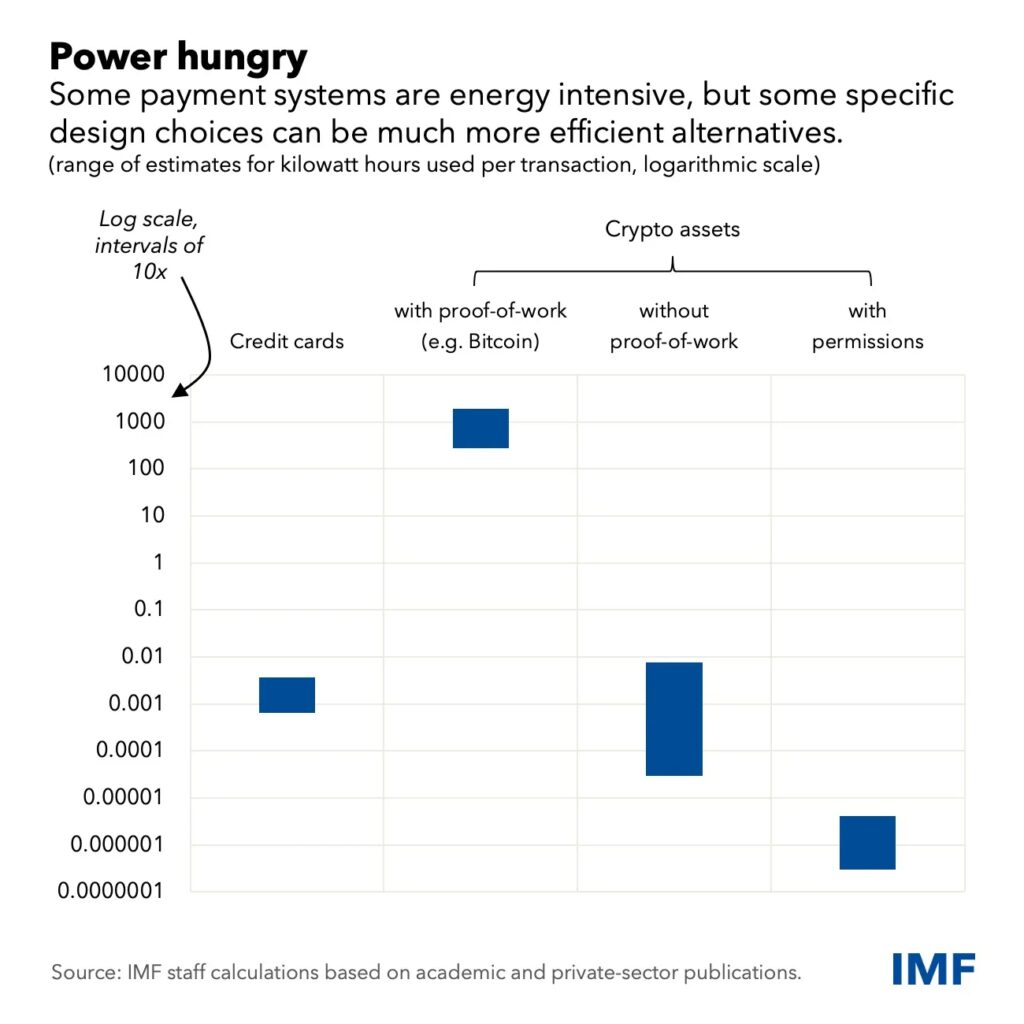

We draw on academic and industry estimates to compare digital currencies to one another and to existing payment systems. This research is at the intersection of digital currencies and climate change, two important subjects for policymakers, and the conclusions are especially pertinent for many central banks planning new digital currencies while also considering their environmental impact. Our research shows how the technological design choices for digital currencies make a major difference for their energy consumption.

Depending on the specific details of how they are configured, CBDCs and some kinds of crypto assets can be more energy efficient than much of the current payment landscape, including credit and debit cards. Credit and debit cards are important for comparison because they account for about three-quarters of cashless transactions, according to the most recent Red Book statistics from the Bank for International Settlements.

Deeper examination

Our conclusions about energy efficiency stem from a detailed look at the new technologies that are shaking up how global consumers make purchases and send money. Digital currencies often rely on distributed ledgers for validating and recording transactions. In those cases, how much energy they use mainly depends on two factors:

The first is how network participants agree on transaction histories. Some crypto assets like Bitcoin use a proof-of-work consensus mechanism that needs substantial calculation power, and energy, to obtain the right to update the transaction trail. Other crypto types use different approaches for their ledger updates that don’t require as much computing muscle.

The second is access to distributed-ledger systems. Some of these are permissionless, allowing anyone to join and validate transactions. Entry to others requires permission from a central authority, which offers greater control over key aspects of energy consumption such as the number of network participants, their geographic location, and software updates.Our study of digital currencies’ energy use relies on academic and industry estimates for different processing technologies. The research shows that proof-of-work crypto uses vastly more energy than credit cards. Replacing proof-of-work with other consensus mechanisms is a first green leap for crypto, and using permissioned systems is a second. Together, these advances put crypto’s energy consumption well below that of credit cards.

But there’s more to payment systems than processing technologies. Total energy use varies by technology, payment-chain size, and other additional features.

Considerations like these resonate with central banks considering digital currencies. Many CBDC projects build on energy efficient distributed-ledger systems under which only permissioned institutions like commercial banks can join and validate without proof-of-work.

Other options that don’t feature distributed ledgers are also being considered, and some of these are seen as promising from an energy-consumption standpoint. That means CBDCs have the potential to reduce the power needs for digital payments, and even be more energy efficient than the credit card networks now widely used.

CBDCs are still in their early days, and it’s hard to know how far and how fast they might go, but it is clear that central banks will adopt new technologies that impact power use. Their energy-saving potential will depend on the use associated with other design features that may be added for compliance, to aid security and integrity, or to facilitate universal access.

For example, some central banks are considering whether CBDCs should be accessible through physical cards, like credit cards. Card payments use more energy than those with digital wallets, which is how most crypto transactions are made. But cards can help adoption and inclusion, particularly when digital literacy or mobile network connectivity are a concern.

As payment systems increasingly use distributed ledgers, there’s a clear case for those more energy-efficient options that are permissioned and don’t rely on proof-of-work mechanisms. And though the debate on the future of money is still in its early stages too, power use is just one among many considerations. Policymakers should weigh energy needs along with other benefits and risks when they design CBDCs or consider the regulatory environment for crypto.

Eurasia Press & News

Eurasia Press & News