The White House has warned that the potential for higher shipping costs to affect the U.S. economy amid diversion of ships from the Red Sea will depend on how long Houthi rebels sustain their attacks on commercial vessels.

A FreightWaves report said on Thu, Jan. 4, 2024:

“If we were not concerned, we would not have stood up an operation in the Red Sea, now consisting of more than 20 nations, to try to protect that commerce,” White House spokesman John Kirby said at a White House press conference on Wednesday, referring to the U.S.-led military force Operation Prosperity Guardian.

“The Red Sea is a vital waterway, and a significant amount of global trade flows through it. By forcing nations to go around the Cape of Good Hope, you are adding weeks and weeks onto voyages, and untold resources and expenses have to be applied in order to do that. So obviously there is a concern about the impact on global trade.”

Asked if those impacts will become a “pocketbook” issue for Americans, Kirby responded that the administration is not yet seeing that.

“It would depend on how long this threat goes and on how much more energetic the Houthis think they might become,” he said. “Right now we have not seen an uptick or a specific effect on the U.S. economy. But make no mistake. This is a key international waterway. Countries more and more are becoming aware of this increasing threat to the free flow of commerce.”

Kirby, the coordinator for strategic communications for the National Security Council, was at the White House to announce a multinational ultimatum directed at rebel attackers and condemning recent attacks on commercial shipping in the Red Sea. The U.S. and 12 other countries issued the ultimatum.

“These actions directly threaten freedom of navigation and global trade, and they put innocent lives at risk,” Kirby said. “This joint statement demonstrates the resolve of global partners against these unlawful attacks and underlines our commitment to holding maligned actors accountable for their actions.”

The statement points out that nearly 15% of global maritime trade passes through the Red Sea, including 8% of global grain trade, 12% of seaborne-traded oil and 8% of the world’s liquefied natural gas.

Rerouting vessels around Africa’s Cape of Good hope imperils “the movement of critical food, fuel, and humanitarian assistance throughout the world,” it read.

Maersk, the world’s second-largest ocean carrier, announced on Tuesday that it would suspend Red Sea transits indefinitely and reroute ships around the Cape of Good Hope after Houthi rebels launched a missile against one of its container ships on Saturday.

Three major maritime shipping groups — the World Shipping Council, the International Chamber of Shipping and BIMCO — praised the 13-country condemnation of the attacks.

“On behalf of our members and their seafarers and customers throughout the world, the organizations thank these … nations for their strong commitment to defending rules-based international order and to holding malign actors accountable for unlawful seizures and attacks,” the groups stated.

“The shipping associations call on all nations and international organizations to protect seafarers, international trade in the Red Sea, and to support the welfare of the global commons by bringing all pressure to bear on the aggressors so that these intolerable attacks cease with immediate effect.”

In addition to the U.S. the countries warning against further attacks in the joint statement are Australia, Bahrain, Belgium, Canada, Denmark, Germany, Italy, Japan, Netherlands, New Zealand, Singapore, and the United Kingdom.

Shipping Costs Have Jumped 250%

A report by BBC News said:

“Some of our costs have gone up 250%”.

That is the reality for Thomas O’Brien, boss of family-run Boxer Gifts, which designs games and seasonal presents.

Their products are made in China so the Leeds-based firm relies heavily on global shipping. But attacks on commercial vessels in the Red Sea have prompted long diversions to avoid one of the world’s busiest shipping lanes.

Mr O’Brien is among business owners who have told the BBC this could lead to delays and price rises.

It follows a warning from the British Retail Consortium (BRC) that the disruption could have a knock-on effect on product availability and prices.

Chief executive Helen Dickinson said this was “as a result of higher transportation and shipping insurance costs”.

“Over the coming months, some goods will take longer to be shipped,” she added.

Guy Platten, secretary general of the International Chamber of Shipping warned “we won’t see much of an impact until later on in January”.

The report said:

The attacks are being carried out by the Houthi group which has declared support for Hamas and has said it was targeting ships travelling to Israel. It is not clear if all the ships that have been attacked were actually heading to Israel.

Because of this and the threat of future assaults, several of the world’s largest shipping firms, including Mediterranean Shipping Company and Maersk, have diverted vessels away to a much longer route around Africa’s Cape of Good Hope and then up the west side of the continent.

Mr O’Brien said this had led to shipping companies increasing their container costs. For Boxer Gifts that has amounted to a 250% increase in shipping rates in the past two weeks, he said.

The company said it would continue to absorb rising costs as much as possible, but if that prices rose further, the cost would have to be passed on. Delays are a problem too.

“We just about got used to shipments arriving on time after Covid, but at the moment with the Red Sea, that’s adding another 10 to 14 days to shipments,” Mr O’Brien said.

“You end up with a two or three week delay. We have got Valentine’s Day products that are likely to be delayed and miss Valentine’s Day.

“The same effect is going to be felt on Mother’s Day meaning a huge chunk of our selling time for these games is missed”.

The German shipping giant Hapag-Lloyd told the BBC it would continue to avoid the Red Sea route until at least 9 January. It sends an average of 50 ships a month through the Suez Canal. Some 25 ships were diverted in the last half of December and 15-20 more will be impacted by today’s decision.

MSC and Maersk two of the largest shipping lines in the world have paused journeys through the Red Sea until further notice. While, France’s CMA-CGM is increasing its rates between Asia and the Mediterranean.

While there has been some disruption to supply chains already, Mr Platten, from the International Chamber of Shipping said it would take a few weeks before the problems are really noticed.

He said while insurance and fuels costs have gone up for shipping lines “goods are still getting through” because there is an alternative route available.

For Mr O’Brien, the financial hit of the ongoing disruption could be hundreds of thousands of pounds, but he said his main concern is letting customers down.

“That damage your reputation for a lot longer than the short term pain of some money,” he said.

‘Nightmare’

The report said:

Rachael Waring said some of her customers were waiting for furniture to arrive

Rachael Waring’s furniture business has been hit with disruption too.

A container filled with her imported products was due to pass through the Red Sea before Christmas. Instead, it has been diverted around the Cape of Africa, along with many other cargo ships.

“I have got customers that most of the goods on one of the container was destined for, which is a nightmare because they would not have furniture,” she said.

“It has a knock on effect for cash flow because that furniture has been paid for in advance, whereas I should be delivering and invoicing the customer now I can’t for another month”.

Ms Waring said the cost of paying for a container have trebled, and she expected prices to rise further.

“That increased shipment cost has to be taken into account for creating customers going forward. And that obviously is going to cause problems for inflation,” she added.

Peter Sand, chief analyst at the Copenhagen-based shipping analytics platform Xeneta, said: “One extra million dollars of fuel costs is put on top of every voyage that goods around the Cape of Good Hope instead of Suez Canal.”

But he said the increased charges should not become fixed after the threat of attack on ships has subsided.

“Everyone needs to have their costs covered from an escalation, but they cannot become embedded,” he said.

Red Sea Fallout Much Greater For Containers Than Tankers, Bulkers

Another FreightWave report said on Dec. 20, 2023:

Tuesday’s announcement of Operation Prosperity Guardian, a joint military operation to protect commercial shipping in the Red Sea, was met with skepticism — and jokes about the Seychelles, a popular island honeymoon destination off the coast of Africa.

The existing naval security operation in the Red Sea, Combined Task Force 153, is a 39-nation partnership. Operation Prosperity Guardian has just 10 partners: the U.S., U.K., Canada, France, Italy, Spain, the Netherlands, Norway, Bahrain and the Seychelles.

As of Wednesday, there were no details available on what Operation Prosperity Guardian will do beyond expanded patrols, or how long it will take for escorted convoys to be put in place, if at all.

“Officials have played down the idea that they will provide naval escorts for commercial vessels,” said ship brokerage Braemar on Tuesday.

According to Evercore ISI shipping analyst Jon Chappell, “The number of ships that transit the Red Sea is large enough that the U.S. is reportedly guiding against the idea that 100% convoy escort is viable.”

The report said:

Current fallout from the Red Sea crisis is focused much more on container shipping than other vessel segments.

Virtually all container vessels are rerouting around the Cape of Good Hope. Container ships that had already transited southbound through the Suez but had yet to reach the Bab-el-Mandeb Strait are now turning back, paying another toll to get to the Mediterranean.

Numerous bulk commodity ships are heading to the Cape, as well, but not to the extent container ships are. That could change with a military escalation, which could increase reroutings across all shipping sectors.

“We see the outcomes as fairly binary here,” said Chappell in a research note on Tuesday. “Either the creation of the task force substantially restores confidence in shippers using the Red Sea/Suez route, or further escalation largely closes the route.

“The former is the dominant base case, but it is worth being attentive to the latter risk case, as the consequences could be macro-significant,” Chappell warned.

He sees the “strong base case” as “we revert to something tolerably close to business as usual.” But he believes the risk of escalation is “non-trivial.”

In a worst-case scenario, in which Red Sea transits for all ship types are heavily curtailed, “we could see freight prices go up multiples — think five to 10 times,” said Chappell.

“These costs would be passed through to the consumers and shippers and supply chain bottlenecks would re-emerge as the greater distances around Africa would tie up extreme amounts of shipping capacity.”

In the unlikely event of a full closure of the Red Sea/Suez route for more than a week, Chappell said it “would start to have global effects.”

Diversions Require More Container-ship Capacity

The report added:

Automatic Identification System (AIS) ship-position data from Kpler-owned MarineTraffic shows how different vessel segments are dealing with the Houthi threat differently.

Larger container lines have rerouted all of their services to the Cape of Good Hope. Ship-position data on Wednesday morning showed no container ships transiting the Bab el-Mandeb Strait.

Longer voyages will ultimately require more container ships to maintain the same service levels. According to Sea-Intelligence, the switch to the around-Africa route will require 1.45 million to 1.7 million twenty-foot units of additional ship capacity.

That, in turn, will help container lines absorb new building capacity that is now being delivered, which should keep container freight rates higher than they would have been minus the Houthi attacks.

Bulkers And Tankers Continue To Transit

The report said:

In contrast to container shipping, AIS data shows that the Bab-el-Mandeb Strait remained heavily trafficked by dry bulk carriers on Wednesday.

Dry bulk carrier positions as of Wednesday morning. (Map: MarineTraffic)

MarineTraffic ship-position data on tankers — including crude and product tankers as well as carriers — also showed ongoing traffic through the strait.

Tanker positions as of Wednesday morning. (Map: MarineTraffic)

“Few tankers have thus far been rerouted via South Africa,” reported Braemar. “One or two fixtures via the Suez have failed in recent days, and we know of at least two Suezmaxes [tankers with capacity of 1 million barrels] that have been asked to delay passage through the Suez Canal until the situation settles down.

“We are still fixing cargoes via the Canal without Cape options,” confirmed Braemar. “Most owners we talk to are assessing [transits] on a case-by-case basis, even some of those that have publicly stated that they would not transit the Suez.”

Routing of laden tankers is determined by the ship charterer. Oil companies BP and Equinor have announced that they won’t route their cargoes through the Red Sea, but they are in the minority.

Lars Barstad, CEO of tanker owner Frontline, told S&P Global Commodity Insights: “Shipowners have limited opportunity to reroute when the vessel is already under contract, if safety is deemed acceptable. Disappointingly few oil majors have adopted BP’s and Equinor’s policy.”

Another reason crude tanker flows are not seeing a big effect yet: Much of it is Russian crude, and the Houthis are backed by Russian ally Iran.

According to Ioannis Papadimitrou, senior freight analyst at Vortexa, “Of the approximately 1,200 laden crude voyages that transited the Red Sea in 2023, 60% originated in Russia. Given that Russian barrels are increasingly being carried by non-EU/Western operators, these flows face minimal risk amid the ongoing Houthi attacks.

“Additionally, these barrels are heading to non-EU/Western buyers, which further decrease the likelihood of disruption for these flows.”

Rates Up For Tankers Transiting Red Sea

The report said:

On the plus side for tanker markets, rates are rising for vessels that do take the Red Sea route.

According to Braemar, “While the attacks have failed to influence the broader tanker market, for vessels looking to transit the Suez Canal, the conversation — and the cost — has changed dramatically over the past few days. Suezmax charterers looking to fix Med-to-Far East via the Suez are looking at a jump of $850,000.”

Brokerage Fearnleys said Wednesday that Suezmax rates from the Middle East Gulf to Europe transiting the Red Sea “have firmed significantly … which is no surprise given developments there.”

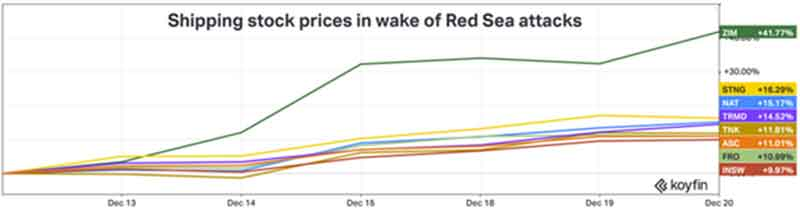

Effect On Shipping Stocks

It said:

The container-centric effect of the Red Sea crisis is being reflected in near-term stock pricing.

Shares of container lines — particularly Israeli carrier Zim — are rising faster than shares of owners of Suezmax crude tankers and product tankers.

Between Dec. 12 and mid-day Wednesday, shares of Zim were up 42%, albeit off highly depressed levels.

In contrast, shares of product-tanker owners Scorpio Tankers, Torm and Ardmore Shipping were up 16%, 15% and 11%, respectively, over the same period.

Shares of Suezmax owners Nordic American Tankers and Teekay Tankers were up 15% and 12%, respectively, since Dec. 12. Stock prices of mixed-fleet owners Frontline and International Seaways were up 11% and 10%, respectively.

Eurasia Press & News

Eurasia Press & News